Condo master insurance information

Home » Trend » Condo master insurance informationYour Condo master insurance images are available. Condo master insurance are a topic that is being searched for and liked by netizens now. You can Get the Condo master insurance files here. Get all free photos.

If you’re searching for condo master insurance images information related to the condo master insurance topic, you have visit the right blog. Our site frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

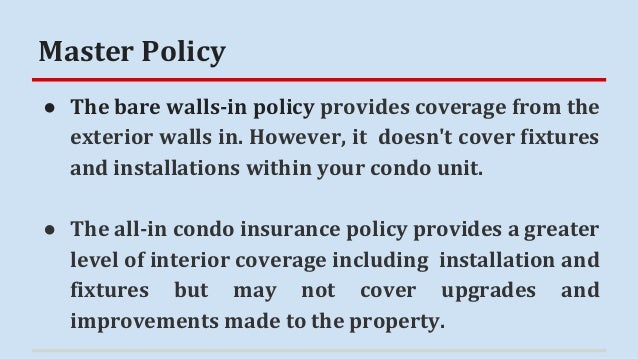

Condo Master Insurance. It may cover cabinets, appliances, floors, etc., but not always. A large part of condo insurance comes down to studs in, vs studs out. Having the right master policy affects the financial options of both the building association and. Our experienced agents are standing by to answer your questions,.

Condo Master Policy HOA Insurance From teamayao.com

Condo Master Policy HOA Insurance From teamayao.com

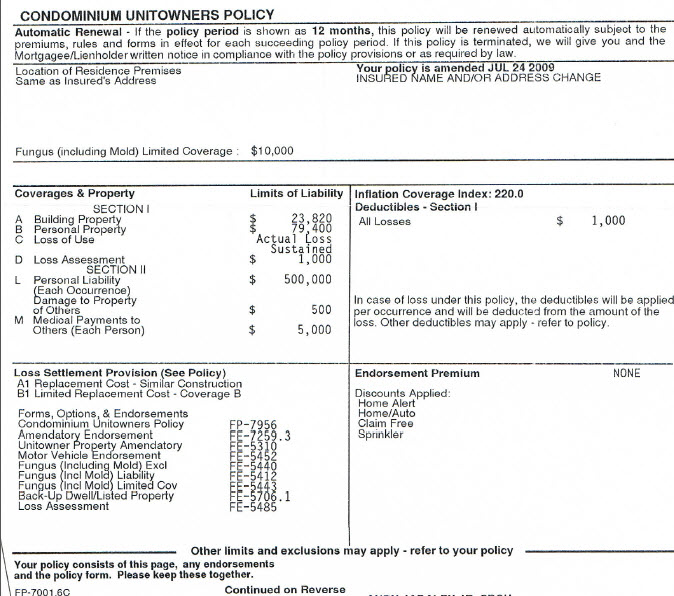

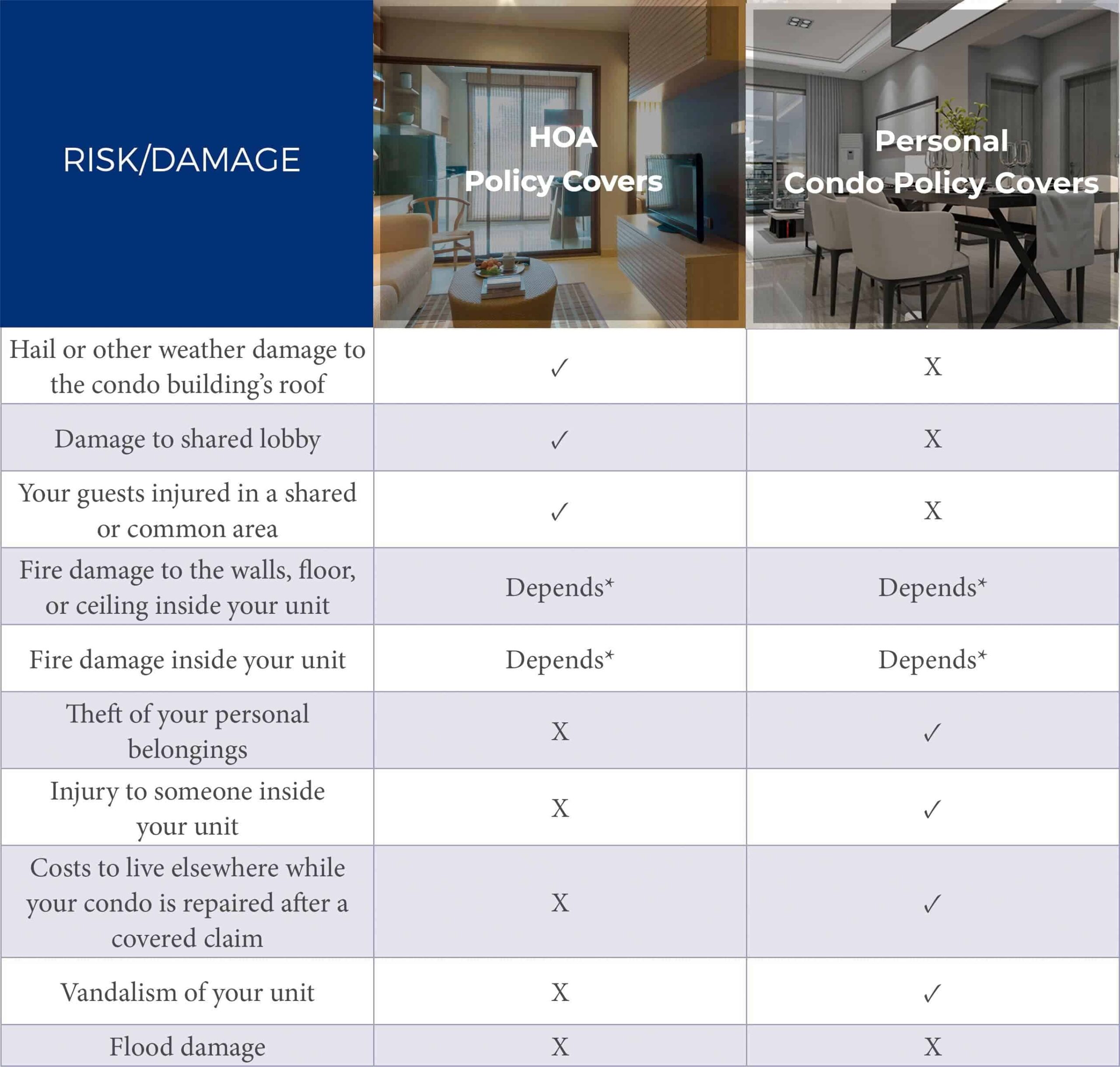

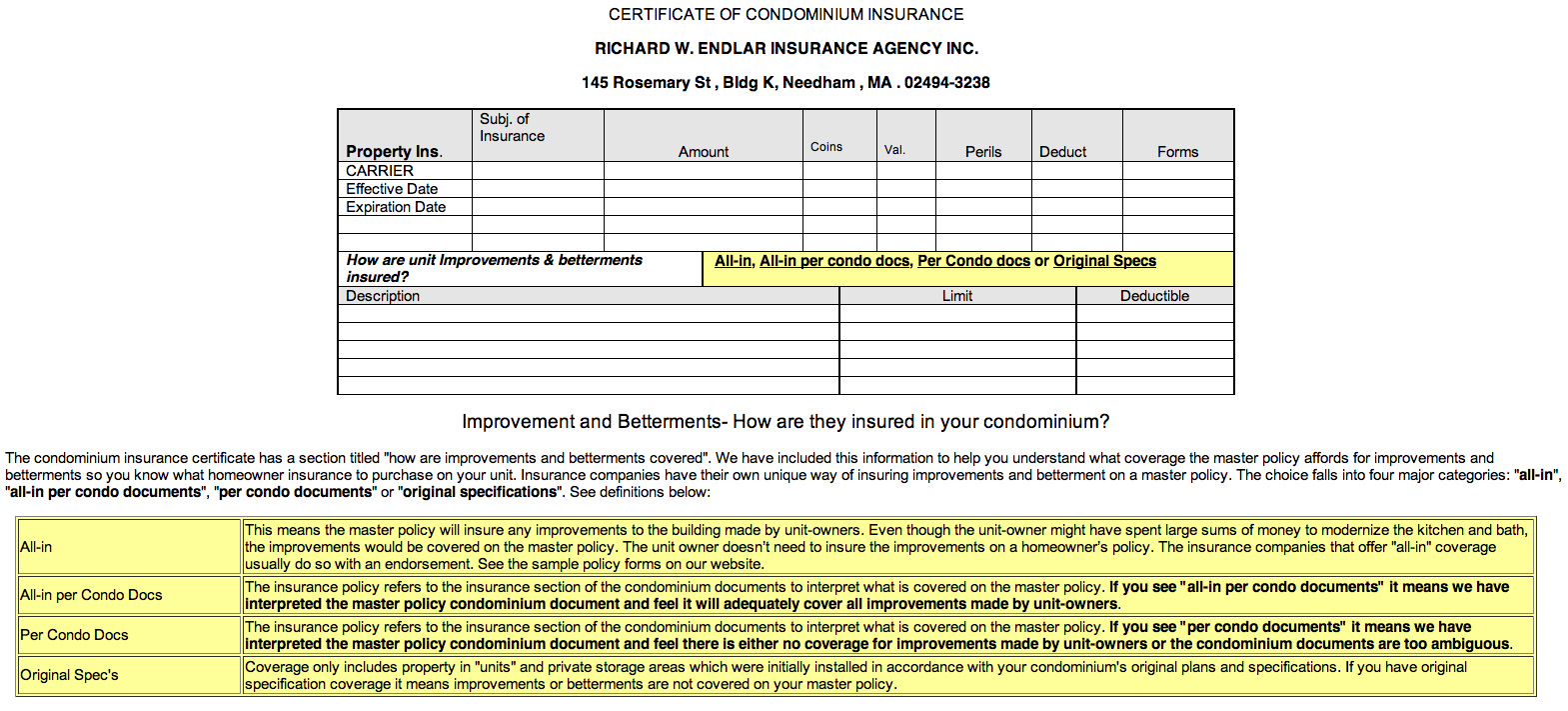

Since the condominium master insurance policy in minnesota varies from company to company, so do their premiums vary. A condo master policy covers the structure of the building and common area s. The association bylaws and the association master policy specify which parts of the complex the association insures and which parts the individual unit. A condo community insurance master policy with a $5,000 deductible and 20 owners would cost each owner $250 per deductible payment ($5,000/20 = $250). The higher your deductible is the lower the cost of the. Your condo or homeowners association (hoa) carries a master policy to insure its buildings and common areas, but as a condo owner you need your own insurance policy to protect your unit, personal belongings, and any liability for your guests.

The higher your deductible is the lower the cost of the.

The condo association insurance covers the unit owners’ shared risks. This includes cabinets, flooring, ceilings etc. This insurance is typically something that they carry in order to protect against any type of liability or legal issues. Also, what is master insurance policy for homeowners association? It is important to research condo association insurance companies before buying homeowners association insurance. Getting an independent condo association insurance agent who has vast knowledge on homeowners association insurance.

Source: trustevergreen.com

Source: trustevergreen.com

A master insurance policy covers places that are regularly used by multiple condo owners, known as shared or common areas. Depending on the insurance coverage, it may extend to some property inside the unit. A master insurance policy covers places that are regularly used by multiple condo owners, known as shared or common areas. These include parks and pools belonging to the association, a shared gym or event space, and the building’s elevator. As c ondominium associations usually are responsible for the common.

Source: mymidtownmojo.com

Source: mymidtownmojo.com

Its premium comes out of your maintenance fees or association dues. Since the condominium master insurance policy in minnesota varies from company to company, so do their premiums vary. Also included in the policy’s coverage are parking lots or garages, walkways, and the general landscape. Condo insurance doesn’t cover water damage from flooding. Condo master insurance is specifically written to meet the needs of each individual condominium association.

Source: daigletravers.com

Source: daigletravers.com

For example, if you live in a condo in ma, you are automatically a part of the association. The condo master insurance is a policy that insures a building or a condominium. You may want to consider purchasing additional policies or adding the below coverages to your condo policy. Thus, to learn more about the insurance coverage you need for condominiums, get in touch today. Getting an independent condo association insurance agent who has vast knowledge on homeowners association insurance.

Source: halespropertymanagement.com

Source: halespropertymanagement.com

The master insurance policy is the insurance that the hoa carries or that the condo board will hold. Condo master policy insurance condominium insurance is a unique kind of insurance that integrates the interests of a condominium association with the interests of the individual unit owners. Thus, to learn more about the insurance coverage you need for condominiums, get in touch today. A master insurance policy covers places that are regularly used by multiple condo owners, known as shared or common areas. With this policy, the building structure and common areas are protected from damages, so if a tree fell and destroyed a.

Source: guarinoinsurancema.com

Source: guarinoinsurancema.com

Condo insurance doesn’t cover water damage from flooding. The condo master insurance is a policy that insures a building or a condominium. A master condo insurance policy is needed by any condominium trust or condominium association in order to cover the building(s) and the liability of the condo association or trust. There are many condominium complexes in massachusetts, both on the north shore and around boston. Condo master insurance policies provide a mixture of property and liability protections.

Source: texaninsurance.com

Source: texaninsurance.com

A condo master insurance policy is an important part of protecting condo unit owners from potential risks. However, unit owners may be partially. It may cover cabinets, appliances, floors, etc., but not always. There are many condominium complexes in massachusetts, both on the north shore and around boston. The master insurance policy is the insurance that the hoa carries or that the condo board will hold.

Source: pinterest.com

Source: pinterest.com

A master insurance policy covers places that are regularly used by multiple condo owners, known as shared or common areas. The higher your deductible is the lower the cost of the. Condominium associations typically take out the policy, and the cost is divided among all the unit owners. The master insurance policy is the insurance that. A condo community insurance master policy with a $5,000 deductible and 20 owners would cost each owner $250 per deductible payment ($5,000/20 = $250).

Source: garrity-insurance.com

You might also see this type of policy referred to as condominium association insurance or an hoa master policy. The condo master policy is a building insurance policy which typically includes liability and property damage coverage. Also included in the policy’s coverage are parking lots or garages, walkways, and the general landscape. The higher your deductible is the lower the cost of the. By signing in, you agree with our.

Source: pinterest.com

Source: pinterest.com

The master insurance policy is the insurance that. A common insurance analogy says if your condo master insurance policy is “studs in” then if you took your condo and turned it upside down everything that stayed attached to the condo would be covered by the master policy. For example, if your building is insured at 500k and it was to burn down, the maximum amount the insurance company would payout, if they paid the claim, would be 500k. The condo master policy is a building insurance policy which typically includes liability and property damage coverage. Depending on the layout and features of a complex, the association will have different needs.

Source: lopriore.com

Source: lopriore.com

The master condo policy or condo association insurance is the insurance policy that is held by the homeowners or condominium association. Condo master insurance is specifically written to meet the needs of each individual condominium association. You may want to consider purchasing additional policies or adding the below coverages to your condo policy. Getting an independent condo association insurance agent who has vast knowledge on homeowners association insurance. Condo insurance is more comprehensive than renters insurance.

Source: fr.slideshare.net

Source: fr.slideshare.net

These include parks and pools belonging to the association, a shared gym or event space, and the building’s elevator. Since the condominium master insurance policy in minnesota varies from company to company, so do their premiums vary. The condo master policy is a building insurance policy which typically includes liability and property damage coverage. Condo insurance doesn’t cover water damage from flooding. The condo association insurance covers the unit owners’ shared risks.

Source: lopriore.com

Source: lopriore.com

You may want to consider purchasing additional policies or adding the below coverages to your condo policy. The building (s) and common elements of a complex are covered with a single policy called an association master policy. A condo community insurance master policy with a $5,000 deductible and 20 owners would cost each owner $250 per deductible payment ($5,000/20 = $250). Condo insurance and master policies come with certain exclusions, meaning types of damage that aren’t covered. A master condo insurance policy is needed by any condominium trust or condominium association in order to cover the building(s) and the liability of the condo association or trust.

Source: teamayao.com

Source: teamayao.com

A master condo insurance policy is needed by any condominium trust or condominium association in order to cover the building(s) and the liability of the condo association or trust. A common insurance analogy says if your condo master insurance policy is “studs in” then if you took your condo and turned it upside down everything that stayed attached to the condo would be covered by the master policy. Also included in the policy’s coverage are parking lots or garages, walkways, and the general landscape. A condo master policy covers the structure of the building and common area s. A master condo insurance policy is needed by any condominium trust or condominium association in order to cover the building(s) and the liability of the condo association or trust.

Source: hpminsurance.com

Source: hpminsurance.com

The condo master policy is a building insurance policy which typically includes liability and property damage coverage. For example, if your building is insured at 500k and it was to burn down, the maximum amount the insurance company would payout, if they paid the claim, would be 500k. Condominium associations typically take out the policy, and the cost is divided among all the unit owners. These include parks and pools belonging to the association, a shared gym or event space, and the building’s elevator. Liability coverages help protect a condominium association from certain liability suits and claims filed against the condo trust.

Source: woodsinsurance.com

Source: woodsinsurance.com

Your condo or homeowners association (hoa) carries a master policy to insure its buildings and common areas, but as a condo owner you need your own insurance policy to protect your unit, personal belongings, and any liability for your guests. A master condo insurance policy is needed by any condominium trust or condominium association in order to cover the building(s) and the liability of the condo association or trust. The condo master policy is a building insurance policy which typically includes liability and property damage coverage. The master condo policy is responsible for covering two main areas of risk — general liability. For example, if your building is insured at 500k and it was to burn down, the maximum amount the insurance company would payout, if they paid the claim, would be 500k.

Source: reardonagency.com

Source: reardonagency.com

Liability coverages help protect a condominium association from certain liability suits and claims filed against the condo trust. The condo association insurance covers the unit owners’ shared risks. A master insurance policy covers places that are regularly used by multiple condo owners, known as shared or common areas. Condo insurance doesn’t cover water damage from flooding. You may want to consider purchasing additional policies or adding the below coverages to your condo policy.

Source: youtube.com

Source: youtube.com

A condominium association or trust’s bylaws will dictate the levels of coverage and any extra coverages that are required to be on the policy. A condo master insurance policy is an important part of protecting condo unit owners from potential risks. A condo master policy covers the structure of the building and common area s. A common insurance analogy says if your condo master insurance policy is “studs in” then if you took your condo and turned it upside down everything that stayed attached to the condo would be covered by the master policy. A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it.

Source: bbdedham.com

Source: bbdedham.com

These include parks and pools belonging to the association, a shared gym or event space, and the building’s elevator. It is important to research condo association insurance companies before buying homeowners association insurance. You may want to consider purchasing additional policies or adding the below coverages to your condo policy. Condo insurance is more comprehensive than renters insurance. Condominium associations typically take out the policy, and the cost is divided among all the unit owners.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title condo master insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information