Consequential loss insurance information

Home » Trending » Consequential loss insurance informationYour Consequential loss insurance images are available. Consequential loss insurance are a topic that is being searched for and liked by netizens now. You can Download the Consequential loss insurance files here. Find and Download all free vectors.

If you’re searching for consequential loss insurance pictures information linked to the consequential loss insurance topic, you have visit the ideal site. Our site always gives you hints for downloading the maximum quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

Consequential Loss Insurance. Consequential loss — a loss that arises as a result of direct damage to property—for example, loss of rent. Consequential damage is included under comprehensive cover and is damage resulting from other damage. If a business has insurance coverage that pays it for consequential losses, it can recover some. A consequential loss typically arises as the result of damage caused by a natural disaster, such as flooding, a tornado, or an earthquake.

Can a company claim “consequential loss’ from there Insurers? From bvkfin.co.za

Can a company claim “consequential loss’ from there Insurers? From bvkfin.co.za

A consequential loss is a loss occurring as the result of a business being unable to function normally due to damage to equipment or property or another peril. Consequential loss insurance is also know as business interruption insurance. For example, if a car’s fan blade breaks off and damages the radiator to such an extent that the engine overheats, the damage to the radiator and engine is consequential damage. Consequential loss insurance be protected against the loss of profit arising from a loss covered under a property material damage policy a property damage insurance policy such as a fire or industrial all risks insurance provides coverage for the costs of repairing, reinstating or replacing damaged property. A consequential loss typically arises as the result of damage caused by a natural disaster, such as flooding, a tornado, or an earthquake. Business interruption insurance can help businesses cope with these losses and many insurers offer the cover within their product lines.

Consequential loss is loss that is not a direct or foreseeable result of the harm suffered.

This insurance is a sure way for you to receive payment for loss of accruable net profit, wages, auditors fees, etc. Insurance cover can be taken for the maximum period (indemnity period) of. 1) such damage is caused at any time after payment of the premium during the period of insurance named in the schedule or any subsequent period in respect of which the insured shall have paid For example, if a car’s fan blade breaks off and damages the radiator to such an extent that the engine overheats, the damage to the radiator and engine is consequential damage. However, there are some important exceptions including where parties to a contract separately define what consequential loss means. A consequential loss insurance policy for fire or other special perils financially compensates the owner for the lost business income due to fire.

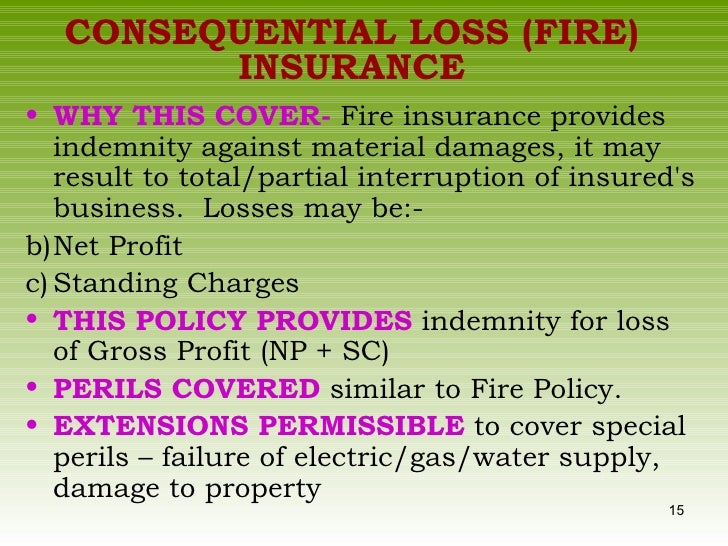

Source: slideshare.net

Source: slideshare.net

Consequential loss can be distinguished from direct and foreseeable loss and is generally not recoverable at law. Its aim is to safeguard the parties from special types of losses that have been made known to the party in breach. Business interruption insurance can help businesses cope with these losses and many insurers offer the cover within their product lines. 1) such damage is caused at any time after payment of the premium during the period of insurance named in the schedule or any subsequent period in respect of which the insured shall have paid For example, if a car’s fan blade breaks off and damages the radiator to such an extent that the engine overheats, the damage to the radiator and engine is consequential damage.

Source: eddisons.com

Source: eddisons.com

For example, if a car’s fan blade breaks off and damages the radiator to such an extent that the engine overheats, the damage to the radiator and engine is consequential damage. A consequential loss is a loss occurring as the result of a business being unable to function normally due to damage to equipment or property or another peril. Consequential damage is included under comprehensive cover and is damage resulting from other damage. This insurance is a sure way for you to receive payment for loss of accruable net profit, wages, auditors fees, etc. A policy that provides protection against loss of profits in business due to an interruption in business consequent upon an insured peril and claim admitted under the material damage policy.

Source: awginsurance.com

Source: awginsurance.com

A consequential loss is an indirect loss, as opposed to a direct loss, and so careful research when selecting insurance is imperative, as not all policies will provide this kind of cover. 1) such damage is caused at any time after payment of the premium during the period of insurance named in the schedule or any subsequent period in respect of which the insured shall have paid Consequential loss is loss that is not a direct or foreseeable result of the harm suffered. Consequential damage is included under comprehensive cover and is damage resulting from other damage. A consequential loss typically arises as the result of damage caused by a natural disaster, such as flooding, a tornado, or an earthquake.

Source: spggib.com.my

Source: spggib.com.my

Sunday, january 8, 2017, 17:36. Depending on your chosen tariff or the individual stipulations in the insurance contract, the insurer will pay compensation not only in the event of direct or indirect damage caused by you, but also if the damage was. The policy can be arranged to pay for the loss of profit, standing charges, additional cost of working or charges which may be incurred to kick start the business operation after a loss (e.g from a fire). A consequential loss is a type of loss that comes about when circumstances beyond the control of the business owner make it impossible to use company equipment or company property to conduct the. It is hereby understood and agreed that we will not pay for any liability directly arising out ofconsequential losses other than consequential losses flowing from personal injury.

Source: youtube.com

Source: youtube.com

A consequential loss is an indirect loss that accompanies an insured loss, for example the loss of earnings arising from a property fire, experienced by a business insured against fire. The policy can be arranged to pay for the loss of profit, standing charges, additional cost of working or charges which may be incurred to kick start the business operation after a loss (e.g from a fire). A consequential loss is a loss occurring as the result of a business being unable to function normally due to damage to equipment or property or another peril. Rather the clause had a wider meaning of financial losses caused by guaranteed defects above and beyond the replacement and repair of. The igi fire consequential loss policy provides cover for expenses and increased cost of working as a result of business interruption following a loss covered by the fire policy.

Source: insurance-sarchi.com

Source: insurance-sarchi.com

For example, if a car’s fan blade breaks off and damages the radiator to such an extent that the engine overheats, the damage to the radiator and engine is consequential damage. Assumption of loss of earnings, compensation for pain and suffering, or pensions. Consequential loss insurance be protected against the loss of profit arising from a loss covered under a property material damage policy a property damage insurance policy such as a fire or industrial all risks insurance provides coverage for the costs of repairing, reinstating or replacing damaged property. A consequential loss is a loss occurring as the result of a business being unable to function normally due to damage to equipment or property or another peril. It is an indirect loss that cannot be compensated even when the damaged unit is covered under the insurance.

Source: guineainsurance.com

Source: guineainsurance.com

Consequential loss is loss that is not a direct or foreseeable result of the harm suffered. A consequential loss is a loss sustained by a business when it is unable to use its assets in the intended manner. The phrase “consequential or special losses, damages or expenses” did not mean those losses coming within the second limb (arising from special circumstances known at the time the contract was entered into). It is an indirect loss that cannot be compensated even when the damaged unit is covered under the insurance. The policy can be arranged to pay for the loss of profit, standing charges, additional cost of working or charges which may be incurred to kick start the business operation after a loss (e.g from a fire).

Source: youtube.com

Source: youtube.com

Insurance cover can be taken for the maximum period (indemnity period) of. Consequential loss insurance is also know as business interruption insurance. A consequential loss is a type of loss that comes about when circumstances beyond the control of the business owner make it impossible to use company equipment or company property to conduct the. The igi fire consequential loss policy provides cover for expenses and increased cost of working as a result of business interruption following a loss covered by the fire policy. Insurance cover can be taken for the maximum period (indemnity period) of.

Source: slideshare.net

Source: slideshare.net

Business interruption insurance can help businesses cope with these losses and many insurers offer the cover within their product lines. Loss resulting from such interruption or interference in accordance with the provisions contained therein: For example, if a car’s fan blade breaks off and damages the radiator to such an extent that the engine overheats, the damage to the radiator and engine is consequential damage. For example, if a car’s fan blade breaks off and damages the radiator to such an extent that the engine overheats, the damage to the radiator and engine is consequential damage. Some types of consequential loss are insurable under standard direct damage or time element coverage forms;

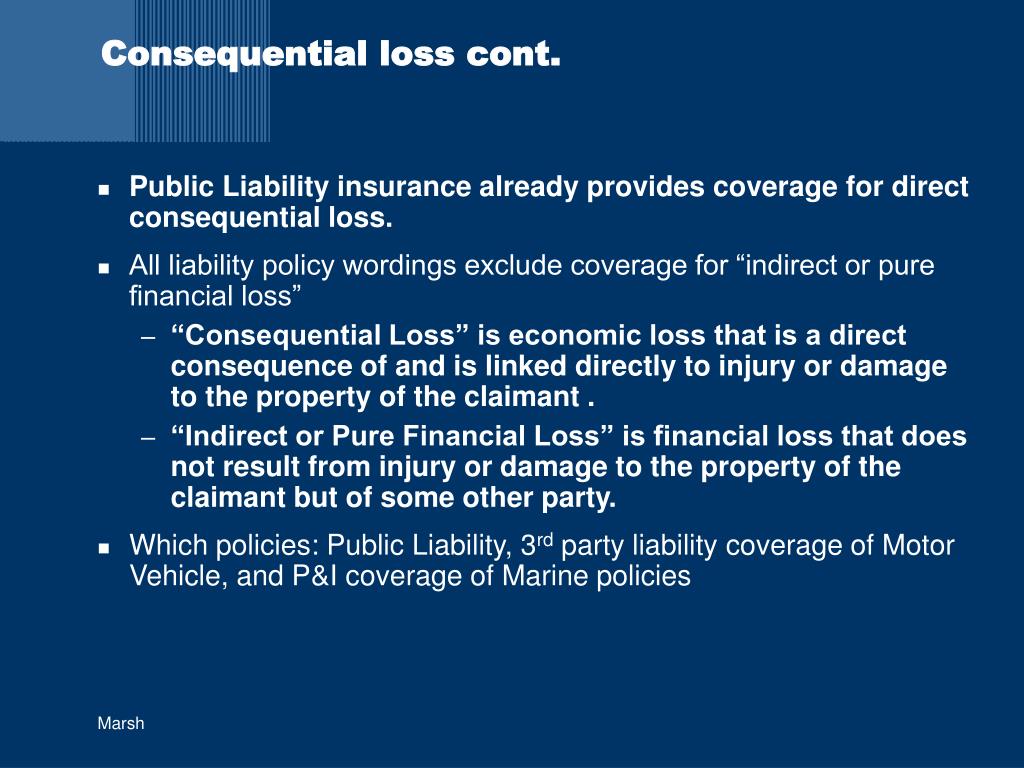

Source: slideserve.com

Source: slideserve.com

The fan blade falls within the exclusion of mechanical breakage and will not be. Consequential damage is included under comprehensive cover and is damage resulting from other damage. Property insurance typically covers primary damage to a building or structure. Any interruption in business operations caused by fire or other special perils, resulting in a financial loss of various kinds is called consequential loss. The consequential loss insurance covers indirect damages and is called a business interruption insurance.

Source: moonstone.co.za

Source: moonstone.co.za

Any interruption in business operations caused by fire or other special perils, resulting in a financial loss of various kinds is called consequential loss. 1) such damage is caused at any time after payment of the premium during the period of insurance named in the schedule or any subsequent period in respect of which the insured shall have paid Its aim is to safeguard the parties from special types of losses that have been made known to the party in breach. Sunday, january 8, 2017, 17:36. While insurance to cover incidences of consequential loss can be somewhat expensive, the coverage can provide a great deal of comfort to business owners.

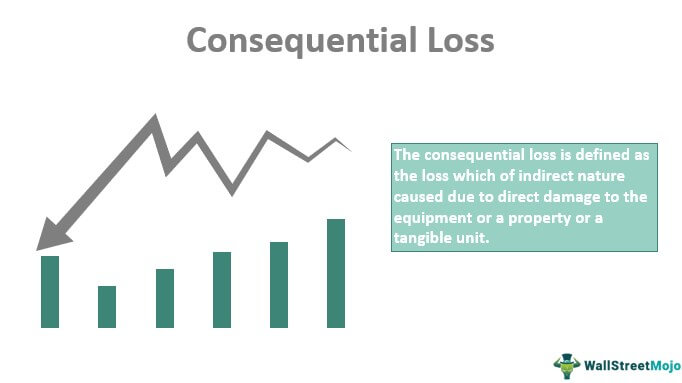

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Rather the clause had a wider meaning of financial losses caused by guaranteed defects above and beyond the replacement and repair of. The fan blade falls within the exclusion of mechanical breakage and will not be. Sunday, january 8, 2017, 17:36. For example, if a car’s fan blade breaks off and damages the radiator to such an extent that the engine overheats, the damage to the radiator and engine is consequential damage. 1) such damage is caused at any time after payment of the premium during the period of insurance named in the schedule or any subsequent period in respect of which the insured shall have paid

Source: bimapanditedu.com

Source: bimapanditedu.com

It is hereby understood and agreed that we will not pay for any liability directly arising out ofconsequential losses other than consequential losses flowing from personal injury. A policy that provides protection against loss of profits in business due to an interruption in business consequent upon an insured peril and claim admitted under the material damage policy. A consequential loss insurance policy for fire or other special perils financially compensates the owner for the lost business income due to fire. Assumption of loss of earnings, compensation for pain and suffering, or pensions. The fan blade falls within the exclusion of mechanical breakage and will not be.

Source: slideserve.com

Source: slideserve.com

While insurance to cover incidences of consequential loss can be somewhat expensive, the coverage can provide a great deal of comfort to business owners. Consequential damage is included under comprehensive cover and is damage resulting from other damage. Property insurance typically covers primary damage to a building or structure. Loss of gross profit or revenue due to reduction in turnover or out put This insurance is a sure way for you to receive payment for loss of accruable net profit, wages, auditors fees, etc.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

For example, if a car’s fan blade breaks off and damages the radiator to such an extent that the engine overheats, the damage to the radiator and engine is consequential damage. Consequential damage is included under comprehensive cover and is damage resulting from other damage. Property insurance typically covers primary damage to a building or structure. Consequential loss can be distinguished from direct and foreseeable loss and is generally not recoverable at law. The consequential loss insurance covers indirect damages and is called a business interruption insurance.

Source: getaquote.com.sg

Source: getaquote.com.sg

However, there are some important exceptions including where parties to a contract separately define what consequential loss means. It is hereby understood and agreed that we will not pay for any liability directly arising out ofconsequential losses other than consequential losses flowing from personal injury. Consequential loss can be distinguished from direct and foreseeable loss and is generally not recoverable at law. The consequential loss insurance covers indirect damages and is called a business interruption insurance. Consequential loss is a kind of collateral damage incurred due to the damage to the equipment, property or any tangible unit.

Source: bvkfin.co.za

Source: bvkfin.co.za

Some types of consequential loss are insurable under standard direct damage or time element coverage forms; Sunday, january 8, 2017, 17:36. Some types of consequential loss are insurable under standard direct damage or time element coverage forms; A consequential loss is an indirect loss that accompanies an insured loss, for example the loss of earnings arising from a property fire, experienced by a business insured against fire. A consequential loss exclusion clause is a contractual clause that limits liability by seeking to protect the parties from disproportionate and unbudgeted exposure to losses if something goes wrong.

Source: youtube.com

Source: youtube.com

What is consequential loss insurance? A consequential loss is an indirect loss, as opposed to a direct loss, and so careful research when selecting insurance is imperative, as not all policies will provide this kind of cover. It is an indirect loss that cannot be compensated even when the damaged unit is covered under the insurance. A consequential loss exclusion clause is a contractual clause that limits liability by seeking to protect the parties from disproportionate and unbudgeted exposure to losses if something goes wrong. A consequential loss is a type of loss that comes about when circumstances beyond the control of the business owner make it impossible to use company equipment or company property to conduct the.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title consequential loss insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea