Condo insurance cost toronto Idea

Home » Trending » Condo insurance cost toronto IdeaYour Condo insurance cost toronto images are available. Condo insurance cost toronto are a topic that is being searched for and liked by netizens now. You can Download the Condo insurance cost toronto files here. Download all royalty-free photos.

If you’re searching for condo insurance cost toronto images information related to the condo insurance cost toronto keyword, you have come to the ideal blog. Our website frequently provides you with hints for downloading the highest quality video and picture content, please kindly search and find more informative video content and images that match your interests.

Condo Insurance Cost Toronto. (if included in the common expenses) condo amenities: That means that if there is a special assessment (an added fee that is on top of your monthly condo fees) levied on your condominium building, all the condo owners must split the cost of. Loss assessment coverage is an important feature of condo insurance because you share in the responsibility with the other condo owners for the condominium building and common areas. Average home insurance costs in canada (both owned and rented) $48/month average home insurance costs in ontario (both owned and rented):

Condo Reviews for Valhalla Town Square Condos, Toronto From condoessentials.com

Condo Reviews for Valhalla Town Square Condos, Toronto From condoessentials.com

181 bedford rd, toronto for lease 3000 mls from www.condo4you.ca. Loss assessment coverage is an important feature of condo insurance because you share in the responsibility with the other condo owners for the condominium building and common areas. How it’s calculated the price you pay for condo insurance is based on several things. That may be because a home policy has more damage risk to assess, such as exterior damage, that condo owners aren’t responsible for. What are typical rates for condo insurance in toronto? You may be eligible to increase or decrease your deductible amount, which may impact your insurance premium.

The standard deductible amount is $1,000 for homeowner, condominium owner or tenant insurance policies.

This compares to a low of $960 in quebec and $1,200 in western provinces. Some condo associations cover window maintenance and replacement, while others place that responsibility on the condo owner. That means that if there is a special assessment (an added fee that is on top of your monthly condo fees) levied on your condominium building, all the condo owners must split the cost of. Not all condo master plans provide coverage for damage caused by sewer or drainage backups. In toronto, for example, the average homeowners policy costs $65 a month on average, while condo policies cost $26. Knowing condo insurance costs in toronto informs condo insurance decisions, so we collected a few important stats for you.

Source: thedavies.com

Source: thedavies.com

Toronto condo insurance average rates. What are typical rates for condo insurance in toronto? Ontario tenants, on the other hand, pay $210 per year or just shy of $20 per month. Here are several stats that provide transparency about condo insurance costs in toronto. The standard deductible amount is $1,000 for homeowner, condominium owner or tenant insurance policies.

Source: jamiesarner.com

Source: jamiesarner.com

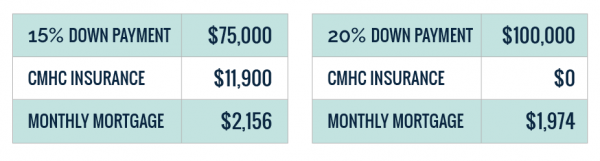

This is because the location is a factor that is going to affect costs such as rebuilding costs, buying new equipment, repairs, etc. Mortgage insurance is a cost that gets added to your mortgage if you have less than a 20% downpayment. Knowing condo insurance costs in toronto informs condo insurance decisions, so we collected a few important stats for you. This is because the location is a factor that is going to affect costs such as rebuilding costs, buying new equipment, repairs, etc. Average homeowners insurance cost illinois / latest home from famousandfashionarehere.blogspot.com

Source: pierrecarapetian.com

Source: pierrecarapetian.com

What is mortgage loan insurance? Ad get renter�s insurance online right now! Loss assessment coverage is an important feature of condo insurance because you share in the responsibility with the other condo owners for the condominium building and common areas. Average home insurance costs in canada (both owned and rented) $48/month average home insurance costs in ontario (both owned and rented): Ontario tenants, on the other hand, pay $210 per year or just shy of $20 per month.

Source: teamayao.com

Source: teamayao.com

• for condos priced $500,000 to $1m, the minimum down payment is 5% on the first $500,000 and then 10% on the remaining balance. The location of your condo does play a role in deciding the amount or limit for your condo insurance. These things eventually can shape your coverage cost too. • for condos priced $1m and more, the minimum downpayment is 20%. As you can see, toronto condo insurance is very affordable.

Source: theyslcondo.ca

Source: theyslcondo.ca

How it’s calculated the price you pay for condo insurance is based on several things. Some condo associations cover window maintenance and replacement, while others place that responsibility on the condo owner. Not all condo master plans provide coverage for damage caused by sewer or drainage backups. Ad get renter�s insurance online right now! • for condos priced $1m and more, the minimum downpayment is 20%.

Source: metawallpaper.com

Source: metawallpaper.com

That means that if there is a special assessment (an added fee that is on top of your monthly condo fees) levied on your condominium building, all the condo owners must split the cost of. Here are several stats that provide transparency about condo insurance costs in toronto. Not all condo master plans provide coverage for damage caused by sewer or drainage backups. That may be because a home policy has more damage risk to assess, such as exterior damage, that condo owners aren’t responsible for. Ontario condo owners pay on average about $345.

Source: j3insurancegroup.com

Source: j3insurancegroup.com

Ad get renter�s insurance online right now! This is because the location is a factor that is going to affect costs such as rebuilding costs, buying new equipment, repairs, etc. That means that if there is a special assessment (an added fee that is on top of your monthly condo fees) levied on your condominium building, all the condo owners must split the cost of. Average condo insurance costs in toronto, on average condo insurance costs in calgary, ab: Toronto condo insurance average rates.

Source: metawallpaper.com

Source: metawallpaper.com

That may be because a home policy has more damage risk to assess, such as exterior damage, that condo owners aren’t responsible for. Below are the average condo fees from a typical 300 unit building in toronto: The corporation’s contribution to the operating costs of shared facilities such as a gym, pool, meeting room, etc. Average homeowners insurance cost illinois / latest home from famousandfashionarehere.blogspot.com • for condos priced $1m and more, the minimum downpayment is 20%.

Source: condoessentials.com

Source: condoessentials.com

Mortgage insurance is a cost that gets added to your mortgage if you have less than a 20% downpayment. Insurance today for peace of mind tomorrow. The standard deductible amount is $1,000 for homeowner, condominium owner or tenant insurance policies. In toronto specifically, the average monthly cost of condo insurance is. Mortgage insurance is a cost that gets added to your mortgage if you have less than a 20% downpayment.

Source: homeinsurancebroker.ca

Source: homeinsurancebroker.ca

What are typical rates for condo insurance in toronto? Ad get renter�s insurance online right now! Mortgage insurance is a cost that gets added to your mortgage if you have less than a 20% downpayment. Toronto condo insurance average rates. Below are the average condo fees from a typical 300 unit building in toronto:

Source: pinterest.com

Source: pinterest.com

This compares to a low of $960 in quebec and $1,200 in western provinces. Condo association master insurance policies can have deductibles as high as $25,000. All in all, condo insurance rates are on the same general level inside and outside of downtown toronto. Ontario tenants, on the other hand, pay $210 per year or just shy of $20 per month. How it’s calculated the price you pay for condo insurance is based on several things.

Source: ratehub.ca

Source: ratehub.ca

How it’s calculated the price you pay for condo insurance is based on several things. All in all, condo insurance rates are on the same general level inside and outside of downtown toronto. One condo apartment saw its insurance rate rise from $66,000 in 2019 to $588,000 in 2020. Insurance today for peace of mind tomorrow. This compares to a low of $960 in quebec and $1,200 in western provinces.

Source: metawallpaper.com

Source: metawallpaper.com

Knowing condo insurance costs in toronto informs condo insurance decisions, so we collected a few important stats for you. In toronto specifically, the average monthly cost of condo insurance is. With the cost of ontario’s condo insurance rising 8 per cent in a year, owners should know what’s covered by the corporation and what individual premiums cover. What are typical rates for condo insurance in toronto? This compares to a low of $960 in quebec and $1,200 in western provinces.

Source: uuinsurance.com

Source: uuinsurance.com

In toronto, for example, the average homeowners policy costs $65 a month on average, while condo policies cost $26. Not all condo master plans provide coverage for damage caused by sewer or drainage backups. Average condo insurance costs in edmonton, ab: Does the condo insurance cover your storage locker? Condo insurance is generally more affordable than home insurance with average condo insurance policy rates in canada falling within the range of $20 to $35 per month.

Source: metawallpaper.com

Source: metawallpaper.com

How it’s calculated the price you pay for condo insurance is based on several things. One condo apartment saw its insurance rate rise from $66,000 in 2019 to $588,000 in 2020. The corporation’s contribution to the operating costs of shared facilities such as a gym, pool, meeting room, etc. The location of your condo does play a role in deciding the amount or limit for your condo insurance. How much is the average cost of condo insurance?

Source: thedavies.com

Source: thedavies.com

181 bedford rd, toronto for lease 3000 mls from www.condo4you.ca. This compares to a low of $960 in quebec and $1,200 in western provinces. Insurance today for peace of mind tomorrow. Knowing condo insurance costs in toronto informs condo insurance decisions, so we collected a few important stats for you. Ontario tenants, on the other hand, pay $210 per year or just shy of $20 per month.

Source: condoessentials.com

Source: condoessentials.com

One condo apartment saw its insurance rate rise from $66,000 in 2019 to $588,000 in 2020. One condo apartment saw its insurance rate rise from $66,000 in 2019 to $588,000 in 2020. Not all condo master plans provide coverage for damage caused by sewer or drainage backups. Does the condo insurance cover your storage locker? Knowing condo insurance costs in toronto informs condo insurance decisions, so we collected a few important stats for you.

Source: insuranceca.org

Source: insuranceca.org

Insurance today for peace of mind tomorrow. • for condos priced $1m and more, the minimum downpayment is 20%. (if included in the common expenses) condo amenities: Get condo insurance for around the same price as a yearly gym membership. Condo association master insurance policies can have deductibles as high as $25,000.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title condo insurance cost toronto by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea