Contractor national insurance calculator Idea

Home » Trending » Contractor national insurance calculator IdeaYour Contractor national insurance calculator images are ready in this website. Contractor national insurance calculator are a topic that is being searched for and liked by netizens now. You can Get the Contractor national insurance calculator files here. Download all free photos.

If you’re searching for contractor national insurance calculator images information related to the contractor national insurance calculator topic, you have visit the right blog. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

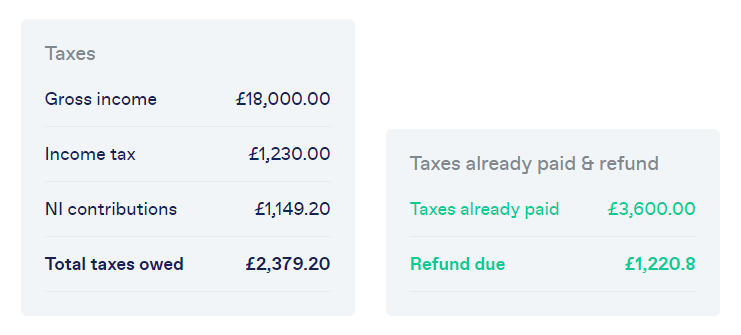

Contractor National Insurance Calculator. It is common for contractors to pay themselves a very low salary to keep income tax and nics to a minimum, taking the remainder of their income as dividends. Net income (post expenses) £28,712. The contractor calculators are completely free for anyone to use and we hope that they provide the user with all of their needs. Select your national insurance letter so we can calculate your employers and employee nic contributions.

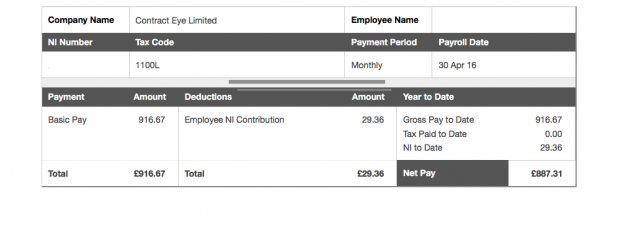

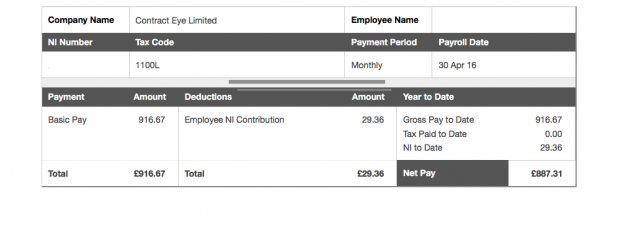

National Insurance concise guide for IT contractors IT From itcontracting.com

National Insurance concise guide for IT contractors IT From itcontracting.com

It is common for contractors to pay themselves a very low salary to keep income tax and nics to a minimum, taking the remainder of their income as dividends. Work out your take home salary, as well as paye and ni contributions, determined by your gross annual salary, with this calculator. To use our employer national insurance calculator simply enter your annual salary, enter the fixed annual bonus, and enter the percentage annual bonus. April 2022 dividend tax (and nic) increase calculator. It is important to understand that national insurance is. Class 2 nics are a fixed amount of £3.05 per week (2021/22), assuming the contractor’s profits are over the threshold of £6,475 (2021/22).

For more insight, try our other contractors tax calculators, such as our ir35 tax calculator or our dividend vs salary calculator.

More than 50,270, ni rate is 2% of your income. Not only that, we�ll calculate your take home pay based on all the possible scenarios, i.e. See how much the increase in national. 2021 / 2022 employer nic calculator. For the 2021/22 tax year, limited companies will pay employers’ national insurance on salaries of £170 per week or more, at a rate of 13.8%, or £8,840 per year. In recent years, national insurance contributions have raised an increasing proportion of total uk treasury receipts, and the system is seen by many as an additional income tax in all but name.

Source: itcontracting.com

Source: itcontracting.com

Use our calculator to work out how much more tax you will pay. National insurance calculation example for the employed: It is common for contractors to pay themselves a very low salary to keep income tax and nics to a minimum, taking the remainder of their income as dividends. 2021 / 2022 employer nic calculator. Dear contractor doctor, i’ve been working inside ir35 and would like to know if there is any difference in the way employer’s national insurance (ni) contributions are calculated between working for an agency or through an umbrella company?

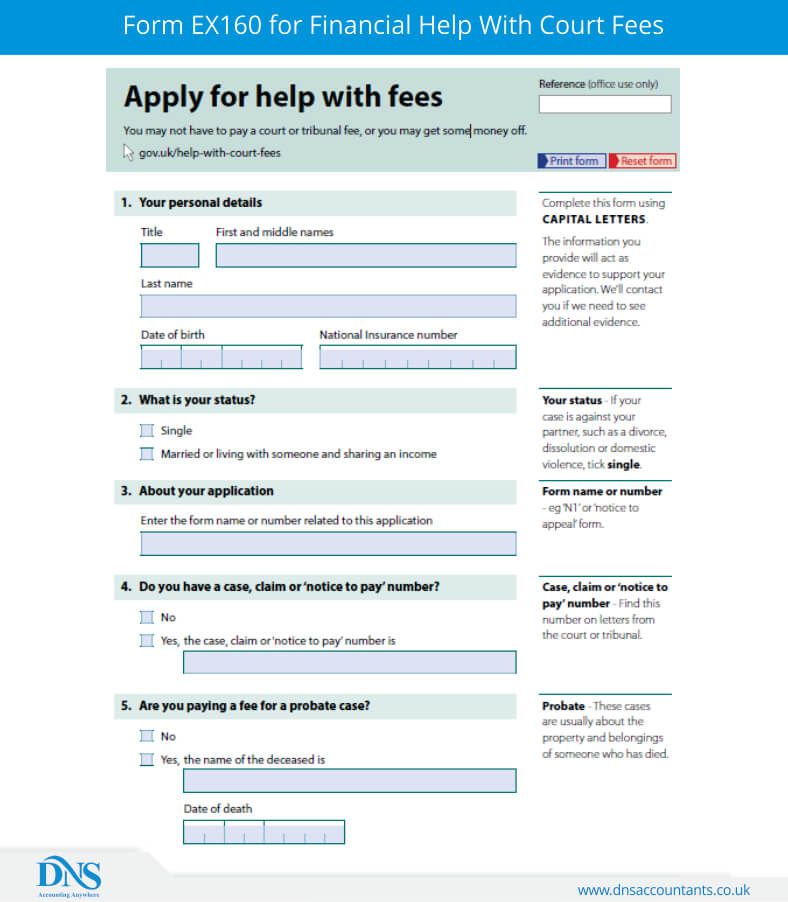

Source: dnsassociates.co.uk

Source: dnsassociates.co.uk

Contractor calculators the good calculators contractor calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. 2021 / 2022 employer nic calculator. This has been updated for the current tax year of 2021/22. It is common for contractors to pay themselves a very low salary to keep income tax and nics to a minimum, taking the remainder of their income as dividends. For more insight, try our other contractors tax calculators, such as our ir35 tax calculator or our dividend vs salary calculator.

Source: keepertax.com

Source: keepertax.com

Net income (post expenses) £28,712. Sole traders will pay class 2 national insurance on profits over the small profits threshold, and class 4 national insurance on profits over the lower profits limit. National insurance and employers national insurance. It is important to understand that national insurance is. For more insight, try our other contractors tax calculators, such as our ir35 tax calculator or our dividend vs salary calculator.

Source: dnsassociates.co.uk

Source: dnsassociates.co.uk

Use our calculator to work out how much more tax you will pay. The employer national insurance contributions calculator is updated for the 2022/23 tax year so that you can calculate your employer nic�s due to hmrc in addition to standard payroll costs. Dear contractor doctor, i’ve been working inside ir35 and would like to know if there is any difference in the way employer’s national insurance (ni) contributions are calculated between working for an agency or through an umbrella company? 2021 / 2022 employer nic calculator. Not only that, we�ll calculate your take home pay based on all the possible scenarios, i.e.

Source: dnsassociates.co.uk

Source: dnsassociates.co.uk

From april 2022, the rates of dividend tax and national insurance will all increase by 1.25 percentage points. Employers national insurance + holiday pay allowance = total total x 13.8%= employers national insurance. The contractor calculators are completely free for anyone to use and we hope that they provide the user with all of their needs. Working with a limited company (outside ir35 as well as inside ir35) as well as through an umbrella company. April 2022 dividend tax hike.

Source: amouretguerre.blogspot.com

Source: amouretguerre.blogspot.com

National insurance and employers national insurance. Request form for paye chaps transfer. There is a personal allowance that hmrc give employers before the 13.8% is calculated, but this is dependent on the number of hours worked or the candidates pay rate for that week/month so it is impossible to include in a rate calculation. The national insurance system was originally put in place to protect workers during times of sickness and unemployment. The prime minister boris johnson has announced a 1.25% hike to national insurance contributions starting from next april (2022).

Source: pia-tx.com

Source: pia-tx.com

Detailed income tax and national insurance contribution calculations included. Employer national insurance contributions calculator ( 2021/22 tax. If you’re a director or an employee, you pay class 1 national insurance and the rates for the tax year of 2020/21 are: >> contractor calculators >> april 2022 dividend tax (and nic) increase calculator. The employer national insurance contributions calculator is updated for the 2022/23 tax year so that you can calculate your employer nic�s due to hmrc in addition to standard payroll costs.

Source: contractorcalculator.co.uk

Source: contractorcalculator.co.uk

National insurance rates for the employed. If you’re a director or an employee, you pay class 1 national insurance and the rates for the tax year of 2020/21 are: >> contractor calculators >> april 2022 dividend tax (and nic) increase calculator. Calculate the company car tax charge based on a car’s taxable value and co2 rating. Select your national insurance letter so we can calculate your employers and employee nic contributions.

Source: theaccountancy.co.uk

Source: theaccountancy.co.uk

2021 / 2022 employer nic calculator. This is a simple tool that provides emlploee ni and employers ni calculations withour the employment allowance factored in. Salary sacrifice lets you make contributions to your pension and helps to save on national insurance at the same time. For the 2021/22 tax year, limited companies will pay employers’ national insurance on salaries of £170 per week or more, at a rate of 13.8%, or £8,840 per year. The contractor calculators are completely free for anyone to use and we hope that they provide the user with all of their needs.

Source: nationwidemortgageandrealty.net

Source: nationwidemortgageandrealty.net

Employees pay employees’ national insurance at a rate of 12% on earnings between £184 and £967 per week, and at 2% for income above £967 per week, i.e. Salary sacrifice lets you make contributions to your pension and helps to save on national insurance at the same time. If you are an employer looking to calculate the employer ni on several employees, you will find this calculator useful. Some contractors who operate via a limited company choose to pay themselves a salary, rather than adopting the usual remuneration. This has been updated for the current tax year of 2021/22.

Source: taxscouts.com

Source: taxscouts.com

Contractor calculators the good calculators contractor calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. If you are an employer looking to calculate the employer ni on several employees, you will find this calculator useful. In recent years, national insurance contributions have raised an increasing proportion of total uk treasury receipts, and the system is seen by many as an additional income tax in all but name. For the 2021/22 tax year, limited companies will pay employers’ national insurance on salaries of £170 per week or more, at a rate of 13.8%, or £8,840 per year. Working with a limited company (outside ir35 as well as inside ir35) as well as through an umbrella company.

Source: contractorcalculator.co.uk

Source: contractorcalculator.co.uk

Some contractors who operate via a limited company choose to pay themselves a salary, rather than adopting the usual remuneration. It is important to understand that national insurance is. Employers national insurance + holiday pay allowance = total total x 13.8%= employers national insurance. Tools to help you run your payroll. Employees pay employees’ national insurance at a rate of 12% on earnings between £184 and £967 per week, and at 2% for income above £967 per week, i.e.

Source: dnsassociates.co.uk

Source: dnsassociates.co.uk

National insurance and employers national insurance. Work out your take home salary, as well as paye and ni contributions, determined by your gross annual salary, with this calculator. For the 2021/22 tax year, limited companies will pay employers’ national insurance on salaries of £170 per week or more, at a rate of 13.8%, or £8,840 per year. This is a simple tool that provides emlploee ni and employers ni calculations withour the employment allowance factored in. Contractor calculators the good calculators contractor calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices.

![Contractor Take Home Pay Calculator [2020] Contractor Take Home Pay Calculator [2020]](https://res.cloudinary.com/goforma/image/upload/f_auto,q_auto/contractor-accounting/take_home_pay_guide_xbxa0q.png) Source: goforma.com

Source: goforma.com

It is simple to follow and shows how you can benefit from doing this. In recent years, national insurance contributions have raised an increasing proportion of total uk treasury receipts, and the system is seen by many as an additional income tax in all but name. Employers national insurance + holiday pay allowance = total total x 13.8%= employers national insurance. Salary sacrifice lets you make contributions to your pension and helps to save on national insurance at the same time. It is simple to follow and shows how you can benefit from doing this.

To use our employer national insurance calculator simply enter your annual salary, enter the fixed annual bonus, and enter the percentage annual bonus. More than 50,270, ni rate is 2% of your income. From april 2022, the rates of dividend tax and national insurance will all increase by 1.25 percentage points. 2021 / 2022 employer nic calculator. Request form for paye chaps transfer.

Source: vector-works.org

Source: vector-works.org

Working with a limited company (outside ir35 as well as inside ir35) as well as through an umbrella company. From april 2022, the rates of dividend tax and national insurance will all increase by 1.25 percentage points. Work out your take home salary, as well as paye and ni contributions, determined by your gross annual salary, with this calculator. Employers national insurance + holiday pay allowance = total total x 13.8%= employers national insurance. For the 2021/22 tax year, limited companies will pay employers’ national insurance on salaries of £170 per week or more, at a rate of 13.8%, or £8,840 per year.

Source: contractorcalculator.co.uk

Detailed income tax and national insurance contribution calculations included. National insurance rates for the employed. The starting threshold, or lower earnings limit, for nics is considerably lower than the income tax personal allowance, so limited company contractors paying themselves a minimum salary and dividends may still be liable for a small amount of national insurance and should consider this when calculating how much they want to earn. Employer national insurance contributions calculator ( 2021/22 tax. Contractors who setup limited companies often overlook the employer element of national insurance, this oversite can be costly with the employer national insurance rate at in 2022.

Source: boox.co.uk

Source: boox.co.uk

It is important to understand that national insurance is. Sole traders will pay class 2 national insurance on profits over the small profits threshold, and class 4 national insurance on profits over the lower profits limit. National insurance and employers national insurance. The national insurance system was originally put in place to protect workers during times of sickness and unemployment. It is simple to follow and shows how you can benefit from doing this.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title contractor national insurance calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea