Contract bond insurance Idea

Home » Trending » Contract bond insurance IdeaYour Contract bond insurance images are available. Contract bond insurance are a topic that is being searched for and liked by netizens now. You can Get the Contract bond insurance files here. Download all royalty-free photos.

If you’re looking for contract bond insurance pictures information related to the contract bond insurance topic, you have come to the ideal site. Our website frequently gives you hints for viewing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

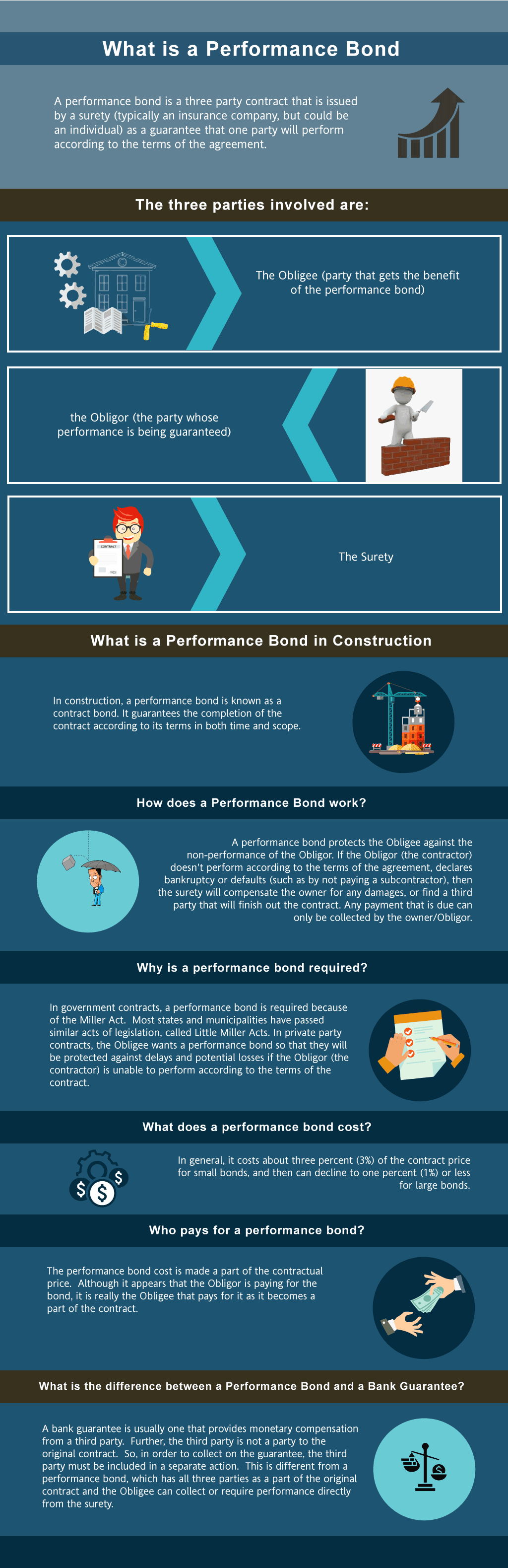

Contract Bond Insurance. Also known as “financial guaranty insurance,” bond insurance guarantees the repayment of the principal and all associated interest payments to bondholders in the event that a payment is defaulted by the issuer. A contract performance bond is the most common type of surety. Bonds are often required for a con tractor to obtain licensing or to meet the obligations of a contract. Contract bonds are the ideal solution.

What Is A Contract Surety Bond? Learn Contract Surety 101 From slideshare.net

What Is A Contract Surety Bond? Learn Contract Surety 101 From slideshare.net

The bond is usually a down payment, performance or warranty bond, but serv insures all types of contract bonds. Ultimately, we want to assure the project owner that the contractor has the resources and capacity to perform the contract according to its terms and conditions. For some industries, carrying a minimum amount of bond. Bonding is a kind of contract which normally comes in the form of either a bank guarantee or insurance guarantee. Contract bonds are the ideal solution. Bid bonds are usually the first step in a bonded contract process.

Also known as “financial guaranty insurance,” bond insurance guarantees the repayment of the principal and all associated interest payments to bondholders in the event that a payment is defaulted by the issuer.

Nowadays, contractors’ insurance companies also offer a variety of contractor bonds insurance.this type of insurance is generally known as surety bonds insurance. Many contractors find this process to be difficult and confusing. The insurance carrier issuing any surety bond, such as a contract bond, will also be referred to as the “surety company” or “bond company”. A performance bond is a surety instrument that guarantees the performance of construction works outlined in a contract that has been awarded to a contractor. A contract bond is a guarantee the terms of a contract are fulfilled. You may be the main contractor on a project and are let down by a subcontractor.

Source: slideshare.net

Source: slideshare.net

Our team has extensive surety company underwriting experience which allows us to provide better service and industry knowledge for your clients. Bonds are often required for a con tractor to obtain licensing or to meet the obligations of a contract. Contract bonds are the ideal solution. This kind of contract agreement or bond mainly contains the minimum work period and under decided circumstances which will include salary, job profile, designation etc. Bonding is a kind of contract which normally comes in the form of either a bank guarantee or insurance guarantee.

Source: biggsinsurance.com

Source: biggsinsurance.com

Contract bonds are the ideal solution. The guarantee is given by a surety to accept responsibility for the performance of a contractual obligation entered into by one party with another in the event of former’s default. Why your company needs contract bonds. Labour & material payment bond: A down payment guarantee is indirectly included.

Source: economybonds.com

Source: economybonds.com

Southern california insurance brokerage takes the pain out of the process by walking you through each step of the process, helping you present the best possible picture of your business so you can qualify for the highest level of bonding capacity with the least amount of stress. Bid bonds are usually the first step in a bonded contract process. They transfer the cost of damages to a licensed surety company when a contractor fails to perform the duties of the contract (performance bonds), or when a contractor fails to pay laborers and material suppliers (payment bond).the most common form of contract bonds. This kind of contract agreement or bond mainly contains the minimum work period and under decided circumstances which will include salary, job profile, designation etc. Contract bond insurance protects swiss exporters from losses caused by a customer calling a contract bond (usually a bank guarantee) that was furnished to secure the exporter’s contractual obligations to the customer.

Source: topcontractorsins.com

Source: topcontractorsins.com

Insurance companies offering the contract bond, known as the surety company, underwrite based on a contractor’s ability to complete the awarded project. Bonds are often required for a con tractor to obtain licensing or to meet the obligations of a contract. Some projects, particularly for government contracts, require you to secure a bid bond in order to even submit a bid. Contract bond insurance protects swiss exporters from losses caused by a customer calling a contract bond (usually a bank guarantee) that was furnished to secure the exporter’s contractual obligations to the customer. Insurance policies protect contractors, their clients, and often finance companies and other project team members from financial loss due to the activities of a contractor.

Source: bondexchange.com

Source: bondexchange.com

Bid bonds are usually the first step in a bonded contract process. A down payment guarantee is indirectly included. Some projects, particularly for government contracts, require you to secure a bid bond in order to even submit a bid. The insurance carrier issuing any surety bond, such as a contract bond, will also be referred to as the “surety company” or “bond company”. Employment bond is an agreement or a contract paper consisting all the terms and conditions of employment agreed by both an employee and the employer.

Source: contractorsinsurance.org

Source: contractorsinsurance.org

“bonding” is the vetting process for contractors seeking a contract surety bond. Bonding is a kind of contract which normally comes in the form of either a bank guarantee or insurance guarantee. As a contractor, providing security can tie up your assets or interfere with your credit lines. A performance bond is a surety instrument that guarantees the performance of construction works outlined in a contract that has been awarded to a contractor. A contract bond is a guarantee that must be issued by a bank on behalf of an exporter to the foreign debtor (bid, advance payment, delivery, service, performance or warranty bonds).

Source: pinterest.com

Source: pinterest.com

Insurance policies protect contractors, their clients, and often finance companies and other project team members from financial loss due to the activities of a contractor. The insurance carrier issuing any surety bond, such as a contract bond, will also be referred to as the “surety company” or “bond company”. Serv contract bond insurance covers these guarantees from the risk of being unfairly called. Bond insurance is a risk mitigation tool commonly used in general contracting and similar fields. For some industries, carrying a minimum amount of bond.

Source: suretybonds.ie

Source: suretybonds.ie

A contract performance bond is the most common type of surety. A labour and material payment bond (or l&m. Insurance companies offering the contract bond, known as the surety company, underwrite based on a contractor’s ability to complete the awarded project. I find that there is often confusion on how bonds differ from insurance policies. The insurance carrier issuing any surety bond, such as a contract bond, will also be referred to as the “surety company” or “bond company”.

Source: sgfinancialinc.com

Source: sgfinancialinc.com

For some industries, carrying a minimum amount of bond. These bonds are conventionally in the amount of fifty percent (50%), but can be up to 100% of the contract price. You may be the main contractor on a project and are let down by a subcontractor. Serv contract bond insurance covers these guarantees from the risk of being unfairly called. While bonds are technically a form of insurance, there are significant differences between bonds and insurance policies and bonds should not be purchased in place of liability.

Source: lawenforcementpartnershipagainstgunviolence.info

Source: lawenforcementpartnershipagainstgunviolence.info

Each bidder for a contract must guarantee the price bid by posting a certified check or indemnity bond, which is forfeited if the contractor fails to enter into the contract awarded. A down payment guarantee is indirectly included. Also known as “financial guaranty insurance,” bond insurance guarantees the repayment of the principal and all associated interest payments to bondholders in the event that a payment is defaulted by the issuer. The bond is usually a down payment, performance or warranty bond, but serv insures all types of contract bonds. They transfer the cost of damages to a licensed surety company when a contractor fails to perform the duties of the contract (performance bonds), or when a contractor fails to pay laborers and material suppliers (payment bond).the most common form of contract bonds.

Source: patuxentinsurance.com

Source: patuxentinsurance.com

I find that there is often confusion on how bonds differ from insurance policies. Our team has extensive surety company underwriting experience which allows us to provide better service and industry knowledge for your clients. Bonds are often required for a con tractor to obtain licensing or to meet the obligations of a contract. Contract bond insurance protects swiss exporters from losses caused by a customer calling a contract bond (usually a bank guarantee) that was furnished to secure the exporter’s contractual obligations to the customer. Insurance policies protect contractors, their clients, and often finance companies and other project team members from financial loss due to the activities of a contractor.

Source: westernpacig.com

Source: westernpacig.com

Usually the amount forfeited is the difference between his bid and the next lowest bid. If a business fails to meet the obligations of a bond in any way, the surety will step in to cover the difference or fulfill the terms of the contract. Our team has extensive surety company underwriting experience which allows us to provide better service and industry knowledge for your clients. Employment bond is an agreement or a contract paper consisting all the terms and conditions of employment agreed by both an employee and the employer. Contract bond insurance protects swiss exporters from losses caused by a customer calling a contract bond (usually a bank guarantee) that was furnished to secure the exporter’s contractual obligations to the customer.

Source: ognikowy-hotel-panfu.blogspot.com

Source: ognikowy-hotel-panfu.blogspot.com

Ultimately, we want to assure the project owner that the contractor has the resources and capacity to perform the contract according to its terms and conditions. Some projects, particularly for government contracts, require you to secure a bid bond in order to even submit a bid. Bonding is a kind of contract which normally comes in the form of either a bank guarantee or insurance guarantee. “bonding” is the vetting process for contractors seeking a contract surety bond. Insurance policies protect contractors, their clients, and often finance companies and other project team members from financial loss due to the activities of a contractor.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Ultimately, we want to assure the project owner that the contractor has the resources and capacity to perform the contract according to its terms and conditions. As a contractor, providing security can tie up your assets or interfere with your credit lines. The bond ensures that if you get the contract, you’ll take it on and get other surety bonds as needed. Upon a review of various criteria, including prior completed works and financial capacity, the surety company will determine if the contractor is qualified to secure a contract bond, thus. Employment bond is an agreement or a contract paper consisting all the terms and conditions of employment agreed by both an employee and the employer.

Source: ccisbonds.com

Source: ccisbonds.com

Southern california insurance brokerage takes the pain out of the process by walking you through each step of the process, helping you present the best possible picture of your business so you can qualify for the highest level of bonding capacity with the least amount of stress. These bonds are conventionally in the amount of fifty percent (50%), but can be up to 100% of the contract price. Bond insurance is a risk mitigation tool commonly used in general contracting and similar fields. Some projects, particularly for government contracts, require you to secure a bid bond in order to even submit a bid. Contract bonds are the ideal solution.

Source: westernpacig.com

Source: westernpacig.com

Southern california insurance brokerage takes the pain out of the process by walking you through each step of the process, helping you present the best possible picture of your business so you can qualify for the highest level of bonding capacity with the least amount of stress. Employment bond is an agreement or a contract paper consisting all the terms and conditions of employment agreed by both an employee and the employer. Usually the amount forfeited is the difference between his bid and the next lowest bid. Ultimately, we want to assure the project owner that the contractor has the resources and capacity to perform the contract according to its terms and conditions. Bid bonds are usually the first step in a bonded contract process.

Source: brockwaybond.com

Source: brockwaybond.com

As a contractor, providing security can tie up your assets or interfere with your credit lines. Upon a review of various criteria, including prior completed works and financial capacity, the surety company will determine if the contractor is qualified to secure a contract bond, thus. Contract bonds must be issued by insurance carriers admitted in the state where the obligee requiring the bond resides. I find that there is often confusion on how bonds differ from insurance policies. Insurance companies offering the contract bond, known as the surety company, underwrite based on a contractor’s ability to complete the awarded project.

Source: jayaproteksindo.co.id

Source: jayaproteksindo.co.id

Bonds are often required for a con tractor to obtain licensing or to meet the obligations of a contract. Employment bond is an agreement or a contract paper consisting all the terms and conditions of employment agreed by both an employee and the employer. A down payment guarantee is indirectly included. A contract bond is a guarantee that must be issued by a bank on behalf of an exporter to the foreign debtor (bid, advance payment, delivery, service, performance or warranty bonds). Ultimately, we want to assure the project owner that the contractor has the resources and capacity to perform the contract according to its terms and conditions.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title contract bond insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea