Contestability of a life insurance policy Idea

Home » Trend » Contestability of a life insurance policy IdeaYour Contestability of a life insurance policy images are available. Contestability of a life insurance policy are a topic that is being searched for and liked by netizens today. You can Get the Contestability of a life insurance policy files here. Find and Download all royalty-free photos.

If you’re searching for contestability of a life insurance policy pictures information related to the contestability of a life insurance policy interest, you have come to the ideal blog. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Contestability Of A Life Insurance Policy. It could impact you, and at the very least, you should know the ins and outs of how it works. Insurance provider for life of insurance contestability policy is dependent upon the reasons should you are issued, life insurance policy and provisions regarding your. Claims that occur during the contestability period are not automatically denied. What is a life insurance contestability period?

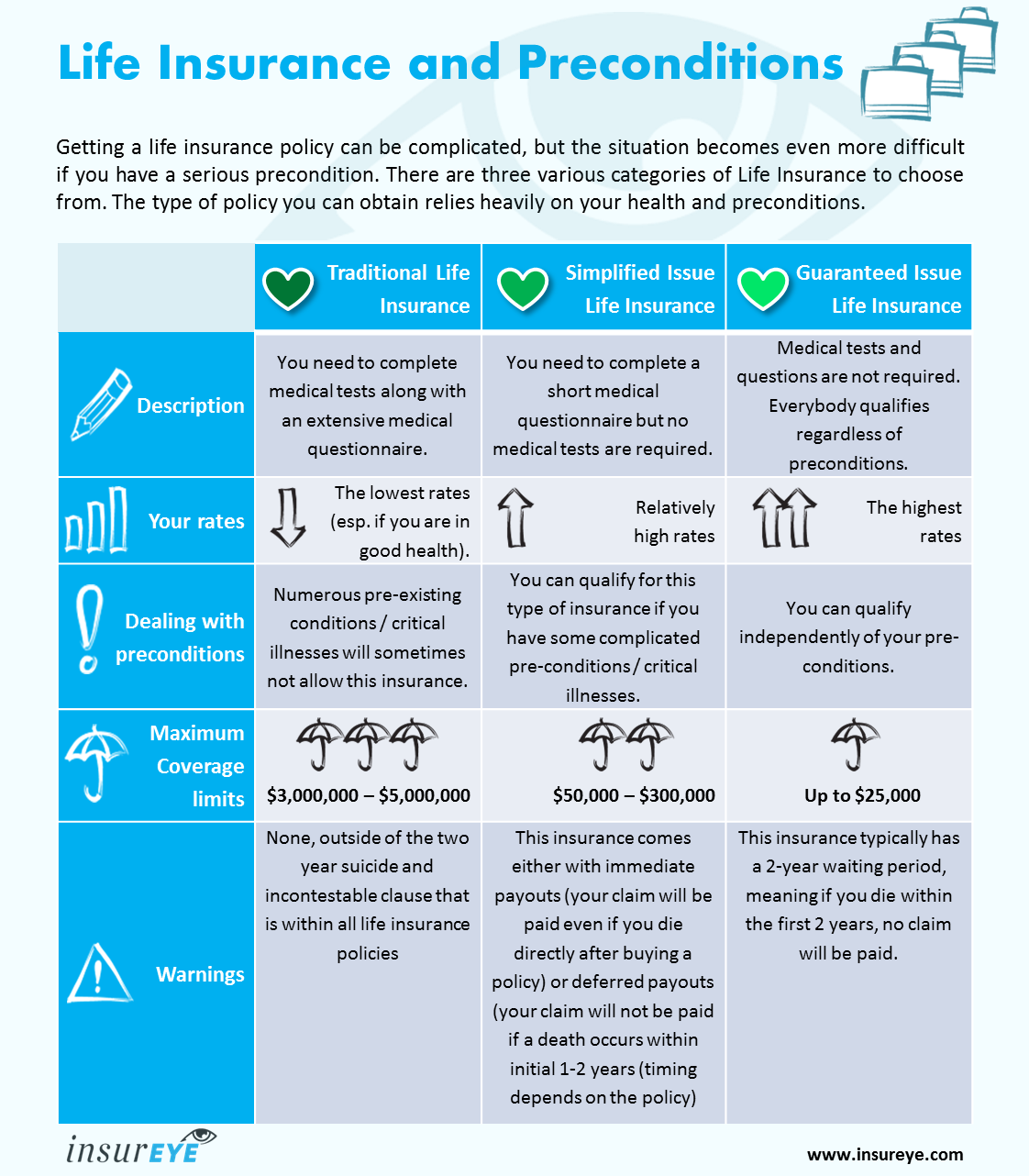

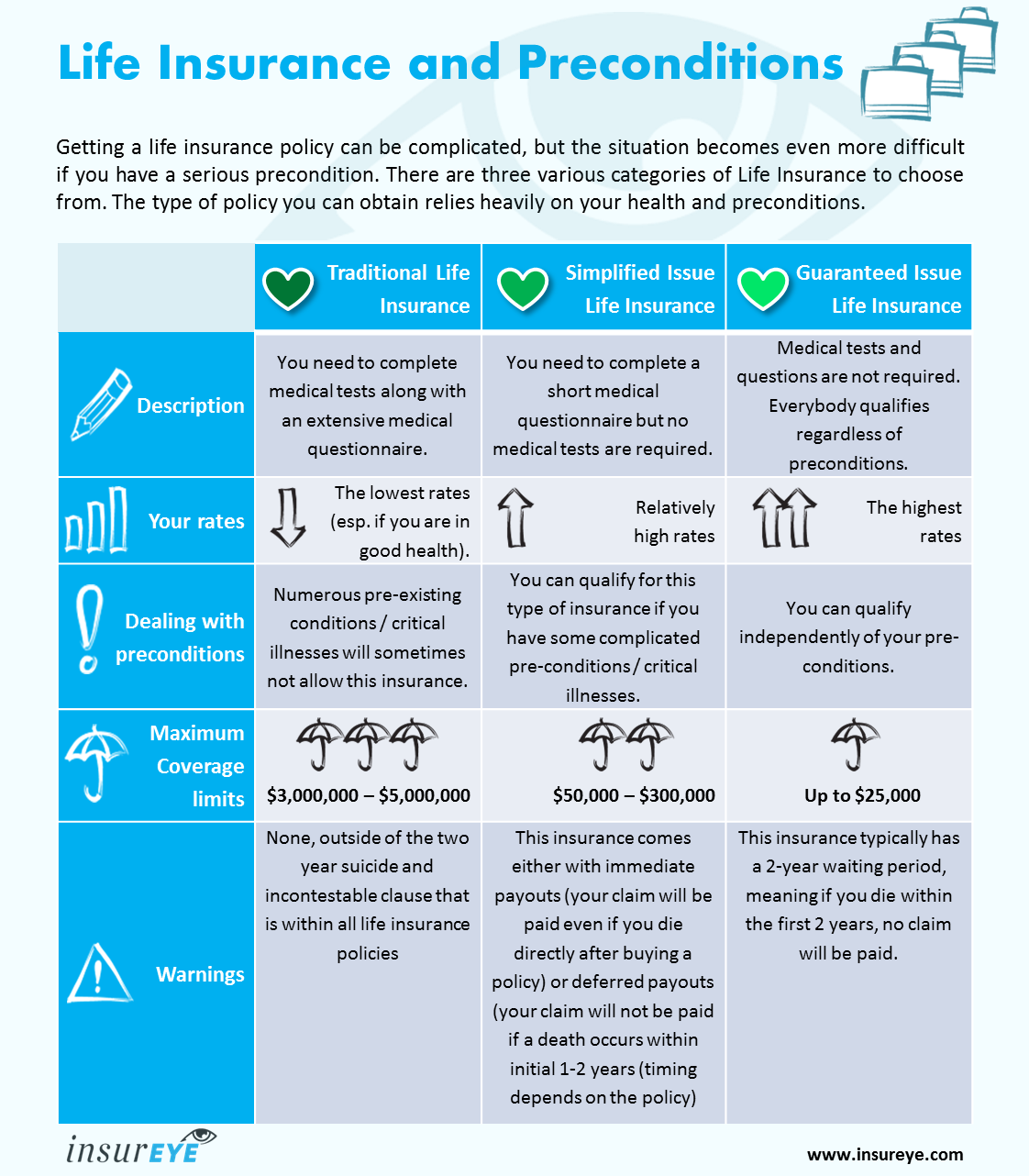

Life Insurance with PreExisting Condition All Answers From insureye.com

Life Insurance with PreExisting Condition All Answers From insureye.com

Because the cost of premiums for life insurance is typically based on a buyer’s age and medical history, some people may try to minimize their monthly premiums by intentionally. This clause gives the insurance company the right to dispute your claim and not pay out your policy if you die within two years of taking out the policy. During that delay, they�ll review your coverage for any misrepresentations on your application. This clause gives the insurance company the right to dispute your claim and potentially refuse to pay out your policy if you die within two years of taking out the policy. During this time, an insurance company can review your application if a death claim is made. Every life insurance policy a person can get these days has what is called a “contestability period”.

It could impact you, and at the very least, you should know the ins and outs of how it works.

During this time, an insurance company can review your application if a death claim is made. There are other options now if you have a health issue such as no medical life insurance. Claims that occur during the contestability period are not automatically denied. Simply put, the life insurance contestability is the window during which an insurance company can look into and deny a claim after a policyholder’s demise. The word “contestability” might sound a little frightening when it�s associated with your life insurance policy. The word contestability means a contest or dispute to a claim.

Source: calilaw.com

Source: calilaw.com

After this period of time, the carrier is unable to use this particular clause in such situations. This period is, in most states, typically set at 24 months starting from the moment the first policy payment is made. The contestability clause enables the insurance company to investigate the application documents which may lead to a claim delay or denial. What is a contestability period? There are other options now if you have a health issue such as no medical life insurance.

Source: scottpage.com

Source: scottpage.com

This means that should the. What is a life insurance contestability period? During this time, the insurance company can deny or reduce the death benefit in the event there has been. The life insurance contestability period is a short time when the insurance company can investigate your claim. After this period of time, the carrier is unable to use this particular clause in such situations.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

The contestability period is a period after the life insurance policy is purchased during which if the insured person dies, the insurance company has a right to contest the claim for a policy pay out. The life insurance company has 2 years to use the contestability clause if evidence of misrepresentation, concealment, or material fraud occurs. Being untruthful on your life insurance application form for getting premiums at lower rates can be dangerous for your. “contest” implies that there�s a. The contestability period is a period after the life insurance policy is purchased during which if the insured person dies, the insurance company has a right to contest the claim for a policy pay out.

Source: economiapersonal.com.ar

Source: economiapersonal.com.ar

If you pass away within these first two years, the payout may be delayed while the insurance company investigates your death. This means that should the. Simply put, the life insurance contestability is the window during which an insurance company can look into and deny a claim after a policyholder’s demise. It could impact you, and at the very least, you should know the ins and outs of how it works. If you pass away during this time, your insurance company is legally allowed to investigate your death.

Source: motherhoodtherealdeal.com

Source: motherhoodtherealdeal.com

What is the life insurance contestability period? What is the life insurance contestability period? The contestability period is a period of time after your life insurance goes into effect. The life insurance contestability period is a short time when the insurance company can investigate your claim. During this time, an insurance company can review your application if a death claim is made.

Source: insurance.ohio.gov

Source: insurance.ohio.gov

What is a contestability period? Life insurance companies can examine the claims to make sure the decision was based on correct information. The contestability period lasts for two years after your life insurance policy goes in force and allows the insurer to review your coverage for misrepresentations during the application process. The life insurance contestability period is a short time when the insurance company can investigate your claim. The policy likely defines contestability or incontestability similar to this:

Source: insureye.com

Source: insureye.com

It could impact you, and at the very least, you should know the ins and outs of how it works. The life insurance contestability period is a short time when the insurance company can investigate your claim. The life insurance company has 2 years to use the contestability clause if evidence of misrepresentation, concealment, or material fraud occurs. Every life insurance policy a person can get these days has what is called a “contestability period”. “contest” implies that there�s a.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

This period is, in most states, typically set at 24 months starting from the moment the first policy payment is made. During this time, an insurance company can review your application if a death claim is made. Contestability protects the life insurance company from fraud. A contestability period is a window of time, generally two years, after a life insurance policy goes into force that allows for the life insurance company to investigate the accuracy of information the application prior to paying a claim. The first two years of your life insurance policy are known as the contestability period.

Source: pinterest.com

Source: pinterest.com

The policy likely defines contestability or incontestability similar to this: The life insurance company has 2 years to use the contestability clause if evidence of misrepresentation, concealment, or material fraud occurs. The first two years of your life insurance policy are known as the contestability period. The contestability clause enables the insurance company to investigate the application documents which may lead to a claim delay or denial. Life insurance companies can examine the claims to make sure the decision was based on correct information.

Source: youtube.com

Source: youtube.com

If you pass away within these first two years, the payout may be delayed while the insurance company investigates your death. The contestability period is a period of time after your life insurance goes into effect. This means that the insurance company may investigate the details of your medical history to make sure you didn’t misrepresent information. The contestability period is a period after the life insurance policy is purchased during which if the insured person dies, the insurance company has a right to contest the claim for a policy pay out. Contestability protects the life insurance company from fraud.

Source: haffnerlawyers.com

Source: haffnerlawyers.com

During this time, the insurance company can deny or reduce the death benefit in the event there has been. If you pass away during this time, your insurance company is legally allowed to investigate your death. If you pass away in the first two years of your life insurance coverage, the insurance company has a right to contest or question your claim. It could impact you, and at the very least, you should know the ins and outs of how it works. The contestability period is a period after the life insurance policy is purchased during which if the insured person dies, the insurance company has a right to contest the claim for a policy pay out.

Source: sproutt.com

Source: sproutt.com

What is a life insurance contestability period? In some states, it is two years, and in others, it is only one year. The contestability period is a time period during which the insurer has the right to investigate the death of a policyholder and review the claim filed by the beneficiaries in order to rule out the possibility of misrepresentation or fraud. If you pass away during this time, your insurance company is legally allowed to investigate your death. If you pass away within these first two years, the payout may be delayed while the insurance company investigates your death.

Source: sgbudgetbabe.blogspot.com

Source: sgbudgetbabe.blogspot.com

There are other options now if you have a health issue such as no medical life insurance. Being untruthful on your life insurance application form for getting premiums at lower rates can be dangerous for your. Life insurance companies can examine the claims to make sure the decision was based on correct information. What is the life insurance contestability period? If you die during that time, the insurance company can delay payment of benefits.

Source: investopedia.com

Source: investopedia.com

Because the cost of premiums for life insurance is typically based on a buyer’s age and medical history, some people may try to minimize their monthly premiums by intentionally. If you pass away within these first two years, the payout may be delayed while the insurance company investigates your death. It could impact you, and at the very least, you should know the ins and outs of how it works. Because the cost of premiums for life insurance is typically based on a buyer’s age and medical history, some people may try to minimize their monthly premiums by intentionally. This period is, in most states, typically set at 24 months starting from the moment the first policy payment is made.

Source: dotcomwomen.com

Source: dotcomwomen.com

A contestability period is a window of time, generally two years, after a life insurance policy goes into force that allows for the life insurance company to investigate the accuracy of information the application prior to paying a claim. Simply put, the life insurance contestability is the window during which an insurance company can look into and deny a claim after a policyholder’s demise. In some states, it is two years, and in others, it is only one year. What is a life insurance contestability period? The word “contestability” might sound a little frightening when it�s associated with your life insurance policy.

Source: lifeinsurance411.org

Source: lifeinsurance411.org

Some very important points that you should know about the contestability period of your life insurance policy are as follows: During that delay, they�ll review your coverage for any misrepresentations on your application. It could impact you, and at the very least, you should know the ins and outs of how it works. If you pass away during this time, your insurance company is legally allowed to investigate your death. The contestability period is a period of time after your life insurance goes into effect.

Source: gandhiselimlaw.com

Source: gandhiselimlaw.com

It could impact you, and at the very least, you should know the ins and outs of how it works. The life insurance contestability period is a short time when the insurance company can investigate your claim. In some states, it is two years, and in others, it is only one year. Insurance provider for life of insurance contestability policy is dependent upon the reasons should you are issued, life insurance policy and provisions regarding your. This means that should the.

Source: chandlerknowlescpa.com

Source: chandlerknowlescpa.com

There are other options now if you have a health issue such as no medical life insurance. The first two years of your life insurance policy are known as the contestability period. The word “contestability” might sound a little frightening when it�s associated with your life insurance policy. During this time, an insurance company can review your application if a death claim is made. In most policies, the contestability period is within the first two years of.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title contestability of a life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information