Comprehensive or third party car insurance information

Home » Trending » Comprehensive or third party car insurance informationYour Comprehensive or third party car insurance images are ready in this website. Comprehensive or third party car insurance are a topic that is being searched for and liked by netizens now. You can Get the Comprehensive or third party car insurance files here. Download all royalty-free vectors.

If you’re searching for comprehensive or third party car insurance images information linked to the comprehensive or third party car insurance interest, you have pay a visit to the right blog. Our website always gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

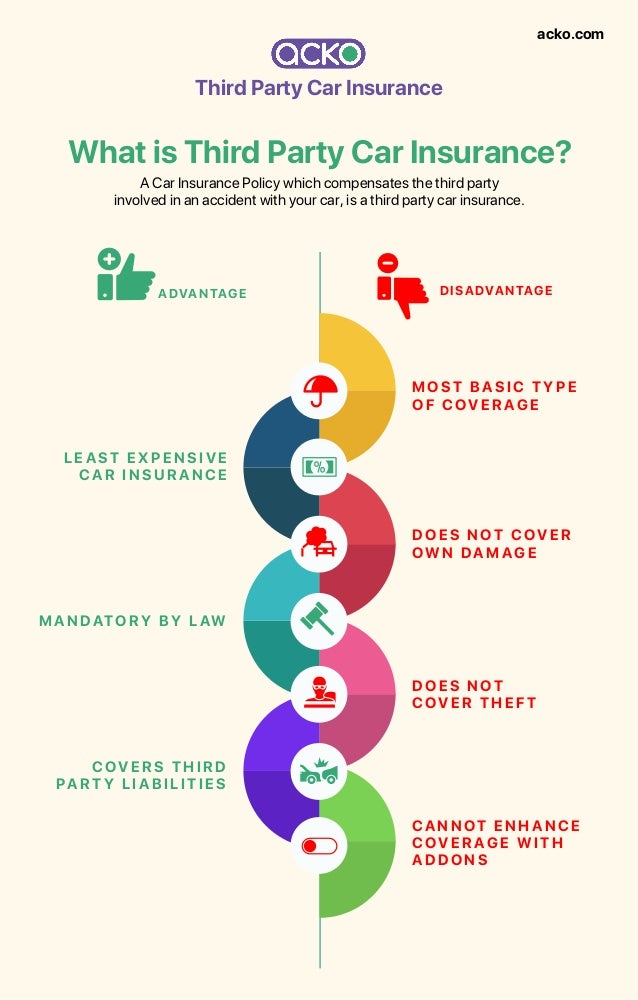

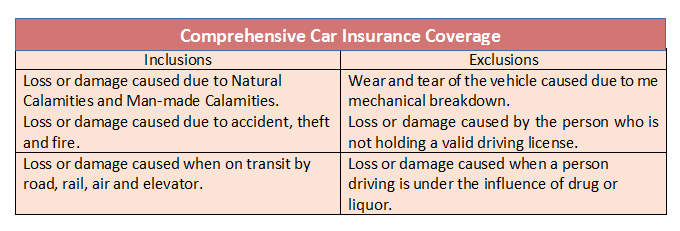

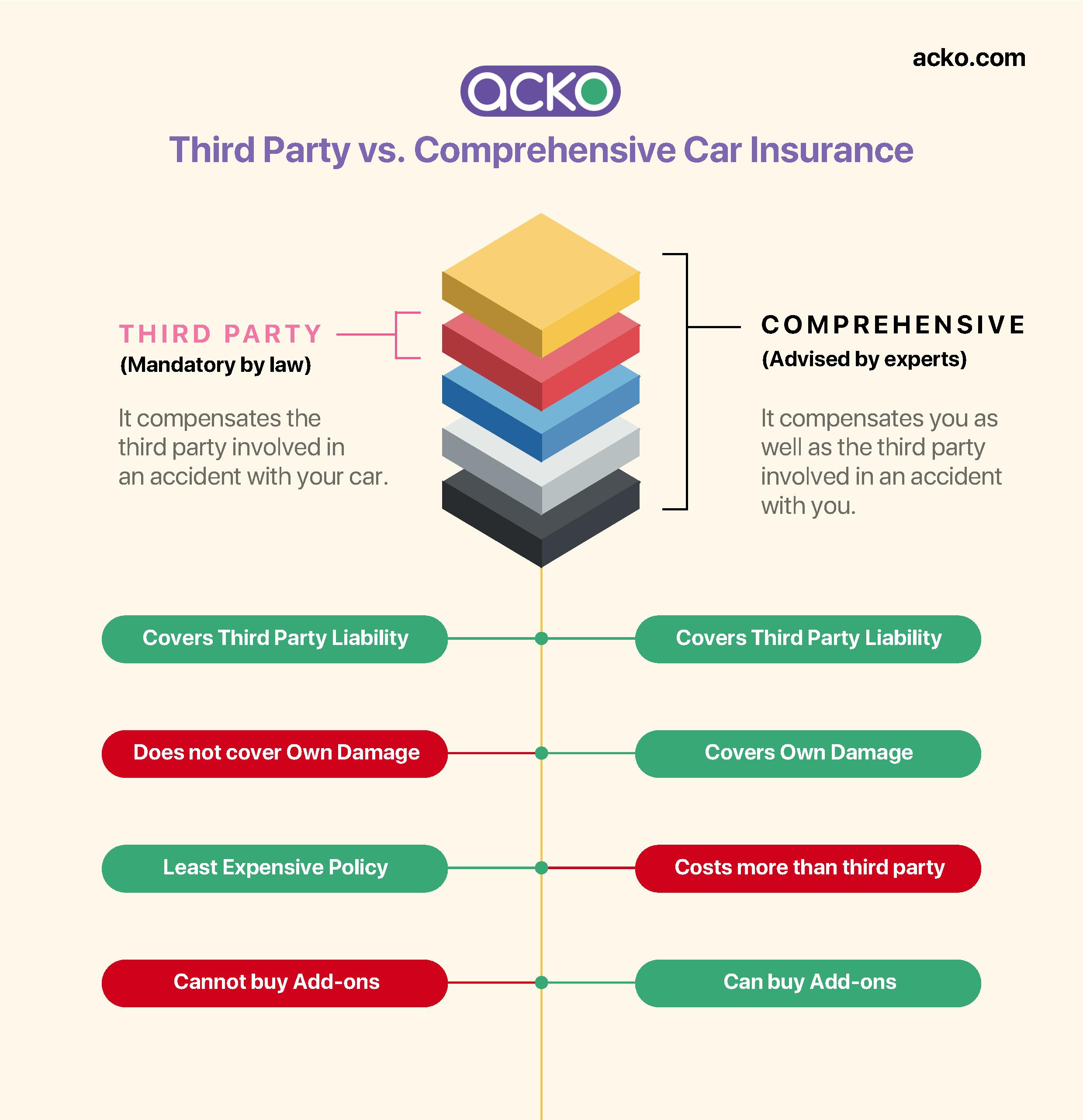

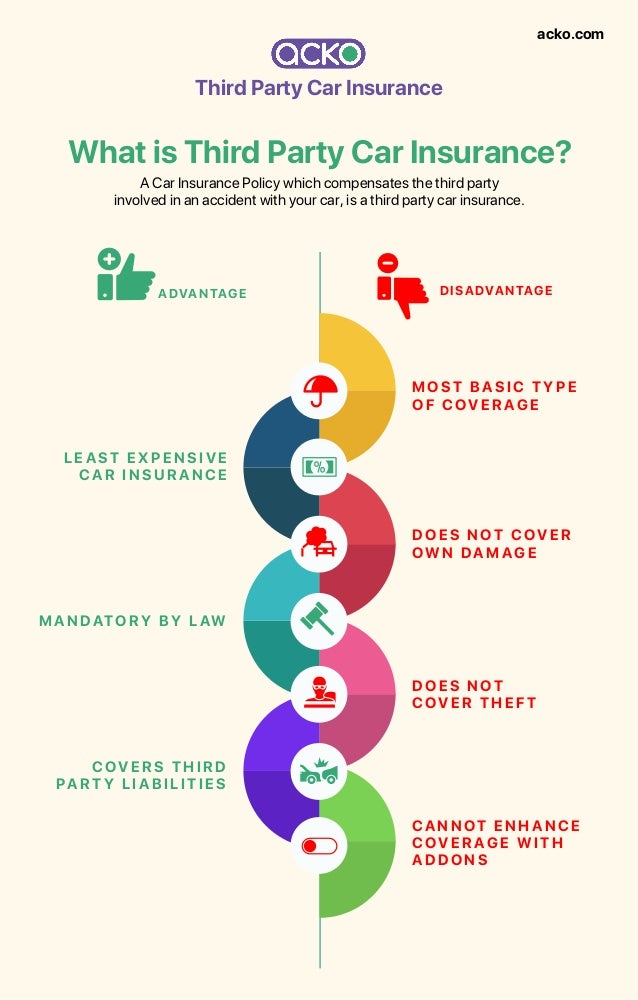

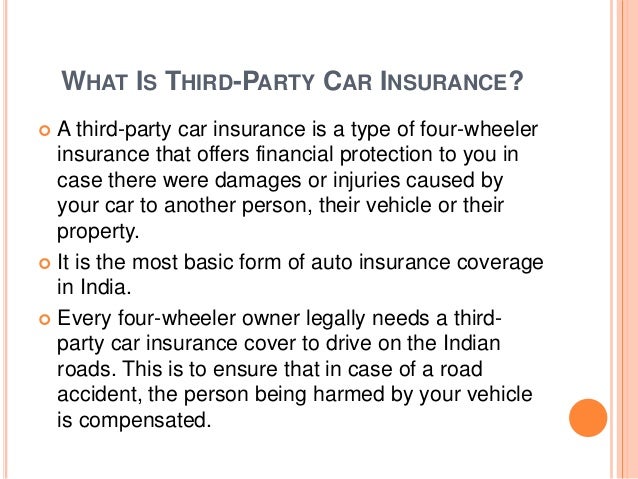

Comprehensive Or Third Party Car Insurance. So in effect, there are two main types of insurance. But when choosing between the two, you should consider your needs as well as the. These are referred to as your liabilities. Thefts, falling objects, or vandalism might also be covered under certain plans.

Third Party Car Insurance / Third Party Vs Comprehensive From yukensaiainwe.blogspot.com

Third Party Car Insurance / Third Party Vs Comprehensive From yukensaiainwe.blogspot.com

Of course, third party with fire and theft is exactly the same as third party except you’re covered if your car is stolen, broken into, set on fire or vandalised. A car insurance policy that offers enhanced coverage in the form of own damage insurance cover. Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else. Third party only (tpo) motor insurance the main reason for mandatory car insurance is to not to protect yourself or your car; It also covers damage to your car. Tpo insurance is basically liabilities coverage

This can be anything from a pedestrian you hit, to a stop sign that you knock down.

Not only could comprehensive insurance be cheaper than paying for third party cover, but if you get into an accident, your insurance company will pay for the damages to your vehicle. Selecting the right kind of insurance is important for you. This provides complete protection, both to you as well as to the third party. It will only cover harm you cause to other people, cars or property, and won’t pay out for any damage to your own car or any medical costs you incur. Fully comprehensive, third party (fire and theft) and third party only. But when choosing between the two, you should consider your needs as well as the.

Source: fincash.com

Source: fincash.com

Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else. Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else. Of course, third party with fire and theft is exactly the same as third party except you’re covered if your car is stolen, broken into, set on fire or vandalised. But when choosing between the two, you should consider your needs as well as the. It also covers damage to your car.

Source: bestfind.com.au

Source: bestfind.com.au

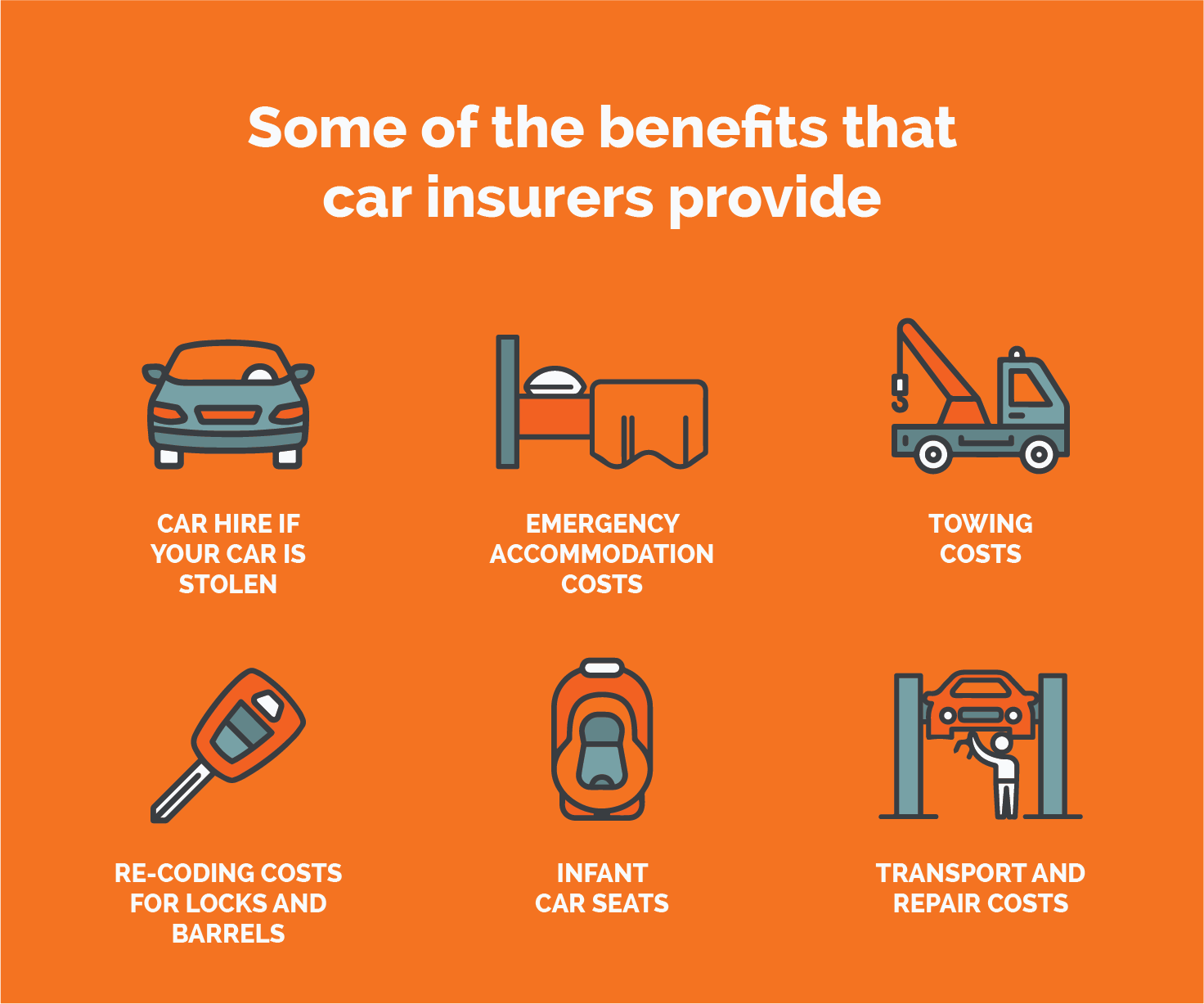

However, if needed, comprehensive cover may pay out for floods, earthquakes, fire, theft, falling tree branches or being hit by a falling meteor on the freeway. These are referred to as your liabilities. At qbe, we offer two levels of car insurance cover in addition to ctp insurance. This includes accidents without a third party, such as reversing into a pole and damaging the car. A car insurance policy that offers enhanced coverage in the form of own damage insurance cover.

Source: slideshare.net

Source: slideshare.net

This means you don’t necessarily have to compromise on your cover just to save a few pounds. But when choosing between the two, you should consider your needs as well as the. Though comprehensive car insurance may cost you more than third party property damage, it offers an extensive range of features and benefits. It covers your car for accidental damage, fire and theft as well as damage your. It is also known as a comprehensive car insurance policy.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

This can be anything from a pedestrian you hit, to a stop sign that you knock down. This provides complete protection, both to you as well as to the third party. Thefts, falling objects, or vandalism might also be covered under certain plans. Read on to know about the difference between third party and comprehensive car insurance. Though comprehensive car insurance may cost you more than third party property damage, it offers an extensive range of features and benefits.

Source: yukensaiainwe.blogspot.com

Source: yukensaiainwe.blogspot.com

As stated above, this mandatory third party insurance covers. It also covers damage to your car. It can provide coverage for personal accidents, or natural calamities like fire or floods. At qbe, we offer two levels of car insurance cover in addition to ctp insurance. Tpo insurance is basically liabilities coverage

Source: yukensaiainwe.blogspot.com

Source: yukensaiainwe.blogspot.com

It will only cover harm you cause to other people, cars or property, and won’t pay out for any damage to your own car or any medical costs you incur. It also covers damage to your car. As mentioned above, comprehensive car insurance is a combination of third party insurance and own damage insurance. However, the driver’s age, the age of driving license and the number of previous car. This can be anything from a pedestrian you hit, to a stop sign that you knock down.

Source: authorstream.com

Source: authorstream.com

Comprehensive insurance, sometimes referred to as ‘fully comp’, covers you and your vehicle as well as any other vehicles that are involved in an accident, regardless of whether it was your fault or not. The main kind is probably accident damage. These are referred to as your liabilities. Comprehensive insurance, sometimes referred to as ‘fully comp’, covers you and your vehicle as well as any other vehicles that are involved in an accident, regardless of whether it was your fault or not. Comprehensive car insurance covers damages to both your car and to the other person’s car or property.

Source: slideshare.net

Source: slideshare.net

This means you don’t necessarily have to compromise on your cover just to save a few pounds. It’s to protect third parties that you may injure. This provides complete protection, both to you as well as to the third party. Thefts, falling objects, or vandalism might also be covered under certain plans. Comprehensive car insurance covers you for damage to someone else�s car or property and your own, whereas third party is generally cheaper because you�ll be out of pocket if something happens to.

Source: pinterest.com

Source: pinterest.com

It helps save money in case you are unable to pay for the repairs. Read on to know about the difference between third party and comprehensive car insurance. The main kind is probably accident damage. It provides comprehensive coverage against third party liabilities and loss or damages of the car from accidents, vandalism, fire, falling objects or floods. Qbe’s comprehensive car insurance is our highest level of protection.

Source: bankbazaarinsurance.com

Source: bankbazaarinsurance.com

Fully comprehensive, third party (fire and theft) and third party only. Comprehensive insurance covers both you and anyone else who might have been involved in an accident where you were at fault. The main kind is probably accident damage. What’s the difference between comprehensive and third party car insurance? Comprehensive car insurance includes liability insurance as above.

Source: banksathi.com

Source: banksathi.com

So in effect, there are two main types of insurance. It can provide coverage for personal accidents, or natural calamities like fire or floods. A car insurance policy that offers enhanced coverage in the form of own damage insurance cover. Selecting the right kind of insurance is important for you. Comprehensive insurance, sometimes referred to as ‘fully comp’, covers you and your vehicle as well as any other vehicles that are involved in an accident, regardless of whether it was your fault or not.

Source: pinterest.com

Source: pinterest.com

Comprehensive car insurance covers damages to both your car and to the other person’s car or property. It covers your car for accidental damage, fire and theft as well as damage your. There are 3 primary types of car insurance cover; It provides comprehensive coverage against third party liabilities and loss or damages of the car from accidents, vandalism, fire, falling objects or floods. It can provide coverage for personal accidents, or natural calamities like fire or floods.

Source: nextinsurance.co.ke

Source: nextinsurance.co.ke

There are 3 primary types of car insurance cover; As mentioned above, comprehensive car insurance is a combination of third party insurance and own damage insurance. This means you don’t necessarily have to compromise on your cover just to save a few pounds. This can be anything from a pedestrian you hit, to a stop sign that you knock down. At qbe, we offer two levels of car insurance cover in addition to ctp insurance.

Source: pinterest.com

Source: pinterest.com

However, if needed, comprehensive cover may pay out for floods, earthquakes, fire, theft, falling tree branches or being hit by a falling meteor on the freeway. Thefts, falling objects, or vandalism might also be covered under certain plans. It is also known as a comprehensive car insurance policy. As mentioned above, comprehensive car insurance is a combination of third party insurance and own damage insurance. However, if needed, comprehensive cover may pay out for floods, earthquakes, fire, theft, falling tree branches or being hit by a falling meteor on the freeway.

Source: youtube.com

Source: youtube.com

Here’s a breakdown to clarify the difference: As stated above, this mandatory third party insurance covers. However, the driver’s age, the age of driving license and the number of previous car. But when choosing between the two, you should consider your needs as well as the. These are referred to as your liabilities.

Source: iselect.com.au

Source: iselect.com.au

It provides comprehensive coverage against third party liabilities and loss or damages of the car from accidents, vandalism, fire, falling objects or floods. It’s to protect third parties that you may injure. Comprehensive car insurance includes liability insurance as above. It will only cover harm you cause to other people, cars or property, and won’t pay out for any damage to your own car or any medical costs you incur. Read on to know about the difference between third party and comprehensive car insurance.

Source: bankbazaar.com

Source: bankbazaar.com

Not only could comprehensive insurance be cheaper than paying for third party cover, but if you get into an accident, your insurance company will pay for the damages to your vehicle. It’s to protect third parties that you may injure. It also covers damage to your car. It helps save money in case you are unable to pay for the repairs. Selecting the right kind of insurance is important for you.

Source: nextinsurance.co.ke

Source: nextinsurance.co.ke

Choosing the right kind of insurance for your vehicle is crucial in india. Of course, third party with fire and theft is exactly the same as third party except you’re covered if your car is stolen, broken into, set on fire or vandalised. When you are looking for car insurance, you usually have two options: Comprehensive insurance, sometimes referred to as ‘fully comp’, covers you and your vehicle as well as any other vehicles that are involved in an accident, regardless of whether it was your fault or not. A car insurance policy that offers enhanced coverage in the form of own damage insurance cover.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title comprehensive or third party car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea