Complaints against insurance companies australia information

Home » Trending » Complaints against insurance companies australia informationYour Complaints against insurance companies australia images are ready. Complaints against insurance companies australia are a topic that is being searched for and liked by netizens now. You can Find and Download the Complaints against insurance companies australia files here. Download all free images.

If you’re looking for complaints against insurance companies australia pictures information linked to the complaints against insurance companies australia keyword, you have pay a visit to the ideal site. Our website always gives you hints for viewing the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

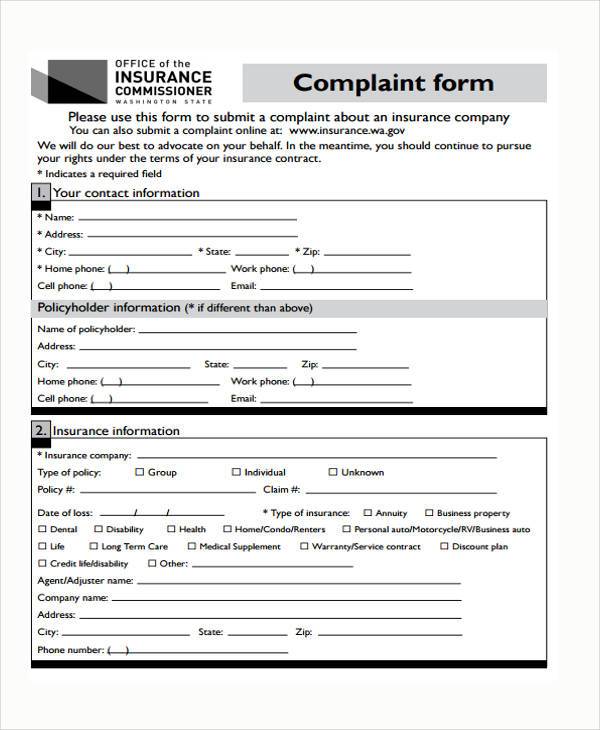

Complaints Against Insurance Companies Australia. The insurance company is dragging its feet, taking too long with your claim, or refusing to respond to calls or emails; We look at the facts and circumstances of each individual complaint. They will usually investigate the complaint in great detail. Types of complaints afca can consider about insurance policies you may wish to complain about several issues arising from your insurance policy, including:

FREE 34+ Complaint Letter Examples & Samples in PDF From examples.com

FREE 34+ Complaint Letter Examples & Samples in PDF From examples.com

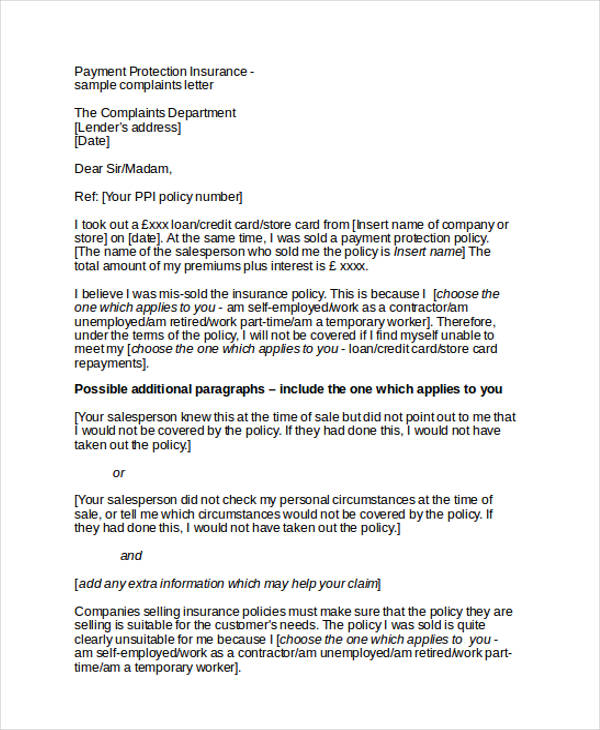

On the right, type in the name of an insurance company and. Businesses that provide consumer credit and loans must hold an australian credit licence under the national consumer credit protection act 2009 (cth). Premiums that were incorrectly charged. Complaints against banking, financial services, insurance companies and super funds; Advice that was not provided to you, or that you received about the insurance policy that may have been inappropriate or misleading. The letter is designed to be sent to the insurer, warning them that the matter will soon be referred to the financial ombudsman service.

Advice that was not provided to you, or that you received about the insurance policy that may have been inappropriate or misleading.

Advice that was not provided to you, or that you received about the insurance policy that may have been inappropriate or misleading. This information sheet (info 218) explains what you should do if you have a complaint about your life insurance policy. Contact the insurer to request as much information as possible about the reasons why your claim was refused. The insurance company is dragging its feet, taking too long with your claim, or refusing to respond to calls or emails; Complaints against banking, financial services, insurance companies and super funds. They will usually investigate the complaint in great detail.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

We look at the facts and circumstances of each individual complaint. Premiums that were incorrectly charged. This page will help you find out who to contact for information or assistance, and whether you should lodge a complaint about a company, organisation or person with another agency or report your concerns to asic. This information sheet (info 218) explains what you should do if you have a complaint about your life insurance policy. Through your superannuation (super) fund.

Source: justinziegler.net

Source: justinziegler.net

Lodge a complaint through the internal dispute resolution (idr) process with the insurer. The insurance company should resolve your complaint within a reasonable time. This information sheet (info 218) explains what you should do if you have a complaint about your life insurance policy. Complaints against banking, financial services, insurance companies and super funds. Irda will not accept your complaint until you have first filed a complaint with your insurance company.

Source: trak.in

Source: trak.in

Complaints against banking, financial services, insurance companies and super funds; If you�re not sure who to contact, call the australian securities and investments commission (asic)�s infoline — 1300 300 630. Premiums that were incorrectly charged. Contact the insurer to request as much information as possible about the reasons why your claim was refused. Afca is independent and provides a free service for consumers.

Source: jeka-vagan.blogspot.com

Source: jeka-vagan.blogspot.com

Some of these complaints can be resolved quickly. Here’s how to find complaints about an insurer. Health and community services complaints commissioner (sa) aged care quality and safety. This page will help you find out who to contact for information or assistance, and whether you should lodge a complaint about a company, organisation or person with another agency or report your concerns to asic. Sira manages complaints about workers compensation legislation, employers, service providers and insurers (if the complaint is made by a service provider or an employer) and complaints about ctp legislation or providers.

![]() Source: claimsmate.com

Source: claimsmate.com

The letter is designed to be sent to the insurer, warning them that the matter will soon be referred to the financial ombudsman service. Businesses that provide consumer credit and loans must hold an australian credit licence under the national consumer credit protection act 2009 (cth). This information sheet (info 218) explains what you should do if you have a complaint about your life insurance policy. Here are 4 steps to help you escalate your complaint to the australian financial complaints authority. This page will help you find out who to contact for information or assistance, and whether you should lodge a complaint about a company, organisation or person with another agency or report your concerns to asic.

Source: sampleforms.com

Source: sampleforms.com

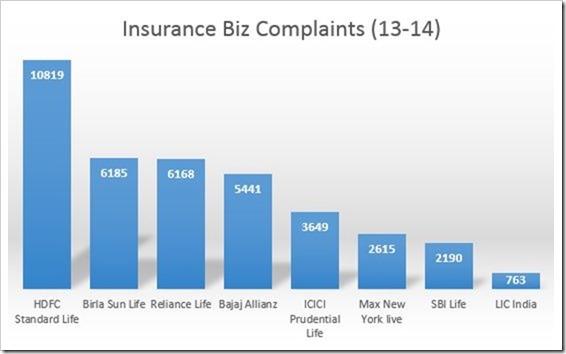

Insurance companies, insurance brokers, financial advisers and related entities providing financial services must. We receive complaints from consumers about a range of insurance products. As of 1 november 2018, all new financial services complaints are dealt with by the australian. The australian financial complaints authority independently and impartially examines general insurance disputes between general insurance companies and customers who hold policies for home and contents, motor vehicle, travel and other forms of general insurance. Here’s how to find complaints about an insurer.

Source: nerdwallet.com

Source: nerdwallet.com

This page outlines the types of complaints afca can consider about insurance products. This page outlines the types of complaints afca can consider about insurance products. In my opinion, i would firstly look at complaining to the ombudsman first as they are able to investigate the allegations that you have made against workcover. They will usually investigate the complaint in great detail. The insurance company has denied your claim without a valid reason;

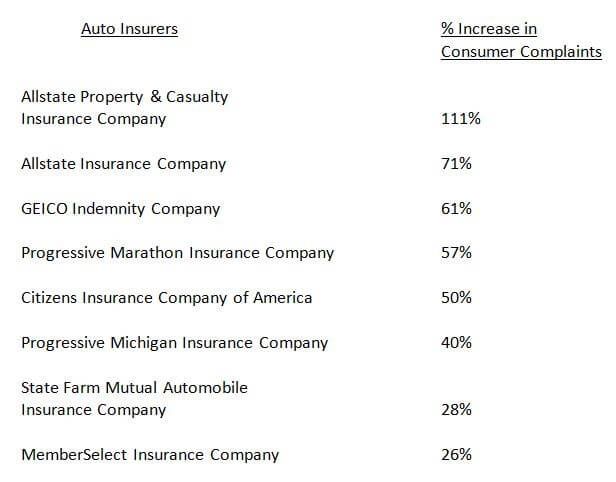

Source: michiganautolaw.com

Source: michiganautolaw.com

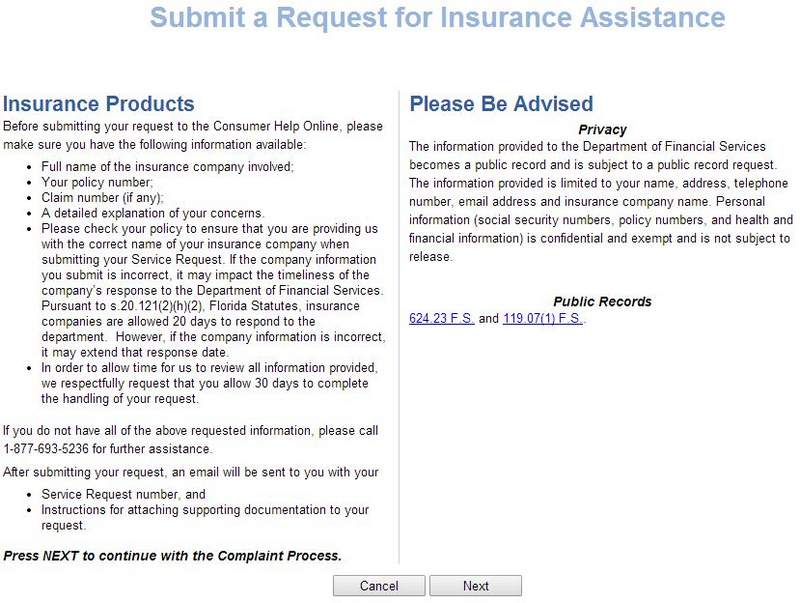

This page outlines the types of complaints afca can consider about insurance products. Sira manages complaints about workers compensation legislation, employers, service providers and insurers (if the complaint is made by a service provider or an employer) and complaints about ctp legislation or providers. There are three steps to follow when making a complaint, but the first step is always to contact the business to explain the problem and how you would like it fixed. This page will help you find out who to contact for information or assistance, and whether you should lodge a complaint about a company, organisation or person with another agency or report your concerns to asic. Contact the insurer to request as much information as possible about the reasons why your claim was refused.

Source: jeka-vagan.blogspot.com

Source: jeka-vagan.blogspot.com

Australian health practitioner regulation agency; In my opinion, i would firstly look at complaining to the ombudsman first as they are able to investigate the allegations that you have made against workcover. They will usually investigate the complaint in great detail. In case if it is not resolved within 15 days or if you are unhappy with their resolution you can approach the grievance redressal cell of the consumer affairs department of irdai: The insurance company is dragging its feet, taking too long with your claim, or refusing to respond to calls or emails;

Source: 457visacompared.com.au

Source: 457visacompared.com.au

Premiums that were incorrectly charged. Advice that was not provided to you, or that you received about the insurance policy that may have been inappropriate or misleading. Complaints against banking, financial services, insurance companies and super funds. The australian financial complaints authority (afca) can consider a complaint you have about a life insurance or general insurance product. As of 1 november 2018, all new financial services complaints are dealt with by the australian.

Source: pinterest.com

Source: pinterest.com

Sira manages complaints about workers compensation legislation, employers, service providers and insurers (if the complaint is made by a service provider or an employer) and complaints about ctp legislation or providers. Advice that was not provided to you, or that you received about the insurance policy that may have been inappropriate or misleading. If the ombudsman fail to find any wrongdoing then the next step would be to go to the workcover authority. The australian financial complaints authority (afca) can consider a complaint you have about a life insurance or general insurance product. They will usually investigate the complaint in great detail.

Source: quora.com

As of 1 november 2018, all new financial services complaints are dealt with by the australian. You can hold your policy: If you�re not sure who to contact, call the australian securities and investments commission (asic)�s infoline — 1300 300 630. Search by insurance company name go to the naic�s consumer information source. Some of the most common reasons include:

Through your superannuation (super) fund. The australian financial complaints authority (afca) can consider a complaint you have about a life insurance or general insurance product. Australian health practitioner regulation agency; Types of complaints afca can consider about insurance policies you may wish to complain about several issues arising from your insurance policy, including: Businesses that provide consumer credit and loans must hold an australian credit licence under the national consumer credit protection act 2009 (cth).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

It also tells you what to do next if you want to make a complaint to us. Lodge a complaint through the internal dispute resolution (idr) process with the insurer. Contact the insurer to request as much information as possible about the reasons why your claim was refused. Sira manages complaints about workers compensation legislation, employers, service providers and insurers (if the complaint is made by a service provider or an employer) and complaints about ctp legislation or providers. Insurance companies, insurance brokers, financial advisers and related entities providing financial services must.

Source: maddmagzzdesignz.blogspot.com

Premiums that were incorrectly charged. Australian health practitioner regulation agency; The insurance company has denied your claim without a valid reason; In my opinion, i would firstly look at complaining to the ombudsman first as they are able to investigate the allegations that you have made against workcover. Here are 4 steps to help you escalate your complaint to the australian financial complaints authority.

Source: nerdwallet.com

Source: nerdwallet.com

We look at the facts and circumstances of each individual complaint. Complaints against health and community services; There are three steps to follow when making a complaint, but the first step is always to contact the business to explain the problem and how you would like it fixed. Insurance companies, insurance brokers, financial advisers and related entities providing financial services must. If you�re not sure who to contact, call the australian securities and investments commission (asic)�s infoline — 1300 300 630.

Source: template.net

Source: template.net

Insurance companies, insurance brokers, financial advisers and related entities providing financial services must. Sira manages complaints about workers compensation legislation, employers, service providers and insurers (if the complaint is made by a service provider or an employer) and complaints about ctp legislation or providers. The letter is designed to be sent to the insurer, warning them that the matter will soon be referred to the financial ombudsman service. This page outlines the types of complaints afca can consider about insurance products. On the right, type in the name of an insurance company and.

Source: examples.com

Source: examples.com

In my opinion, i would firstly look at complaining to the ombudsman first as they are able to investigate the allegations that you have made against workcover. Complaints against health and community services; Advice that was not provided to you, or that you received about the insurance policy that may have been inappropriate or misleading. Some of the most common reasons include: Resolve a problem the repair, replace, refund problem solver helps you understand your consumer rights and the steps you can take to resolve a problem.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title complaints against insurance companies australia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea