Contesting life insurance beneficiary information

Home » Trending » Contesting life insurance beneficiary informationYour Contesting life insurance beneficiary images are ready in this website. Contesting life insurance beneficiary are a topic that is being searched for and liked by netizens now. You can Download the Contesting life insurance beneficiary files here. Get all royalty-free vectors.

If you’re looking for contesting life insurance beneficiary pictures information linked to the contesting life insurance beneficiary keyword, you have come to the ideal blog. Our site frequently gives you hints for downloading the highest quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

Contesting Life Insurance Beneficiary. Contesting life insurance beneficiaries is fairly common. Contesting a life insurance beneficiary is difficult and may result in a legal battle. Yes, you can contest a life insurance beneficiary designation and you may be able to sue for life insurance proceeds. Contesting a life insurance beneficiary is difficult and may result in a legal battle.

Life Insurance Mansell & Mansell Probate From losangelesprobate.com

Life Insurance Mansell & Mansell Probate From losangelesprobate.com

Contesting life insurance beneficiaries is a legal process but whether your dispute is subject to state or federal law can depend on the policy. The beneficiary designation is chosen by the contract owner and can only be changed by the contract owner. While it is possible to dispute beneficiaries on a life insurance policy, doing so creates a tremendous amount of cost and takes a lot of time. This will be a legal matter, and will require working with an experienced. It can consume a lot of time, energy and money. The insureds person will is a separate document that is not usually taken into consideration when life.

The insurance company won�t disburse funds while the case is pending.

Grounds to contest a life insurance beneficiary. A life insurance beneficiary is a party explicitly named as the intended recipient of the policy’s death benefit (the amount payable to the beneficiary (ies) when a policyholder passes away). Can you contest life insurance beneficiary.a current spouse who objects to a former spouse being named as the life insurance policy’s beneficiary a life insurance policy is a contract in which an insurance company agrees to pay the proceeds of a policy to a named beneficiary upon the insured’s death. Contesting life insurance beneficiary designation. If, for example, the life insurance policy was issued by an employer and is covered by erisa guidelines then federal law would apply when disputing a. Many people who contest beneficiaries based on mental.

Source: youtube.com

Source: youtube.com

If you have a life insurance policy, there are some things you can do to minimize the possibility of someone challenging your choice of beneficiary. A life insurance beneficiary is a party explicitly named as the intended recipient of the policy’s death benefit (the amount payable to the beneficiary (ies) when a policyholder passes away). Learn about contesting beneficiaries on a life insurance policy. State law mandates a beneficiary change. Traditionally one cannot contest the beneficiary of a life insurance contract.

Source: hit-my-head.blogspot.com

Source: hit-my-head.blogspot.com

Contesting life insurance beneficiaries is fairly common. Contesting a life insurance beneficiary is difficult and may result in a legal battle. Death claim letter of policy no. The insureds person will is a separate document that is not usually taken into consideration when life. A life insurance policy is a contract in which an insurance company agrees to pay the proceeds of a policy to a named beneficiary upon the insured’s death.

Source: youtube.com

Source: youtube.com

Most life insurance policies have a clause that allow you to contest the designated beneficiary. Contesting life insurance beneficiaries is fairly common. A life insurance beneficiary is a party explicitly named as the intended recipient of the policy’s death benefit (the amount payable to the beneficiary (ies) when a policyholder passes away). If, for example, the life insurance policy was issued by an employer and is covered by erisa guidelines then federal law would apply when disputing a. This will be a legal matter, and will require working with an experienced.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

Most life insurance policies have a clause that allow you to contest the designated beneficiary. This person can be designated by the policyholder or it can be determined automatically by state law. The insurance company may hold the payment or put it into a special escrow account managed by the probate court. You’ll choose your beneficiaries when you first purchase a policy; Contact a life insurance lawyer.

Source: smartasset.com

Source: smartasset.com

It can be extremely difficult. Learn how to do it in this step by step guide. This is the easiest and most straightforward way in which to contest the life insurance beneficiary designation. Grounds to contest a life insurance beneficiary. The insurance company won�t disburse funds while the case is pending.

Source: noclutter.cloud

Source: noclutter.cloud

Getting help when disputing life insurance beneficiary. Contact a life insurance lawyer. A contested life insurance beneficiary designation is not only about who gets the death benefit, but whether the intent of the insured will be honored. How contesting life insurance beneficiary works. It is important to speak with an attorney if you do not believe another person is a proper beneficiary of a life insurance policy.

Source: breaking-news-update-live390.blogspot.com

Source: breaking-news-update-live390.blogspot.com

This will be a legal matter, and will require working with an experienced. If you have a life insurance policy, there are some things you can do to minimize the possibility of someone challenging your choice of beneficiary. Legalese idk) to wrap up, and what do you expect would happen here? A contested life insurance beneficiary designation is not only about who gets the death benefit, but whether the intent of the insured will be honored. However, if you can show that the deceased neglected.

Source: noclutter.cloud

Source: noclutter.cloud

Encourage family members to review their life insurance policies regularly, to make sure the money will actually go to the. Learn about contesting beneficiaries on a life insurance policy. It can be extremely difficult. Contact a life insurance lawyer. Yes, you are making a gift to each one of them.

Source: noclutter.cloud

Source: noclutter.cloud

Contesting life insurance beneficiaries is fairly common. The beneficiary designation is chosen by the contract owner and can only be changed by the contract owner. This will be a legal matter, and will require working with an experienced. It also forces the rest of the estate to stay open, preventing the probate courts from closing the estate and distributing its assets. Contesting a beneficiary change, however, is often the right way of handling a life insurance claim denial if fraud or duress is involved.

Source: patricklegal.com

Source: patricklegal.com

Learn how to do it in this step by step guide. Traditionally one cannot contest the beneficiary of a life insurance contract. Individuals may seek to contest a beneficiary designation on an ira, life insurance policy, or other account for any number of reasons. Encourage family members to review their life insurance policies regularly, to make sure the money will actually go to the. Contact a life insurance lawyer.

Source: lacontoh.blogspot.com

Source: lacontoh.blogspot.com

How contesting life insurance beneficiary works. This is the easiest and most straightforward way in which to contest the life insurance beneficiary designation. However, if you can show that the deceased neglected. Learn about contesting beneficiaries on a life insurance policy. Grounds to contest a life insurance beneficiary.

Source: noclutter.cloud

Source: noclutter.cloud

State law mandates a beneficiary change. Methven, 346 s.w.2d 797, 799 (tex. The most common case for contesting life insurance is in the case of divorce. Challenging a life insurance beneficiary is a complex and challenging undertaking. Death claim letter of policy no.

Source: wikihow.com

Source: wikihow.com

The most common case for contesting life insurance is in the case of divorce. A sample letter to send to life insurance company by a beneficiary of the life insurance policy. However, if you can show that the deceased neglected. People often designate their spouse or adult children. The bad news (or good news depending on how you view it), is that’s it’s rather hard to change the named beneficiaries.

Source: youtube.com

Source: youtube.com

A common beneficiary dispute arises when an. Each disputed beneficiary claim is unique and the specific facts of that claim are critically important. Encourage family members to review their life insurance policies regularly, to make sure the money will actually go to the. A common beneficiary dispute arises when an. That is what an insurance company and ultimately the courts are charged with finding out,.

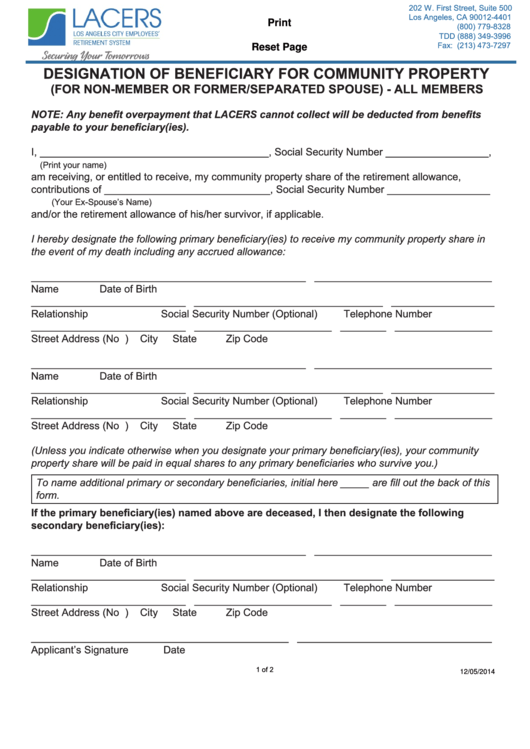

Source: formsbank.com

Source: formsbank.com

A life insurance policy is a contract in which an insurance company agrees to pay the proceeds of a policy to a named beneficiary upon the insured’s death. Many people who contest beneficiaries based on mental. However, if you can show that the deceased neglected. If you have a life insurance policy, there are some things you can do to minimize the possibility of someone challenging your choice of beneficiary. Encourage family members to review their life insurance policies regularly, to make sure the money will actually go to the.

Source: wikihow.com

Source: wikihow.com

Contesting a life insurance beneficiary is difficult and may result in a legal battle. The beneficiary designation is chosen by the contract owner and can only be changed by the contract owner. Grounds to contest a life insurance beneficiary. This person can be designated by the policyholder or it can be determined automatically by state law. A life insurance policy is a contract in which an insurance company agrees to pay the proceeds of a policy to a named beneficiary upon the insured’s death.

Source: npa1.org

Source: npa1.org

A sample letter to send to life insurance company by a beneficiary of the life insurance policy. Got a letter from an insurance company if you are the child of deceased please contact. Contact a life insurance lawyer. The most common case for contesting life insurance is in the case of divorce. Super traumatic shit for me.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

The beneficiary designation is chosen by the contract owner and can only be changed by the contract owner. That the beneficiary change was made shortly before the death of the insured should raise. A life insurance beneficiary is a party explicitly named as the intended recipient of the policy’s death benefit (the amount payable to the beneficiary (ies) when a policyholder passes away). Encourage family members to review their life insurance policies regularly, to make sure the money will actually go to the. While it is possible to dispute beneficiaries on a life insurance policy, doing so creates a tremendous amount of cost and takes a lot of time.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title contesting life insurance beneficiary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea