Contingent life insurance information

Home » Trending » Contingent life insurance informationYour Contingent life insurance images are ready in this website. Contingent life insurance are a topic that is being searched for and liked by netizens today. You can Get the Contingent life insurance files here. Find and Download all royalty-free photos.

If you’re searching for contingent life insurance pictures information connected with to the contingent life insurance interest, you have visit the ideal blog. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Contingent Life Insurance. Learn more from fidelity (11). What happens if there is no contingent beneficiary? Your primary beneficiary is the first in line, with the contingent beneficiary only coming into play if the primary beneficiary is unavailable. A contingent beneficiary on a life insurance policy receives the death benefit if the primary beneficiary becomes impaired and passes away.

Life Insurance Contingent Beneficiary / Contingent From eho-pirmadienanaujinamai.blogspot.com

Life Insurance Contingent Beneficiary / Contingent From eho-pirmadienanaujinamai.blogspot.com

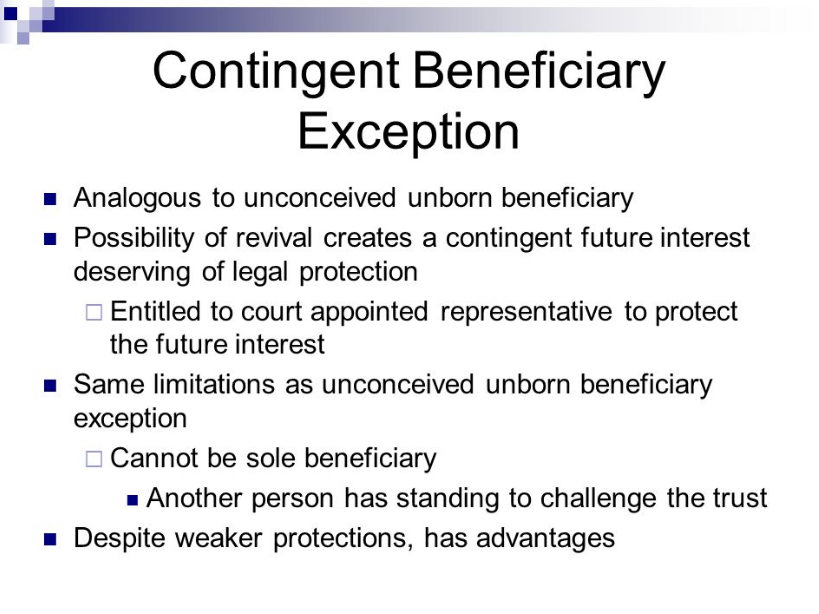

Learn about the differences between primary and contingent beneficiaries, as well as how to make sure your death benefit gets to the right family members. What is a contingent life insurance beneficiary? A contingent beneficiary is basically your ‘secondary’ beneficiary. Life insurance policy death benefits are not subject to probate when there is a valid beneficiary. When you pass away, if all of your primary beneficiaries have also passed away, your contingent beneficiaries will receive the payout. What is a contingent beneficiary?

In life insurance, you can choose a contingent beneficiary or owner for your policy on the condition that the primary beneficiary or owner dies.

A contingent beneficiary, or secondary beneficiary, serves as a backup to the primary beneficiaries named on your life insurance policy. A contingent beneficiary on a life insurance policy is a person or entity that receives the plan’s death benefit if the primary beneficiary or beneficiaries can’t be located, refuse the payout or die before the insured individual does. What is a contingent life insurance beneficiary? The policy owner has the option of naming a primary beneficiary (or beneficiaries) and may also wish to have contingent beneficiaries. A contingent beneficiary is specified by an insurance contract holder or retirement account owner as the person or entity receiving proceeds if the primary beneficiary is. What does contingent mean on life insurance?

Source: eho-pirmadienanaujinamai.blogspot.com

Source: eho-pirmadienanaujinamai.blogspot.com

When purchasing life insurance, you�ll be asked to designate at least one. Tertiary beneficiaries are the back up to the back up. A contingent beneficiary is the person who is next in line to receive the payout from your life insurance policy if your primary beneficiary cannot. Whether you have a life insurance policy, certain retirement accounts or even bank accounts, you’ll want to name primary and contingent beneficiaries as the inheritors when possible. In a life insurance policy or an annuity plan, contingent beneficiary gets proceeds from the policy in the event of a demise of the primary beneficiary at the same time as that of the insured.

Source: bestbusinesscommunity.com

Source: bestbusinesscommunity.com

You can have multiple primary beneficiaries and multiple contingent beneficiaries; Insurance has been proven to be a form of risk management, which is primarily used to hedge against the risk of an uncertain or contingent loss. A contingent beneficiary is specified by an insurance contract holder or retirement account owner as the person or entity receiving proceeds if the primary beneficiary is. Payout to a secondary beneficiary may be governed by specific terms or conditions. Contracts of insurance are contingent contracts because, in a life insurance contract, the insurer pays a certain amount if the insured dies under certain conditions.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

A contingent beneficiary ensures life insurance death benefits can be received if the primary beneficiary cannot receive them. Learn about the differences between primary and contingent beneficiaries, as well as how to make sure your death benefit gets to the right family members. Payout to a secondary beneficiary may be governed by specific terms or conditions. Naming a contingent beneficiary helps ensure that the funds. They will receive the life insurance payout in the event that the primary beneficiary cannot be found, dies before the insured, or simultaneously with the insured.

Source: elsa-ita.blogspot.com

Source: elsa-ita.blogspot.com

What is a contingent beneficiary? The word ‘contingent’ is associated with the word ‘beneficiary’ in the life insurance dynamic. Learn about the differences between primary and contingent beneficiaries, as well as how to make sure your death benefit gets to the right family members. Long story short, your contingent life insurance beneficiary is simply a backup in case your primary beneficiaries are unable to receive the death benefit. If you’re the policy owner and your primary beneficiary dies before you do, you can either name a new primary beneficiary or move your contingent beneficiary up to primary and name a new contingent beneficiary.

Source: eho-pirmadienanaujinamai.blogspot.com

In a life insurance policy or an annuity plan, contingent beneficiary gets proceeds from the policy in the event of a demise of the primary beneficiary at the same time as that of the insured. If you’re the policy owner and your primary beneficiary dies before you do, you can either name a new primary beneficiary or move your contingent beneficiary up to primary and name a new contingent beneficiary. A contingent beneficiary is a person alternatively named to receive the benefits in a will or trust. A contingent beneficiary is specified by an insurance contract holder or retirement account owner as the person or entity receiving proceeds if the primary beneficiary is. A contingent beneficiary on a life insurance policy is a person or entity that receives the plan’s death benefit if the primary beneficiary or beneficiaries can’t be located, refuse the payout or die before the insured individual does.

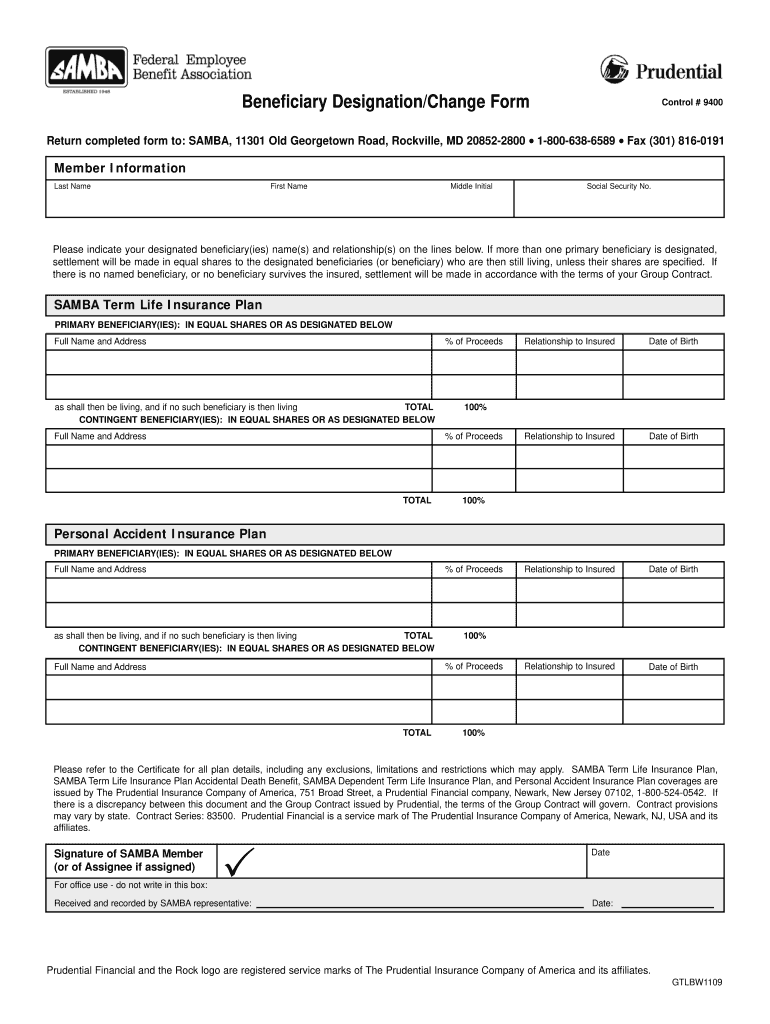

Source: signnow.com

Source: signnow.com

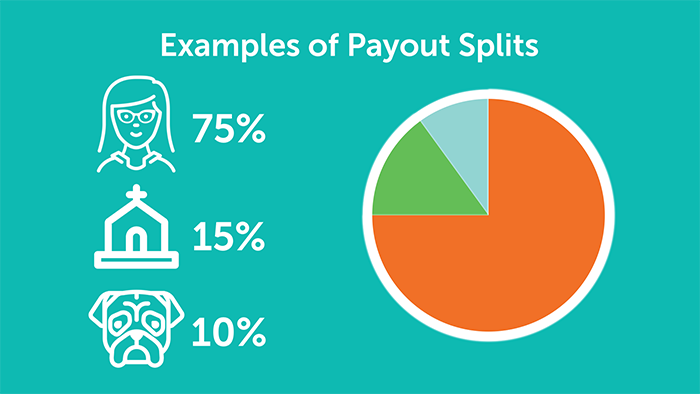

You can have multiple primary beneficiaries and multiple contingent beneficiaries; What is a contingent life insurance beneficiary? The word ‘contingent’ is associated with the word ‘beneficiary’ in the life insurance dynamic. You can have multiple primary beneficiaries and multiple contingent beneficiaries; They will receive the life insurance payout in the event that the primary beneficiary cannot be found, dies before the insured, or simultaneously with the insured.

Source: lifeinsuranceira401kinvestments.com

Source: lifeinsuranceira401kinvestments.com

But what does it mean in life insurance? You simply need to designate what percentage of your life insurance proceeds you want to allocate to each of your primary. Insurance has been proven to be a form of risk management, which is primarily used to hedge against the risk of an uncertain or contingent loss. However, the spouse dies at the same time as that of the insured. Besides the primary life insurance beneficiary, they can also name a contingent or secondary beneficiary.

Source: eho-pirmadienanaujinamai.blogspot.com

Source: eho-pirmadienanaujinamai.blogspot.com

If you’re the policy owner and your primary beneficiary dies before you do, you can either name a new primary beneficiary or move your contingent beneficiary up to primary and name a new contingent beneficiary. The word ‘contingent’ is associated with the word ‘beneficiary’ in the life insurance dynamic. Long story short, your contingent life insurance beneficiary is simply a backup in case your primary beneficiaries are unable to receive the death benefit. They will receive the life insurance payout in the event that the primary beneficiary cannot be found, dies before the insured, or simultaneously with the insured. When purchasing life insurance, you�ll be asked to designate at least one.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

In life insurance, you can choose a contingent beneficiary or owner for your policy on the condition that the primary beneficiary or owner dies. When you pass away, if all of your primary beneficiaries have also passed away, your contingent beneficiaries will receive the payout. Siblings and favorite charities are great contingent life insurance beneficiary options. If you’re the policy owner and your primary beneficiary dies before you do, you can either name a new primary beneficiary or move your contingent beneficiary up to primary and name a new contingent beneficiary. A contingent beneficiary is someone named to insurance policies who receives the death benefit if the primary beneficiary can’t receive the payout for whatever reason.

Source: researchgate.net

Source: researchgate.net

If alive, they’ll receive life insurance proceeds before a contingent beneficiary. You simply need to designate what percentage of your life insurance proceeds you want to allocate to each of your primary. What is a contingent life insurance beneficiary? Contracts of insurance are contingent contracts because, in a life insurance contract, the insurer pays a certain amount if the insured dies under certain conditions. They will receive the life insurance payout in the event that the primary beneficiary cannot be found, dies before the insured, or simultaneously with the insured.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

Naming at least one contingent beneficiary protects your insurance proceeds from paying into your estate and entering a lengthy legal process or being taken by creditors. Naming a contingent beneficiary helps ensure that the funds. Besides the primary life insurance beneficiary, they can also name a contingent or secondary beneficiary. A contingent beneficiary is sometimes known as a “secondary beneficiary.” for example, it’s possible that your primary beneficiary may die before receiving the death benefit. Typically, primary life insurance beneficiaries are your spouse and adult children.

Source: everquote.com

Source: everquote.com

A contingent beneficiary ensures life insurance death benefits can be received if the primary beneficiary cannot receive them. Besides the primary life insurance beneficiary, they can also name a contingent or secondary beneficiary. A contingent beneficiary, or secondary beneficiary, serves as a backup to the primary beneficiaries named on your life insurance policy. Contingent beneficiaries are basically the backup that would receive your life insurance death benefit if all of your primary beneficiaries were deceased. Naming a contingent beneficiary helps ensure that the funds.

Source: youtube.com

Source: youtube.com

The insurer is not called into action until the event of the death of the insured happens. Tertiary beneficiaries are the back up to the back up. A contingent beneficiary is a person alternatively named to receive the benefits in a will or trust. However, the spouse dies at the same time as that of the insured. Typically, primary life insurance beneficiaries are your spouse and adult children.

Source: everquote.com

Source: everquote.com

The latter is what we commonly see at haven life. This is a contingent contract. Contingent beneficiaries are basically the backup that would receive your life insurance death benefit if all of your primary beneficiaries were deceased. A contingent in life insurance is a back up beneficiary or a back up policy owner. You simply need to designate what percentage of your life insurance proceeds you want to allocate to each of your primary.

Source: youtube.com

Source: youtube.com

When purchasing life insurance, you�ll be asked to designate at least one. If you’re the policy owner and your primary beneficiary dies before you do, you can either name a new primary beneficiary or move your contingent beneficiary up to primary and name a new contingent beneficiary. You can have multiple primary beneficiaries and multiple contingent beneficiaries; A contingent beneficiary on a life insurance policy receives the death benefit if the primary beneficiary becomes impaired and passes away. What happens if there is no contingent beneficiary?

Source: businesspromotionstore.com

Source: businesspromotionstore.com

The insurer is not called into action until the event of the death of the insured happens. What happens if there is no contingent beneficiary? A contingent beneficiary is specified by an insurance contract holder or retirement account owner as the person or entity receiving proceeds if the primary beneficiary is. Besides the primary life insurance beneficiary, they can also name a contingent or secondary beneficiary. Contracts of insurance are contingent contracts because, in a life insurance contract, the insurer pays a certain amount if the insured dies under certain conditions.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

A contingent beneficiary is specified by an insurance contract holder or retirement account owner as the person or entity receiving proceeds if the primary beneficiary is. In life insurance, you can choose a contingent beneficiary or owner for your policy on the condition that the primary beneficiary or owner dies. When you pass away, if all of your primary beneficiaries have also passed away, your contingent beneficiaries will receive the payout. Long story short, your contingent life insurance beneficiary is simply a backup in case your primary beneficiaries are unable to receive the death benefit. A contingent beneficiary is the person who is next in line to receive the payout from your life insurance policy if your primary beneficiary cannot.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title contingent life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea