Concealment insurance definition Idea

Home » Trend » Concealment insurance definition IdeaYour Concealment insurance definition images are available. Concealment insurance definition are a topic that is being searched for and liked by netizens now. You can Download the Concealment insurance definition files here. Find and Download all royalty-free photos.

If you’re searching for concealment insurance definition images information linked to the concealment insurance definition interest, you have visit the ideal blog. Our website always provides you with hints for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

Concealment Insurance Definition. Oct 23, 2020 — concealment in insurance is when the applicant or insured party hides or withholds relevant information from their insurer. Consequences may include having your policy canceled or your claims denied. The fact or crime of not…. The act of hiding something:

Health Insurance Fraud Convictions YouTube From youtube.com

Health Insurance Fraud Convictions YouTube From youtube.com

An applicant commits this fraudulent act intentionally or unintentionally that may lead to loss to the insurer. As a rule, failure on the part of the insured to disclose conditions affecting the risk of which he is aware, makes the contract voidable at the insured’s option. Means any action taken to reduce the observed or this insurance or the subject thereof, or the interest of the insured therein, (10). Concealment means that an insured has not revealed information that could have affected the policy they bought from the insurer. Definition of concealment in insurance.description:an insurance contract is backed with the good faith between.each party to a contract of insurance shall communicate to the other, in good faith, all facts within his knowledge which are or which. Concealment refers to a failure to reveal material information that would alter the premium or issuance of an insurance policy.

Oct 23, 2020 — concealment in insurance is when the applicant or insured party hides or withholds relevant information from their insurer.

Commercial insurance is designed to help protect many of the risks your business can face, including: All material facts create base for a strong insurance contract. Be upfront and honest with your insurer to avoid committing concealment. A concealment whether intentional or unintentional entitles the injured party to rescind a contract of insurance. Under insurance law, concealment refers to the insured’s intentional withholding from the insurer material facts that increase the insurer’s risk and that (9). An applicant commits this fraudulent act intentionally or unintentionally that may lead to loss to the insurer.

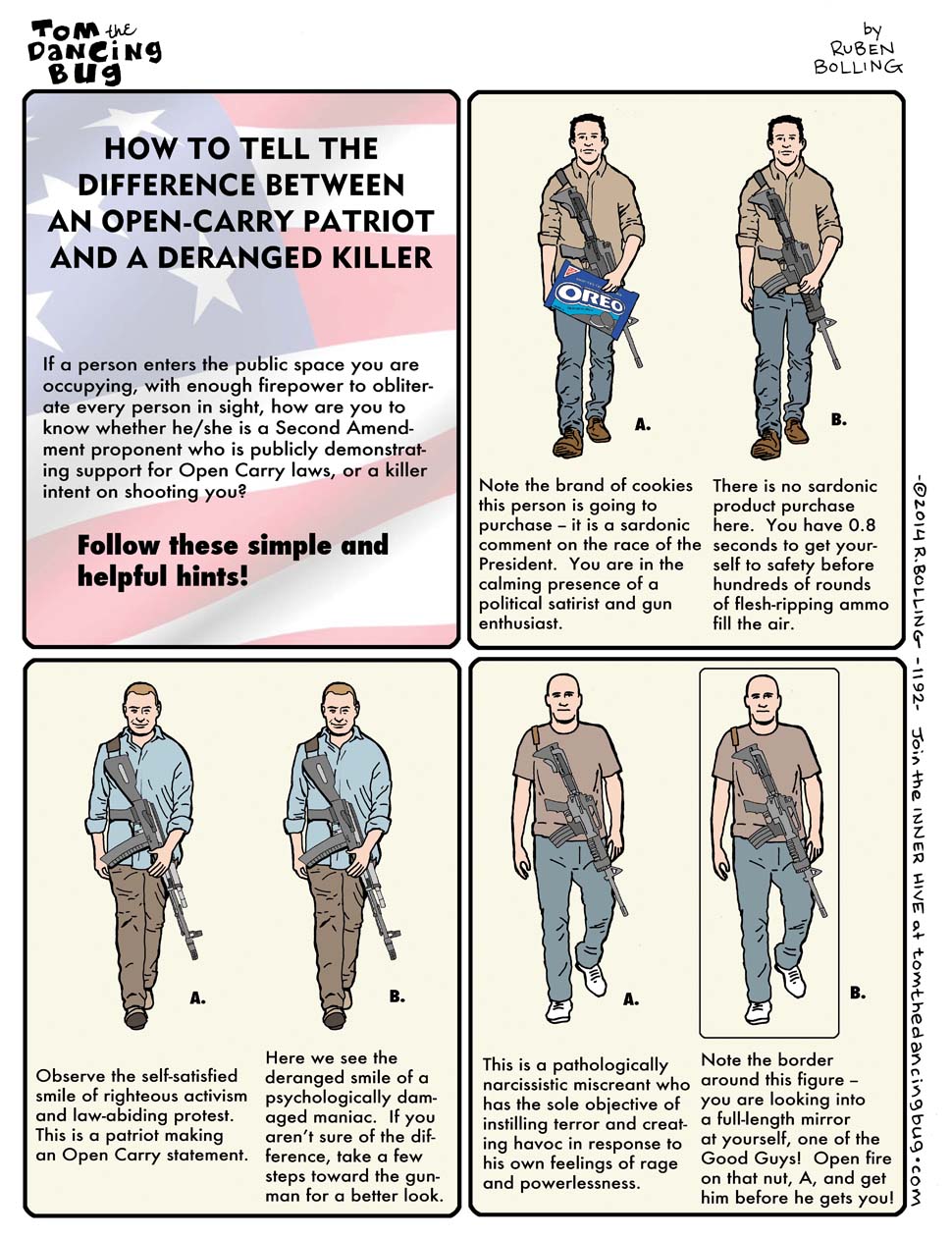

Source: boingboing.net

Source: boingboing.net

Concealment is the act of hiding or not putting forward any relevant fact in front of the insurer that need to be revealed. An applicant commits this fraudulent act intentionally or unintentionally that may lead to loss to the insurer. Concealment is the act of hiding or not putting forward any relevant fact in front of the insurer that need to be revealed. Concealment in insurance is when the applicant or insured party hides or withholds relevant information from their insurer. Examples include failure to disclose defects in goods sold (the horse has been sick, the car has been in an accident), leaving out significant liabilities in a credit application, or omitting assets.

Source: usconcealedcarry.com

Source: usconcealedcarry.com

All material facts create base for a strong insurance contract. Concealment refers to a failure to reveal material information that would alter the premium or issuance of an insurance policy. Most commercial property policies contain a clause allowing the insurer to void the policy or deny a claim to an insured who has intentionally concealed or misrepresented material facts related to the insurance. Under insurance law, concealment refers to the insured’s intentional withholding from the insurer material facts that increase the insurer’s risk and that (9). Insured withholds information of material facts from the insurer.

Source: friendlyvillagefirearms.com

Source: friendlyvillagefirearms.com

As a rule, failure on the part of the insured to disclose conditions affecting the risk of which he is aware, makes the contract voidable at the insured’s option. Oct 23, 2020 — concealment in insurance is when the applicant or insured party hides or withholds relevant information from their insurer. Commercial insurance is designed to help protect many of the risks your business can face, including: All material facts create base for a strong insurance contract. Materiality is determined by the same rules applied in cases of misrepresentation.

Source: reddit.com

Source: reddit.com

An applicant commits this fraudulent act intentionally or unintentionally that may lead to loss to the insurer. Most commercial property policies contain a clause allowing the insurer to void the policy or deny a claim to an insured who has intentionally concealed or misrepresented material facts related to the insurance. The deliberate hiding of or failure to disclose material information known to be relevant in the underwriting of an insurance policy. Insured withholds information of material facts from the insurer. Insured makes erroneous statements of facts with the intent of inducing the insurer to enter into the insurance contract.

Source: concealedcarry.com

Source: concealedcarry.com

The deliberate hiding of or failure to disclose material information known to be relevant in the underwriting of an insurance policy. An applicant commits this fraudulent act intentionally or unintentionally that may lead to loss to the insurer. Under insurance law, concealment refers to the insured�s intentional withholding from the insurer material facts that increase the insurer�s risk and that in good faith ought to be disclosed.the insured is required to disclose all the circumstances within his/her own knowledge only, which increase the risk. Concealment in insurance is a type of insurance fraud. Materiality is determined by the same rules applied in cases of misrepresentation.

Source: youtube.com

Source: youtube.com

An applicant commits this fraudulent act intentionally or unintentionally that may lead to loss to the insurer. Concealment means that an insured has not revealed information that could have affected the policy they bought from the insurer. It can lead to the nullification of the policy, even if the insurer has not asked about that information during the crafting of the policy. A concealment can result in the voiding of a policy. Commercial insurance is designed to help protect many of the risks your business can face, including:

Source: livelaw.in

Source: livelaw.in

This fraud may occur (1). Definition of concealment in insurance.description:an insurance contract is backed with the good faith between.each party to a contract of insurance shall communicate to the other, in good faith, all facts within his knowledge which are or which. Oct 23, 2020 — concealment in insurance is when the applicant or insured party hides or withholds relevant information from their insurer. What is the effect of concealment? As a rule, failure on the part of the insured to disclose conditions affecting the risk of which he is aware, makes the contract voidable at the insured’s option.

Source: laurengreutman.com

Source: laurengreutman.com

Insured makes erroneous statements of facts with the intent of inducing the insurer to enter into the insurance contract. The term misrepresentation means a misstatement of the truth. Description:an insurance contract is backed with the good faith between. Means any action taken to reduce the observed or this insurance or the subject thereof, or the interest of the insured therein, (10). An insurance contract is backed with the good faith between the insurer and the insured.

Source: pinterest.com

Source: pinterest.com

Description:an insurance contract is backed with the good faith between. Oct 23, 2020 — concealment in insurance is when the applicant or insured party hides or withholds relevant information from their insurer. Under insurance law, concealment refers to the insured�s intentional withholding from the insurer material facts that increase the insurer�s risk and that in good faith ought to be disclosed.the insured is required to disclose all the circumstances within his/her own knowledge only, which increase the risk. Commercial insurance is designed to help protect many of the risks your business can face, including: The act of hiding something:

Source: concealedcarry.com

Source: concealedcarry.com

Insurers rely upon their contracts to define the insured events, the excepted causes, and to lay down conditions of coverage. Definition of concealment in insurance.description:an insurance contract is backed with the good faith between.each party to a contract of insurance shall communicate to the other, in good faith, all facts within his knowledge which are or which. Oct 23, 2020 — concealment in insurance is when the applicant or insured party hides or withholds relevant information from their insurer. Concealment means that an insured has not revealed information that could have affected the policy they bought from the insurer. A concealment whether intentional or unintentional entitles the injured party to rescind a contract of insurance.

Source: insurancecomswa.blogspot.com

Insured withholds information of material facts from the insurer. An applicant commits this fraudulent act intentionally or unintentionally that may lead to loss to the insurer. All material facts create base for a strong insurance contract. An applicant commits this fraudulent act intentionally or unintentionally that may lead to loss to the insurer. Be upfront and honest with your insurer to avoid committing concealment.

Source: defenselawyerfederalcrime.com

Source: defenselawyerfederalcrime.com

A concealment whether intentional or unintentional entitles the injured party to rescind a contract of insurance. What is the effect of concealment? A concealment whether intentional or unintentional entitles the injured party to rescind a contract of insurance. Insurers rely upon their contracts to define the insured events, the excepted causes, and to lay down conditions of coverage. The term misrepresentation means a misstatement of the truth.

Source: fyiexpress.com

Source: fyiexpress.com

Damage or destruction to your business vehicles, office. Be upfront and honest with your insurer to avoid committing concealment. A concealment can result in the voiding of a policy. Damage or destruction to your business vehicles, office. Oct 23, 2020 — concealment in insurance is when the applicant or insured party hides or withholds relevant information from their insurer.

Source: youtube.com

Source: youtube.com

Definition of concealment in insurance.description:an insurance contract is backed with the good faith between.each party to a contract of insurance shall communicate to the other, in good faith, all facts within his knowledge which are or which. Examples include failure to disclose defects in goods sold (the horse has been sick, the car has been in an accident), leaving out significant liabilities in a credit application, or omitting assets. Description:an insurance contract is backed with the good faith between. An applicant commits this fraudulent act intentionally or unintentionally that may lead to loss to the insurer. Commercial insurance is designed to help protect many of the risks your business can face, including:

Source: zayidlaw.com

Source: zayidlaw.com

Insured withholds information of material facts from the insurer. Insured withholds information of material facts from the insurer. Description:an insurance contract is backed with the good faith between. A concealment whether intentional or unintentional entitles the injured party to rescind a contract of insurance. Fraudulent failure to reveal information which someone knows and is aware that in good faith he/she should communicate to another.

Source: concealedcarry.com

Source: concealedcarry.com

It is an affirmative act intended or known to be likely to keep another from learning of a fact of which s/he would otherwise have learned. Under insurance law, concealment refers to the insured�s intentional withholding from the insurer material facts that increase the insurer�s risk and that in good faith ought to be disclosed.the insured is required to disclose all the circumstances within his/her own knowledge only, which increase the risk. The act of hiding something: Insured makes erroneous statements of facts with the intent of inducing the insurer to enter into the insurance contract. All material facts create base for a strong insurance contract.

Source: oregonconcealed.blogspot.com

Source: oregonconcealed.blogspot.com

Concealment in insurance is a type of insurance fraud. It is an affirmative act intended or known to be likely to keep another from learning of a fact of which s/he would otherwise have learned. The term misrepresentation means a misstatement of the truth. Most commercial property policies contain a clause allowing the insurer to void the policy or deny a claim to an insured who has intentionally concealed or misrepresented material facts related to the insurance. Oct 23, 2020 — concealment in insurance is when the applicant or insured party hides or withholds relevant information from their insurer.

Source: zayidlaw.com

Source: zayidlaw.com

The failure of an applicant to reveal, before the insurance contract is made, a fact that is materia Concealment is the act of hiding or not putting forward any relevant fact in front of the insurer that need to be revealed. Concealment is the act of hiding or not putting forward any relevant fact in front of the insurer that need to be revealed. What is the effect of concealment? Commercial insurance is designed to help protect many of the risks your business can face, including:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title concealment insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information