Contingent cargo insurance Idea

Home » Trending » Contingent cargo insurance IdeaYour Contingent cargo insurance images are available in this site. Contingent cargo insurance are a topic that is being searched for and liked by netizens today. You can Download the Contingent cargo insurance files here. Get all free vectors.

If you’re looking for contingent cargo insurance pictures information related to the contingent cargo insurance interest, you have pay a visit to the right site. Our website always gives you suggestions for downloading the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

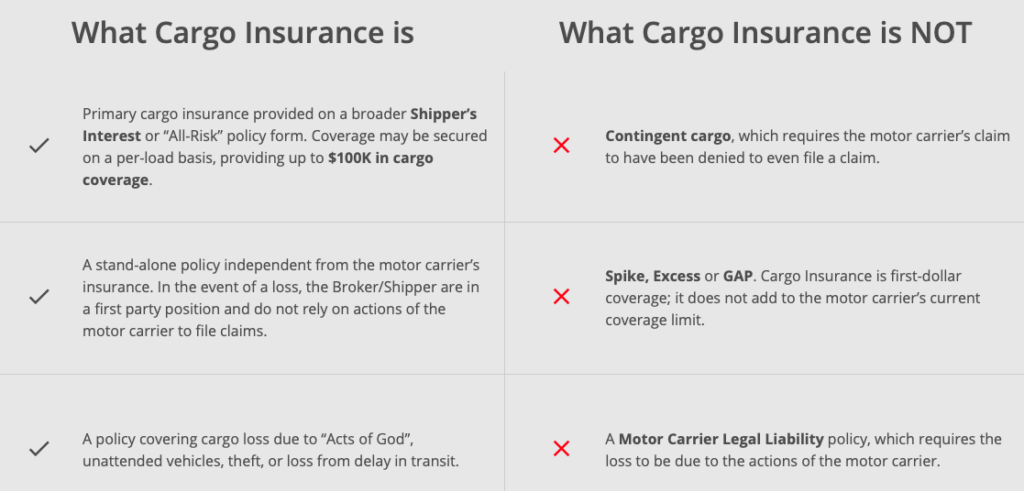

Contingent Cargo Insurance. Yes no if yes, describe type: Contingent cargo insurance for freight brokers is a secondary insurance policy to the carrier’s primary insurance. Learn more about contingent insurance online. If a cargo insurance claim is declined, or one or more parties fails to meet obligations, contingent cargo insurance comes into play.

Top 12 Contingent Cargo Insurance Quotes & Sayings From quotessayings.net

Top 12 Contingent Cargo Insurance Quotes & Sayings From quotessayings.net

The management at bridgestar has vast experience working. Legal precedent has been set holding the logistics service provider liable in these cases. If you are relying solely on the trucker’s certificate of insurance to protect you and your shippers, any one of these circumstances could eliminate insurance coverage for a loss or damage claim. Many companies will not deal with a brokerage, which does not have this insurance. It protects the customer who is. If a carrier�s insurance does not pay out on a claim, the shipper will look to the freight broker for coverage.

Contingent cargo insurance can protect your business from claims and law suits for lost or damaged cargo.

We specialize in offering contingent cargo insurance to freight brokers across the united states and canada. Contingent cargo insurance is insurance for freight brokers that covers a complex claim between shipper and carrier. Contingent cargo broad insurance is a unique type of cargo insurance that is typically held by freight brokers. Contingent cargo is designed to cover the freight broker on a contingent basis for cargo damage or loss. Co is administered by proactive financial services, a privately held company. Contingent cargo coverage is generally carried by a trucking brokerage to protect the customer of the goods being transported.

Source: bbsfinder.com

Source: bbsfinder.com

Contingent cargo insurance is insurance for freight brokers that covers a complex claim between shipper and carrier. Learn more about contingent insurance online. If the shipping company’s insurance covers the cargo, there does not seem to be a need for this additional coverage from the broker. This insurance is usually carried by a trucking brokerage firm. It provides coverage in the event that a general cargo insurance claim doesn’t function as it is designed to.

However, carriers usually won�t work with brokers/forwarders who don�t have this insurance. Contingent cargo coverage for freight brokers and freight forwarders, high limits available. We have the following products available: This means that claims are typically filed first with the motor carrier in an attempt to recover. What distinguishes us from our competitors is the fact that we make conscientious efforts to provide affordable insurance to freight brokers through a.m best a+ rated carriers.

Source: blog.intekfreight-logistics.com

We specialize in offering contingent cargo insurance to freight brokers across the united states and canada. Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. Absent of that, coverage does not trigger. Shipping companies who end up losing money due to cargo that is either lost or broken during transit will want to hold a freight broker liable for the losses. Contingent cargo coverage for freight brokers and freight forwarders, high limits available.

Source: news.falveyshippers.com

Source: news.falveyshippers.com

If you are relying solely on the trucker’s certificate of insurance to protect you and your shippers, any one of these circumstances could eliminate insurance coverage for a loss or damage claim. Contingent cargo insurance is designed to cover property in covered vehicles for when the insured (a licensed freight broker/forwarder) and the subcontracted motor carrier are legally liable in a covered claim. We have the following products available: From a+ insurers to offshore insurance companies, all lay trust in our verification and tracking service. As it is a �contingent� policy, claims must be presented to the motor carrier�s primary insurance provider first.

Source: tcbinspro.com

Source: tcbinspro.com

A brief overview of contingent cargo insurance. Contingent cargo legal liability provides coverage when a trucker�s primary motor truck cargo policy fails to assume the responsibility for cargo loss or damage. These policies respond to the legal liability that transportation brokers and freight forwarders assume under law. If a cargo insurance claim is declined, or one or more parties fails to meet obligations, contingent cargo insurance comes into play. Bridgestar insurance is a privately held company formed in 2017.

Source: tcbinspro.com

Source: tcbinspro.com

This means that claims are typically filed first with the motor carrier in an attempt to recover. A brief overview of contingent cargo insurance. There are many types of contingent cargo forms with various. If the shipping company’s insurance covers the cargo, there does not seem to be a need for this additional coverage from the broker. You don’t have to have contingent cargo insurance as a broker or shipper, but you should.

Source: interlogusa.com

Source: interlogusa.com

We have the following products available: Like the name suggests, it’s contingent upon the carrier’s insurance being in place. Contingent cargo broad insurance is a unique type of cargo insurance that is typically held by freight brokers. “contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage. The management at bridgestar has vast experience working.

Source: quotessayings.net

Source: quotessayings.net

Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. If the shipping company’s insurance covers the cargo, there does not seem to be a need for this additional coverage from the broker. Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. It provides coverage in the event that a general cargo insurance claim doesn’t function as it is designed to. So the insured will be left to fund $50,000.

Source: happyrockgirl.blogspot.com

Source: happyrockgirl.blogspot.com

Contingent cargo insurance there is no law that requires a freight broker/forwarder to carry contingent cargo insurance. All contingent cargo policies require the insured to require the carrier to provide a coi for the value of the load. It is commonplace to see these claims denied based on exclusions that may be present in the motor carrier’s policy. It protects the customer who is. Many companies will not deal with a brokerage, which does not have this insurance.

Source: truckstop.com

Source: truckstop.com

Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. Bridgestar insurance is a privately held company formed in 2017. If the cargo insurance of the carrier to which cargo is entrusted is canceled, not paid, denied or if the limits are inadequate, contingent cargo insurance will kick in. Yes no if yes, describe type: Contingent cargo insurance for freight brokers is a secondary insurance policy to the carrier’s primary insurance.

Source: quotessayings.net

Source: quotessayings.net

What a contingent cargo insurance plan or a contingent motor cargo insurance plan does is cover all of the unexpected costs and expenses that may occur when accidents arise that are not covered by primary auto insurance. Contingent cargo insurance there is no law that requires a freight broker/forwarder to carry contingent cargo insurance. If you are a trucking brokerage, you most likely need contingent cargo insurance. If the cargo insurance of the carrier to which cargo is entrusted is canceled, not paid, denied or if the limits are inadequate, contingent cargo insurance will kick in. You don’t have to have contingent cargo insurance as a broker or shipper, but you should.

Source: happyrockgirl.blogspot.com

Source: happyrockgirl.blogspot.com

Contingent cargo insurance cost is as affordable as other specialized insurance policies, like engineer insurance or web developer insurance, tailored to one profession. “contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage. What a contingent cargo insurance plan or a contingent motor cargo insurance plan does is cover all of the unexpected costs and expenses that may occur when accidents arise that are not covered by primary auto insurance. It provides coverage in the event that a general cargo insurance claim doesn’t function as it is designed to. As it is a �contingent� policy, claims must be presented to the motor carrier�s primary insurance provider first.

Source: happyrockgirl.blogspot.com

Source: happyrockgirl.blogspot.com

A brief overview of contingent cargo insurance. Co is administered by proactive financial services, a privately held company. Contingent cargo insurance is designed to cover property in covered vehicles for when the insured (a licensed freight broker/forwarder) and the subcontracted motor carrier are legally liable in a covered claim. Contingent cargo insurance is insurance for freight brokers that covers a complex claim between shipper and carrier. From a+ insurers to offshore insurance companies, all lay trust in our verification and tracking service.

Source: jencapholdings.com

Source: jencapholdings.com

Contingent cargo insurance is held by the broker as opposed to the carrier. This means that claims are typically filed first with the motor carrier in an attempt to recover. You don’t have to have contingent cargo insurance as a broker or shipper, but you should. “contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage. Contingent cargo is designed to cover the freight broker on a contingent basis for cargo damage or loss.

Source: youtube.com

Source: youtube.com

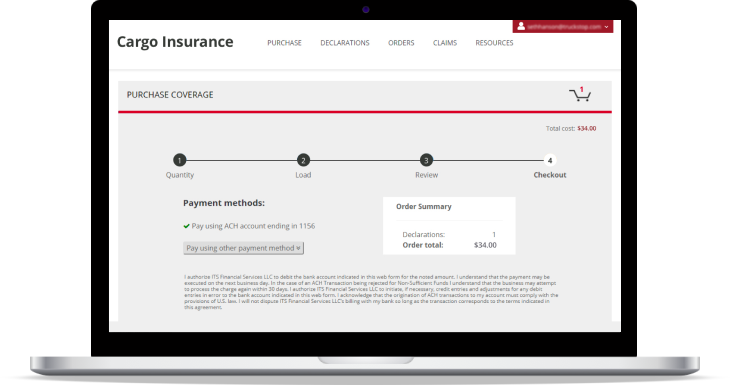

Motor truck cargo cargo insurance contingent cargo motor truck cargo legal liability 49 states. If you are relying solely on the trucker’s certificate of insurance to protect you and your shippers, any one of these circumstances could eliminate insurance coverage for a loss or damage claim. If you are a trucking brokerage, you most likely need contingent cargo insurance. Contingent cargo.co is an easy to use and affordable online tool for freight brokers. “contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage.

Source: upwix.com

Source: upwix.com

Learn more about contingent insurance online. Many companies will not deal with a brokerage, which does not have this insurance. Contingent cargo insurance for freight brokers is a secondary insurance policy to the carrier’s primary insurance. It protects the customer who is. Contingent cargo coverage is generally carried by a trucking brokerage to protect the customer of the goods being transported.

Source: quotessayings.net

Source: quotessayings.net

Contingent cargo insurance for freight brokers cost $1,500 a year on average. Contingent cargo insurance is a secondary insurance that covers some or all of the cost of handling, storing, getting rid of or replacing cargo that’s refused, damaged or lost. Contingent cargo insurance is designed to cover property in covered vehicles for when the insured (a licensed freight broker/forwarder) and the subcontracted motor carrier are legally liable in a covered claim. Legal precedent has been set holding the logistics service provider liable in these cases. Contingent cargo coverage for freight brokers and freight forwarders, high limits available.

Source: truckstop.com

Source: truckstop.com

We have the following products available: From a+ insurers to offshore insurance companies, all lay trust in our verification and tracking service. It protects the customer who is. It is not a primary cargo policy, and your customers should understand that. So the insured will be left to fund $50,000.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title contingent cargo insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea