Contingent property insurance coverage Idea

Home » Trend » Contingent property insurance coverage IdeaYour Contingent property insurance coverage images are available. Contingent property insurance coverage are a topic that is being searched for and liked by netizens now. You can Download the Contingent property insurance coverage files here. Find and Download all royalty-free vectors.

If you’re searching for contingent property insurance coverage images information connected with to the contingent property insurance coverage keyword, you have pay a visit to the right site. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Contingent Property Insurance Coverage. When you know you’re covered, you can dedicate your time and expertise to helping your business. Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. Monitoring of ongoing lawsuits involving lessees. For instance, a certain area might be prone to issues such as hurricanes, earthquakes, or mold.

What Differences Exist between Contingent Business From flinjuryfirm.com

What Differences Exist between Contingent Business From flinjuryfirm.com

Contingent business interruption (cbi) insurance provides coverage to an insured when a supplier or a key customer suffers a direct physical loss that interrupts the insured�s own business (e.g., revenue stream).� just as property insurance generally restores damaged real or personal property, placing the you also need special coverages that. The insurance transfers a known or uncertain contingent liability from (usually) a buyer’s balance sheet to an insurance company. Definition of contingent transit insurance. The contingent property may be specifically named, or the coverage may blanket all customers and. Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. Expanded coverage and peace of mind.

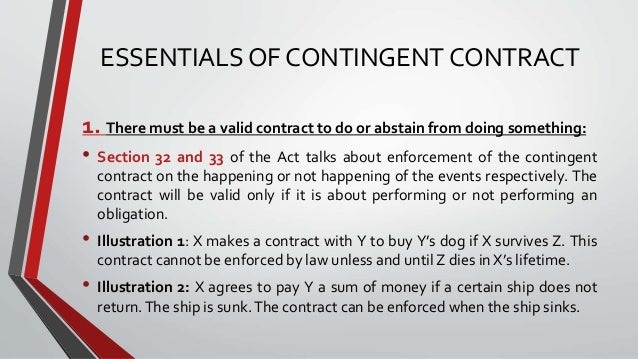

For example, the 1973 commercial general liability (cgl) policy stated that it provided primary insurance, except when stated to apply in excess of or contingent upon the absence of other insurance.when both this insurance and other insurance apply to.

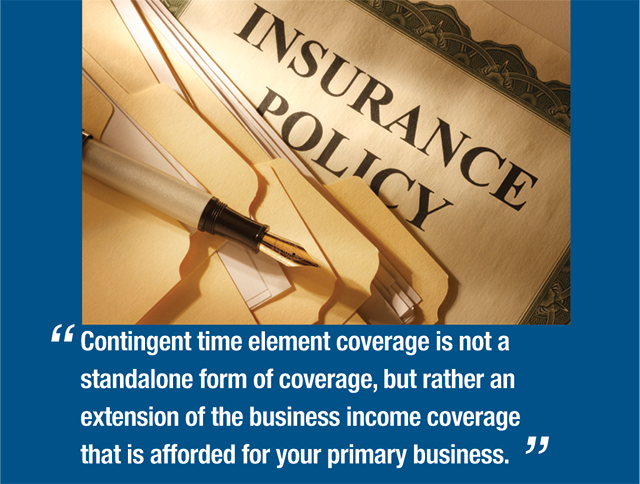

Monitoring of ongoing lawsuits involving lessees. To regular business interruption coverage—which applies only where there is physical damage to the insured’s own property—cte coverage applies where an insured’s customer or supplier sustains physical damage to its property. However, contingent business interruption insurance is often added to business income insurance to further mitigate risk. We’ll work with to you to determine which of our property policies make sense for you. Property insurance coverage law blog. Definition of contingent transit insurance.

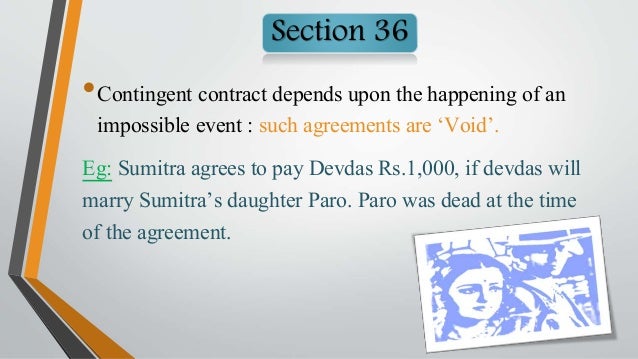

Source: slideshare.net

Source: slideshare.net

The truck owner refuses to compensate the insured for damages; The allocation of liabilities for identified contingent risks is typically heavily negotiated between parties. For example, the 1973 commercial general liability (cgl) policy stated that it provided primary insurance, except when stated to apply in excess of or contingent upon the absence of other insurance.when both this insurance and other insurance apply to. To regular business interruption coverage—which applies only where there is physical damage to the insured’s own property—cte coverage applies where an insured’s customer or supplier sustains physical damage to its property. Cbi insurance expands your coverage to include both your property.

Source: sacsconsulting.com

Source: sacsconsulting.com

Contingent insurance — the term contingent insurance refers to a policy that is contingent on the absence of other insurance. Monitoring of ongoing lawsuits involving lessees. 2005), the court concluded that the contingent time element coverage applied where an explosion damaged both the insured’s property and its customer’s property in the same incident, but the insured’s property was repaired first. When you know you’re covered, you can dedicate your time and expertise to helping your business. To regular business interruption coverage—which applies only where there is physical damage to the insured’s own property—cte coverage applies where an insured’s customer or supplier sustains physical damage to its property.

![Contingent Workforce Models Nov09[1] Contingent Workforce Models Nov09[1]](https://image.slidesharecdn.com/contingentworkforcemodelsnov091-12711771375044-phpapp02/95/contingent-workforce-models-nov091-2-728.jpg?cb=1271159161) Source: slideshare.net

Source: slideshare.net

Coverage for lessors when the lessee’s insurance is not in force, is uncollectable, or is written at lower limits than those required by the lease agreement. The truck owner refuses to compensate the insured for damages; We’ll work with to you to determine which of our property policies make sense for you. Expanded coverage and peace of mind. Contingent liability limits are $100,000 per person, $300,000 per occurrence (bodily injury) and $50,000 per occurrence (property damage)

Source: slideshare.net

Source: slideshare.net

If we want the home inspector to have coverage for property damage that occurs due to his negligence, we need to make sure that his professional liability policy provides contingent bodily injury/property damage coverage. We believe in your peace of mind. Contingent risk insurance typically offers coverage for. These exposures are often the subject of purchase price negotiations, specific indemnities, and/or escrow arrangements. For example, the 1973 commercial general liability (cgl) policy stated that it provided primary insurance, except when stated to apply in excess of or contingent upon the absence of other insurance.when both this insurance and other insurance apply to.

Source: procorllc.com

Source: procorllc.com

While it is clear that ownership or an insurable interest over the leader property (ie. Definition of contingent transit insurance. Leaseholds) do not trigger contingent business income coverage, it must also be understood that control, use and intent of the “leader property” destroys contingent business income coverage. You also need special coverages that are unique to condo life. In that case, the insured.

Source: blogpapi.com

Source: blogpapi.com

Contingent business interruption insurance and contingent extra expense coverage is an extension to other insurance that reimburses lost profits and extra expenses resulting from an interruption of business at the premises of a customer or supplier. We’ll work with to you to determine which of our property policies make sense for you. As a condition precedent to coverage under this endorsement, the first of you named on the declarations agrees and warrants that comprehensive general liability insurance, including products/completed operations and premises/operations, covering bodily injury and property damage in the amount of $_____ The contingent property may be specifically named, or the coverage may blanket all customers and. When you know you’re covered, you can dedicate your time and expertise to helping your business.

Source: irmi.com

Source: irmi.com

Homeowner’s insurance provides protection for things such as property damage, fires, natural disasters, and other issues. 2005), the court concluded that the contingent time element coverage applied where an explosion damaged both the insured’s property and its customer’s property in the same incident, but the insured’s property was repaired first. Homeowner’s insurance provides protection for things such as property damage, fires, natural disasters, and other issues. Helping you protect your business begins with providing a range of coverage options. National union fire insurance co.of louisiana, inc., 918 so.

Source: slideshare.net

Source: slideshare.net

The contingent part of that phrase refers to the bi/pd arising as a result of his professional services. For example, a truck transporting furniture of the insured is involved in an accident and the furniture is damaged. The contingent property may be specifically named, or the coverage may blanket all customers and. When you know you’re covered, you can dedicate your time and expertise to helping your business. Contingent insurance — the term contingent insurance refers to a policy that is contingent on the absence of other insurance.

Source: unlitips.com

Source: unlitips.com

If we want the home inspector to have coverage for property damage that occurs due to his negligence, we need to make sure that his professional liability policy provides contingent bodily injury/property damage coverage. Leaseholds) do not trigger contingent business income coverage, it must also be understood that control, use and intent of the “leader property” destroys contingent business income coverage. Coverage for lessors when the lessee’s insurance is not in force, is uncollectable, or is written at lower limits than those required by the lease agreement. Business income insurance, or business interruption insurance, protects you financially in the case of direct injury or loss to your own property or business. The contingent property may be specifically named, or the coverage may blanket all customers and.

Source: adjustersinternational.com

Source: adjustersinternational.com

National union fire insurance co.of louisiana, inc., 918 so. However, contingent business interruption insurance is often added to business income insurance to further mitigate risk. The insurance transfers a known or uncertain contingent liability from (usually) a buyer’s balance sheet to an insurance company. Contingent business interruption insurance and contingent extra expense coverage is an extension to other insurance that reimburses lost profits and extra expenses resulting from an interruption of business at the premises of a customer or supplier. 2005), the court concluded that the contingent time element coverage applied where an explosion damaged both the insured’s property and its customer’s property in the same incident, but the insured’s property was repaired first.

Source: tcbinspro.com

Source: tcbinspro.com

Helping you protect your business begins with providing a range of coverage options. In such cases, the homeowner might want to take out a property insurance coverage plan that covers these types of problems. Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. Coverage if an insured can not collect on property damage or destruction losses from the hired transporter. The contingent part of that phrase refers to the bi/pd arising as a result of his professional services.

Source: plannprogress.com

Source: plannprogress.com

Contingent cargo covers goods in vehicles that are the legal liability of insureds (usually freight brokers) and their carriers. Coverage for lessors when the lessee’s insurance is not in force, is uncollectable, or is written at lower limits than those required by the lease agreement. The contingent part of that phrase refers to the bi/pd arising as a result of his professional services. A brief overview of contingent cargo insurance. However, contingent business interruption insurance is often added to business income insurance to further mitigate risk.

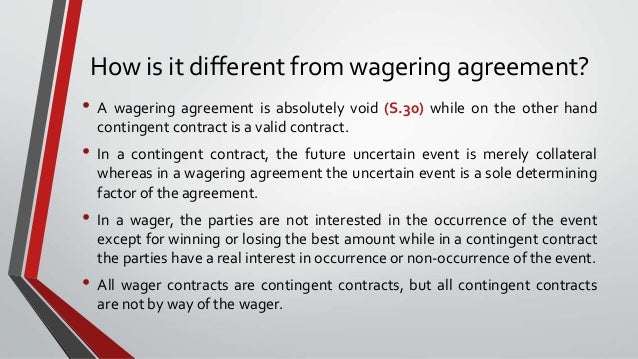

Source: slideshare.net

Source: slideshare.net

We’ll work with to you to determine which of our property policies make sense for you. Monitoring of ongoing lawsuits involving lessees. Contingent liability limits are $100,000 per person, $300,000 per occurrence (bodily injury) and $50,000 per occurrence (property damage) Contingent business interruption insurance and contingent extra expense coverage is an extension to other insurance that reimburses lost profits and extra expenses resulting from an interruption of business at the premises of a customer or supplier. Contingent business interruption insurance and contingent extra expense coverage is an extension to other insurance that reimburses lost profits and extra expenses resulting from an interruption of business at the premises of a customer or supplier.

Source: wellingtonhometeam.com

Source: wellingtonhometeam.com

However, contingent business interruption insurance is often added to business income insurance to further mitigate risk. You also need special coverages that are unique to condo life. Cbi insurance expands your coverage to include both your property. Contingent business interruption (cbi) insurance provides coverage to an insured when a supplier or a key customer suffers a direct physical loss that interrupts the insured�s own business (e.g., revenue stream).� just as property insurance generally restores damaged real or personal property, placing the you also need special coverages that. However, contingent business interruption insurance is often added to business income insurance to further mitigate risk.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

A brief overview of contingent cargo insurance. Contingent liability limits are $100,000 per person, $300,000 per occurrence (bodily injury) and $50,000 per occurrence (property damage) Expanded coverage and peace of mind. The insurance transfers a known or uncertain contingent liability from (usually) a buyer’s balance sheet to an insurance company. You also need special coverages that are unique to condo life.

Source: slideshare.net

Source: slideshare.net

Contingent risk insurance typically offers coverage for. The contingent property may be specifically named, or the coverage may blanket all customers and. While it is clear that ownership or an insurable interest over the leader property (ie. As a condition precedent to coverage under this endorsement, the first of you named on the declarations agrees and warrants that comprehensive general liability insurance, including products/completed operations and premises/operations, covering bodily injury and property damage in the amount of $_____ A brief overview of contingent cargo insurance.

Source: flinjuryfirm.com

Source: flinjuryfirm.com

Zurich american insurance co., 393 f.3d. The contingent part of that phrase refers to the bi/pd arising as a result of his professional services. You also need special coverages that are unique to condo life. 12 rows contingent property and business income. However, contingent business interruption insurance is often added to business income insurance to further mitigate risk.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title contingent property insurance coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information