Contingent cargo insurance for freight brokers Idea

Home » Trending » Contingent cargo insurance for freight brokers IdeaYour Contingent cargo insurance for freight brokers images are ready in this website. Contingent cargo insurance for freight brokers are a topic that is being searched for and liked by netizens today. You can Find and Download the Contingent cargo insurance for freight brokers files here. Find and Download all free images.

If you’re looking for contingent cargo insurance for freight brokers images information linked to the contingent cargo insurance for freight brokers topic, you have pay a visit to the ideal blog. Our site always provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Contingent Cargo Insurance For Freight Brokers. Why does a brokerage need it since the carrier has to have insurance? Most aggressive prices in the industry. Freight brokers often ask me whether they can buy auto liability coverage, to bridge the gap between the shipper’s requirement and the carrier’s limits. Motor truck cargo insurance is a requirement for any freight broker and there are several different options available in the marketplace.

What Is Contingent Cargo Insurance? From news.falveyshippers.com

What Is Contingent Cargo Insurance? From news.falveyshippers.com

Shipping companies who end up losing money due to cargo that is either lost or broken during transit will want to hold a freight broker liable for the losses. We specialize in offering contingent cargo insurance to freight brokers across the united states and canada. If a cargo insurance claim is declined, or one or more parties fails to meet obligations, contingent cargo insurance comes into play. Our laser focus and specialty underwriting expertise help you, our retail partners, build your business year over year. The broad cargo insurance will then provide this protection. “contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage exclusions, etc.).

If a cargo insurance claim is declined, or one or more parties fails to meet obligations, contingent cargo insurance comes into play.

Shipping companies who end up losing money due to cargo that is either lost or broken during transit will want to hold a freight broker liable for the losses. We specialize in offering contingent cargo insurance to freight brokers across the united states and canada. Don’t waste your time or money on these: We have multiple contingent cargo carriers available. Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. Contingent cargo insurance is insurance for freight brokers that covers a complex claim between shipper and carrier.

Source: paperless-insurance.com

Source: paperless-insurance.com

Brokers can mitigate potential losses by purchasing insurance that covers freight damage, property damage and injuries caused by contracted motor carriers. First of all, there is no law that requires a freight brokerage to carry contingent cargo. Amwins transportation underwriters� freight brokers’ liability & contingent cargo product helps to service this segment of the industry. The broad cargo insurance will then provide this protection. Don’t waste your time or money on these:

Whenever a freight broker signs a contract with a customer client it should be reviewed to determine if it is expanding the freight broker’s liability assumed under their d.o.t. This type of policy is designed to protect a transportation broker or freight forwarder against the liability assumed when making arrangements to move cargo for others. Loss payee endorsement available on select contingent cargo program. Truck and freight brokerage operations need coverage for the exposures presented when their clients’ policies fail to respond. This coverage will step in in the event that, after all necessary due diligence, the coverage of motor carrier fails to respond due to cancellation or misrepresentation.

First of all, there is no law that requires a freight brokerage to carry contingent cargo. We have the following products available: Like the name suggests, it’s contingent upon the carrier’s insurance being in place. Why does a brokerage need it since the carrier has to have insurance? We specialize in offering contingent cargo insurance to freight brokers across the united states and canada.

Source: news.falveyshippers.com

Source: news.falveyshippers.com

Many freight brokers also opt to purchase vicarious liability and contingent cargo insurance, both of which can provide additional coverages to help fill in the gaps of coverage that your other policies may have. This insurance is designed to cover on legal fees and/or judgments against a freight forwarder. What does contingent cargo insurance cover? Freight brokers feel proud to be associated with us. These policies respond to the legal liability that.

Source: upwix.com

Source: upwix.com

Contingent cargo & liability insurance. Also, additional options provide $100,000 up to $1 million coverage for professional liability insurance, general liability insurance, and freight broker’s auto insurance. Lastly, purchasing a commercial umbrella is a great way to increase your coverage limits and is often very affordable. This contingent cargo coverage is required when a freight broker agrees to assume responsibility for cargo loss or damage that a motor carrier fails to pay. This type of policy is designed to protect a transportation broker or freight forwarder against the liability assumed when making arrangements to move cargo for others.

Source: ctrp.org

Source: ctrp.org

Like the name suggests, it’s contingent upon the carrier’s insurance being in place. Truck and freight brokerage operations need coverage for the exposures presented when their clients’ policies fail to respond. Motor truck cargo insurance is a requirement for any freight broker and there are several different options available in the marketplace. Contingent cargo broad insurance is a unique type of cargo insurance that is typically held by freight brokers. Contingent cargo insurance is insurance for freight brokers that covers a complex claim between shipper and carrier.

Source: happyrockgirl.blogspot.com

Source: happyrockgirl.blogspot.com

For example, the shipper wants $2 million in auto liability. Contingent cargo insurance is designed to cover property in covered vehicles for when the insured (a licensed freight broker/forwarder) and the subcontracted motor carrier are legally liable in a covered claim. Freight brokers often ask me whether they can buy auto liability coverage, to bridge the gap between the shipper’s requirement and the carrier’s limits. Whenever a freight broker signs a contract with a customer client it should be reviewed to determine if it is expanding the freight broker’s liability assumed under their d.o.t. Contingent cargo insurance for freight brokers is a secondary insurance policy to the carrier’s primary insurance.

Motor truck cargo insurance is a requirement for any freight broker and there are several different options available in the marketplace. Contingent cargo insurance is designed to cover property in covered vehicles for when the insured (a licensed freight broker/forwarder) and the subcontracted motor carrier are legally liable in a covered claim. Motor truck cargo insurance is a requirement for any freight broker and there are several different options available in the marketplace. Contingent cargo insurance for freight brokers. Contingent cargo limits to $1,000,000.

Source: happyrockgirl.blogspot.com

Source: happyrockgirl.blogspot.com

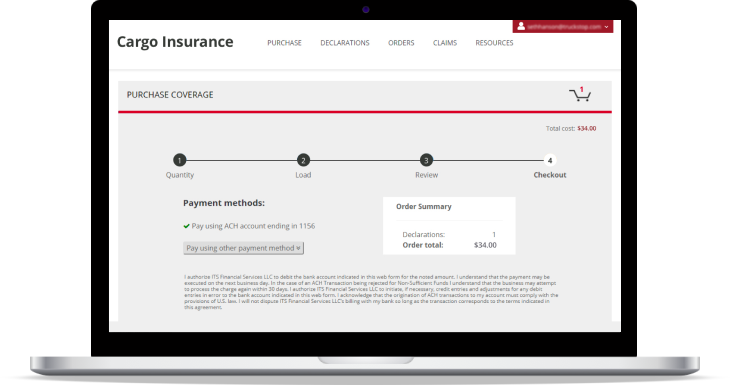

Contingent cargo insurance for freight brokers is a secondary insurance policy to the carrier’s primary insurance. Contingent cargo.co is an easy to use and affordable online tool for freight brokers. We have the following products available: The base coverage is $5 million. “contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage exclusions, etc.).

Source: logistiq.com

Source: logistiq.com

This coverage will step in in the event that, after all necessary due diligence, the coverage of motor carrier fails to respond due to cancellation or misrepresentation. Why does a brokerage need it since the carrier has to have insurance? For example, the shipper wants $2 million in auto liability. This insurance is designed to cover on legal fees and/or judgments against a freight forwarder. Shipping companies who end up losing money due to cargo that is either lost or broken during transit will want to hold a freight broker liable for the losses.

Source: youtube.com

Source: youtube.com

Contingent cargo & liability insurance. Shipping companies who end up losing money due to cargo that is either lost or broken during transit will want to hold a freight broker liable for the losses. The management at bridgestar has vast experience working. As it is a �contingent� policy, claims must be presented to the motor carrier�s primary insurance provider. For example, the shipper wants $2 million in auto liability.

Source: jencapholdings.com

Source: jencapholdings.com

Like the name suggests, it’s contingent upon the carrier’s insurance being in place. Brokers can also mitigate risk by requiring motor carriers to have the right insurance and by checking to make certain that the motor carrier actually buys the right insurance. When would a brokerage need contingent cargo insurance? This type of policy is designed to protect a transportation broker or freight forwarder against the liability assumed when making arrangements to move cargo for others. “contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage exclusions, etc.).

Source: truckstop.com

Source: truckstop.com

Contingent cargo limits to $1,000,000. Also, additional options provide $100,000 up to $1 million coverage for professional liability insurance, general liability insurance, and freight broker’s auto insurance. Amwins transportation underwriters� freight brokers’ liability & contingent cargo product helps to service this segment of the industry. The broad cargo insurance will then provide this protection. Contingent cargo insurance is designed to cover property in covered vehicles for when the insured (a licensed freight broker/forwarder) and the subcontracted motor carrier are legally liable in a covered claim.

Source: happyrockgirl.blogspot.com

Source: happyrockgirl.blogspot.com

Also, additional options provide $100,000 up to $1 million coverage for professional liability insurance, general liability insurance, and freight broker’s auto insurance. Brokers can mitigate potential losses by purchasing insurance that covers freight damage, property damage and injuries caused by contracted motor carriers. Why does a brokerage need it since the carrier has to have insurance? Our laser focus and specialty underwriting expertise help you, our retail partners, build your business year over year. First of all, there is no law that requires a freight brokerage to carry contingent cargo.

Source: fmstms.com

Source: fmstms.com

The management at bridgestar has vast experience working. Like the name suggests, it’s contingent upon the carrier’s insurance being in place. Amwins transportation underwriters� freight brokers’ liability & contingent cargo product helps to service this segment of the industry. As it is a �contingent� policy, claims must be presented to the motor carrier�s primary insurance provider. Bridgestar insurance is a privately held company formed in 2017.

Source: tcbinspro.com

Source: tcbinspro.com

Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. This coverage will step in in the event that, after all necessary due diligence, the coverage of motor carrier fails to respond due to cancellation or misrepresentation. Lastly, purchasing a commercial umbrella is a great way to increase your coverage limits and is often very affordable. It is not a primary cargo policy, and your customers should understand that. “contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage exclusions, etc.).

Source: freightbrokertv.com

Source: freightbrokertv.com

If a cargo insurance claim is declined, or one or more parties fails to meet obligations, contingent cargo insurance comes into play. This type of policy is designed to protect a transportation broker or freight forwarder against the liability assumed when making arrangements to move cargo for others. Whenever a freight broker signs a contract with a customer client it should be reviewed to determine if it is expanding the freight broker’s liability assumed under their d.o.t. Don’t waste your time or money on these: Contingent cargo insurance is insurance for freight brokers that covers a complex claim between shipper and carrier.

Source: happyrockgirl.blogspot.com

Source: happyrockgirl.blogspot.com

What does contingent cargo insurance cover? Contingent cargo insurance for freight brokers is a secondary insurance policy to the carrier’s primary insurance. Brokers can also mitigate risk by requiring motor carriers to have the right insurance and by checking to make certain that the motor carrier actually buys the right insurance. Professional customer service including 24/7 email support. Contingent cargo limits to $1,000,000.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title contingent cargo insurance for freight brokers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea