Contract fulfillment insurance Idea

Home » Trend » Contract fulfillment insurance IdeaYour Contract fulfillment insurance images are ready in this website. Contract fulfillment insurance are a topic that is being searched for and liked by netizens today. You can Download the Contract fulfillment insurance files here. Get all free photos and vectors.

If you’re searching for contract fulfillment insurance images information related to the contract fulfillment insurance interest, you have visit the ideal blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and find more informative video articles and images that match your interests.

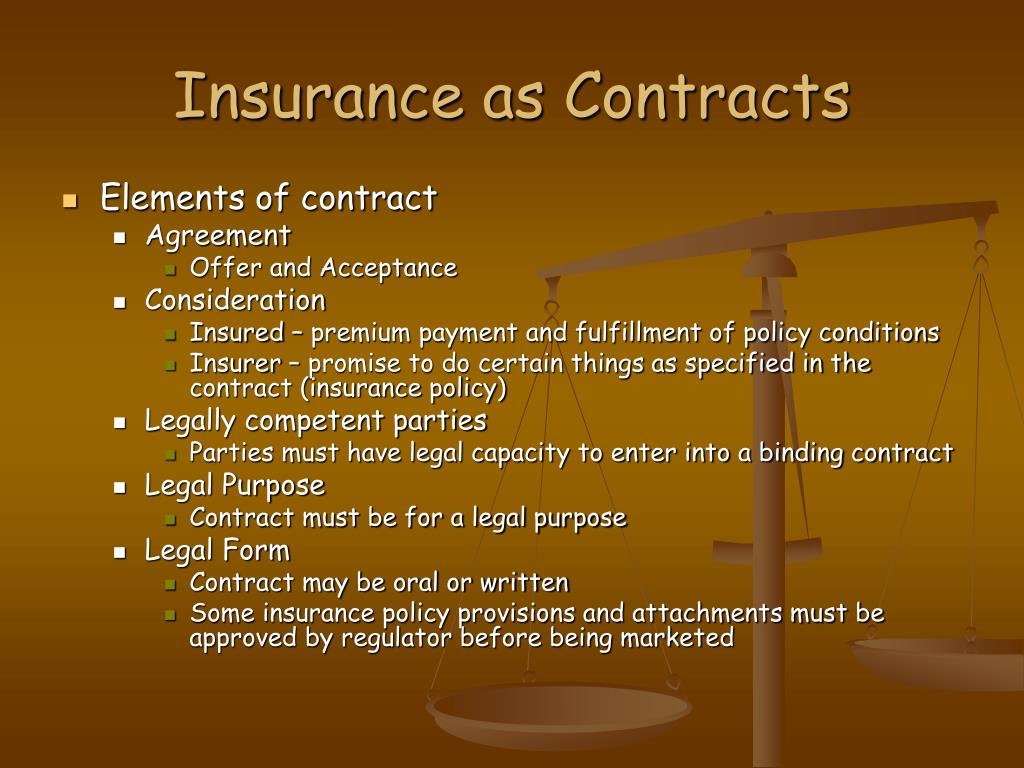

Contract Fulfillment Insurance. Reconciliation of the measurement components of insurance contract balances 64 2.5.1.3. Related to contract fulfillment and promotion, b licensed documentation if commercially available, licensee shall have the option to require the contractor to deliver, at contractor’s expense: Warranty is a very important condition in the insurance contract which is to be fulfilled by the insured. Understanding the role of warehouse legal liability insurance is vital to your peace of mind as a manufacturer or supplier.

The 7 Commandments of Insurance every person should follow From clearlysurely.com

The 7 Commandments of Insurance every person should follow From clearlysurely.com

Definition service fulfillment insurance — insurance to protect against losses arising from the requirement to perform services within a specified time period. Though some consider surety bonds a form of insurance, this a loose a comparison. Covers direct damage while goods are in our care, custody or control at our designated fulfillment centers approved by our insurers. Insurance might agree on contracts that have causes that benefit their families like flexible work hours. It does not include the cost of bearing risk. April 7, 2020 commercial lines advisor.

If they are, the provider should already be authorised by us as an insurance company to do this or it is breaking the law.

Therefore insured must have to fulfill the conditions and promises of the insurance contract whether it is important or not in connection with the risk. If they are, the provider should already be authorised by us as an insurance company to do this or it is breaking the law. But you still may have some lingering concerns about potential inventory loss and how insurance contracts work. Allocation of costs that relate directly to the contract or to contract activities (for example, costs of contract management and supervision, insurance, and depreciation of tools and equipment used in fulfilling the contract) costs that are explicitly chargeable to. Impact of contracts recognised in the year 66 2.5.1.4. Understanding the role of warehouse legal liability insurance is vital to your peace of mind as a manufacturer or supplier.

Source: kimmcmahill.com

Source: kimmcmahill.com

Typically, clients require contract insurance for one reason: Can be sold separately or as part of a product warranty. Psychological contract fulfillment (pcf), according to karagonlar et al. Fulfillment center coverage shall insure against all risk of damage, except as excluded in the policy to which this endorsement is attached, and as hereinafter excluded or specifically provided for. A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder.

Source: gaapdynamics.com

Though some consider surety bonds a form of insurance, this a loose a comparison. It does not include the cost of bearing risk. All of these should be described in full in the fulfillment agreement. An insurance contract issued by an entity (the reinsurer) to compensate another entity (the cedant) for claims arising from insurance contract (s) issued by the cedant. You may also wish to learn more about the specific steps taken to protect your inventory.

Source: boomtowntools.com

Source: boomtowntools.com

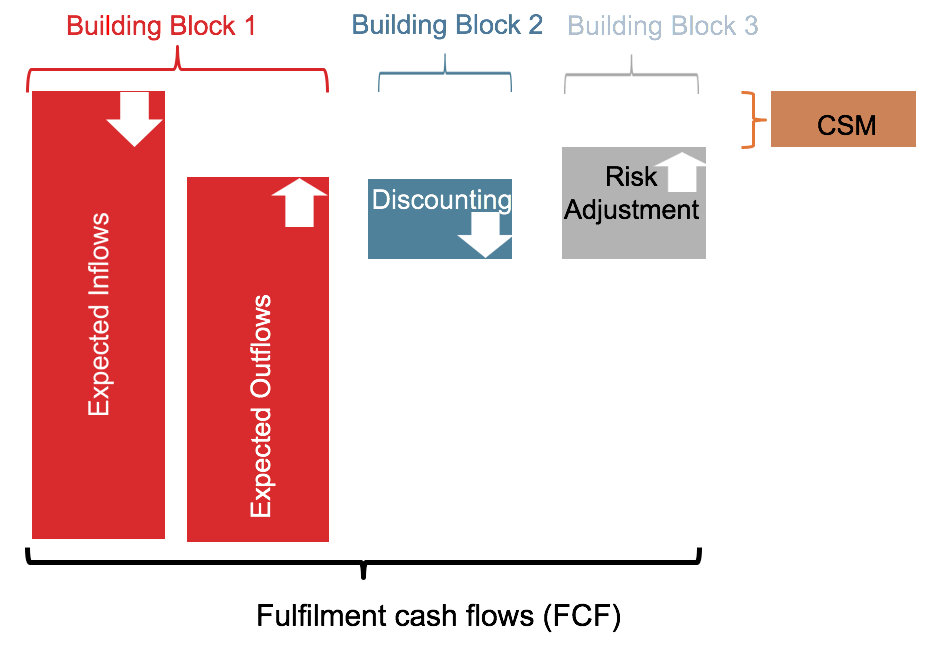

Allocation of costs that relate directly to the contract or to contract activities (for example, costs of contract management and supervision, insurance, and depreciation of tools and equipment used in fulfilling the contract) costs that are explicitly chargeable to. Fulfillment cash flows consist of: Psychological contract fulfillment (pcf), according to karagonlar et al. Allocation of costs that relate directly to the contract or to contract activities (for example, costs of contract management and supervision, insurance, and depreciation of tools and equipment used in fulfilling the contract) costs that are explicitly chargeable to. To protect their interests in the event you fail to hold up your end of the bargain regarding fulfillment of.

Source: sec.gov

Source: sec.gov

The international accounting standards board (iasb) has published a new standard, ifrs 17 �insurance contracts�. Insurance for the contract should also include various aspects, including workers’ compensation, liability insurance, and cargo liability. Insurance might agree on contracts that have causes that benefit their families like flexible work hours. Based on this method, upon inception, there is a possibility of experiencing loss on day 1 if the initial premium collected does not cover the insurance obligations. We started to regulate the selling and administration of contracts of insurance in january 2005.

Source: fr.slideserve.com

Source: fr.slideserve.com

Based on this method, upon inception, there is a possibility of experiencing loss on day 1 if the initial premium collected does not cover the insurance obligations. The bond is simply a line of credit that can pay the initial costs of the claim. On the breach of warranty, the insurer becomes free from his liability. Understanding the role of warehouse legal liability insurance is vital to your peace of mind as a manufacturer or supplier. Insurance for the contract should also include various aspects, including workers’ compensation, liability insurance, and cargo liability.

Source: mondaq.com

Source: mondaq.com

To protect their interests in the event you fail to hold up your end of the bargain regarding fulfillment of. Assignment of contracts to the extent the assignment of any insurance policy, contract, lease, permit, commitment or other asset to be assigned by sellers to buyers pursuant to the provisions of this agreement shall require the consent of any other person, this agreement shall not constitute a contract to assign the same if an attempted assignment would constitute a breach. Allocation of costs that relate directly to the contract or to contract activities (for example, costs of contract management and supervision, insurance, and depreciation of tools and equipment used in fulfilling the contract) costs that are explicitly chargeable to. Insurance for the contract should also include various aspects, including workers’ compensation, liability insurance, and cargo liability. Based on this method, upon inception, there is a possibility of experiencing loss on day 1 if the initial premium collected does not cover the insurance obligations.

Source: insuranceerm.com

Source: insuranceerm.com

These requirements are designed to achieve the goal of a. Reconciliation of the liability for remaining coverage and the liability for incurred claims 62 2.5.1.2. Assignment of contracts to the extent the assignment of any insurance policy, contract, lease, permit, commitment or other asset to be assigned by sellers to buyers pursuant to the provisions of this agreement shall require the consent of any other person, this agreement shall not constitute a contract to assign the same if an attempted assignment would constitute a breach. You may also wish to learn more about the specific steps taken to protect your inventory. These cash flows may comprise commissions paid for new contracts issued that insurers expect policyholders to renew in the future, sometimes more than once.

(ii) based on hard copy instructions for access by downloading. The bond is simply a line of credit that can pay the initial costs of the claim. Whether the contracts it is providing are contracts of insurance. Related to contract fulfillment and promotion, b licensed documentation if commercially available, licensee shall have the option to require the contractor to deliver, at contractor’s expense: Under ifrs 17, insurance acquisition cash flows are accounted for by including them in the cash flows expected to fulfil contracts in a group of insurance contracts.

The bond is simply a line of credit that can pay the initial costs of the claim. Covers direct damage while goods are in our care, custody or control at our designated fulfillment centers approved by our insurers. But you still may have some lingering concerns about potential inventory loss and how insurance contracts work. It does not include the cost of bearing risk. Some distributors or fulfillment houses give you the option of insuring your books stored in their warehouse, either through your own insurance agent or through them.

Source: gaapdynamics.com

Source: gaapdynamics.com

Can be sold separately or as part of a product warranty. Reconciliation of the measurement components of insurance contract balances 64 2.5.1.3. Insurance is only one way that the contractor can fulfill its financial responsibilities to your entity. A bond if different because it does not cover any of the expenses that may stem from a claim. These cash flows may comprise commissions paid for new contracts issued that insurers expect policyholders to renew in the future, sometimes more than once.

Source: slideshare.net

Source: slideshare.net

If you want to deal directly with a product provider Impact of contracts recognised in the year 66 2.5.1.4. Under ifrs 17, insurance acquisition cash flows are accounted for by including them in the cash flows expected to fulfil contracts in a group of insurance contracts. Additional activities related to the fulfillment of the insurance contract may include enrollment (for group plans), provider network access, routine physicals and screenings, immunizations, preventative care and wellness benefits, transportation to facilities for treatment, and access to durable medical equipment (e.g., wheelchairs and. Reconciliation of the measurement components of insurance contract balances 64 2.5.1.3.

Source: paramythia.info

Source: paramythia.info

But you still may have some lingering concerns about potential inventory loss and how insurance contracts work. If you want to deal directly with a product provider Whether the contracts it is providing are contracts of insurance. Psychological contract fulfillment (pcf), according to karagonlar et al. Definition service fulfillment insurance — insurance to protect against losses arising from the requirement to perform services within a specified time period.

Source: pdffiller.com

Source: pdffiller.com

Related to contract fulfillment and promotion, b licensed documentation if commercially available, licensee shall have the option to require the contractor to deliver, at contractor’s expense: Reconciliation of the liability for remaining coverage and the liability for incurred claims 62 2.5.1.2. It does not include the cost of bearing risk. On the breach of warranty, the insurer becomes free from his liability. Insurance is only one way that the contractor can fulfill its financial responsibilities to your entity.

Source: clearlysurely.com

Source: clearlysurely.com

The new standard requires insurance liabilities to be measured at a current fulfillment value and provides a more uniform measurement and presentation approach for all insurance contracts. (ii) based on hard copy instructions for access by downloading. Such policy shall include general liability coverage of at least $1,000,000, employer liability coverage of at least $1,000,000 and statutory workers’ compensation coverage. A section in the contract should state that the lack of insurance does not negate the contractor’s obligations under the contract, such as “these indemnification provisions are independent of and. Related to contract fulfillment and promotion, b licensed documentation if commercially available, licensee shall have the option to require the contractor to deliver, at contractor’s expense:

Source: gaapdynamics.com

(2016), is defined as the degree to. Insurance is a must, as hundreds of warehoused books have been known to disappear at a time. Under ifrs 17, insurance acquisition cash flows are accounted for by including them in the cash flows expected to fulfil contracts in a group of insurance contracts. To protect their interests in the event you fail to hold up your end of the bargain regarding fulfillment of. These cash flows may comprise commissions paid for new contracts issued that insurers expect policyholders to renew in the future, sometimes more than once.

Source: theactuary.net

Source: theactuary.net

The fulfillment value is the expected cost that insurer demands to fulfill the insurance obligations over time. If they are, the provider should already be authorised by us as an insurance company to do this or it is breaking the law. If you want to deal directly with a product provider Amounts determined on transition to ifrs 17 67 Impact of contracts recognised in the year 66 2.5.1.4.

Source: ssnutra.co

Source: ssnutra.co

If you want to deal directly with a product provider Insurance for the contract should also include various aspects, including workers’ compensation, liability insurance, and cargo liability. To protect their interests in the event you fail to hold up your end of the bargain regarding fulfillment of. Though some consider surety bonds a form of insurance, this a loose a comparison. If they are, the provider should already be authorised by us as an insurance company to do this or it is breaking the law.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title contract fulfillment insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information