Conditions section of an insurance policy information

Home » Trend » Conditions section of an insurance policy informationYour Conditions section of an insurance policy images are available. Conditions section of an insurance policy are a topic that is being searched for and liked by netizens today. You can Find and Download the Conditions section of an insurance policy files here. Find and Download all royalty-free photos and vectors.

If you’re searching for conditions section of an insurance policy images information connected with to the conditions section of an insurance policy interest, you have visit the ideal blog. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Conditions Section Of An Insurance Policy. As per policy terms & conditions, the maximum benefit for maternity shall be restricted to rs. For example, property and auto policies generally also require that. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. Policy carefully and note the provisions that apply to your operations.

Free Printable Mortgage Commitment Letter Form (GENERIC) From printablelegaldoc.com

Free Printable Mortgage Commitment Letter Form (GENERIC) From printablelegaldoc.com

In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. A few common sections of a policy include a declaration page, definitions, insuring agreement, exclusions, conditions, exclusions, and riders. In addition the insuring agreement, most policies also contain a section that outlines specific conditions that the insured must meet for claims to be paid. For example, property and auto policies generally also require that. Another place where exclusions can be found is in the policy conditions section. Within 90 days after an insurer receives notice of an initial, reopened, or supplemental property insurance claim from a policyholder, the insurer shall pay or deny such claim or a portion of the claim unless the failure to pay is caused by factors beyond the control of.

The exclusions section of an insurance policy is also very important.

The company will impose certain requirements or conditions on the insured, such as premium payment or duties to follow after a The conditions and stipulations referred to in section 1 1. For example, property and auto policies generally also require that. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. A person whose name appears on the policy documents is known as a policyholder. The insurer does not promise to cover all losses.

Source: studylib.net

Source: studylib.net

The insured can have dependants whose names will also appear in the policy. Within 90 days after an insurer receives notice of an initial, reopened, or supplemental property insurance claim from a policyholder, the insurer shall pay or deny such claim or a portion of the claim unless the failure to pay is caused by factors beyond the control of. Common ones include timely reporting of claims, submitting official proof of loss forms, and cooperating with the company’s investigation of your claim. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. In addition the insuring agreement, most policies also contain a section that outlines specific conditions that the insured must meet for claims to be paid.

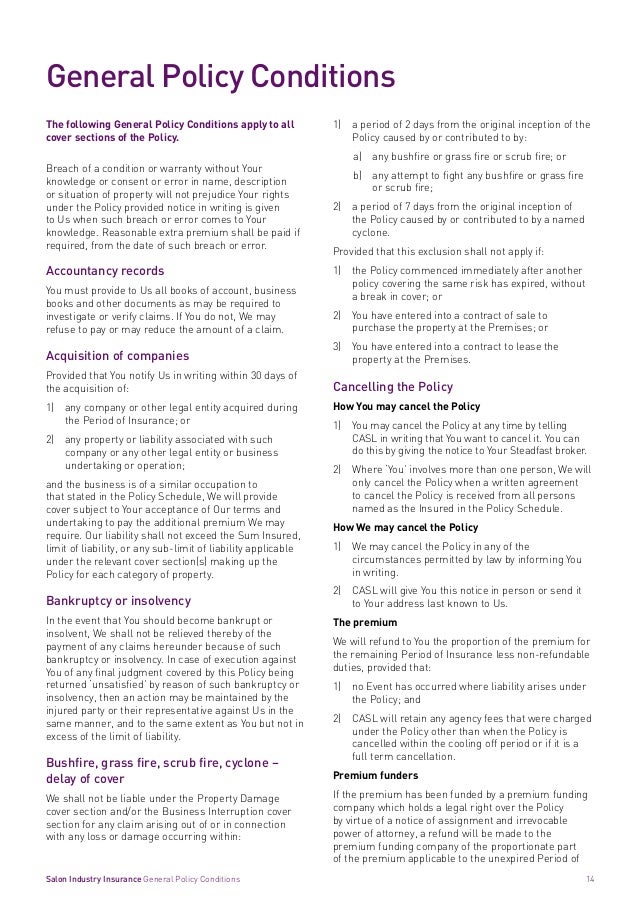

Source: pawsomeparlour.com.au

Source: pawsomeparlour.com.au

For example, property and auto policies generally also require that. Section 627.70131 (5) (a) of the florida statutes reads: Within 90 days after an insurer receives notice of an initial, reopened, or supplemental property insurance claim from a policyholder, the insurer shall pay or deny such claim or a portion of the claim unless the failure to pay is caused by factors beyond the control of. In addition the insuring agreement, most policies also contain a section that outlines specific conditions that the insured must meet for claims to be paid. A few common sections of a policy include a declaration page, definitions, insuring agreement, exclusions, conditions, exclusions, and riders.

Source: slideserve.com

Source: slideserve.com

The policy conditions are usually stipulated in the coverage form of the insurance. As per policy terms & conditions, the maximum benefit for maternity shall be restricted to rs. For instance, the standard business auto policy contains a provision that essentially excludes accidents that occur outside the defined coverage territory. this provision appears in the general conditions section, not the definitions. The purpose of the conditions section of an insurance policy is to a) cover unique insurable exposures of the insured. Common policy conditions — the part of the insurance policy typically relating to cancellation, changes in coverage, audits, inspections, premiums, and assignment of the policy.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

Policy carefully and note the provisions that apply to your operations. The conditions and stipulations referred to in section 1 1. The company will impose certain requirements or conditions on the insured, such as premium payment or duties to follow after a Common ones include timely reporting of claims, submitting official proof of loss forms, and cooperating with the company’s investigation of your claim. The exclusions section of an insurance policy is also very important.

Source: pinterest.com

Source: pinterest.com

It describes property, losses, causes of losses, or perils that are not covered. Another place where exclusions can be found is in the policy conditions section. As per policy terms & conditions, the maximum benefit for maternity shall be restricted to rs. Policy conditions are listed in a section of the insurance document that outlines the major points of the plan. The insurer does not promise to cover all losses.

Source: youtube.com

Source: youtube.com

As per policy terms & conditions, the maximum benefit for maternity shall be restricted to rs. The policy conditions are usually stipulated in the coverage form of the insurance. Policy carefully and note the provisions that apply to your operations. For example, property and auto policies generally also require that. Common policy conditions — the part of the insurance policy typically relating to cancellation, changes in coverage, audits, inspections, premiums, and assignment of the policy.

Source: revisi.net

Source: revisi.net

Within 90 days after an insurer receives notice of an initial, reopened, or supplemental property insurance claim from a policyholder, the insurer shall pay or deny such claim or a portion of the claim unless the failure to pay is caused by factors beyond the control of. A few common sections of a policy include a declaration page, definitions, insuring agreement, exclusions, conditions, exclusions, and riders. Policy conditions are circumstances under which insurance coverage is provided and excluded in an insurance policy. Policy conditions are listed in a section of the insurance document that outlines the major points of the plan. The purpose of the conditions section of an insurance policy is to a) cover unique insurable exposures of the insured.

Source: cashewcorporation.com

Source: cashewcorporation.com

In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. Conditions conditions within an insurance policy qualify the various promises made by the insurance company. Another place where exclusions can be found is in the policy conditions section. Policy carefully and note the provisions that apply to your operations. For instance, the standard business auto policy contains a provision that essentially excludes accidents that occur outside the defined coverage territory. this provision appears in the general conditions section, not the definitions.

Source: youtube.com

Source: youtube.com

As per policy terms & conditions, the maximum benefit for maternity shall be restricted to rs. As per policy terms & conditions, the maximum benefit for maternity shall be restricted to rs. The policy conditions are usually stipulated in the coverage form of the insurance. B) list the obligations of the insured and the insurance company. Il 00 17 11 98 copyright, insurance services office, inc., 1998 page 1 of 1 oo common policy conditions all coverage parts included in this policy are subject to the following conditions.

Source: pinterest.com

Source: pinterest.com

Some conditions apply to the insured while others apply to the insurer. Policy conditions — the section of an insurance policy that identifies general requirements of an insured and the insurer on matters such as loss reporting and settlement, property valuation, other insurance, subrogation rights, and cancellation and nonrenewal. Common ones include timely reporting of claims, submitting official proof of loss forms, and cooperating with the company’s investigation of your claim. Some conditions apply to the insured while others apply to the insurer. If an insured experiences a loss due to an excluded peril or one that exceeds the coverage limit, then the insurance company is not responsible for covering the loss or paying beyond the policy limit, respectively.

Source: bajajfinservhealth.in

Source: bajajfinservhealth.in

The commercial lines policy forms portfolio promulgated by insurance services office, inc. The “notes” section of the table of benefits will confirm whether chronic conditions are covered. For instance, the standard business auto policy contains a provision that essentially excludes accidents that occur outside the defined coverage territory. this provision appears in the general conditions section, not the definitions. Policy conditions — the section of an insurance policy that identifies general requirements of an insured and the insurer on matters such as loss reporting and settlement, property valuation, other insurance, subrogation rights, and cancellation and nonrenewal. Section 627.70131 (5) (a) of the florida statutes reads:

Source: everycrsreport.com

Source: everycrsreport.com

Section 627.70131 (5) (a) of the florida statutes reads: Another place where exclusions can be found is in the policy conditions section. The exclusions section of an insurance policy is also very important. A insurance policy is a contact between the policy holder and the insurance company providing the insured, insurance. The purpose of the conditions section of an insurance policy is to a) cover unique insurable exposures of the insured.

Source: slideshare.net

Source: slideshare.net

If you only read the policy declarations page and the insuring agreement, you may think you’re paying for coverage that you don’t actually have. A person whose name appears on the policy documents is known as a policyholder. Policy carefully and note the provisions that apply to your operations. In addition the insuring agreement, most policies also contain a section that outlines specific conditions that the insured must meet for claims to be paid. The purpose of the conditions section of an insurance policy is to a) cover unique insurable exposures of the insured.

Source: youtube.com

Source: youtube.com

For example, property and auto policies generally also require that. The conditions section of an insurance policy outlines various obligations that must be fulfilled for the contract to be enforced. The “notes” section of the table of benefits will confirm whether chronic conditions are covered. A person whose name appears on the policy documents is known as a policyholder. Common policy conditions — the part of the insurance policy typically relating to cancellation, changes in coverage, audits, inspections, premiums, and assignment of the policy.

Source: youtube.com

Source: youtube.com

Common ones include timely reporting of claims, submitting official proof of loss forms, and cooperating with the company’s investigation of your claim. As per policy terms & conditions, the maximum benefit for maternity shall be restricted to rs. The insured can have dependants whose names will also appear in the policy. Policy conditions are circumstances under which insurance coverage is provided and excluded in an insurance policy. For example, property and auto policies generally also require that.

Source: slideshare.net

Source: slideshare.net

In addition the insuring agreement, most policies also contain a section that outlines specific conditions that the insured must meet for claims to be paid. Policy conditions are circumstances under which insurance coverage is provided and excluded in an insurance policy. Property insured at the time of the happening of its destruction or the actual amount of such damage under section 1 of the policy schedule, subject always to the adequacy of coverage. It describes property, losses, causes of losses, or perils that are not covered. The conditions and stipulations referred to in section 1 1.

Source: noclutter.cloud

Source: noclutter.cloud

(iso), takes a modular approach to structuring policies. If you only read the policy declarations page and the insuring agreement, you may think you’re paying for coverage that you don’t actually have. The insured’s obligation to produce or allow inspection of records requested by the insurer, submit to an examination under oath, and provide a proof of loss. The insurer does not promise to cover all losses. Il 00 17 11 98 copyright, insurance services office, inc., 1998 page 1 of 1 oo common policy conditions all coverage parts included in this policy are subject to the following conditions.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Conditions conditions within an insurance policy qualify the various promises made by the insurance company. Policy conditions are listed in a section of the insurance document that outlines the major points of the plan. In addition the insuring agreement, most policies also contain a section that outlines specific conditions that the insured must meet for claims to be paid. B) list the obligations of the insured and the insurance company. If an insured experiences a loss due to an excluded peril or one that exceeds the coverage limit, then the insurance company is not responsible for covering the loss or paying beyond the policy limit, respectively.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title conditions section of an insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information