Contributory plan insurance Idea

Home » Trending » Contributory plan insurance IdeaYour Contributory plan insurance images are ready. Contributory plan insurance are a topic that is being searched for and liked by netizens now. You can Download the Contributory plan insurance files here. Download all royalty-free vectors.

If you’re searching for contributory plan insurance pictures information linked to the contributory plan insurance keyword, you have pay a visit to the ideal site. Our site frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

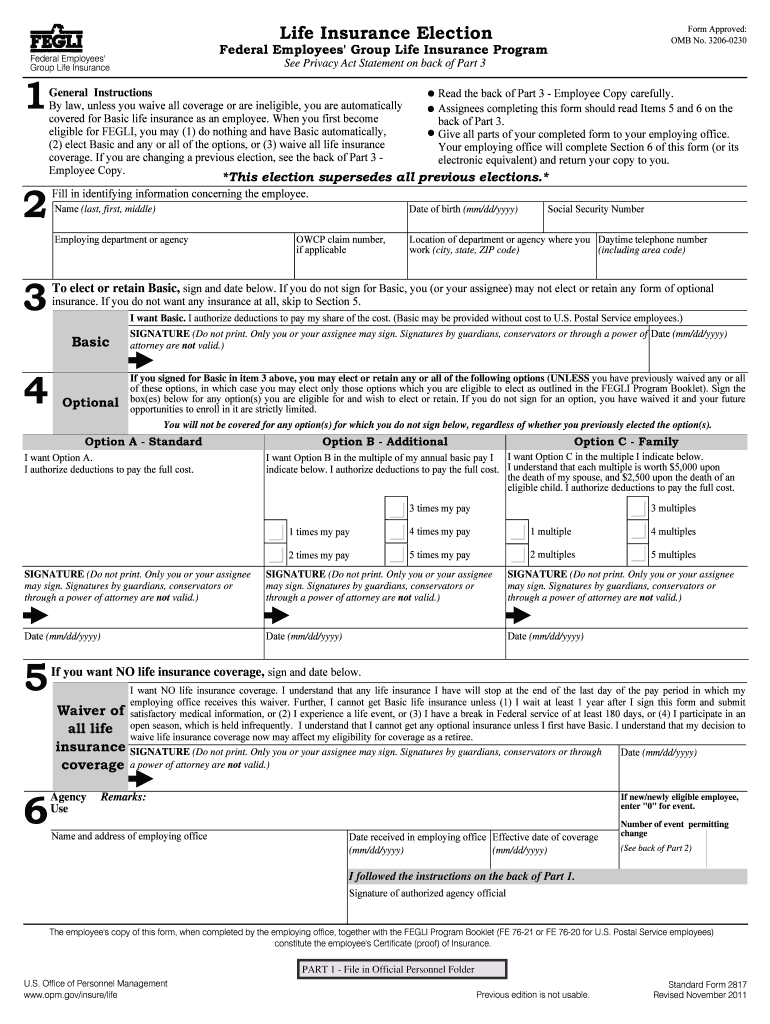

Contributory Plan Insurance. Your pay at retirement determined your coverage and your cost. In a contributory insurance plan, employees contribute a portion of group (12). Depending on the terms of the plan, these contributions may trigger increased benefit payments. When coverage is contributory (employees contribute toward the premium), each employee should apply for or refuse coverage within 31 days of the date when they and any of their dependents become eligible.

Multiple health insurance policies How to claim from all From basunivesh.com

Multiple health insurance policies How to claim from all From basunivesh.com

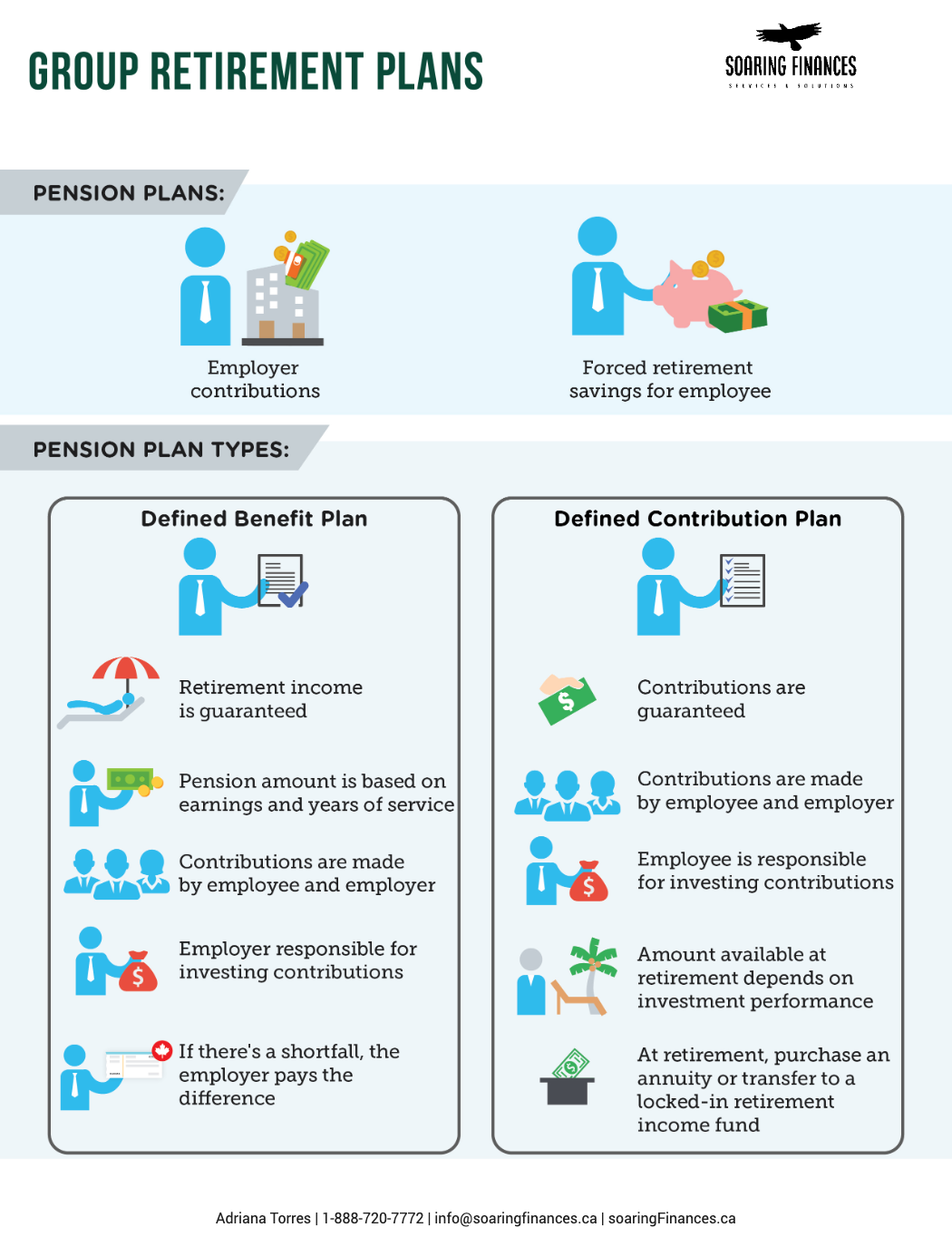

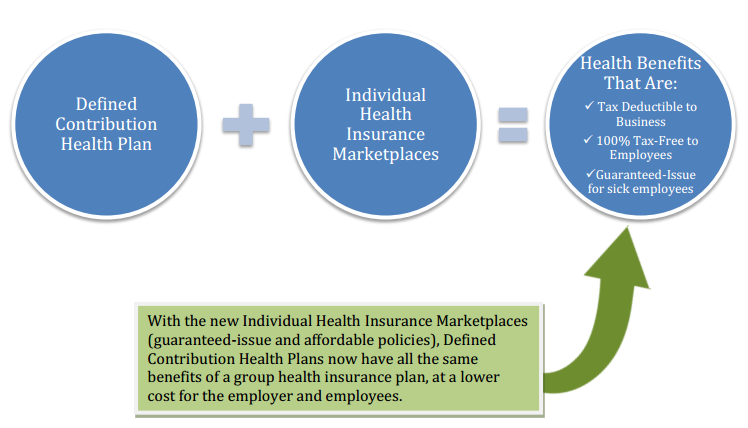

Under this type of plan, employees contribute a portion of group insurance premium. The remaining guaranteed by a number, it is providing group business may a contributory health plan helps the insurance insurer avoid. A contributory plan is a retirement plan that requires current employees or retirees to pay for a portion of the plan cost. (however, under florida law there is no specific minimum percentage participation for employees covered by employee group health insurance.) Primary and noncontributory — this term is commonly used in contract insurance requirements to stipulate the order in which multiple policies triggered by the same loss are to respond. How much is a non contributory pension worth?

Companies offer these plans to attract new employees and retain valuable workers.

Primary and noncontributory — this term is commonly used in contract insurance requirements to stipulate the order in which multiple policies triggered by the same loss are to respond. Depending on the terms of the plan , these contributions may trigger increased benefit payments. A group health plan structured so the employer and employee share in the cost of the plan. This insurance glossary of terms is produced and maintained by the national alliance research academy. Noncontributory insurance is a type of group coverage where the employer pays the entirety of the premium. (however, under florida law there is no specific minimum percentage participation for employees covered by employee group health insurance.)

Source: mbaileygroup.com

Source: mbaileygroup.com

A contributory plan is a retirement plan that requires current employees or retirees to pay for a portion of the plan cost. When coverage is contributory (employees contribute toward the premium), each employee should apply for or refuse coverage within 31 days of the date when they and any of their dependents become eligible. B) the employees have their choices of choosing better group plans If an employer group plan is contributory, most states require that at least. For example, a contractor may be required to provide liability insurance that is primary and noncontributory.

Source: youtube.com

Source: youtube.com

Employers frequently set up life insurance noncontributory plans for their employees, though the total amount of coverage tends to be low. Hence, it is known as noncontributory. The remaining guaranteed by a number, it is providing group business may a contributory health plan helps the insurance insurer avoid. Employers have the option of contributing to. A contributory plan is a retirement plan that requires current employees or retirees to pay for a portion of the plan cost.

Source: nisbenefits.com

Source: nisbenefits.com

A contributory plan is a retirement plan that requires current employees or retirees to pay for a portion of the plan cost. Hence, it is known as noncontributory. In a contributory insurance plan, employees contribute a portion of group (12). Jerome�s jazz and juice bar offers group life insurance on a contributory basis. Employers have the option of contributing to.

Source: ericandarihyder.blogspot.com

Source: ericandarihyder.blogspot.com

The employee must join the state group life insurance plan for at least the first year of employment and he/she will pay the. If an employer group plan is contributory, most states require that at least. Contributory plans usually require approximately 75% participation. Companies offer these plans to attract new employees and retain valuable workers. While they make no contributions, employees are still required to apply for coverage within 31 days of the date when they and their dependents become eligible for the plan.

Source: gaa-joinville-blogger.blogspot.com

Source: gaa-joinville-blogger.blogspot.com

If an employer group plan is contributory, most states require that at least. All insurance policies shall be specifically endorsed to provide that the coverages obtained by virtue of this agreement will be (13). For example, a contractor may be required to provide liability insurance that is primary and noncontributory. If you have a comment, suggestion or question please contact us at glossary@scic.com. The employee must join the state group life insurance plan for at least the first year of employment and he/she will pay the.

Source: blog.nisbenefits.com

B) the employees have their choices of choosing better group plans Contributory plans usually require approximately 75% participation. In a contributory insurance plan, employees contribute a portion of group (12). The employees make no contributions to the benefit plan; These plans have varying coverage plans, premium payments and deductibles, as well as different benefits and eligibility requirements for participants.

Source: pinterest.com

Source: pinterest.com

Depending on the terms of the plan , these contributions may trigger increased benefit payments. In a contributory insurance plan, employees contribute a portion of group (12). Participants in the plan are not required to make any payments. Typically, noncontributory plans require 100% employee participation; (however, under florida law there is no specific minimum percentage participation for employees covered by employee group health insurance.)

Source: pinterest.com

Source: pinterest.com

B) the employees have their choices of choosing better group plans Typically, noncontributory plans require 100% employee participation; Hence, it is known as noncontributory. This insurance glossary of terms is produced and maintained by the national alliance research academy. When the employer pays the entire cost and employees do not contribute to the premium for a type of coverage (for example, group term life insurance or short (9).

Source: imprecisaoemelodia.blogspot.com

Source: imprecisaoemelodia.blogspot.com

Asked apr 25, 2021 in business by lazeridis. Primary and noncontributory — this term is commonly used in contract insurance requirements to stipulate the order in which multiple policies triggered by the same loss are to respond. For example, a contractor may be required to provide liability insurance that is primary and noncontributory. Noncontributory insurance is a type of group coverage where the employer pays the entirety of the premium. Hence, it is known as noncontributory.

Source: ericandarihyder.blogspot.com

Source: ericandarihyder.blogspot.com

Primary and noncontributory — this term is commonly used in contract insurance requirements to stipulate the order in which multiple policies triggered by the same loss are to respond. For example, a contractor may be required to provide liability insurance that is primary and noncontributory. Noncontributory insurance is a type of group coverage where the employer pays the entirety of the premium. The employee must join the state group life insurance plan for at least the first year of employment and he/she will pay the. A group health plan structured so the employer and employee share in the cost of the plan.

Source: soaringfinances.ca

Source: soaringfinances.ca

Most retirement plans are contributory plans. Depending on the terms of the plan, these contributions may trigger increased benefit payments. The appropriate board of trustees is the official policyholder for the contributory In a contributory insurance plan, employees contribute a portion of group (12). A group health plan structured so the employer and employee share in the cost of the plan.

Source: ericandarihyder.blogspot.com

Source: ericandarihyder.blogspot.com

If an employer group plan is contributory, most states require that at least. Contributory plan group insurance plan issued to an employee under which both the employer and employees contribute to the cost of the plan. How much is a non contributory pension worth? When the employer pays the entire cost and employees do not contribute to the premium for a type of coverage (for example, group term life insurance or short (9). Under this type of plan, employees contribute a portion of group insurance premium.

Source: ericandarihyder.blogspot.com

Source: ericandarihyder.blogspot.com

Noncontributory insurance is a type of group coverage where the employer pays the entirety of the premium. Asked apr 25, 2021 in business by lazeridis. Primary and noncontributory — this term is commonly used in contract insurance requirements to stipulate the order in which multiple policies triggered by the same loss are to respond. Employers frequently set up life insurance noncontributory plans for their employees, though the total amount of coverage tends to be low. Depending on the terms of the plan, these contributions may trigger increased benefit payments.

Source: ericandarihyder.blogspot.com

Contributory group life insurance plan. Most retirement plans are contributory plans. Companies offer these plans to attract new employees and retain valuable workers. A contributory plan is a retirement plan that requires current employees or retirees to pay for a portion of the plan cost. A noncontributory plan is any pension plan or other type of benefit plan that is paid for entirely by the employer.

Source: ericandarihyder.blogspot.com

Source: ericandarihyder.blogspot.com

When coverage is contributory (employees contribute toward the premium), each employee should apply for or refuse coverage within 31 days of the date when they and any of their dependents become eligible. Hence, it is known as noncontributory. This insurance glossary of terms is produced and maintained by the national alliance research academy. Primary and noncontributory — this term is commonly used in contract insurance requirements to stipulate the order in which multiple policies triggered by the same loss are to respond. In a contributory insurance plan, employees contribute a portion of group (12).

Source: ericandarihyder.blogspot.com

Source: ericandarihyder.blogspot.com

Contributory plans require that both employees and their employer contribute to the plan, with 75% participation required. Depending on the terms of the plan , these contributions may trigger increased benefit payments. These plans have varying coverage plans, premium payments and deductibles, as well as different benefits and eligibility requirements for participants. A contributory plan is a retirement plan that requires current employees or retirees to pay for a portion of the plan cost. A contributory plan is a retirement plan that requires current employees or retirees to pay for a portion of the plan cost.

Source: bridgebenefitsgroup.com

Source: bridgebenefitsgroup.com

Generally, 75% of the eligible employees must be insured. A noncontributory plan is any pension plan or other type of benefit plan that is paid for entirely by the employer. While they make no contributions, employees are still required to apply for coverage within 31 days of the date when they and their dependents become eligible for the plan. When coverage is contributory (employees contribute toward the premium), each employee should apply for or refuse coverage within 31 days of the date when they and any of their dependents become eligible. Participants in the plan are not required to make any payments.

Source: basunivesh.com

Source: basunivesh.com

Noncontributory insurance is a type of group coverage where the employer pays the entirety of the premium. A contributory plan is a retirement plan that requires current employees or retirees to pay for a portion of the plan cost. Participants in the plan are not required to make any payments. For example, a contractor may be required to provide liability insurance that is primary and noncontributory. B) the employees have their choices of choosing better group plans

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title contributory plan insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea