Condo master insurance policy Idea

Home » Trend » Condo master insurance policy IdeaYour Condo master insurance policy images are available in this site. Condo master insurance policy are a topic that is being searched for and liked by netizens today. You can Find and Download the Condo master insurance policy files here. Download all royalty-free images.

If you’re searching for condo master insurance policy pictures information linked to the condo master insurance policy topic, you have pay a visit to the ideal site. Our site always gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

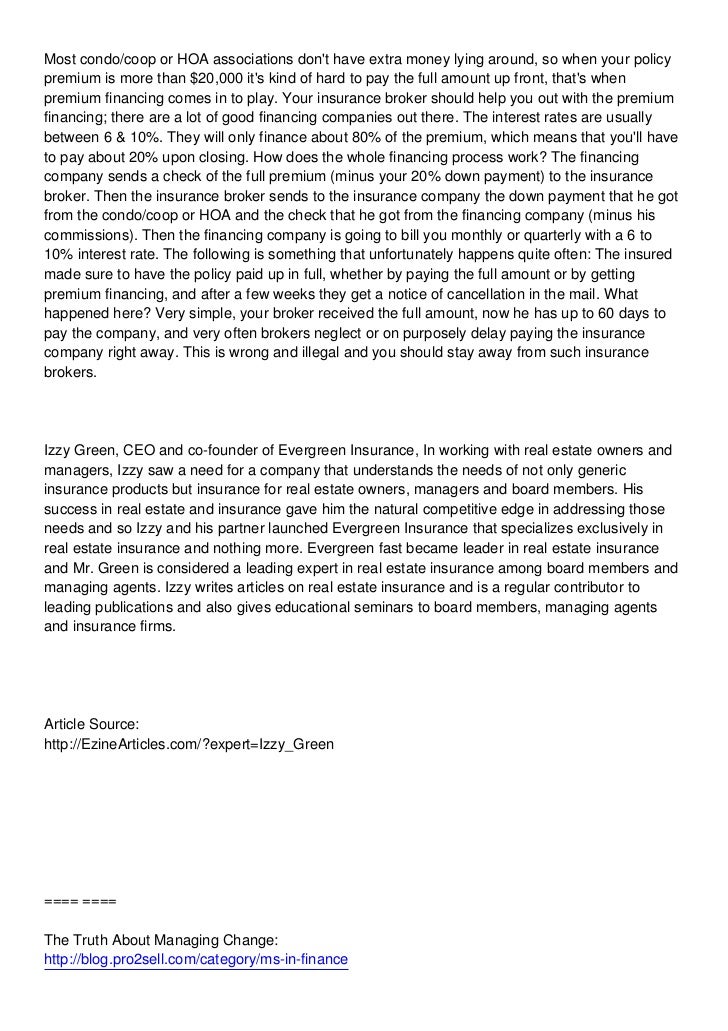

Condo Master Insurance Policy. A condo master insurance policy is an important part of protecting condo unit owners from potential risks. Anyone who owns a condo or townhome should be aware that their personal possessions, personal liability and upgrades to the unit may not be covered under the condominium master insurance policy and therefore they will need to take out their own condominium unit owners policy. This insurance is typically something that they carry in order to protect against any type of liability or legal issues. You might also see this type of policy referred to as condominium association insurance or an hoa master policy.

Fey Insurance Blog Certificates of Insurance From feyinsuranceblog.blogspot.com

Fey Insurance Blog Certificates of Insurance From feyinsuranceblog.blogspot.com

1 insuring your condominium is often not so easy, especially since it usually requires that you are covered by both your. The condo master insurance is a policy that insures a building or a condominium. A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it. This insurance is typically something that they carry in order to protect against any type of liability or legal issues. A condo master insurance policy is an important part of protecting condo unit owners from potential risks. It also covers any property that is collectively owned by the condo association.

It also covers any property that is collectively owned by the condo association.

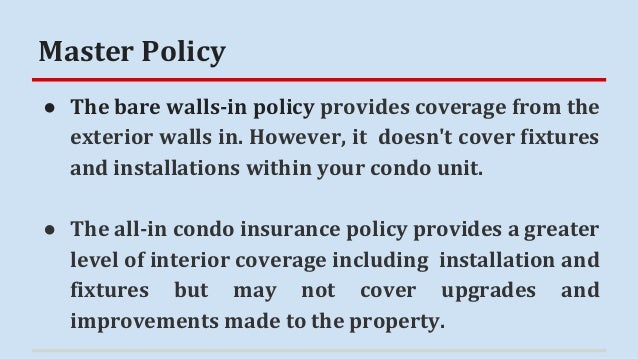

Bare walls coverage is a limited master insurance policy that covers the structure, as well as most fixtures and furnishings in common areas. Thus, to learn more about the insurance coverage you need for condominiums, get in touch today. What is a condo master policy? A common insurance analogy says if your condo master insurance policy is “studs in” then if you took your condo and turned it upside down everything that stayed attached to the condo would be covered by the master policy. Also included in the policy’s coverage are parking lots or garages, walkways, and the general landscape. It may cover cabinets, appliances, floors, etc., but not always.

Source: slideshare.net

Source: slideshare.net

You might also see this type of policy referred to as condominium association insurance or an hoa master policy. Even though each unit owner has a proportional interest in the association, unit owners do have distinct and separate interests from those of the association. Thus, to learn more about the insurance coverage you need for condominiums, get in touch today. Anyone who owns a condo or townhome should be aware that their personal possessions, personal liability and upgrades to the unit may not be covered under the condominium master insurance policy and therefore they will need to take out their own condominium unit owners policy. A master insurance policy covers places that are regularly used by multiple condo owners, known as shared or common areas.

Source: gallinaandsons.com

Bare walls coverage is a limited master insurance policy that covers the structure, as well as most fixtures and furnishings in common areas. A condo master policy covers the structure of the building and common area s. It’s important to understand the cost of condominium unit. Condo master policy insurance condominium insurance is a unique kind of insurance that integrates the interests of a condominium association with the interests of the individual unit owners. The master insurance policy is the insurance that.

Source: teamayao.com

Source: teamayao.com

The higher your deductible is the lower the cost of the insurance policy. Condo master policy insurance condominium insurance is a unique kind of insurance that integrates the interests of a condominium association with the interests of the individual unit owners. Hence, the protection of the building is your responsibility too! The master insurance policy is the insurance that. Property coverages may protect common areas from damage caused by perils such as fire, vandalism, and wind.

Source: youtube.com

Source: youtube.com

It’s important to understand the cost of condominium unit. A master insurance policy covers buildings or areas used by multiple unit owners. Also, what is master insurance policy for homeowners association? Condominium associations typically take out the policy, and the cost is divided among all the unit owners. Condominium master insurance policies must have one of the following coverages:

Source: socallimosandbuses.com

Source: socallimosandbuses.com

Anyone who owns a condo or townhome should be aware that their personal possessions, personal liability and upgrades to the unit may not be covered under the condominium master insurance policy and therefore they will need to take out their own condominium unit owners policy. A master insurance policy covers buildings or areas used by multiple unit owners. Condominium master insurance policies must have one of the following coverages: It may cover cabinets, appliances, floors, etc., but not always. Even though each unit owner has a proportional interest in the association, unit owners do have distinct and separate interests from those of the association.

Source: youtube.com

Source: youtube.com

A condo community insurance master policy with a $5,000 deductible and 20 owners would cost each owner $250 per deductible payment ($5,000/20 = $250). The master condo policy or condo association insurance is the insurance policy that is held by the homeowners or condominium association. Liability coverage can help pay legal expenses and settlements associated with suits filed against the condo association over covered accidents. With this policy, the building structure and common areas are protected from damages, so if a tree fell and destroyed a. Anyone who owns a condo or townhome should be aware that their personal possessions, personal liability and upgrades to the unit may not be covered under the condominium master insurance policy and therefore they will need to take out their own condominium unit owners policy.

Source: hawaiiliving.com

Source: hawaiiliving.com

Liability coverage can help pay legal expenses and settlements associated with suits filed against the condo association over covered accidents. A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it. It’s important to understand the cost of condominium unit. Property coverages may protect common areas from damage caused by perils such as fire, vandalism, and wind. A master insurance policy covers buildings or areas used by multiple unit owners.

Source: mymidtownmojo.com

Source: mymidtownmojo.com

Its premium comes out of your maintenance fees or association dues. Thus, to learn more about the insurance coverage you need for condominiums, get in touch today. This may include slips, falls, and similar accidents. Liability coverages help protect a condominium association from certain liability suits and claims filed against the condo trust. Even though each unit owner has a proportional interest in the association, unit owners do have distinct and separate interests from those of the association.

Source: hawaiiliving.com

Source: hawaiiliving.com

It also covers any property that is collectively owned by the condo association. Everything else would need to be covered in your personal insurance policy. The master insurance policy is the insurance that the hoa carries or that the condo board will hold. Condo master insurance policies provide a mixture of property and liability protections. Liability coverages help protect a condominium association from certain liability suits and claims filed against the condo trust.

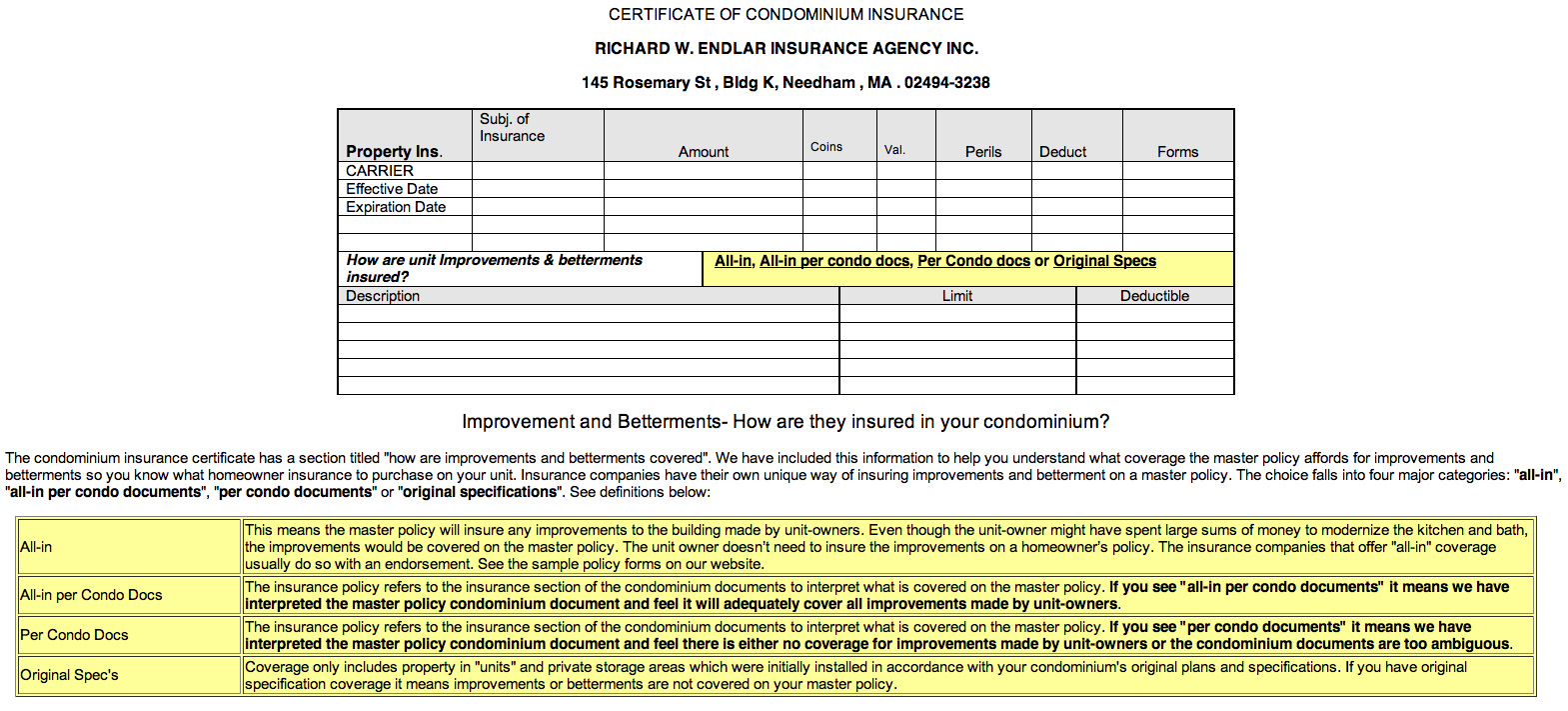

Source: feyinsuranceblog.blogspot.com

Source: feyinsuranceblog.blogspot.com

A common insurance analogy says if your condo master insurance policy is “studs in” then if you took your condo and turned it upside down everything that stayed attached to the condo would be covered by the master policy. Having the right master policy affects the financial options of both the building association and. A master insurance policy covers buildings or areas used by multiple unit owners. These include parks and pools belonging to the association, a shared gym or event space, and the building’s elevator. A common insurance analogy says if your condo master insurance policy is “studs in” then if you took your condo and turned it upside down everything that stayed attached to the condo would be covered by the master policy.

Source: reddit.com

Source: reddit.com

These include parks and pools belonging to the association, a shared gym or event space, and the building’s elevator. Most condo master insurance policies provide liability and property coverage for the public areas that they insure. It may cover cabinets, appliances, floors, etc., but not always. With this policy, the building structure and common areas are protected from damages, so if a tree fell and destroyed a. Hence, the protection of the building is your responsibility too!

Source: boardtraining.info

Source: boardtraining.info

However, unit owners may be partially. A condo master policy covers the structure of the building and common area s. It also covers any property that is collectively owned by the condo association. Bare walls coverage is a limited master insurance policy that covers the structure, as well as most fixtures and furnishings in common areas. A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it.

Source: bbdedham.com

Source: bbdedham.com

Condo master insurance policies provide a mixture of property and liability protections. Also included in the policy’s coverage are parking lots or garages, walkways, and the general landscape. Condominium master insurance policies must have one of the following coverages: A common insurance analogy says if your condo master insurance policy is “studs in” then if you took your condo and turned it upside down everything that stayed attached to the condo would be covered by the master policy. Everything else would need to be covered in your personal insurance policy.

Source: condoinsurancedoshinmi.blogspot.com

Source: condoinsurancedoshinmi.blogspot.com

This may include slips, falls, and similar accidents. The master insurance policy is the insurance that. Condo master insurance policies provide a mixture of property and liability protections. Hence, the protection of the building is your responsibility too! A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it.

Source: fr.slideshare.net

Source: fr.slideshare.net

The master insurance policy is the insurance that the hoa carries or that the condo board will hold. Also, what is master insurance policy for homeowners association? The master condo policy or condo association insurance is the insurance policy that is held by the homeowners or condominium association. It may cover cabinets, appliances, floors, etc., but not always. Condominium master insurance policies must have one of the following coverages:

Source: icerts.com

Source: icerts.com

The master policy generally covers all common areas of the condominium building, like a lounge or recreational room, as well as providing varying levels of protection for the interior structure of your condo unit, depending on the policy type. A master insurance policy covers places that are regularly used by multiple condo owners, known as shared or common areas. 1 insuring your condominium is often not so easy, especially since it usually requires that you are covered by both your. A condo master policy covers the structure of the building and common area s. Condominium master insurance policies must have one of the following coverages:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Having the right master policy affects the financial options of both the building association and. It also covers any property that is collectively owned by the condo association. A common insurance analogy says if your condo master insurance policy is “studs in” then if you took your condo and turned it upside down everything that stayed attached to the condo would be covered by the master policy. Liability coverage can help pay legal expenses and settlements associated with suits filed against the condo association over covered accidents. A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it.

Source: condoassociation.com

Source: condoassociation.com

Only allowed if the master deed allows this type of insurance to be obtained by the project. Anyone who owns a condo or townhome should be aware that their personal possessions, personal liability and upgrades to the unit may not be covered under the condominium master insurance policy and therefore they will need to take out their own condominium unit owners policy. Its premium comes out of your maintenance fees or association dues. Even though each unit owner has a proportional interest in the association, unit owners do have distinct and separate interests from those of the association. You might also see this type of policy referred to as condominium association insurance or an hoa master policy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title condo master insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information