Conversion provision in group life insurance information

Home » Trending » Conversion provision in group life insurance informationYour Conversion provision in group life insurance images are available. Conversion provision in group life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Conversion provision in group life insurance files here. Find and Download all free vectors.

If you’re searching for conversion provision in group life insurance images information linked to the conversion provision in group life insurance interest, you have come to the ideal site. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

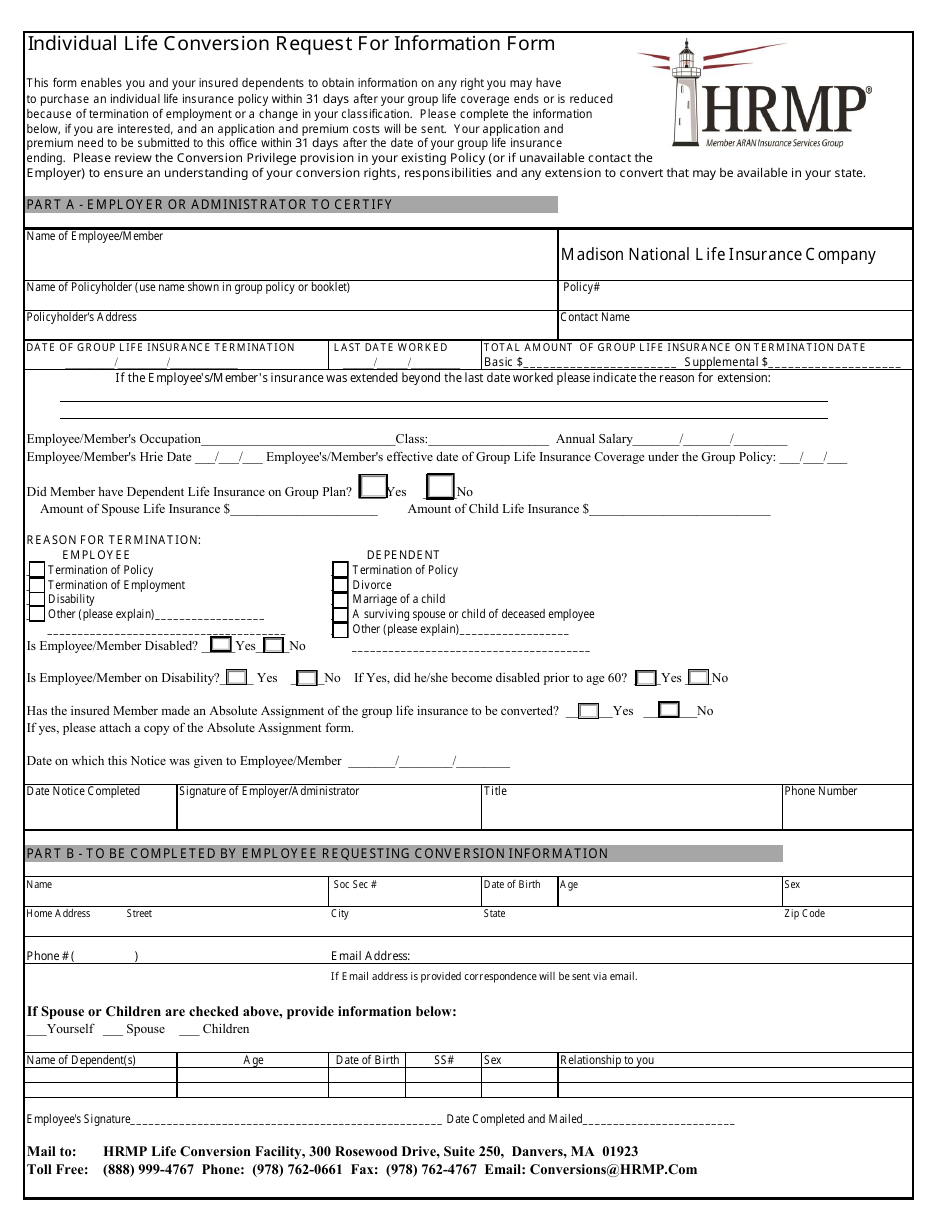

Conversion Provision In Group Life Insurance. No medical examination or other evidence of good health is required for a conversion policy. Under this provision, eligible employees have the right to convert their group life insurance, including any additional life, supplemental life and. (2) that in no event shall insurance take effect unless the provisions for conversion of insurance contained in the group policy have been fully complied with, the full first premium has been paid, and the insurance under the group policy has been terminated. Hrmp, life conversion facility, 300 rosewood drive, suite 250, danvers, ma 01923.

Conversion Provision In Group Life Insurance Laws Under From elissabebongs.blogspot.com

Conversion Provision In Group Life Insurance Laws Under From elissabebongs.blogspot.com

The group term life insurance coverages are terminating as indicated above. The provision usually provides only conversion to an individual whole life policy and normally does not require the individual to demonstrate he is insurable. The right to convert provision is another life insurance. Name of employer (use name shown in group policy or booklet): Under this provision, eligible employees have the right to convert their group life insurance, including any additional life, supplemental life and. Conversion means you can change (convert) your coverage to an individual whole life policy.

(2) that in no event shall insurance take effect unless the provisions for conversion of insurance contained in the group policy have been fully complied with, the full first premium has been paid, and the insurance under the group policy has been terminated.

If you are unable to qualify for life insurance elsewhere then the portability or conversion provision may be a good option for you. Health insurance, continuation and conversion benefits issues: The provision usually provides only conversion to an individual whole life policy and normally does not require the individual to demonstrate he is insurable. Please note that an employer should reference their specific contract for more details. According to florida law, all group life policies must contain a conversion provision, which allows the covered individual 31 days to convert the group coverage to an individual plan without evidence of insurability if their employment is terminated. You may be eligible to convert existing coverage(s) to an individual life policy by mailing this form within 31 days (see the certificate for applicable time period) of such termination.

Source: revisi.net

Source: revisi.net

Option for eligible employees if their group life insurance ends or is reduced for any reason other than failure to pay premiums. Under this provision, eligible employees have the right to convert their group life insurance, including any additional life, supplemental life and. With this provision, an employee can convert her group life insurance policy into. Conversion means you can change (convert) your coverage to an individual whole life policy. There is a provision available with many term life insurance policies that many people are not aware of.

Source: insurancecomswa.blogspot.com

Health insurance, continuation and conversion benefits issues: The group term life insurance coverages are terminating as indicated above. Benefit with an individual whole life insurance policy if all or part of his/her coverage under the group life insurance policy terminates. Although, i’m probably one of the few people that’s actually. The amount of premium an individual pays for this new policy is.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

Why would someone choose to continue their life insurance? Here’s how portability and conversion work. Usually, the coverage offered by group life insurance is a modest term policy, which is a component of an employee’s benefits package. Please note that an employer should reference their specific contract for more details. Sometimes, a group policy is purchased through another entity, like a membership organization.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

Which provision is not a requirement in a group life policy? The conversion provision allows a separated employee to convert their life insurance coverage to a private plan, and it usually does not require. Here’s how portability and conversion work. An insured whose coverage is reduced because of age, if available in the group life insurance certificate of insurance, (2) that in no event shall insurance take effect unless the provisions for conversion of insurance contained in the group policy have been fully complied with, the full first premium has been paid, and the insurance under the group policy has been terminated.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

The provision usually provides only conversion to an individual whole life policy and normally does not require the individual to demonstrate he is insurable. Depending on the plan, this conversion will have to take place in the first month after separating employment. Hrmp, life conversion facility, 300 rosewood drive, suite 250, danvers, ma 01923. The majority of group life insurance policies include a waiver of premium provision. You may be eligible to convert existing coverage(s) to an individual life policy by mailing this form within 31 days (see the certificate for applicable time period) of such termination.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

This provision is an enhancement as it provides life insurance benefits without payment of premiums for those that meet certain requirements. And because it costs a little bit extra, they will likely pass on it even if they are made aware of it. Certificate master policy participation agreement individual policy. Conversion means you can change (convert) your coverage to an individual whole life policy. The amount of premium an individual pays for this new policy is.

Source: lavislaw.com

Source: lavislaw.com

The converted policy will be effective 31 days after coverage under the group life insurance policy terminates. (most group conversion provisions require the individual to convert the coverage under a group term plan to a whole life policy.) if an employee in poor health is part of a large group that is acceptable for group life insurance, that employee is? The conversion provision allows a separated employee to convert their life insurance coverage to a private plan, and it usually does not require. The right to convert provision is another life insurance. The amount of premium an individual pays for this new policy is.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

Although, i’m probably one of the few people that’s actually. Why would someone choose to continue their life insurance? Please note that an employer should reference their specific contract for more details. Which provision is not a requirement in a group life policy? If you are unable to qualify for life insurance elsewhere then the portability or conversion provision may be a good option for you.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

Option for eligible employees if their group life insurance ends or is reduced for any reason other than failure to pay premiums. It’s the term life conversion option, and it could be the single best method available […] Which provision is not a requirement in a group life policy? Group term life insurance will sometimes have a conversion option that allows you to convert your term policy to a whole life policy. Conversion grace period incontestable period accidental.

Source: vitalpartnersinc.com

Source: vitalpartnersinc.com

These current empire life products are available as conversion options for inforce life insurance policies with. An insured whose coverage is reduced because of age, if available in the group life insurance certificate of insurance, If the insured dies before the end of the conversion period or before converting the policy, benefits. And because it costs a little bit extra, they will likely pass on it even if they are made aware of it. Usually, the coverage offered by group life insurance is a modest term policy, which is a component of an employee’s benefits package.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

(2) that in no event shall insurance take effect unless the provisions for conversion of insurance contained in the group policy have been fully complied with, the full first premium has been paid, and the insurance under the group policy has been terminated. Option for eligible employees if their group life insurance ends or is reduced for any reason other than failure to pay premiums. The office of general counsel issued the following informal opinion on march 18, 2002, representing the position of the new york state insurance department. The converted policy will be effective 31 days after coverage under the group life insurance policy terminates. This provision is an enhancement as it provides life insurance benefits without payment of premiums for those that meet certain requirements.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

A life insurance conversion privilege is a clause in a life insurance contract that makes it easier for individuals to qualify for individual life insurance after leaving a group life insurance plan. Under this provision, eligible employees have the right to convert their group life insurance, including any additional life, supplemental life and. Option for eligible employees if their group life insurance ends or is reduced for any reason other than failure to pay premiums. Depending on the plan, this conversion will have to take place in the first month after separating employment. Conversion with sun life financial group life and ad&d plans, employees can take their coverage with them by porting or converting.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

Group term life insurance will sometimes have a conversion option that allows you to convert your term policy to a whole life policy. Convert up to the amount of coverage terminating under the group life insurance policy, but not less than $2,000 (unless your benefit was less than $2,000). Please note that an employer should reference their specific contract for more details. Usually, the coverage offered by group life insurance is a modest term policy, which is a component of an employee’s benefits package. This provision is an enhancement as it provides life insurance benefits without payment of premiums for those that meet certain requirements.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

Option for eligible employees if their group life insurance ends or is reduced for any reason other than failure to pay premiums. A life insurance conversion privilege is a clause in a life insurance contract that makes it easier for individuals to qualify for individual life insurance after leaving a group life insurance plan. The majority of group life insurance policies include a waiver of premium provision. Read the conversion section/provision in the group certificate to determine. You may be eligible to convert existing coverage(s) to an individual life policy by mailing this form within 31 days (see the certificate for applicable time period) of such termination.

Source: elissabebongs.blogspot.com

When an employee is terminated, which statement about a group term life conversion is true? The policy provision that permits an employee to change from group life coverage to an individual life policy is called the a. Sometimes, a group policy is purchased through another entity, like a membership organization. A life insurance conversion privilege is a clause in a life insurance contract that makes it easier for individuals to qualify for individual life insurance after leaving a group life insurance plan. The group term life insurance coverages are terminating as indicated above.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

Contract of insurance, and declare that they have been correctly recorded. Conversion means you can change (convert) your coverage to an individual whole life policy. Contract of insurance, and declare that they have been correctly recorded. An insured whose coverage is reduced because of age, if available in the group life insurance certificate of insurance, These current empire life products are available as conversion options for inforce life insurance policies with.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

It’s the term life conversion option, and it could be the single best method available […] It’s the term life conversion option, and it could be the single best method available […] These current empire life products are available as conversion options for inforce life insurance policies with. Hrmp, life conversion facility, 300 rosewood drive, suite 250, danvers, ma 01923. Which provision is not a requirement in a group life policy?

Source: revisi.net

Source: revisi.net

Group life insurance covers a group of people under a single contract, often provided by your employer. Convert up to the amount of coverage terminating under the group life insurance policy, but not less than $2,000 (unless your benefit was less than $2,000). Is an insurer required to issue a conversion policy or contract that provides the same benefits as were provided in the former group policy. No medical examination or other evidence of good health is required for a conversion policy. A person who is insured within a group contract will be given a.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title conversion provision in group life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea