Conventional life insurance products information

Home » Trend » Conventional life insurance products informationYour Conventional life insurance products images are available in this site. Conventional life insurance products are a topic that is being searched for and liked by netizens now. You can Get the Conventional life insurance products files here. Download all royalty-free vectors.

If you’re looking for conventional life insurance products pictures information related to the conventional life insurance products interest, you have visit the right site. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Conventional Life Insurance Products. Conventional life insurance policies, unbundled life insurance policies, and insurance bonds. The following products pay out on death of the life insured, namely • whole life assurance • term assurance • convertible or renewable term assurances omari c.o page 11 of 22 life assurance 1.5 whole life assurance a whole life assurance is a contract to pay a benefit on the death of the life insured whenever that might occur. That is, if you have a ₹20 lakh life insurance cover (with maturity benefit), your yearly premium would be ₹20,000. Purpose, scope, cross references, and effective date 1.1 purpose—this actuarial standard of practice (asop) provides guidance to actuaries when performing actuarial services with respect to the pricing of life insurance and annuity products.

6 Facts About What Are Conventional Whole Life Product From insurance-resource.ca

6 Facts About What Are Conventional Whole Life Product From insurance-resource.ca

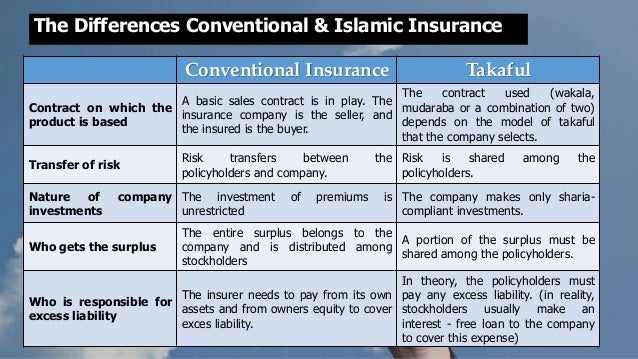

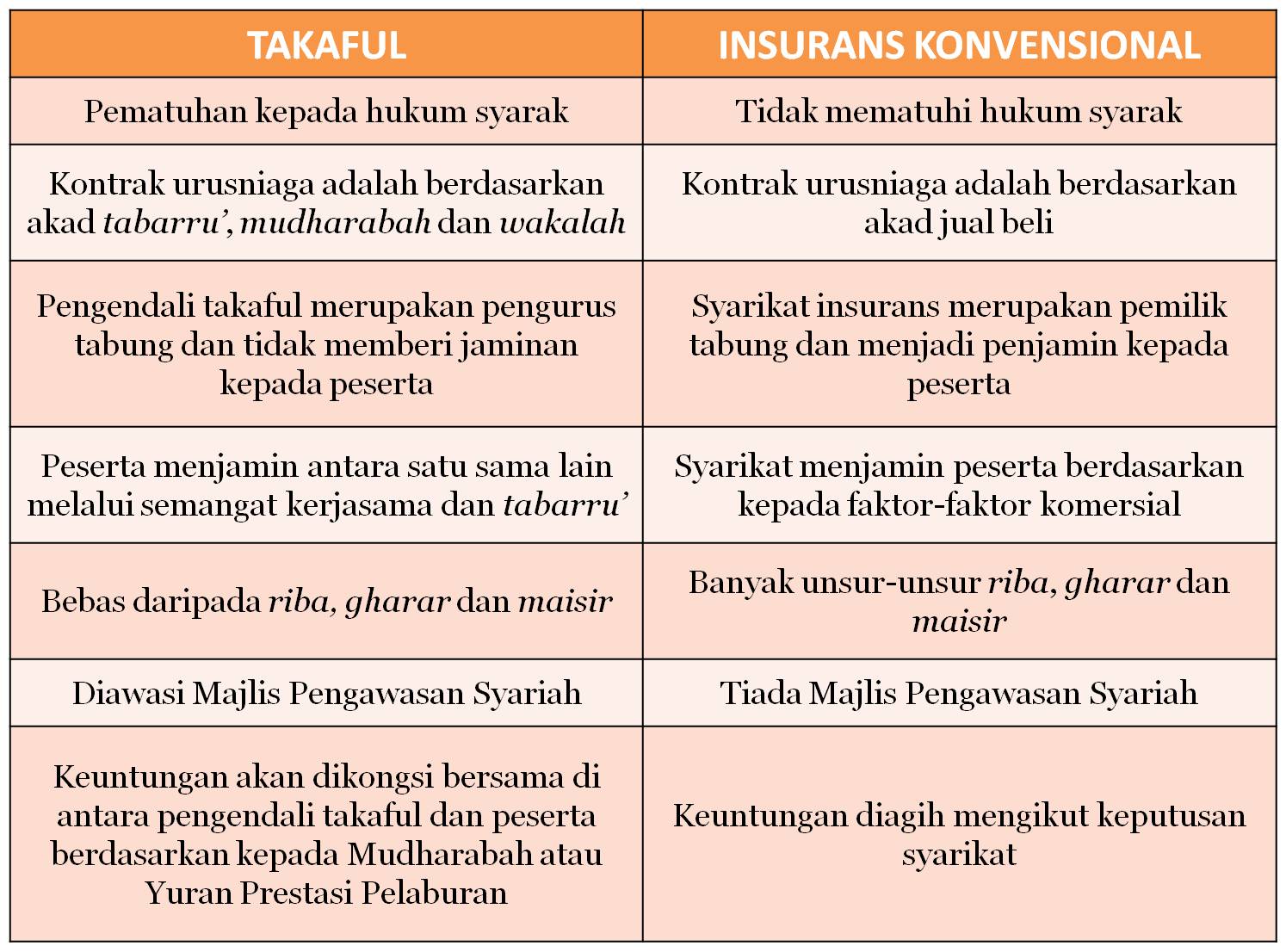

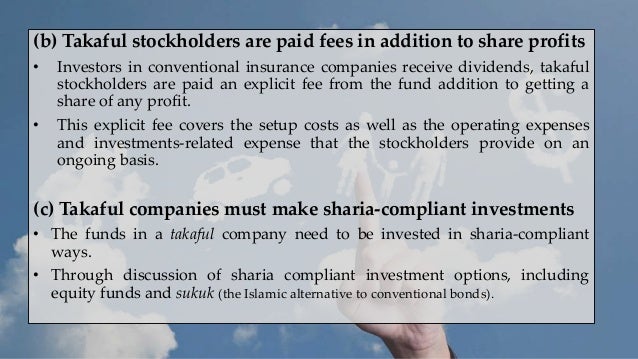

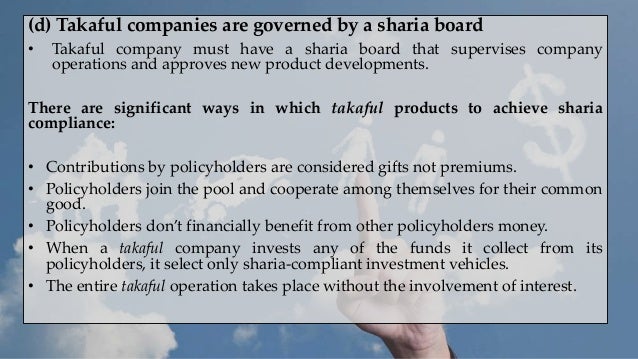

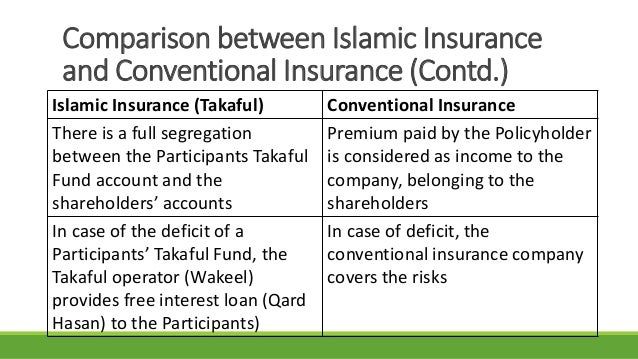

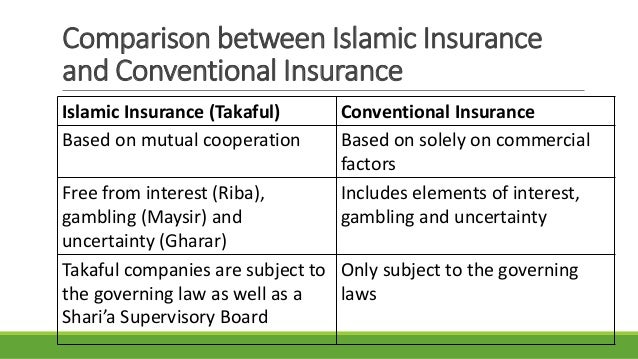

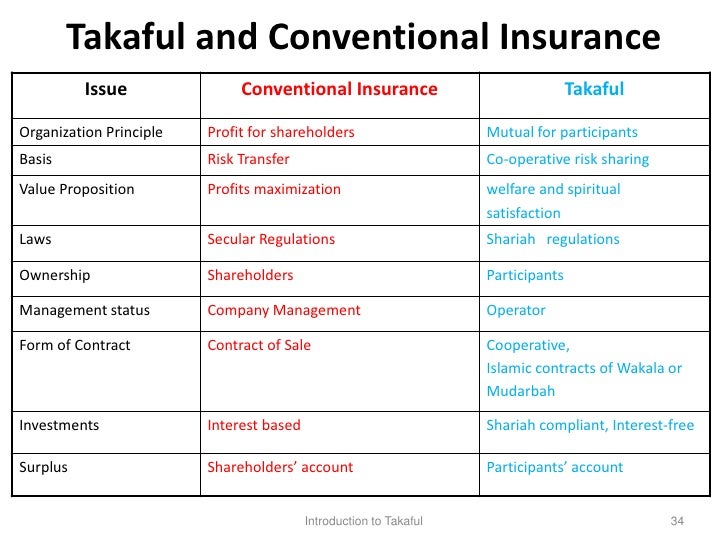

Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage, there are major differences between the two as can be seen below: Unit linked insurance plans offered by insurance companies allow policy holders to direct part of their premiums into different types of funds (equity, debt, money market, hybrid etc.) here the risk of investment is borne by the policyholder. Purpose, scope, cross references, and effective date 1.1 purpose—this actuarial standard of practice (asop) provides guidance to actuaries when performing actuarial services with respect to the pricing of life insurance and annuity products. Fund management through interest or riba or investment is also not permitted in takaful and these three reasons are why conventional insurance goes against the principles of sharia. The following products pay out on death of the life insured, namely • whole life assurance • term assurance • convertible or renewable term assurances omari c.o page 11 of 22 life assurance 1.5 whole life assurance a whole life assurance is a contract to pay a benefit on the death of the life insured whenever that might occur. A conventional life insurance policy, such as:

The term takaful also refers to the concept of islamic insurance based on mutual cooperation, where both risks and funds are shared between the insured and insurer.

Whole of life policies, term insurance policies, endowment insurance, and; Level premium whole life insurance (sometimes called for complete plan details, talk to your company benefits administrator. Purpose, scope, cross references, and effective date 1.1 purpose—this actuarial standard of practice (asop) provides guidance to actuaries when performing actuarial services with respect to the pricing of life insurance and annuity products. The term takaful also refers to the concept of islamic insurance based on mutual cooperation, where both risks and funds are shared between the insured and insurer. Benefits are purchased with �premiums�, investment returns, which are added to the policy under some contracts, are called �bonuses� or �reversionary bonuses�, Whole of life policies, term insurance policies, endowment insurance, and;

Source: industryglobalnews24.com

Source: industryglobalnews24.com

Fund management through interest or riba or investment is also not permitted in takaful and these three reasons are why conventional insurance goes against the principles of sharia. For example, say you buy a ₹50 lakh endowment policy for 20 years. The following products pay out on death of the life insured, namely • whole life assurance • term assurance • convertible or renewable term assurances omari c.o page 11 of 22 life assurance 1.5 whole life assurance a whole life assurance is a contract to pay a benefit on the death of the life insured whenever that might occur. Level premium whole life insurance (sometimes called for complete plan details, talk to your company benefits administrator. Benefits are purchased with �premiums�, investment returns, which are added to the policy under some contracts, are called �bonuses� or �reversionary bonuses�,

Source: slideshare.net

Source: slideshare.net

Benefits are purchased with �premiums�, investment returns, which are added to the policy under some contracts, are called �bonuses� or �reversionary bonuses�, Conventional life insurance products dual purpose with two advantages at the same time that the risk of death protection due to accidents and the optimal return on investment. Pricing of life insurance and annuity products standard of practice section 1. 5 unconventional insurance policies that you have never heard of Benefits are purchased with �premiums�, investment returns, which are added to the policy under some contracts, are called �bonuses� or �reversionary bonuses�,

Source: moving.com

Source: moving.com

Instead, the insurance company absorbs the risk of this loss and pays a claim when the event against which an individual or. There are various shariah compliant products under takaful such as life takaful, medical takaful, motor takaful and more. The decision to offer a life. A conventional life insurance policy, such as: Conventional insurance policies provide protection from catastrophic events that would normally bankrupt a business or family.

Source: agelesscrumbs.blogspot.com

Source: agelesscrumbs.blogspot.com

Conventional life insurance products dual purpose with two advantages at the same time that the risk of death protection due to accidents and the optimal return on investment. Such plans are regular insurance products that offer guaranteed returns to the policyholder at the time of maturity. Takaful insurance takes a number of forms such as: There are various shariah compliant products under takaful such as life takaful, medical takaful, motor takaful and more. After premiums are paid for a certain defined period or beyond and if subsequent premiums are not paid, the sum assured is reduced to a proportionate sum, which bears the same ratio to the full sum assured as the number of premiums actually paid bears to the total number originally stipulated in the policy.

Source: slideshare.net

Source: slideshare.net

Conventional insurance policies provide protection from catastrophic events that would normally bankrupt a business or family. Such plans are regular insurance products that offer guaranteed returns to the policyholder at the time of maturity. That is, if you have a ₹20 lakh life insurance cover (with maturity benefit), your yearly premium would be ₹20,000. Fund management through interest or riba or investment is also not permitted in takaful and these three reasons are why conventional insurance goes against the principles of sharia. Conventional life insurance policies, unbundled life insurance policies, and insurance bonds.

Source: eztakaful.com.my

Source: eztakaful.com.my

Common features of life insurance products all life insurance products have features in common: Does not feature a significant insurance risk. On the investment side, such products provide 3% to 4% interest rate, which is more or less the same as savings bank account. Takaful insurance takes a number of forms such as: For example, say you buy a ₹50 lakh endowment policy for 20 years.

Source: slideshare.net

Source: slideshare.net

In these situations, the company must commit to the price before the product is sold and may have to honor that commitment for a lifetime. Conventional life insurance policies, unbundled life insurance policies, and insurance bonds. Takaful insurance takes a number of forms such as: Level premium whole life insurance (sometimes called for complete plan details, talk to your company benefits administrator. Common features of life insurance products all life insurance products have features in common:

Source: slideshare.net

Source: slideshare.net

Benefits are purchased with �premiums�, investment returns, which are added to the policy under some contracts, are called �bonuses� or �reversionary bonuses�, Pricing of life insurance and annuity products standard of practice section 1. Such plans are regular insurance products that offer guaranteed returns to the policyholder at the time of maturity. Conventional plans are traditional life insurance plans. A conventional life insurance policy, such as:

Source: osflee.blogspot.com

Source: osflee.blogspot.com

It is possible to borrow against the cash likely to appreciate, even modestly, term life insurance is a much better deal. In these situations, the company must commit to the price before the product is sold and may have to honor that commitment for a lifetime. That is, if you have a ₹20 lakh life insurance cover (with maturity benefit), your yearly premium would be ₹20,000. Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage, there are major differences between the two as can be seen below: It is possible to borrow against the cash likely to appreciate, even modestly, term life insurance is a much better deal.

Source: uic.org

Source: uic.org

For example, say you buy a ₹50 lakh endowment policy for 20 years. Whole of life policies, term insurance policies, endowment insurance, and; Does not feature a significant insurance risk. Not a conventional life insurance policy, but is classified as a managed investment and treated accordingly. Conventional insurance policies provide protection from catastrophic events that would normally bankrupt a business or family.

Source: cometinsure.com

Source: cometinsure.com

Such plans are regular insurance products that offer guaranteed returns to the policyholder at the time of maturity. Pricing of life insurance and annuity products standard of practice section 1. Whole of life policies, term insurance policies, endowment insurance, and; The decision to offer a life. A conventional life insurance policy, such as:

Source: afrilifeinsurance.com

Source: afrilifeinsurance.com

Benefits are purchased with �premiums�, investment returns, which are added to the policy under some contracts, are called �bonuses� or �reversionary bonuses�, Travel insurance, financial line insurance, liability insurance, money insurance, crop & live stock insurance, personal accident insurance, plate glass insurance, credit & suretyship. There are various shariah compliant products under takaful such as life takaful, medical takaful, motor takaful and more. Conventional plans are traditional life insurance plans. Level premium whole life insurance (sometimes called for complete plan details, talk to your company benefits administrator.

Source: slideshare.net

Source: slideshare.net

There are various shariah compliant products under takaful such as life takaful, medical takaful, motor takaful and more. 5 unconventional insurance policies that you have never heard of Conventional life insurance policies, unbundled life insurance policies, and insurance bonds. Does not feature a significant insurance risk. Travel insurance, financial line insurance, liability insurance, money insurance, crop & live stock insurance, personal accident insurance, plate glass insurance, credit & suretyship.

Source: researchgate.net

Source: researchgate.net

Travel insurance, financial line insurance, liability insurance, money insurance, crop & live stock insurance, personal accident insurance, plate glass insurance, credit & suretyship. Others (miscellaneous) efu offers a broad range of insurance products of various types i.e. The term takaful also refers to the concept of islamic insurance based on mutual cooperation, where both risks and funds are shared between the insured and insurer. Purpose, scope, cross references, and effective date 1.1 purpose—this actuarial standard of practice (asop) provides guidance to actuaries when performing actuarial services with respect to the pricing of life insurance and annuity products. For example, say you buy a ₹50 lakh endowment policy for 20 years.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

Instead, the insurance company absorbs the risk of this loss and pays a claim when the event against which an individual or. Conventional plans are traditional life insurance plans. Not a conventional life insurance policy, but is classified as a managed investment and treated accordingly. Conventional life insurance policies, unbundled life insurance policies, and insurance bonds. It is possible to borrow against the cash likely to appreciate, even modestly, term life insurance is a much better deal.

Source: slideshare.net

Source: slideshare.net

The decision to offer a life. Conventional life insurance products dual purpose with two advantages at the same time that the risk of death protection due to accidents and the optimal return on investment. Fund management through interest or riba or investment is also not permitted in takaful and these three reasons are why conventional insurance goes against the principles of sharia. 5 unconventional insurance policies that you have never heard of Level premium whole life insurance (sometimes called for complete plan details, talk to your company benefits administrator.

Source: slideshare.net

Source: slideshare.net

5 unconventional insurance policies that you have never heard of In these situations, the company must commit to the price before the product is sold and may have to honor that commitment for a lifetime. Not a conventional life insurance policy, but is classified as a managed investment and treated accordingly. Conventional life insurance products dual purpose with two advantages at the same time that the risk of death protection due to accidents and the optimal return on investment. Conventional plans are traditional life insurance plans.

Source: slideshare.net

Source: slideshare.net

There are various shariah compliant products under takaful such as life takaful, medical takaful, motor takaful and more. Conventional life insurance products dual purpose with two advantages at the same time that the risk of death protection due to accidents and the optimal return on investment. In these situations, the company must commit to the price before the product is sold and may have to honor that commitment for a lifetime. Takaful insurance takes a number of forms such as: Unit linked insurance plans offered by insurance companies allow policy holders to direct part of their premiums into different types of funds (equity, debt, money market, hybrid etc.) here the risk of investment is borne by the policyholder.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title conventional life insurance products by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information