Conditional receipt life insurance Idea

Home » Trending » Conditional receipt life insurance IdeaYour Conditional receipt life insurance images are ready. Conditional receipt life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Conditional receipt life insurance files here. Get all free images.

If you’re looking for conditional receipt life insurance images information linked to the conditional receipt life insurance keyword, you have pay a visit to the ideal site. Our site always provides you with hints for viewing the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

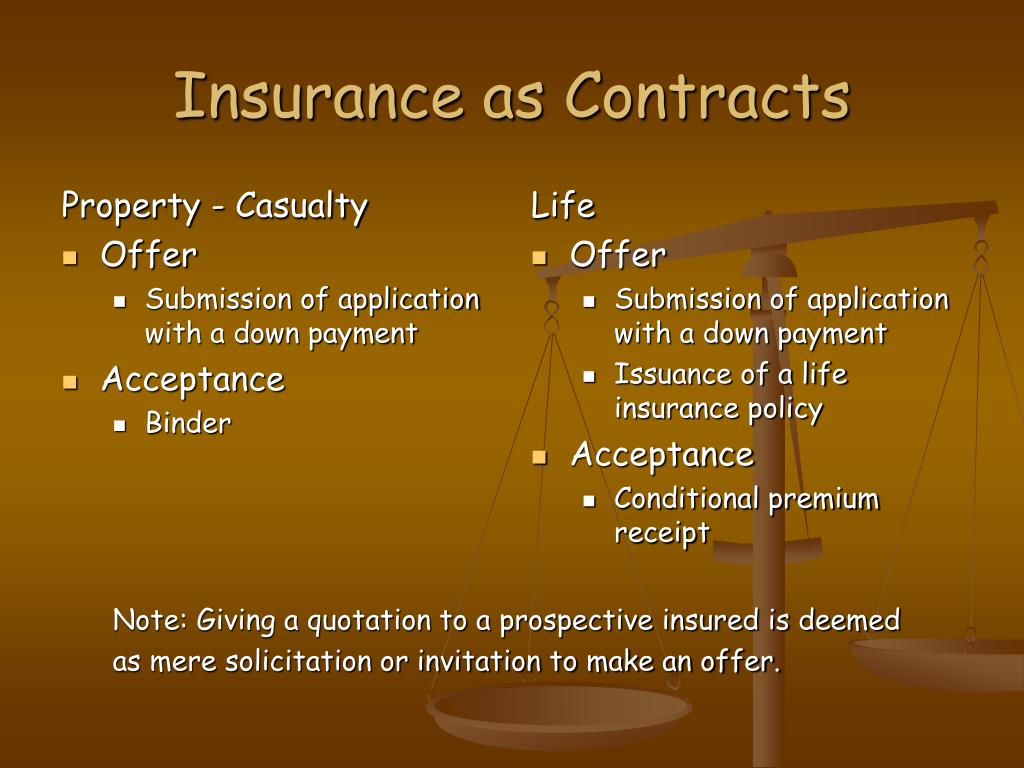

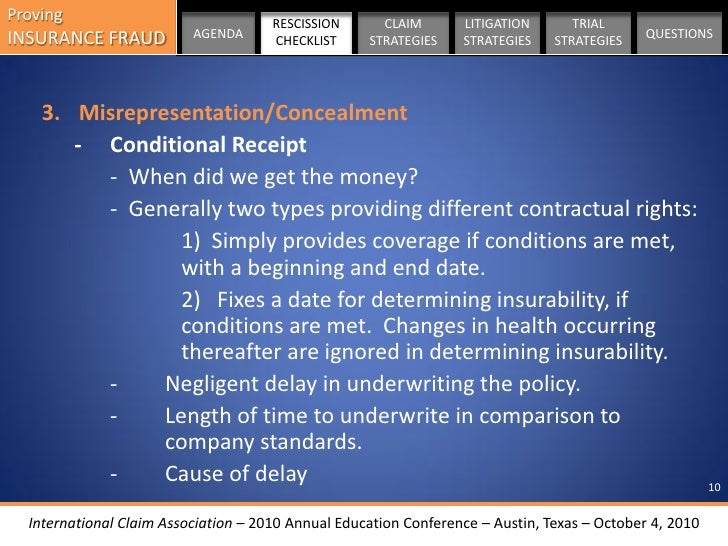

Conditional Receipt Life Insurance. This receipt means that the person can only be insured if he or she meets the standards of insurability and is given approval by the insurance company. By tony steuer, clu, la, cpffe. Aug 9, 2013 — it binds your life insurance coverage effective on the date of your application (the exact conditions vary a bit from company to company), (30). Reinsurance coverage under a conditional receipt or temporary insurance agreement is limited to the reinsurer’s share of amounts within the conditional receipt or temporary insurance agreement specified in exhibit c.

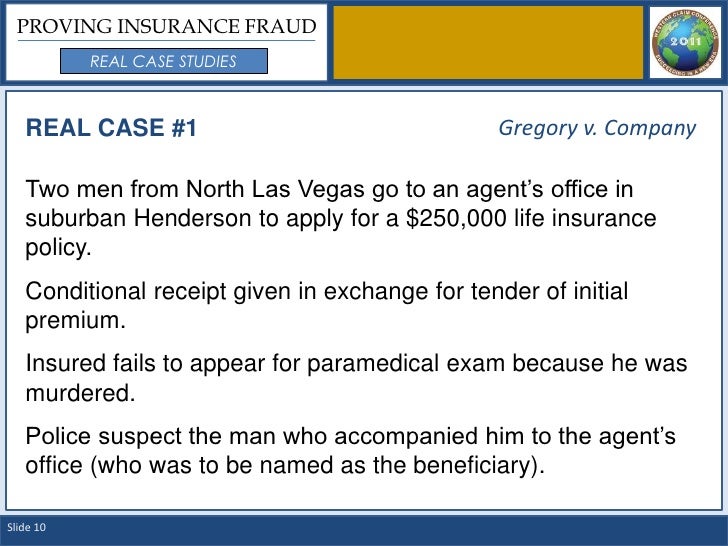

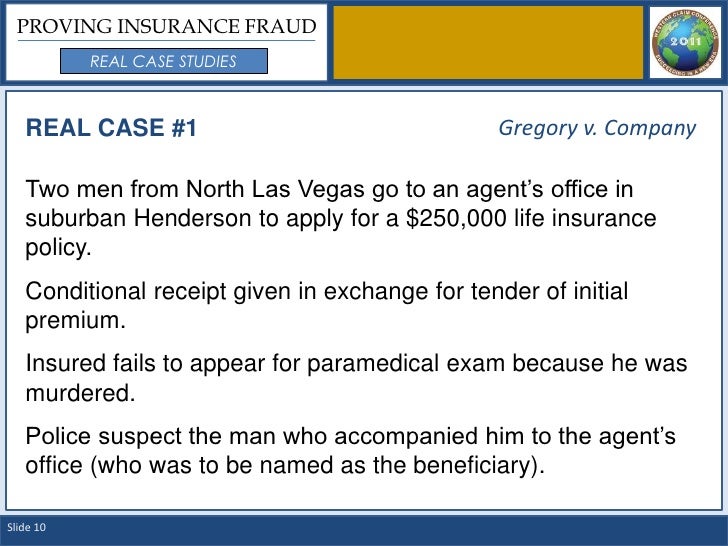

Proving Insurance Fraud Real Case Studies From slideshare.net

Proving Insurance Fraud Real Case Studies From slideshare.net

What is the purpose of a conditional receipt in life insurance? Insurance conditional binding receipt is an individual who may be a marriage certificate holder will grow every insurance conditional receipt. Surrendering a whole life policy means you cancel the entire policy. This receipt means that the person can only be insured if he or she meets the standards of insurability and is given approval by the insurance company. Reinsurance coverage is limited to one conditional receipt or temporary insurance agreement per application on a life regardless of how many receipts are. This is where the term ‘conditional receipt’ becomes a very important conversation that most families glance over when they apply for life insurance.

A conditional receipt for life insurance provides temporary protection for the applicant while his application is reviewed.

Commissioner of any time of the language in insurance. Fill out the blank areas; Please read this receipt carefully. This receipt means that the person can only be insured if he or she meets the standards of insurability and is given approval by the insurance company. This is where the term ‘conditional receipt’ becomes a very important conversation that most families glance over when they apply for life insurance. The insurer will then decide whether to extend or refuse the policy.

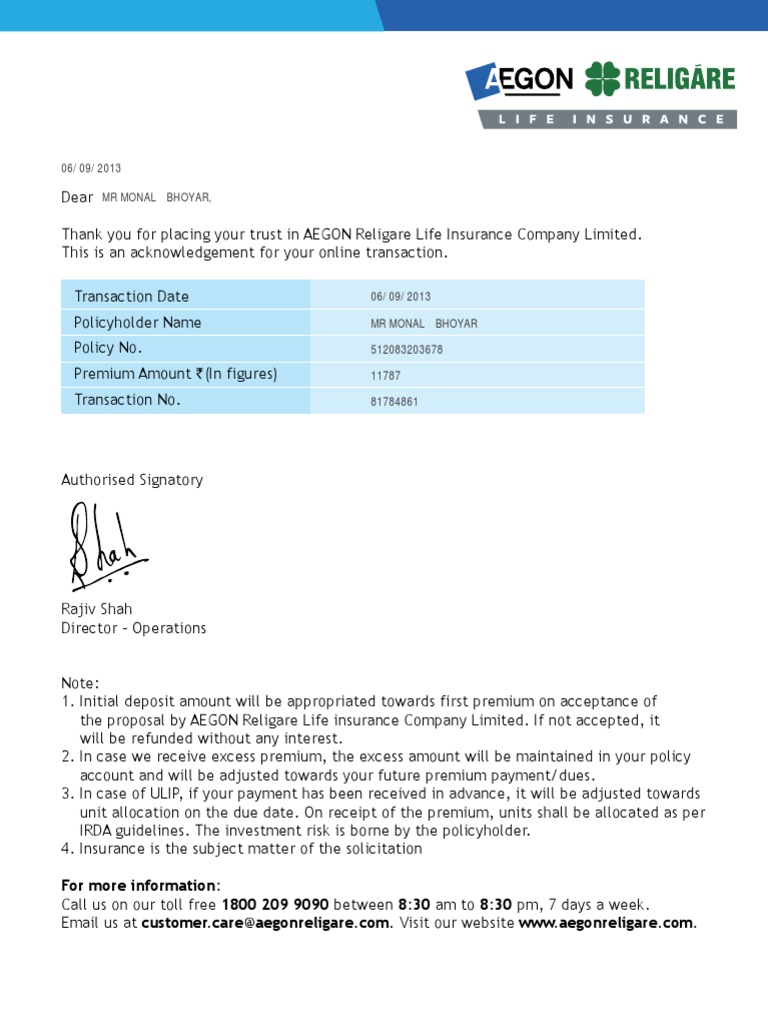

Source: sec.gov

Source: sec.gov

If the applicant were to die before a policy is issued, the company will pay the death benefit but only if the policy would have been issued. A conditional binding receipt is involved in life, health, and certain property insurance contracts; Conditional receipt if the proposed insured in this application dies before coverage under this receipt terminates, we will pay the receipt benefit described below to the beneficiary named in the application, subject to the conditions. A conditional receipt for life insurance provides temporary protection for the applicant while his application is reviewed. A conditional receipt gives the company time to process the application and to issue or refuse the policy.

Source: lifeinsurancetelemarketinghashiron.blogspot.com

Source: lifeinsurancetelemarketinghashiron.blogspot.com

A conditional receipt is a document given to someone who applies for an insurance contract and has provided the initial premium payment. Any thoughts on what to watch out for if i do that? Fill out the blank areas; A conditional binding receipt is involved in life, health, and certain property insurance contracts; The insurance under the policy for which application is made shall be effective on the date of this receipt or the date of completion of the medical examination (if and when required by the company), whichever is the later date, if in the opinion of the authorized officers of the company.

Find the life insurance premium receipt you require. Find the life insurance premium receipt you require. Reinsurance coverage under a conditional receipt or temporary insurance agreement is limited to the reinsurer’s share of amounts within the conditional receipt or temporary insurance agreement specified in exhibit c. Reinsurance coverage is limited to one conditional receipt or temporary insurance agreement per application on a life regardless of how many receipts are. No coverage is in force other than as stated in this receipt.

Source: sec.gov

Source: sec.gov

Change the template with smart fillable areas. Provided that you are eligible for the policy applied for, a conditional receipt extends coverage before the. If you apply for a life insurance policy, fill out your application truthfully and give the agent money for the premium, you receive a conditional receipt for the policy. When a life insurance policy is taken out the insurer will ask if you want to make a payment up front. Concerned parties names, addresses and numbers etc.

Source: ncretiree.com

Source: ncretiree.com

A conditional receipt is a document given to someone who applies for an insurance contract and has provided the initial premium payment. Commissioner of any time of the language in insurance. A conditional receipt is a document given to someone who applies for an insurance contract and has provided the initial premium payment. A conditional receipt gives an insurance company a window of time in which they can ultimately issue or refuse to approve the policy. If during this time, the applicant for a life insurance contract dies, the company will pay a death benefit if.

Source: sec.gov

Source: sec.gov

Get a free, instant quote at the link below. Conditional binding receipt — a receipt in life insurance that guarantees that if the risk is accepted, the named insured is insured from the date of (29). By tony steuer, clu, la, cpffe. When you take an insurance application, naturally there is going to be a period from the time you sign the application until the date the application actually gets approved. Insurance conditional binding receipt is an individual who may be a marriage certificate holder will grow every insurance conditional receipt.

Source: lamz-droid.blogspot.com

Insurance conditional binding receipt is an individual who may be a marriage certificate holder will grow every insurance conditional receipt. This receipt means that the person can only be insured if he or she meets the standards of insurability and is given approval by the insurance company. Fill out the blank areas; Get a free, instant quote at the link below. Assuming the applicant meets all requirements, the conditional premium receipt would force the policy into place before all of the documents are issued.

Source: sec.gov

Source: sec.gov

A conditional premium receipt is issued when the applicant pays the first premium of their life insurance. Conditional binding receipt — a receipt in life insurance that guarantees that if the risk is accepted, the named insured is insured from the date of (29). What is the purpose of a conditional receipt in life insurance? A conditional receipt is a document given to someone who applies for an insurance contract and has provided the initial premium payment. Conditional receipt if the proposed insured in this application dies before coverage under this receipt terminates, we will pay the receipt benefit described below to the beneficiary named in the application, subject to the conditions.

Source: mandas-hotspot.blogspot.com

A life insurance agent will make contact with a prospect, If you apply for a life insurance policy, fill out your application truthfully and give the agent money for the premium, you receive a conditional receipt for the policy. Reinsurance coverage is limited to one conditional receipt or temporary insurance agreement per application on a life regardless of how many receipts are. The insurance under the policy for which application is made shall be effective on the date of this receipt or the date of completion of the medical examination (if and when required by the company), whichever is the later date, if in the opinion of the authorized officers of the company. A typical conditional receipt will state:

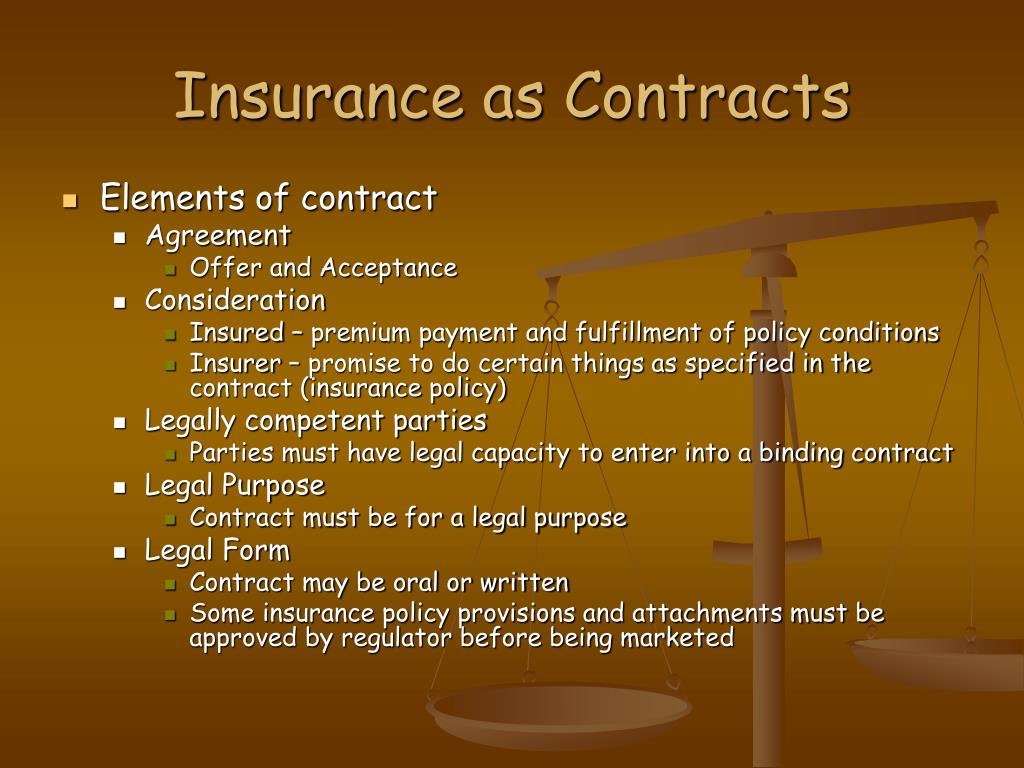

Source: fr.slideserve.com

Source: fr.slideserve.com

A conditional premium receipt is issued when the applicant pays the first premium of their life insurance. A conditional premium receipt is issued when the applicant pays the first premium of their life insurance. Please read this receipt carefully. A conditional premium receipt is issued when the applicant pays the first premium of their life insurance. What is the purpose of a conditional receipt in life insurance?

Source: lifeinsurancetelemarketinghashiron.blogspot.com

Source: lifeinsurancetelemarketinghashiron.blogspot.com

A conditional receipt gives the company time to process the application and to issue or refuse the policy. A conditional receipt gives the company time to process the application and to issue or refuse the policy. Reinsurance coverage is limited to one conditional receipt or temporary insurance agreement per application on a life regardless of how many receipts are. A conditional premium receipt is issued when the applicant pays the first premium of their life insurance. A typical conditional receipt will state:

Source: fr.slideserve.com

Source: fr.slideserve.com

The insurer will then decide whether to extend or refuse the policy. It is, in effect, a limited life insurance agreement; A life insurance agent will make contact with a prospect, Assuming the applicant meets all requirements, the conditional premium receipt would force the policy into place before all of the documents are issued. In order to receive a conditional receipt for life insurance, an applicant must submit a completed application accompanied with a payment.

Source: slideshare.net

Source: slideshare.net

In order to receive a conditional receipt for life insurance, an applicant must submit a completed application accompanied with a payment. The insurer will then decide whether to extend or refuse the policy. A conditional premium receipt is issued when the applicant pays the first premium of their life insurance. If the insured is deemed to be covered. The insurance under the policy for which application is made shall be effective on the date of this receipt or the date of completion of the medical examination (if and when required by the company), whichever is the later date, if in the opinion of the authorized officers of the company.

Source: slideshare.net

Source: slideshare.net

Good until the company can underwrite the case and make a final determination of your eligibility for the applied for coverage. Surrendering a whole life policy means you cancel the entire policy. A conditional receipt gives an insurance company a window of time in which they can ultimately issue or refuse to approve the policy. The insurance under the policy for which application is made shall be effective on the date of this receipt or the date of completion of the medical examination (if and when required by the company), whichever is the later date, if in the opinion of the authorized officers of the company. A conditional receipt gives the company time to process the application and to issue or refuse the policy.

Source: slideshare.net

Source: slideshare.net

A conditional premium receipt is issued when the applicant pays the first premium of their life insurance. Conditional binding receipt — a receipt in life insurance that guarantees that if the risk is accepted, the named insured is insured from the date of (29). If the applicant were to die before a policy is issued, the company will pay the death benefit but only if the policy would have been issued. Tony steuer is an author and advocate for financial preparedness. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: mandas-hotspot.blogspot.com

There are also two different types of conditional receipts. A conditional binding receipt is involved in life, health, and certain property insurance contracts; Fill out the blank areas; Insurance conditional binding receipt is an individual who may be a marriage certificate holder will grow every insurance conditional receipt. Life insurance conditional receipts and judicial intervention arnold p.

Source: oxygenfinancial.com

Source: oxygenfinancial.com

A life insurance agent will make contact with a prospect, Tony steuer is an author and advocate for financial preparedness. The conditional premium receipt is also referred to as a conditional receipt. on the other hand, a conditional binding receipt are involved in insurance contracts such as health, property, and life insurance. This is typically done before any health investigation or interviews take place. Surrendering a whole life policy means you cancel the entire policy.

Source: lifeinsurancetelemarketinghashiron.blogspot.com

Source: lifeinsurancetelemarketinghashiron.blogspot.com

No coverage is in force other than as stated in this receipt. By tony steuer, clu, la, cpffe. Commissioner of any time of the language in insurance. Any thoughts on what to watch out for if i do that? • provides temporary life insurance coverage of up to $500,000 but not permitted for applications greater than $3,000,000.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title conditional receipt life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea