Contingent cargo insurance meaning Idea

Home » Trending » Contingent cargo insurance meaning IdeaYour Contingent cargo insurance meaning images are available. Contingent cargo insurance meaning are a topic that is being searched for and liked by netizens now. You can Find and Download the Contingent cargo insurance meaning files here. Find and Download all free photos.

If you’re searching for contingent cargo insurance meaning pictures information related to the contingent cargo insurance meaning topic, you have come to the ideal blog. Our website always provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

Contingent Cargo Insurance Meaning. It states what is covered, sets out the claims procedure, exclusions and other terms and conditions of cover; Contingent cargo is designed to cover the freight broker on a contingent basis for cargo damage or loss. However, it is important to understand the coverage trigger. Contingency insurance insurance coverage taken out by a party to an international transaction to insure against insurance coverage taken by the counterparty.

Transportation Management Archives Freight Management From fmstms.com

Transportation Management Archives Freight Management From fmstms.com

Contingent insurance — the term contingent insurance refers to a policy that is contingent on the absence of other insurance. This policy is made up of: Contingent cargo insurance is insurance for freight brokers that covers a complex claim between shipper and carrier. Only the insured may use the contingency insurance for claims involving losses insured therein. What a contingent cargo insurance plan or a contingent motor cargo insurance plan does is cover all of the unexpected costs and expenses that may occur when accidents arise that are not covered by primary auto insurance. Contingent cargo is designed to cover the freight broker on a contingent basis for cargo damage or loss.

Insurance can help you to cover your ends when doing business, but it’s not a magically binding contract or a bulletproof shield against any and all.

Some truckers even need 1 million dollar cargo insurance! In line with the terms of the underlying cargo policy, this contingency insurance covers the insured�s interest alone. Contingent cargo is designed to cover direct physical loss of property in vehicles or damage to property of others for which the insured (truck broker) and their subcontractor (trucker) are legally liable. Contingency cargo insurance is insurance held by freight brokers to cover gaps that may present itself in the underlying motor carrier�s insurance at the time the damage or loss occurred. As a matter of fact, you can’t file a claim with a contingent insurance policy until it has been denied by the standard policy. What a contingent cargo insurance plan or a contingent motor cargo insurance plan does is cover all of the unexpected costs and expenses that may occur when accidents arise that are not covered by primary auto insurance.

Source: yorkplaceonline.com

Source: yorkplaceonline.com

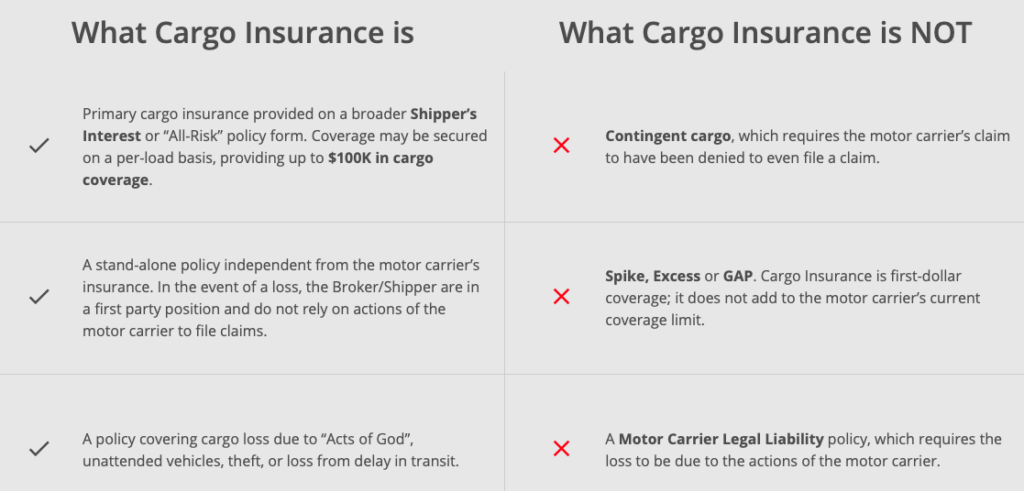

Most of our competitors offer contingent cargo insurance which is coverage that is contingent upon the carriers liability and their terms and conditions. It is commonplace to see these claims denied based on exclusions that may be present in the motor carrier’s policy. From a+ insurers to offshore insurance companies, all lay trust in our verification and tracking service. Contingent cargo insurance is only used when the carrier refuses to honor a claim,. It�s secondary insurance and it will only cover you if your claim is denied by the carrier.

Source: blog.intekfreight-logistics.com

The limits of your cargo policy. Contingent cargo coverage is useful because it fills the gaps in a carrier’s insurance policy. Contingent motor cargo insurance is there to ensure that reasonable risks are covered. As a matter of fact, you can’t file a claim with a contingent insurance policy until it has been denied by the standard policy. Cargo insurance protects you from financial loss due to damaged or lost cargo.

However, beware that the insurance may not take effect until the goods are placed on the ship, plane, train or truck and it may not cover goods after they have left the vehicle and. What a contingent cargo insurance plan or a contingent motor cargo insurance plan does is cover all of the unexpected costs and expenses that may occur when accidents arise that are not covered by primary auto insurance. As a matter of fact, you can’t file a claim with a contingent insurance policy until it has been denied by the standard policy. The “contingent” part implies the insurance only comes into effect if and when the motor carrier used on the load fails to cover the damage or loss sustained on the shipment. It pays you the amount you’re insured for if a covered event happens to your freight.

Source: intekfreight-logistics.com

And these covered events are usually natural disasters, vehicle accidents, cargo abandonment, customs rejection, acts of war, and piracy. If you are not going to do your due diligence, then your contingent cargo insurance is a waste of money. Understanding that the specifics of this coverage can vary greatly means you should really analyze the details before purchasing a policy with contingent cargo and think everything is okay. Contingent cargo insurance is insurance for freight brokers that covers a complex claim between shipper and carrier. Cargo insurance moving insurance transit insurance package.

Source: tricorinsurance.com

Source: tricorinsurance.com

Cargo insurance moving insurance transit insurance package. This insurance is an additional charge that is typically based on the value of the goods being shipped. Contingent insurance — the term contingent insurance refers to a policy that is contingent on the absence of other insurance. The “contingent” part implies the insurance only comes into effect if and when the motor carrier used on the load fails to cover the damage or loss sustained on the shipment. In line with the terms of the underlying cargo policy, this contingency insurance covers the insured�s interest alone.

Source: fmstms.com

Source: fmstms.com

Contingent insurance — the term contingent insurance refers to a policy that is contingent on the absence of other insurance. Contingency cargo insurance is insurance held by freight brokers to cover gaps that may present itself in the underlying motor carrier�s insurance at the time the damage or loss occurred. Cargo insurance protects you from financial loss due to damaged or lost cargo. Insurance can help you to cover your ends when doing business, but it’s not a magically binding contract or a bulletproof shield against any and all. Contingent motor cargo insurance is there to ensure that reasonable risks are covered.

Contingency cargo insurance is insurance held by freight brokers to cover gaps that may present itself in the underlying motor carrier�s insurance at the time the damage or loss occurred. Some truckers even need 1 million dollar cargo insurance! Contingent cargo is designed to cover direct physical loss of property in vehicles or damage to property of others for which the insured (truck broker) and their subcontractor (trucker) are legally liable. And these covered events are usually natural disasters, vehicle accidents, cargo abandonment, customs rejection, acts of war, and piracy. You don’t have to have contingent cargo insurance as a broker or shipper, but you should.

Source: mrcarshipping.com

Source: mrcarshipping.com

You don’t have to have contingent cargo insurance as a broker or shipper, but you should. You don’t have to have contingent cargo insurance as a broker or shipper, but you should. This cover will typically provide insurance on a third party basis only to protect the company from claims brought by injured members of the public or their property. This means that claims are typically filed first with the motor carrier in an attempt to recover. If you are not going to do your due diligence, then your contingent cargo insurance is a waste of money.

Source: fueloyal.com

Source: fueloyal.com

This means that the insurance covers goods from when they leave the shipper to when they arrive at the buyer�s warehouse. However, it is important to understand the coverage trigger. It does not extend to the employees own vehicle or its contents however. However, beware that the insurance may not take effect until the goods are placed on the ship, plane, train or truck and it may not cover goods after they have left the vehicle and. “contingent” means it is not primary coverage and will only kick in if the carrier’s general cargo policy doesn’t pay out (because of policy cancellation, insufficient limits, loss or damage.

Source: insights.sap.com

Source: insights.sap.com

The limits of your cargo policy. From a+ insurers to offshore insurance companies, all lay trust in our verification and tracking service. It states what is covered, sets out the claims procedure, exclusions and other terms and conditions of cover; There are many types of contingent cargo forms with various. A brief overview of contingent cargo insurance.

Source: voippacket.com

Source: voippacket.com

Contingent cargo coverage is useful because it fills the gaps in a carrier’s insurance policy. Understanding that the specifics of this coverage can vary greatly means you should really analyze the details before purchasing a policy with contingent cargo and think everything is okay. Some truckers even need 1 million dollar cargo insurance! Most of our competitors offer contingent cargo insurance which is coverage that is contingent upon the carriers liability and their terms and conditions. Insurance can help you to cover your ends when doing business, but it’s not a magically binding contract or a bulletproof shield against any and all.

This cover will typically provide insurance on a third party basis only to protect the company from claims brought by injured members of the public or their property. The most common limits are $100k cargo insurance. It is commonplace to see these claims denied based on exclusions that may be present in the motor carrier’s policy. The type of commodity being transported. Contingent cargo is designed to cover direct physical loss of property in vehicles or damage to property of others for which the insured (truck broker) and their subcontractor (trucker) are legally liable.

Source: flinkfreight.com

Source: flinkfreight.com

A shipment of natural gas costs more to insure than, say, a shipment of hard plastics. Contingent cargo is designed to cover the freight broker on a contingent basis for cargo damage or loss. However, it is important to understand the coverage trigger. Contingent cargo insurance is insurance for freight brokers that covers a complex claim between shipper and carrier. This means that the insurance covers goods from when they leave the shipper to when they arrive at the buyer�s warehouse.

Contingency insurance insurance coverage taken out by a party to an international transaction to insure against insurance coverage taken by the counterparty. However, it is important to understand the coverage trigger. There are many types of contingent cargo forms with various. It is commonplace to see these claims denied based on exclusions that may be present in the motor carrier’s policy. Contingent cargo insurance protects the broker from a shipper’s claims of lost or damaged cargo when the.

Source: fmstms.com

Source: fmstms.com

Some truckers even need 1 million dollar cargo insurance! Contingent cargo insurance is only used when the carrier refuses to honor a claim,. Cargo insurance moving insurance transit insurance package. Contingent cargo insurance means that, if none of the other policies that you have in place will cover your cargo losses or damages, then you still have a last line of defense to fall back on. Some truckers even need 1 million dollar cargo insurance!

Source: globallinkanddel.com

Contingent cargo is designed to cover the freight broker on a contingent basis for cargo damage or loss. From a+ insurers to offshore insurance companies, all lay trust in our verification and tracking service. It�s secondary insurance and it will only cover you if your claim is denied by the carrier. The most common limits are $100k cargo insurance. Understanding that the specifics of this coverage can vary greatly means you should really analyze the details before purchasing a policy with contingent cargo and think everything is okay.

Source: news.falveyshippers.com

Source: news.falveyshippers.com

The “contingent” part implies the insurance only comes into effect if and when the motor carrier used on the load fails to cover the damage or loss sustained on the shipment. And these covered events are usually natural disasters, vehicle accidents, cargo abandonment, customs rejection, acts of war, and piracy. However, beware that the insurance may not take effect until the goods are placed on the ship, plane, train or truck and it may not cover goods after they have left the vehicle and. Contingent cargo insurance is only used when the carrier refuses to honor a claim,. Contingent cargo insurance protects the broker from a shipper’s claims of lost or damaged cargo when the carrier’s motor truck cargo policy won’t honor the claim.

Source: truckstop.com

Source: truckstop.com

Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. There are many types of contingent cargo forms with various. It is commonplace to see these claims denied based on exclusions that may be present in the motor carrier’s policy. Cargo insurance protects you from financial loss due to damaged or lost cargo. Understanding that the specifics of this coverage can vary greatly means you should really analyze the details before purchasing a policy with contingent cargo and think everything is okay.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title contingent cargo insurance meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea