Contract of insurance in india Idea

Home » Trending » Contract of insurance in india IdeaYour Contract of insurance in india images are ready in this website. Contract of insurance in india are a topic that is being searched for and liked by netizens today. You can Get the Contract of insurance in india files here. Find and Download all royalty-free vectors.

If you’re looking for contract of insurance in india images information linked to the contract of insurance in india topic, you have visit the right blog. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

Contract Of Insurance In India. Insurance contracts are unilateral contracts, where only the insurer makes legally enforceable promises to pay for covered losses. 107 insurers were amalgamated and grouped into four companies, namely national insurance company ltd., the new india assurance company ltd., the oriental insurance company ltd and the united india. Insurance association of india, insurance councils and committees thereof. The company cannot sue the insured for breach of contract.

Basics of �Indian Contract Act, 1872 & �Principles Of From slideshare.net

Basics of �Indian Contract Act, 1872 & �Principles Of From slideshare.net

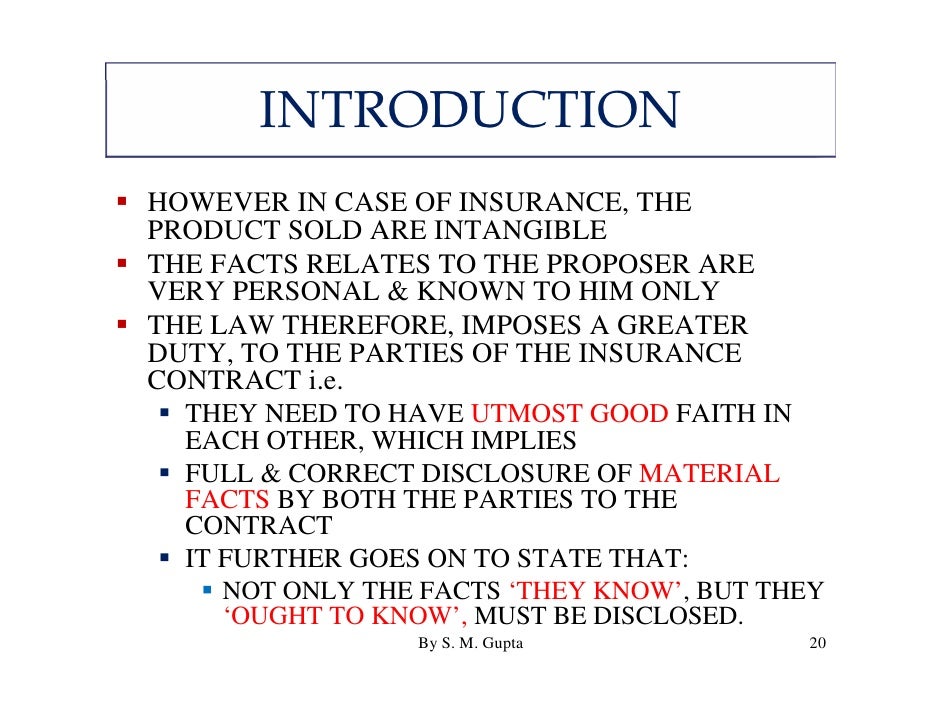

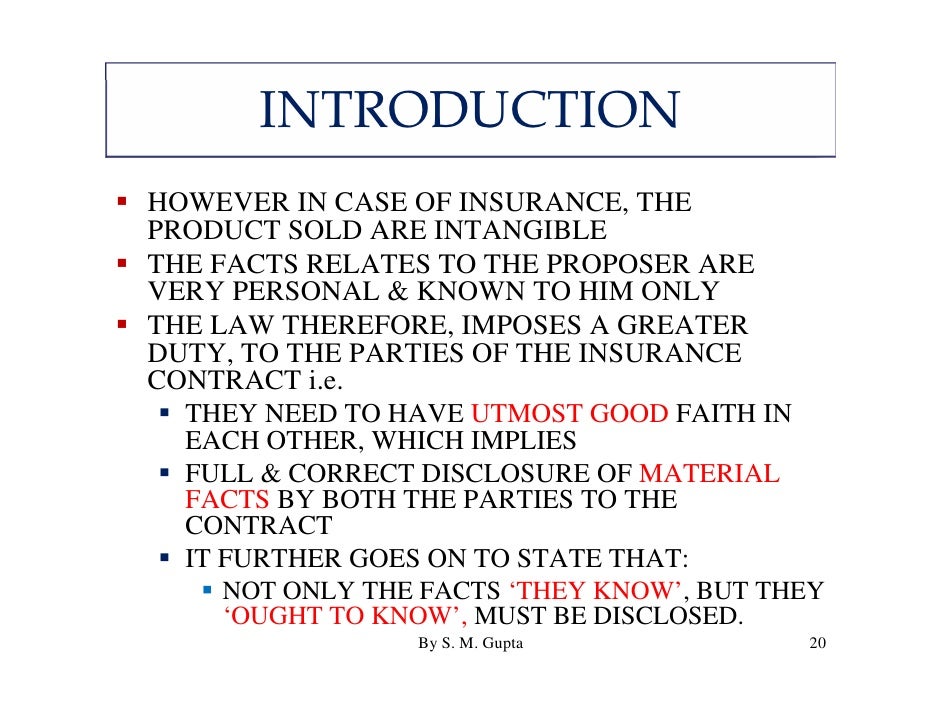

Essentials of insurance contract principles of insurance 42 with respect to the insured, the person should be of legal age i.e. Firstly, in insurance contracts the seller is the insurer and he has no knowledge about the property to be insured. The special contract of insurance involves principles: Of utmost good faith is observed and simple good faith is not enough. Term insurance with return of premium However, as far as the interpretation of insurance contracts is concerned, courts have, over time, evolved certain unique rules.

Disorders of the eyes, ears and nose;

It is important that the insured disclose all relevant facts to the insurance company. Insurance contracts the principles of “uberrima fides” i.e. It was recommended to include those. The first mention of insurance was in the form of ‘bottomry,� a monetary payment that protects traders from debt if goods are lost or destroyed. The company cannot sue the insured for breach of contract. Insurance contracts are no exception to this, though the insurance act 1938 would also have a bearing on such species of contract.

Source: slideshare.net

Source: slideshare.net

Represented in a form of policy, insurance is a contract in which the individual or an entity gets the financial protection, in other words, reimbursement from the insurance company for the damage (big or small) caused to their property. Why this difference in insurance contracts? Law of insurance contract of insurance insurer & insured premium policy subject matter of insurance &insurable interest perils insured against various kinds of insurance—life, fire, marine, personal accident nature of contract of insurance. Any facts that would increase his premium amount, or would cause any prudent insurer to reconsider the policy must be disclosed. The proposer on the other hand knows or is supposed to know

Source: slideshare.net

Source: slideshare.net

In 1972 with the passing of the general insurance business (nationalisation) act, general insurance business was nationalized with effect from 1 st january, 1973. Insurance association of india, insurance councils and committees thereof. Following are the various types of general insurance in india: 18 years and of sound mind. However, as far as the interpretation of insurance contracts is concerned, courts have, over time, evolved certain unique rules.

Source: slideshare.net

Source: slideshare.net

Following are several types of life insurance available in india: 18 years and of sound mind. Following are the various types of general insurance in india: Last updated on 2 years by admin lb i. Law of insurance contract of insurance insurer & insured premium policy subject matter of insurance &insurable interest perils insured against various kinds of insurance—life, fire, marine, personal accident nature of contract of insurance.

Source: slideshare.net

Source: slideshare.net

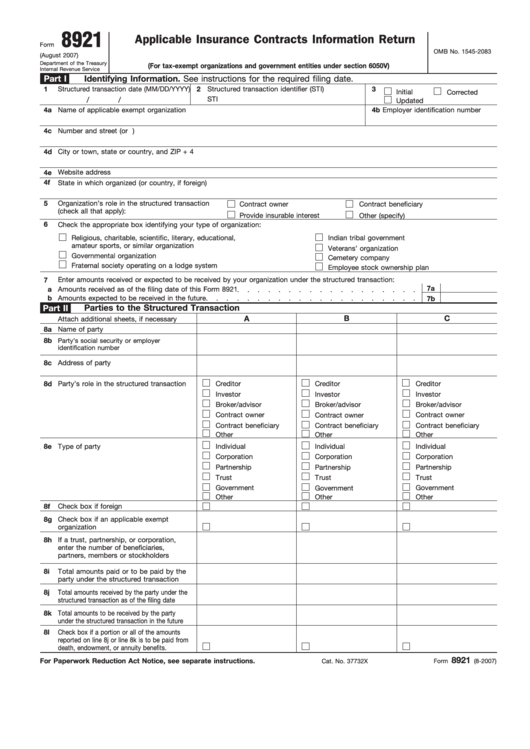

70 insurance companies to accept risk on. Introduction the contract of indemnity as described in section 124 of the indian contract act [1], is a contract between two parties where one party promises to indemnify the other party in case the later one suffers from any loss or to incur any kind of expenses or. Firstly, in insurance contracts the seller is the insurer and he has no knowledge about the property to be insured. Insurance contracts are unilateral contracts, where only the insurer makes legally enforceable promises to pay for covered losses. It is important that the insured disclose all relevant facts to the insurance company.

Source: slideshare.net

Source: slideshare.net

The law commission of india, on the contrary, in its 13 th report on the indian contract act, 1872 advised a recommendation that the understanding of indemnity must be expanded to include within its horizon, insurance contracts too as both the contracts share the same essence, making good the loss of another. Of utmost good faith is observed and simple good faith is not enough. Insurance contracts are no exception to this, though the insurance act 1938 would also have a bearing on such species of contract. Financial planning and life insurance; In insurance contract the insurer is bound by the

Source: slideshare.net

Source: slideshare.net

Essentials of special contract of insurance: If the insured fails to abide the contract, then the insurer is not obligated to pay for any insured’s losses. Law of insurance contract of insurance insurer & insured premium policy subject matter of insurance &insurable interest perils insured against various kinds of insurance—life, fire, marine, personal accident nature of contract of insurance. It is the ‘earliest authenticated insurance contract� demonstrating the characteristics of insurance in terms of risk transfer owing to any unavoidable incident in place of any payment of premium. 107 insurers were amalgamated and grouped into four companies, namely national insurance company ltd., the new india assurance company ltd., the oriental insurance company ltd and the united india.

Source: slideshare.net

Source: slideshare.net

The proposer on the other hand knows or is supposed to know In general terms, a surety bond is a contract, in which a surety provider or an insurance company provides a guarantee to an obligee or beneficiary that the principal or debtor will meet its contractual obligations or that a monetary compensation is paid to such obligee, if the principal fails to deliver on its promise. Disorders of the eyes, ears and nose; Last updated on 2 years by admin lb i. In insurance contract the insurer is bound by the

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

In general terms, a surety bond is a contract, in which a surety provider or an insurance company provides a guarantee to an obligee or beneficiary that the principal or debtor will meet its contractual obligations or that a monetary compensation is paid to such obligee, if the principal fails to deliver on its promise. The first mention of insurance was in the form of ‘bottomry,� a monetary payment that protects traders from debt if goods are lost or destroyed. Essentials of special contract of insurance: Essentials of insurance contract principles of insurance 42 with respect to the insured, the person should be of legal age i.e. Last updated on 2 years by admin lb i.

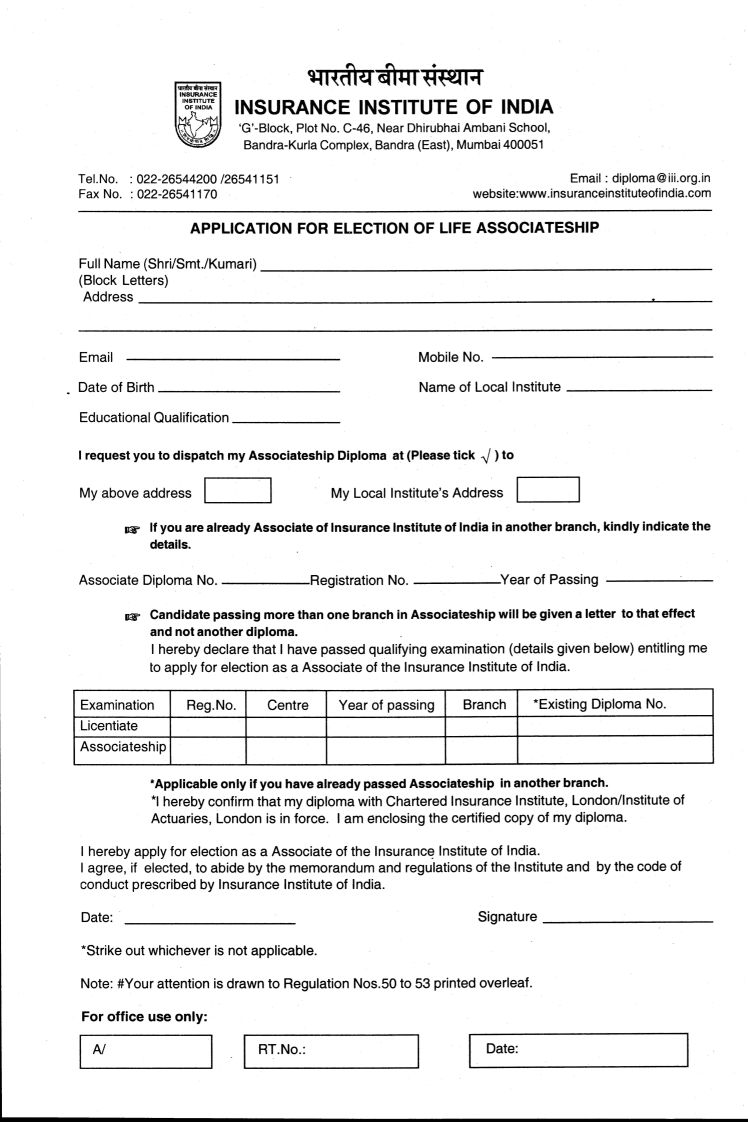

Source: formsbank.com

Source: formsbank.com

18 years and of sound mind. All contractual arrangements in india are governed by the indian contract act, 1872. Why this difference in insurance contracts? Last updated on 2 years by admin lb i. Following are several types of life insurance available in india:

Source: slideshare.net

Source: slideshare.net

The insurance contract involves— (a) the elements of the general contract, and (b) the element of special contract relating to insurance. The special contract of insurance involves principles: If the insured fails to abide the contract, then the insurer is not obligated to pay for any insured’s losses. It is the ‘earliest authenticated insurance contract� demonstrating the characteristics of insurance in terms of risk transfer owing to any unavoidable incident in place of any payment of premium. Insurance contracts are no exception to this, though the insurance act 1938 would also have a bearing on such species of contract.

Source: bcmtouring.com

Source: bcmtouring.com

Essentials of special contract of insurance: The insurance contract involves— (a) the elements of the general contract, and (b) the element of special contract relating to insurance. Represented in a form of policy, insurance is a contract in which the individual or an entity gets the financial protection, in other words, reimbursement from the insurance company for the damage (big or small) caused to their property. The first mention of insurance was in the form of ‘bottomry,� a monetary payment that protects traders from debt if goods are lost or destroyed. Last updated on 2 years by admin lb i.

Source: management.ind.in

Source: management.ind.in

The insurance contract involves— (a) the elements of the general contract, and (b) the element of special contract relating to insurance. The law commission of india, on the contrary, in its 13 th report on the indian contract act, 1872 advised a recommendation that the understanding of indemnity must be expanded to include within its horizon, insurance contracts too as both the contracts share the same essence, making good the loss of another. Of utmost good faith is observed and simple good faith is not enough. Insurance contract and indemnity in india. Last updated on 2 years by admin lb i.

Source: slideshare.net

Source: slideshare.net

Following are the various types of general insurance in india: Financial planning and life insurance; Insurance contract and indemnity in india. If a contract is made with an underage the application may be held unenforceable if the minor decides to repudiate it at a later date. Of utmost good faith is observed and simple good faith is not enough.

Source: slideshare.net

Source: slideshare.net

A contract of insurance must be made based on utmost good faith ( a contract of uberrimate fidei). Insurance contracts are no exception to this, though the insurance act 1938 would also have a bearing on such species of contract. Essentials of insurance contract principles of insurance 42 with respect to the insured, the person should be of legal age i.e. In general terms, a surety bond is a contract, in which a surety provider or an insurance company provides a guarantee to an obligee or beneficiary that the principal or debtor will meet its contractual obligations or that a monetary compensation is paid to such obligee, if the principal fails to deliver on its promise. Firstly, in insurance contracts the seller is the insurer and he has no knowledge about the property to be insured.

Source: slideshare.net

Source: slideshare.net

Firstly, in insurance contracts the seller is the insurer and he has no knowledge about the property to be insured. Term insurance with return of premium Insurance contracts are no exception to this, though the insurance act 1938 would also have a bearing on such species of contract. Insurance is actually a contract between 2 parties whereby one party called insurer undertakes in exchange for a fixed sum called premium to pay the other party on happening of a certain event. Essentials of special contract of insurance:

Source: slideshare.net

Source: slideshare.net

Following are the various types of general insurance in india: 107 insurers were amalgamated and grouped into four companies, namely national insurance company ltd., the new india assurance company ltd., the oriental insurance company ltd and the united india. It is the ‘earliest authenticated insurance contract� demonstrating the characteristics of insurance in terms of risk transfer owing to any unavoidable incident in place of any payment of premium. The law commission of india, on the contrary, in its 13 th report on the indian contract act, 1872 advised a recommendation that the understanding of indemnity must be expanded to include within its horizon, insurance contracts too as both the contracts share the same essence, making good the loss of another. 18 years and of sound mind.

Source: welireng1.blogspot.com

However, as far as the interpretation of insurance contracts is concerned, courts have, over time, evolved certain unique rules. However, as far as the interpretation of insurance contracts is concerned, courts have, over time, evolved certain unique rules. Following are the types of insurance in india: It is the ‘earliest authenticated insurance contract� demonstrating the characteristics of insurance in terms of risk transfer owing to any unavoidable incident in place of any payment of premium. Insurance is actually a contract between 2 parties whereby one party called insurer undertakes in exchange for a fixed sum called premium to pay the other party on happening of a certain event.

Source: slideshare.net

Source: slideshare.net

Following are the various types of general insurance in india: Following are several types of life insurance available in india: All contractual arrangements in india are governed by the indian contract act, 1872. Essentials of special contract of insurance: 70 insurance companies to accept risk on.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title contract of insurance in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea