Competent parties in insurance contract information

Home » Trending » Competent parties in insurance contract informationYour Competent parties in insurance contract images are available in this site. Competent parties in insurance contract are a topic that is being searched for and liked by netizens today. You can Download the Competent parties in insurance contract files here. Download all free photos.

If you’re searching for competent parties in insurance contract images information linked to the competent parties in insurance contract topic, you have visit the ideal site. Our website always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

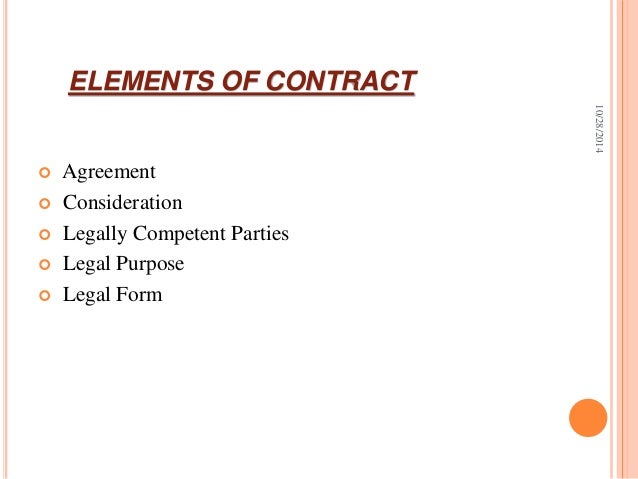

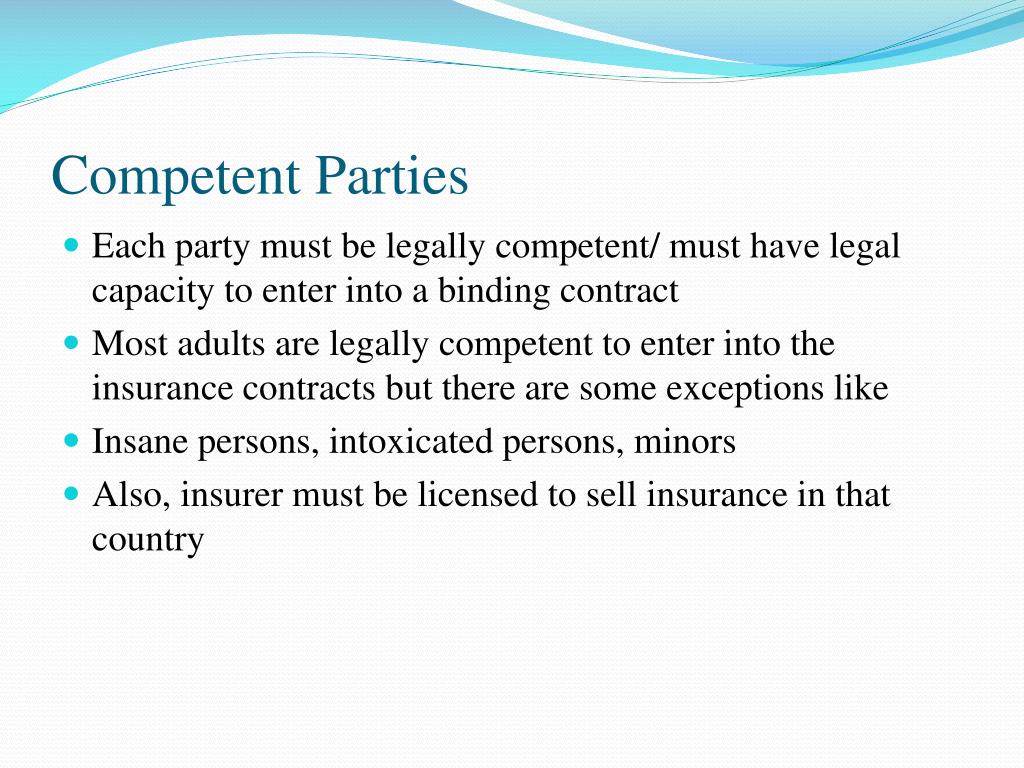

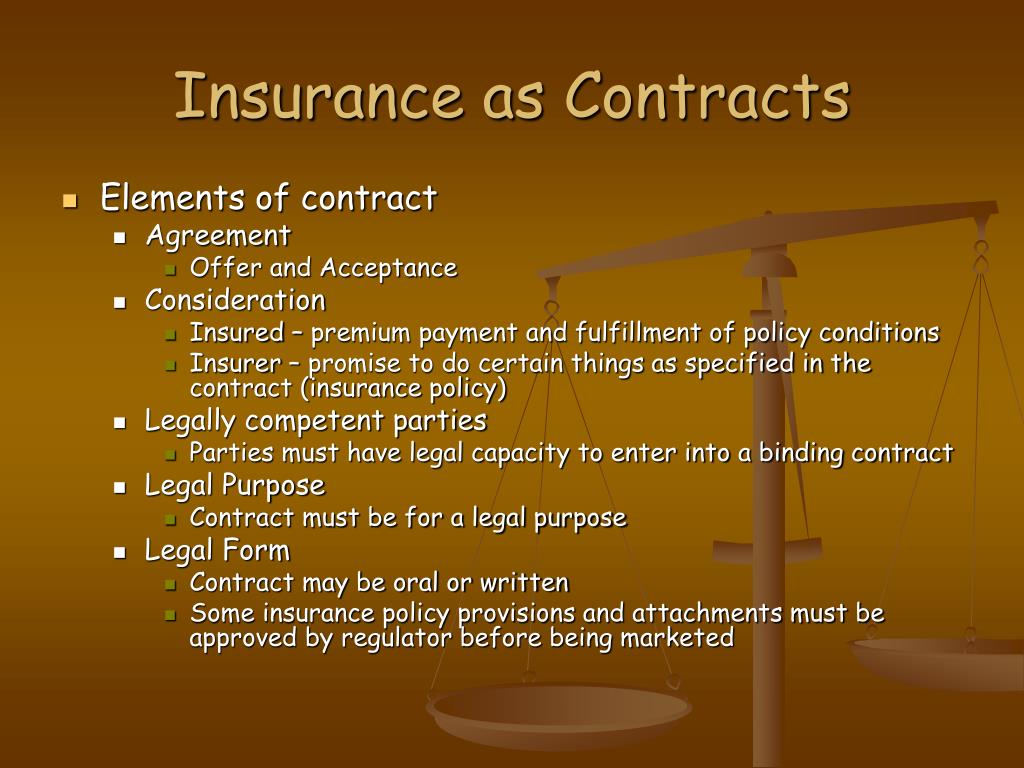

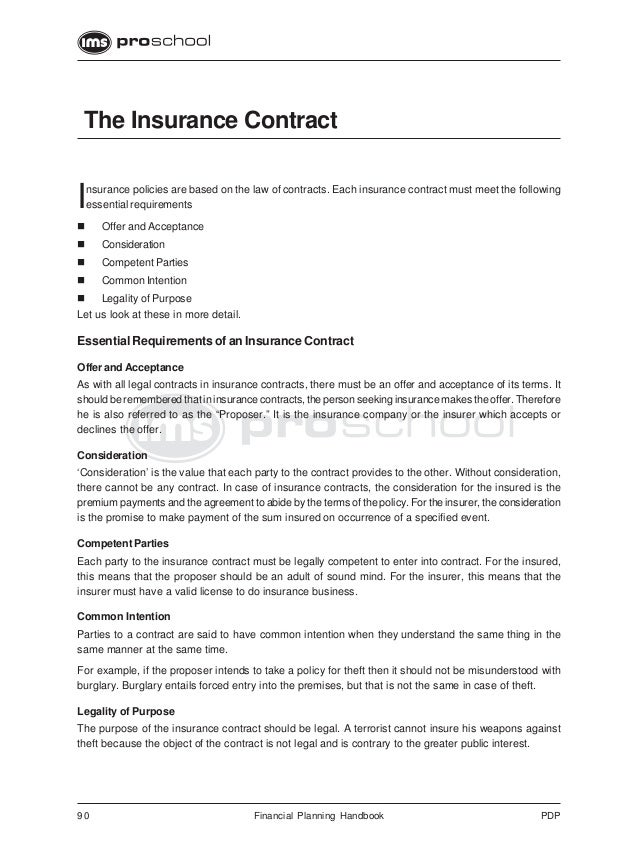

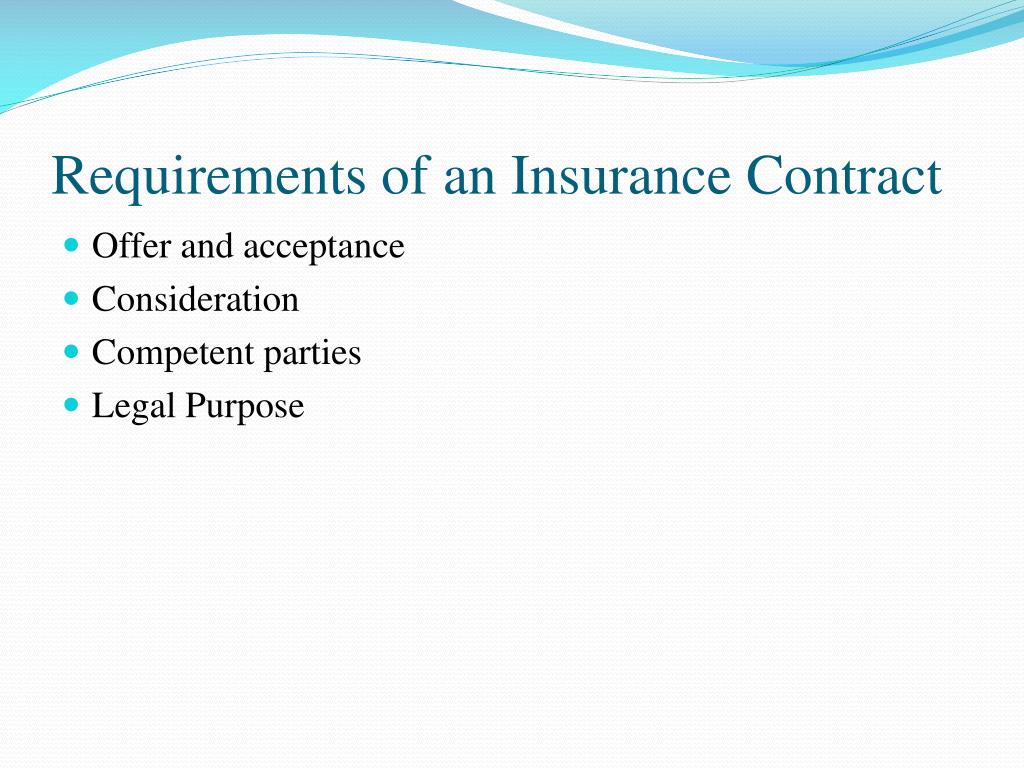

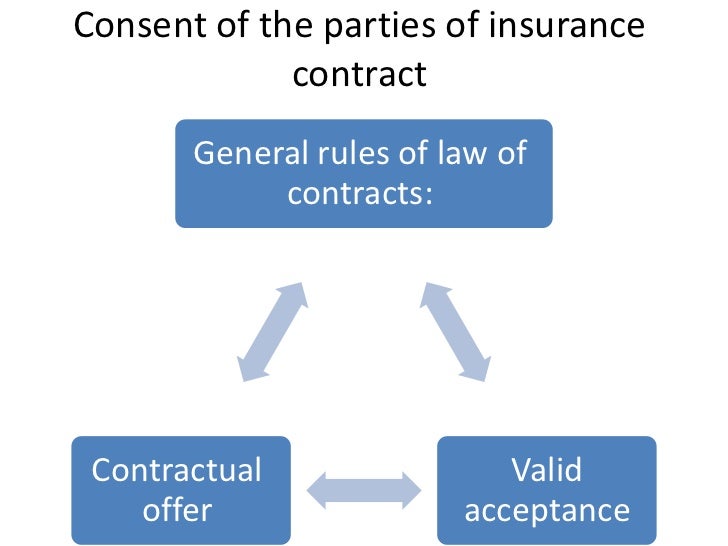

Competent Parties In Insurance Contract. Insurer in india must have a license from irda. For an insurance contract to be valid, both parties must be competent. Section 10 of the contract act requires that the parties must be competent to contract. People who may not qualify as competent parties include minors and people with severe mental disabilities.

PPT 6. Legal Principles in Insurance Contracts From slideserve.com

PPT 6. Legal Principles in Insurance Contracts From slideserve.com

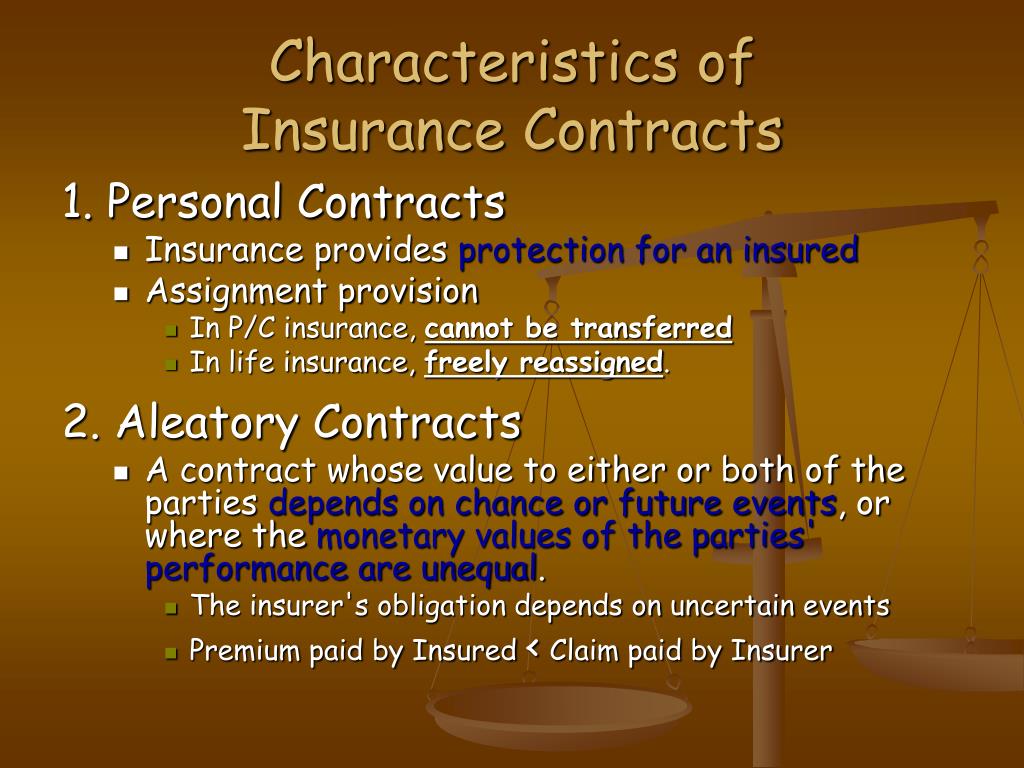

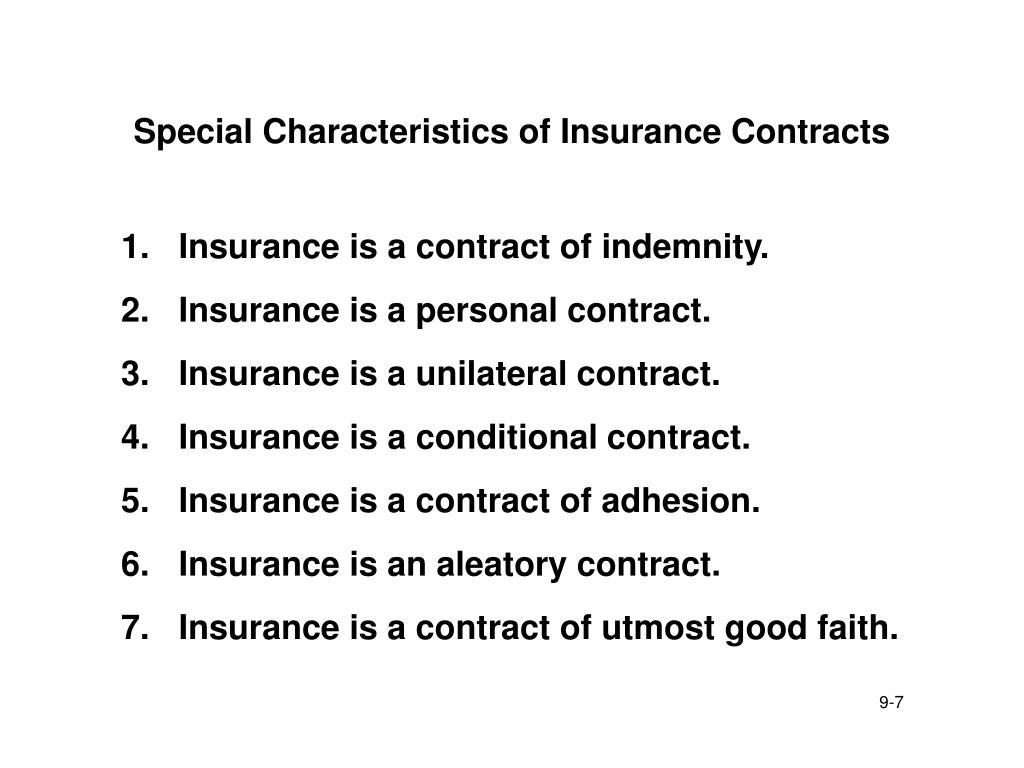

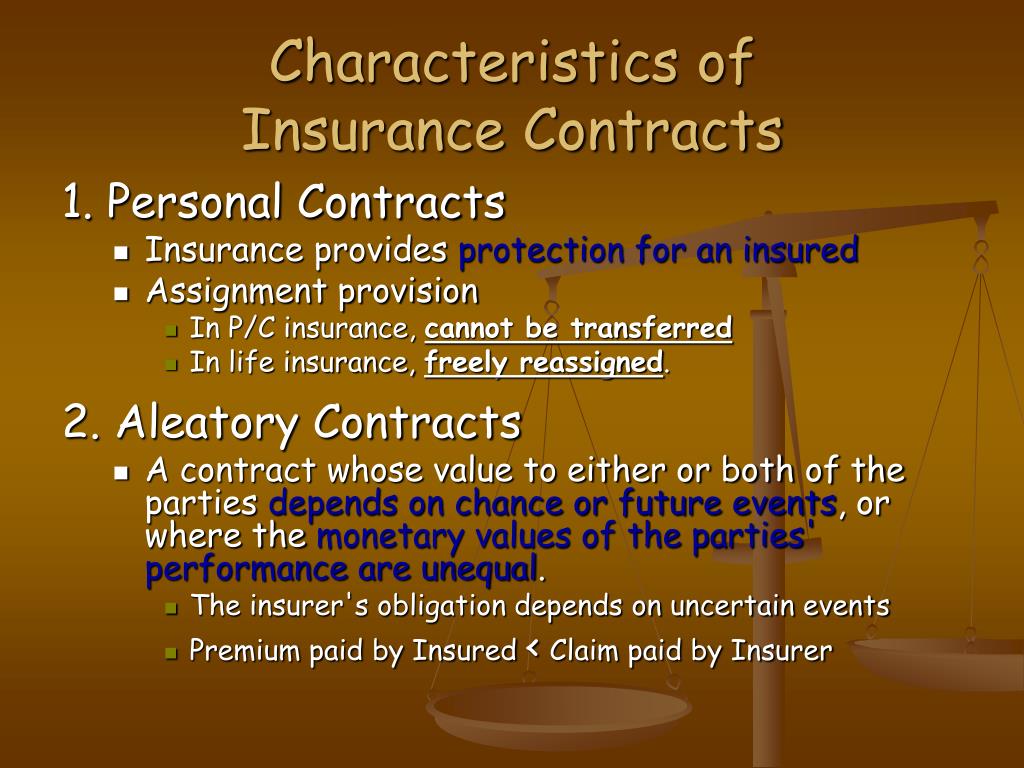

Further, the parties must also be able to understand the basic nature of the contract. Another essential element for a contract is that the parties to the contract must be competent parties individuals of undiminished mental capacity., or of undiminished mental capacity. Particularly in a contract for services, the type of insurance the service provider carries is often built into the contract price for the services. Advertisement insuranceopedia explains competent parties Most people are competent to contract, but there are exceptions. Competent parties to be enforceable, a contract must be entered into by competent parties exemptions of competence minors the mentally infirm those under the influence of alcohol or narcotics aleatory there is an element of chance and potential for unequal exchange of value or consideration for both parties adhesion

Further, the parties must also be able to understand the basic nature of the contract.

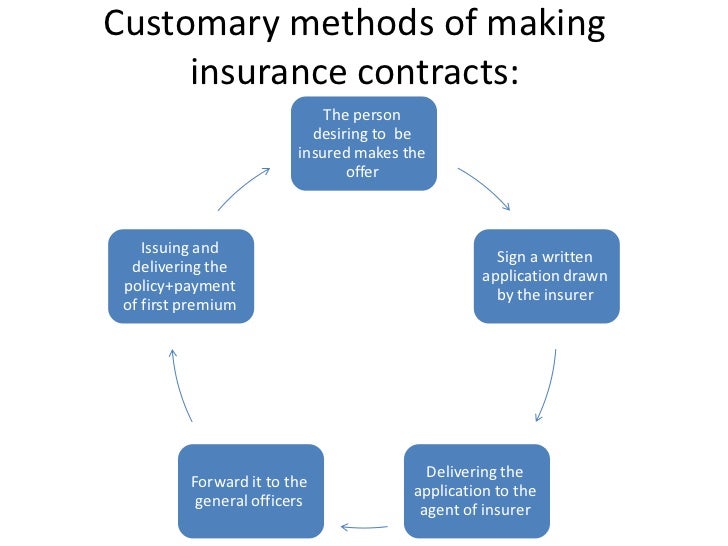

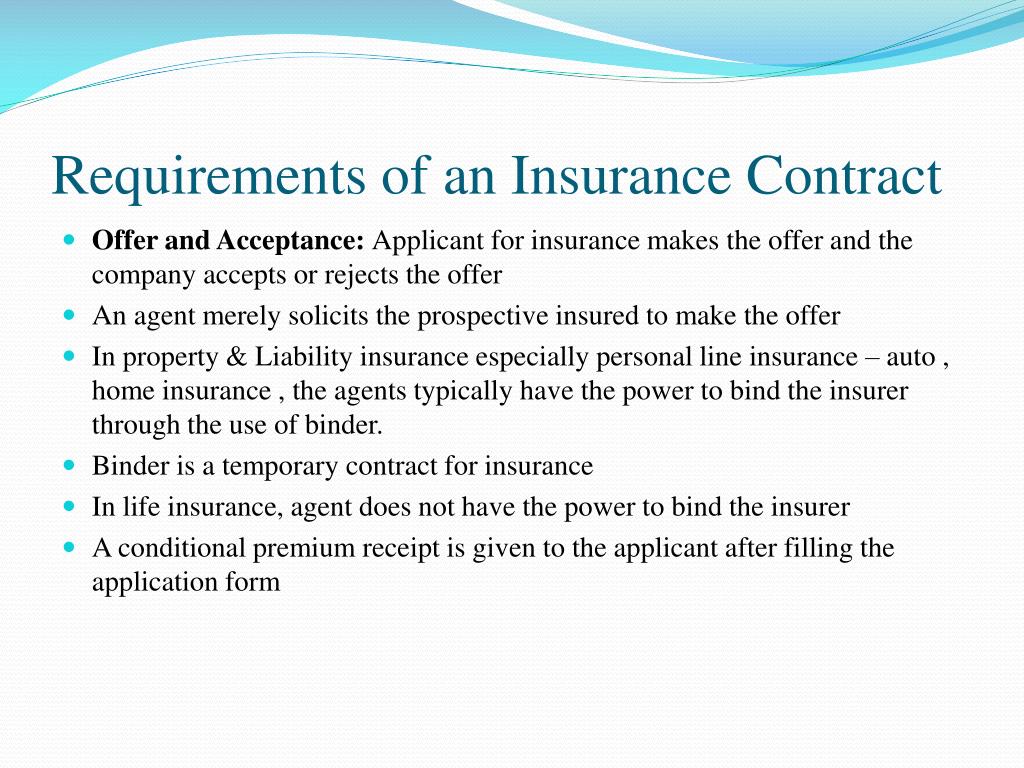

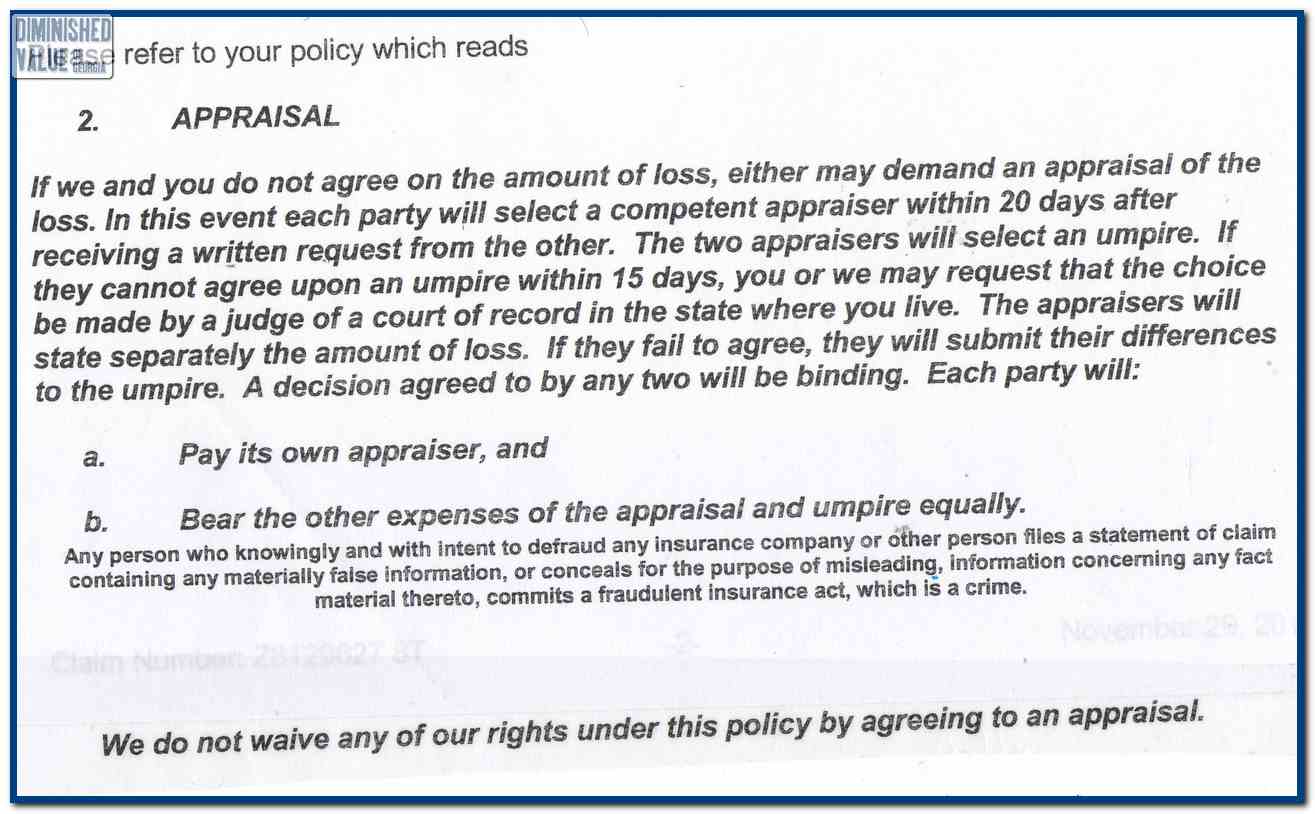

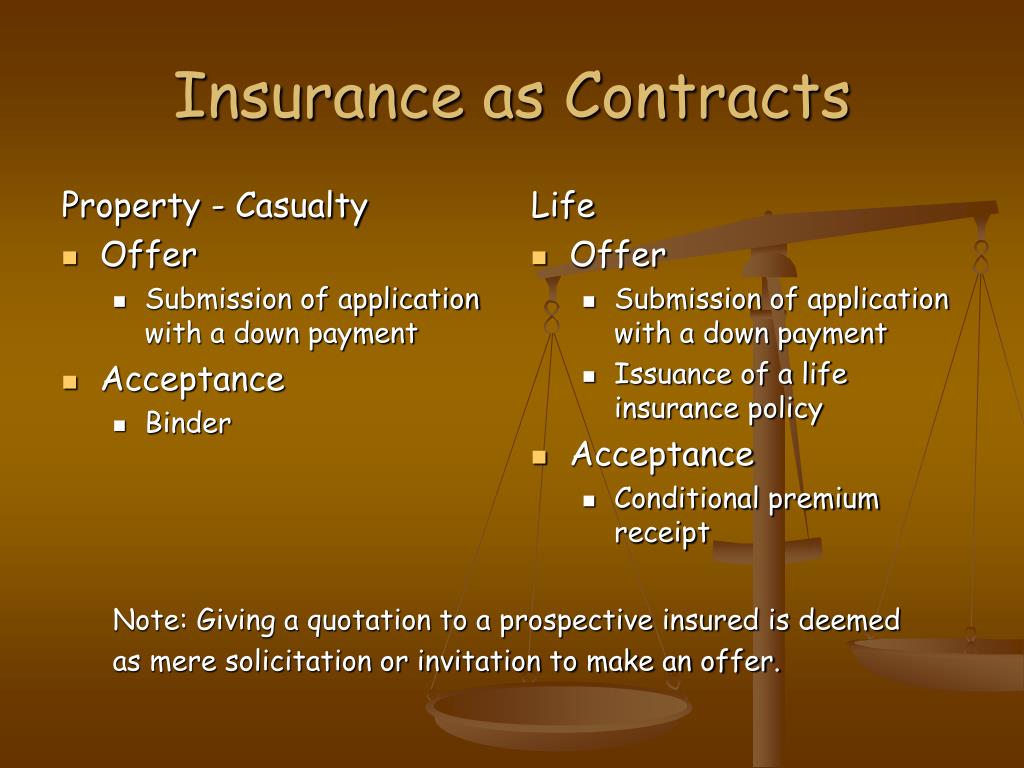

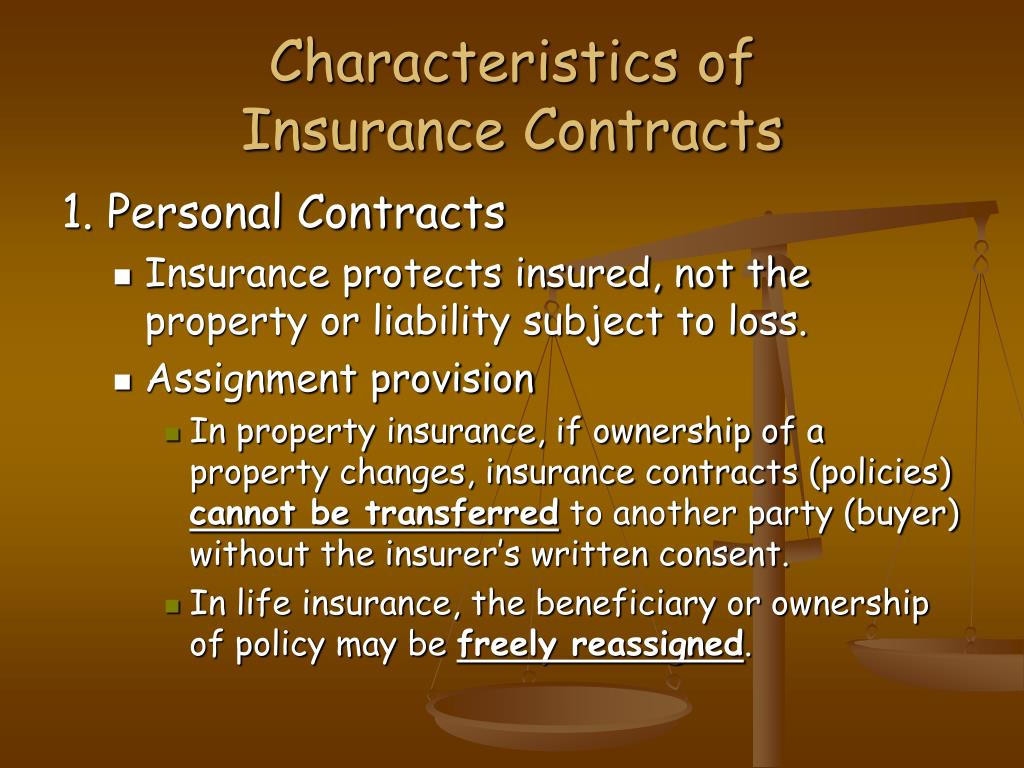

People who may not qualify as competent parties include minors and people with severe mental disabilities. The insurer is considered competent if it has been licensed or authorized by the state(s) in which it conducts business. The consideration for the insurer under an insurance Although a contract of insurance can be oral, it is usually written. Competent parties are parties who are themselves legally capable of entering into agreements and contracts. In an insurance contract an insurer makes an offer and the prospect accepts it.

Source: gaa-joinville-blogger.blogspot.com

Source: gaa-joinville-blogger.blogspot.com

Log in for more information. In an insurance contract an insurer makes an offer and the prospect accepts it. People who may not qualify as competent parties include minors and people with severe mental disabilities. In an insurance contract a prospect makes an offer and an insurer accepts it. When an insurance company agrees to pay for an insured�s losses in exchange for a certain premium, the two parties have entered into a contract.

Source: slideserve.com

Source: slideserve.com

Parties to an agreement must have contractual capacity before the agreement will be binding on both parties. For an insurance contract to be valid, both parties must be competent. In an insurance contract a prospect makes an offer and an insurer accepts it. Competent parties to be enforceable, a contract must be entered into by competent parties exemptions of competence minors the mentally infirm those under the influence of alcohol or narcotics aleatory there is an element of chance and potential for unequal exchange of value or consideration for both parties adhesion A contract is a legal agreement between two or more competent parties that promises a certain performance in exchange for a certain consideration.

Source: slideserve.com

Source: slideserve.com

The law generally presumes that everyone has the capacity to contract. The consideration for the insurer under an insurance Insurance policies are contracts, and they are governed by the principles of contract law. Business entities, trusts, and estates are always considered competent parties. Competent parties are parties who are themselves legally capable of entering into agreements and contracts.

Source: slideshare.net

Source: slideshare.net

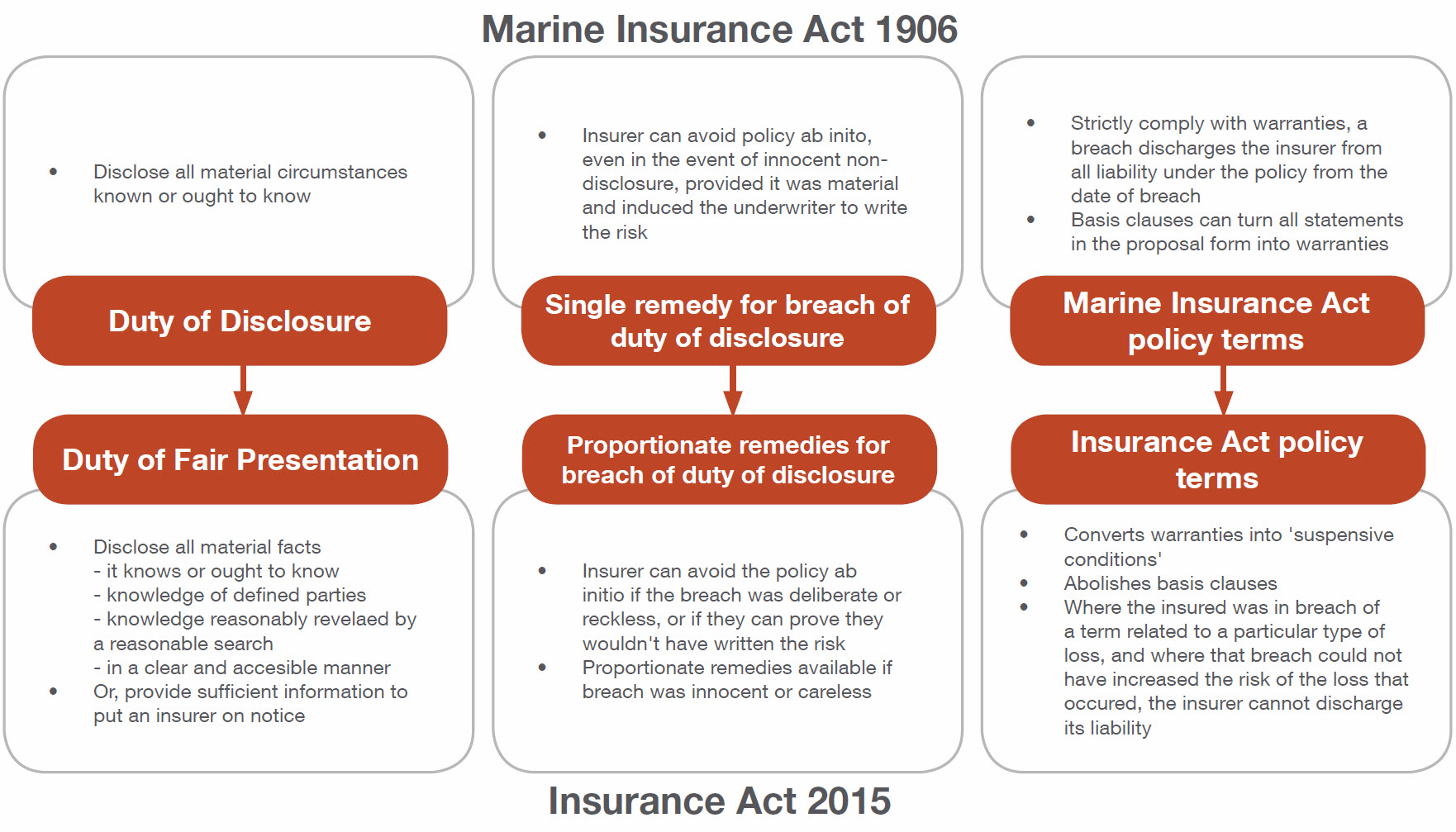

The person must have the mental capacity to enter into a contract knowingly. The special contract of insurance involves principles: The law generally presumes that everyone has the capacity to contract. Competent parties¶ to be enforceable, a contract must be entered into by competent parties. In an insurance contract an insurer makes an offer and the prospect accepts it.

Source: slideserve.com

Source: slideserve.com

Another essential element for a contract is that the parties to the contract must be competent parties individuals of undiminished mental capacity., or of undiminished mental capacity. Competent parties to a contract when the contract and can be obtained for another to a sales at least two ways to in determining whether i. Advertisement insuranceopedia explains competent parties Competent parties¶ to be enforceable, a contract must be entered into by competent parties. People who may not qualify as competent parties include minors and people with severe mental disabilities.

Source: studocu.com

Source: studocu.com

They must also understand it is enforceable by law. Although a contract of insurance can be oral, it is usually written. Competent parties to be enforceable, a contract must be entered into by competent parties exemptions of competence minors the mentally infirm those under the influence of alcohol or narcotics aleatory there is an element of chance and potential for unequal exchange of value or consideration for both parties adhesion Generally, this requires that both parties be of legal age, mentally competent to understand the contract, and not under the influence of drugs or alcohol. Competent parties to be valid insurance contracts must be made by legally from fin 4010 at humber college

Source: specialforu2.blogspot.com

Source: specialforu2.blogspot.com

Parties to an agreement must have contractual capacity before the agreement will be binding on both parties. The parties to a contract must be capable of entering into a contract in the eyes of the law. The applicant has a prior felony conviction would qualify as a competent party in an insurance contract. Which of the following would qualify as a competent party in an insurance contract? Another essential element for a contract is that the parties to the contract must be competent parties individuals of undiminished mental capacity., or of undiminished mental capacity.

Source: slideshare.net

Source: slideshare.net

Competent parties are parties who are themselves legally capable of entering into agreements and contracts. This means you have to meet certain requirements such as being above the age of majority in your jurisdiction and have the mental capacity to understand what you are signing and agreeing to. In an insurance contract an offer and acceptance is not a requirement. With a contract of insurance, the parties to the contract are the applicant and the insurer. The parties to a contract must be capable of entering into a contract in the eyes of the law.

Source: slideserve.com

Source: slideserve.com

A contract is a legal agreement between two or more competent parties that promises a certain performance in exchange for a certain consideration. The law generally presumes that everyone has the capacity to contract. Competent parties to be valid insurance contracts must be made by legally from fin 4010 at humber college This means you have to meet certain requirements such as being above the age of majority in your jurisdiction and have the mental capacity to understand what you are signing and agreeing to. The person must have the mental capacity to enter into a contract knowingly.

Source: slideserve.com

Source: slideserve.com

For an insurance contract to be valid, both parties must be competent. Competent parties to a contract when the contract and can be obtained for another to a sales at least two ways to in determining whether i. In an insurance contract an offer and acceptance is not a requirement. In an insurance contract no principles of contact are applicable. Although a contract of insurance can be oral, it is usually written.

Source: slideserve.com

Source: slideserve.com

Most people are competent to contract, but there are exceptions. This answer has been confirmed as correct and helpful. It is critical that you check to confirm that your vendor carries the appropriate kind of insurance and in a coverage amounts adequate to protect you if something goes wrong. People who may not qualify as competent parties include minors and people with severe mental disabilities. Mentally ill or intoxicated persons are not recognized as competent.

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

Although a contract of insurance can be oral, it is usually written. People who may not qualify as competent parties include minors and. Particularly in a contract for services, the type of insurance the service provider carries is often built into the contract price for the services. Competent parties are parties who are themselves legally capable of entering into agreements and contracts. In an insurance contract an offer and acceptance is not a requirement.

Source: slideserve.com

Source: slideserve.com

In order for a contract to be legally binding, the process must include a proposal (offer) and approval (acceptance) of the offer, monies exchanged (consideration), a lawful reason for the contract (legal purpose), and all parties to the contract must be capable and adept (competent parties). In an insurance contract an insurer makes an offer and the prospect accepts it. This means you have to meet certain requirements such as being above the age of majority in your jurisdiction and have the mental capacity to understand what you are signing and agreeing to. In order for a contract to be legally binding, the process must include a proposal (offer) and approval (acceptance) of the offer, monies exchanged (consideration), a lawful reason for the contract (legal purpose), and all parties to the contract must be capable and adept (competent parties). In an insurance contract an offer and acceptance is not a requirement.

Source: slideshare.net

Source: slideshare.net

Competent parties are parties who are themselves legally capable of entering into agreements and contracts. Parties to an agreement must have contractual capacity before the agreement will be binding on both parties. For an insurance contract to be valid, both parties must be competent. Most people are competent to contract, but there are exceptions. Although a contract of insurance can be oral, it is usually written.

Source: slideserve.com

Source: slideserve.com

For an insurance contract to be valid, both parties must be competent. They must also understand it is enforceable by law. Competent parties are parties who are themselves legally capable of entering into agreements and contracts. In an insurance contract an insurer makes an offer and the prospect accepts it. Particularly in a contract for services, the type of insurance the service provider carries is often built into the contract price for the services.

Source: slideserve.com

Source: slideserve.com

Competent parties to be valid insurance contracts must be made by legally from fin 4010 at humber college Competent parties are parties who are themselves legally capable of entering into agreements and contracts. This means you have to meet certain requirements such as being above the age of majority in your jurisdiction and have the mental capacity to understand what you are signing and agreeing to. The insurance contract involves—(a) the elements of the general contract, and (b) the element of special contract relating to insurance. With a contract of insurance, the parties to the contract are the applicant and the insurer.

Source: slideshare.net

Source: slideshare.net

In an insurance contract an offer and acceptance is not a requirement. Competent parties are parties who are themselves legally capable of entering into agreements and contracts. Competent parties to a contract when the contract and can be obtained for another to a sales at least two ways to in determining whether i. When an insurance company agrees to pay for an insured�s losses in exchange for a certain premium, the two parties have entered into a contract. Insurer in india must have a license from irda.

Source: slideserve.com

Source: slideserve.com

For an insurance contract to be valid, both parties must be competent. Particularly in a contract for services, the type of insurance the service provider carries is often built into the contract price for the services. For an insurance contract to be valid, both parties must be competent. In an insurance contract an insurer makes an offer and the prospect accepts it. Further, the parties must also be able to understand the basic nature of the contract.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title competent parties in insurance contract by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea