Comprehensive vs third party insurance india information

Home » Trending » Comprehensive vs third party insurance india informationYour Comprehensive vs third party insurance india images are ready. Comprehensive vs third party insurance india are a topic that is being searched for and liked by netizens now. You can Download the Comprehensive vs third party insurance india files here. Download all royalty-free images.

If you’re searching for comprehensive vs third party insurance india pictures information connected with to the comprehensive vs third party insurance india interest, you have pay a visit to the right site. Our site always gives you hints for downloading the highest quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

Comprehensive Vs Third Party Insurance India. The most crucial task in india is to choose the right type of policy for your vehicle. This is because the latter offers more expansive coverage There are 3 primary types of car insurance cover; What is comprehensive car insurance?

Comparison Between Comprehensive Insurance VS Third Party From healthnewsreporting.com

Comparison Between Comprehensive Insurance VS Third Party From healthnewsreporting.com

Restricted up to 5 years. This is because the latter offers more expansive coverage Depreciation of parts is not considered: Both insurance covers are different comprehensive being non collision and third party being . It is mandatory, and covers any financial liability the policy holder may incur from a third party damage liability covers costs resulting from damages to or loss of property. Mods, i did not find any other threads on this, if their is one please redirect.

Comprehensive insurance also covers theft and damage caused by third parties.

This type of vehicle insurance policy comes with a bucketful of advantages which makes its premium worthwhile. Both insurance covers are different comprehensive being non collision and third party being . Third party insurance is mandatory, so you can’t skip it. So in effect, there are two main types of insurance. This type of insurance can also be opted for old cars that are no longer in the prime condition. Fully comprehensive, third party (fire and theft) and third party only.

Source: ilainfo.com

Source: ilainfo.com

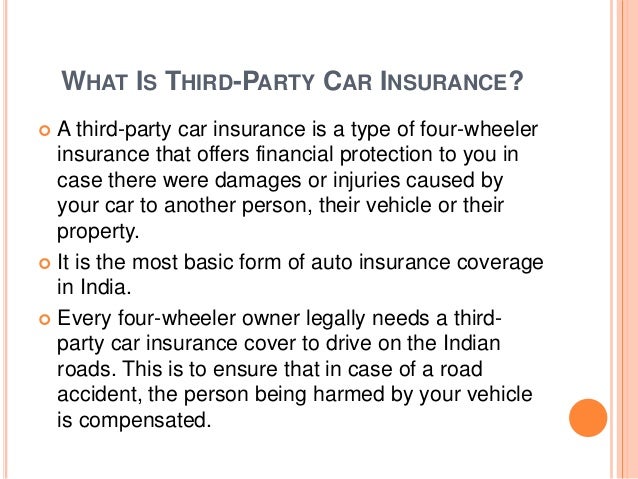

Depreciation of parts is not considered: I just find out that their are two types of insurance comprehensive and third party insurance. The main purpose of this type of insurance is to protect you from damages and losses caused to a third party because of your vehicle. One such rule is to have a valid motor insurance policy for your vehicle. Third party insurance is mandatory, so you can’t skip it.

Source: youtube.com

Source: youtube.com

The main purpose of this type of insurance is to protect you from damages and losses caused to a third party because of your vehicle. Age of the car : It is mandatory, and covers any financial liability the policy holder may incur from a third party damage liability covers costs resulting from damages to or loss of property. Post that, acko and the policyholder will decide. There are 3 primary types of car insurance cover;

Source: ringgitplus.com

Source: ringgitplus.com

Slightly higher premium than comprehensive insurance: Depreciation of parts is not considered: This type of vehicle insurance policy comes with a bucketful of advantages which makes its premium worthwhile. Slightly higher premium than comprehensive insurance: This is because the latter offers more expansive coverage

Source: ilainfo.com

Source: ilainfo.com

It is mandatory, and covers any financial liability the policy holder may incur from a third party damage liability covers costs resulting from damages to or loss of property. Depreciation of parts is considered : I just find out that their are two types of insurance comprehensive and third party insurance. Comprehensive insurance also covers theft and damage caused by third parties. It is mandatory, and covers any financial liability the policy holder may incur from a third party damage liability covers costs resulting from damages to or loss of property.

Source: banksathi.com

Source: banksathi.com

Both insurance covers are different comprehensive being non collision and third party being . Natural disasters, riot damage, etc, and also offers third party coverage. So the question is whether you should opt for a comprehensive policy or not, because comprehensive policy will have a higher premium against it as compared to stand alone tp policy. Third party insurance is mandatory, so you can’t skip it. Usually up to 15 years :

Source: msimages.org

Source: msimages.org

I just find out that their are two types of insurance comprehensive and third party insurance. This type of insurance can also be opted for old cars that are no longer in the prime condition. Slightly higher premium than comprehensive insurance: The main purpose of this type of insurance is to protect you from damages and losses caused to a third party because of your vehicle. This type of vehicle insurance policy comes with a bucketful of advantages which makes its premium worthwhile.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

Age of the car : Choosing the right kind of insurance for your vehicle is crucial in india. There are 3 primary types of car insurance cover; The major difference between the two is just the kind of coverage the company offers. Difference between comprehensive insurance vs bumper to bumper insurance.

Source: bankbazaarinsurance.com

Source: bankbazaarinsurance.com

This type of vehicle insurance policy comes with a bucketful of advantages which makes its premium worthwhile. What is comprehensive car insurance? Difference between comprehensive insurance vs bumper to bumper insurance. Choosing the right kind of insurance for your vehicle is crucial in india. This is because the latter offers more expansive coverage

Source: youtube.com

Source: youtube.com

Mods, i did not find any other threads on this, if their is one please redirect. Difference between comprehensive insurance vs bumper to bumper insurance. It is mandatory, and covers any financial liability the policy holder may incur from a third party damage liability covers costs resulting from damages to or loss of property. Restricted up to 5 years. One such rule is to have a valid motor insurance policy for your vehicle.

Source: pinterest.com

Source: pinterest.com

The most crucial task in india is to choose the right type of policy for your vehicle. Depreciation of parts is considered : The main purpose of this type of insurance is to protect you from damages and losses caused to a third party because of your vehicle. Third party insurance is mandatory, so you can’t skip it. Choosing the right kind of insurance for your vehicle is crucial in india.

Source: authorstream.com

Source: authorstream.com

The major difference between the two is just the kind of coverage the company offers. However, when you do an actual car insurance comparison by looking at terms and inclusions as set out in the. The most crucial task in india is to choose the right type of policy for your vehicle. Difference between comprehensive insurance vs bumper to bumper insurance. Usually up to 15 years :

Source: slideshare.net

Source: slideshare.net

Difference between comprehensive insurance vs bumper to bumper insurance. It is mandatory, and covers any financial liability the policy holder may incur from a third party damage liability covers costs resulting from damages to or loss of property. Usually up to 15 years : Fully comprehensive, third party (fire and theft) and third party only. This is because the latter offers more expansive coverage

Source: bajajfinservmarkets.in

Source: bajajfinservmarkets.in

Third party insurance is mandatory, so you can’t skip it. Slightly higher premium than comprehensive insurance: The major difference between the two is just the kind of coverage the company offers. Depreciation of parts is considered : The most crucial task in india is to choose the right type of policy for your vehicle.

Source: banksathi.com

Source: banksathi.com

The major difference between the two is just the kind of coverage the company offers. So in effect, there are two main types of insurance. There are 3 primary types of car insurance cover; I just find out that their are two types of insurance comprehensive and third party insurance. However, when you do an actual car insurance comparison by looking at terms and inclusions as set out in the.

Source: pinterest.com

Source: pinterest.com

It is mandatory, and covers any financial liability the policy holder may incur from a third party damage liability covers costs resulting from damages to or loss of property. One such rule is to have a valid motor insurance policy for your vehicle. Both insurance covers are different comprehensive being non collision and third party being . This is because the latter offers more expansive coverage Depreciation of parts is considered :

Source: financialexpress.com

Source: financialexpress.com

This is because the latter offers more expansive coverage The main purpose of this type of insurance is to protect you from damages and losses caused to a third party because of your vehicle. Having car insurance is important to protect you from hefty damages, theft, losses due to the mishap, damages due to collison, flood it is important to know the differences between both the coverages to make a decision on. So the question is whether you should opt for a comprehensive policy or not, because comprehensive policy will have a higher premium against it as compared to stand alone tp policy. Usually up to 15 years :

Source: youtube.com

Source: youtube.com

Usually up to 15 years : Of course, third party with fire and theft is exactly the same as third party except you’re covered if your car is stolen, broken into, set on fire or vandalised. Third party insurance is mandatory, so you can’t skip it. This type of vehicle insurance policy comes with a bucketful of advantages which makes its premium worthwhile. Natural disasters, riot damage, etc, and also offers third party coverage.

Source: tennis-games-best.blogspot.com

Source: tennis-games-best.blogspot.com

I just find out that their are two types of insurance comprehensive and third party insurance. Of course, third party with fire and theft is exactly the same as third party except you’re covered if your car is stolen, broken into, set on fire or vandalised. Depreciation of parts is considered : The most crucial task in india is to choose the right type of policy for your vehicle. Restricted up to 5 years.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title comprehensive vs third party insurance india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea