Convertible life insurance information

Home » Trending » Convertible life insurance informationYour Convertible life insurance images are ready in this website. Convertible life insurance are a topic that is being searched for and liked by netizens today. You can Get the Convertible life insurance files here. Get all royalty-free photos.

If you’re searching for convertible life insurance pictures information connected with to the convertible life insurance topic, you have visit the ideal blog. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

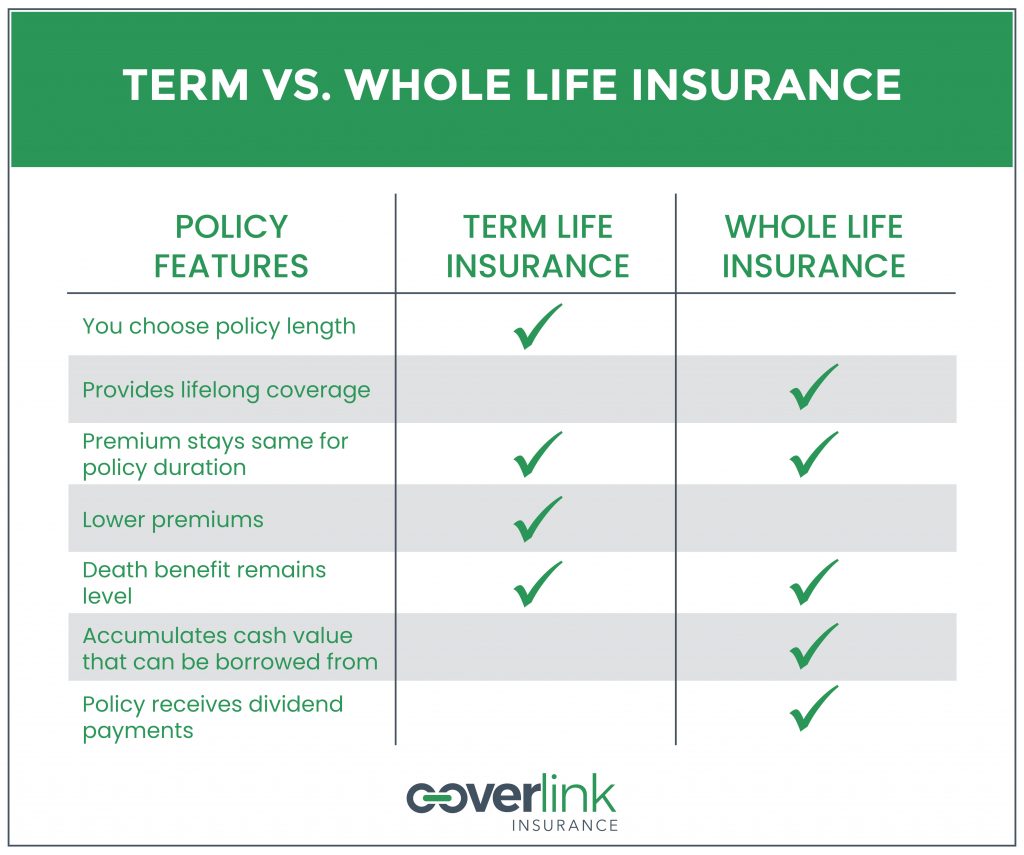

Convertible Life Insurance. Life auto home health business renter disability commercial auto long term care annuity. It’s also known as a ‘conversion option’ as part of a term life insurance policy. Convertible term is a form of life insurance that allows you to exchange it for permanent life insurance without going through the insurance company’s underwriting process. Reasons to consider a convertible policy

Convertible Term Life Insurance Whole Vs Term Life From wholevstermlifeinsurance.com

Convertible Term Life Insurance Whole Vs Term Life From wholevstermlifeinsurance.com

It’s also known as a ‘conversion option’ as part of a term life insurance policy. The affordable protection of a term policy now, plus the option to convert to a permanent life insurance policy later on. They can be exchanged for, or converted to, permanent policies issued by the same insurance company. Life auto home health business renter disability commercial auto long term care annuity. Convertible life insurance, also called convertible insurance, is a type of term life insurance that allows the policy owner to convert the term coverage into permanent coverage without undergoing a new underwriting process. You can convert the cover under the policy into a new policy, to allow it to run for a longer period of time.

Typically the convertible part of the policy is a rider.

Normally, you won�t be asked to undergo a physical. Typically the convertible part of the policy is a rider. Convertible life insurance allows you to transition your term life policy into a permanent life policy. Learn more about convertible term life insurance, including how it works and whether it might be a good life insurance choice for you. Term life insurance lasts a specific period — such as 10, 20 or 30 years — and your beneficiary gets a payout from the insurer if you die within that timeframe. This article will tell you more about:

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

This feature is also called a conversion privilege, guaranteed renewable, or guaranteed insurability. Term life insurance lasts a specific period — such as 10, 20 or 30 years — and your beneficiary gets a payout from the insurer if you die within that timeframe. As a result, convertible term life insurance generally ensures that you can buy a permanent policy even if you develop a medical condition in the future. Convertible term assurance is a type of term policy that allows you to convert to a whole of life policy at the end of the policy term, without providing new medical information. The good news is, a convertible term life insurance policy can give you the best of both worlds:

Source: everquote.com

Source: everquote.com

It’s also known as a ‘conversion option’ as part of a term life insurance policy. With convertible life insurance, the insurer guarantees that you can convert your policy, and the underwriting process is simplified. Most life insurance policies have a number of riders that can be attached to alter the way a policy works. It’s also known as a ‘conversion option’ as part of a term life insurance policy. The good news is, a convertible term life insurance policy can give you the best of both worlds:

Source: everquote.com

Source: everquote.com

Normally, you won�t be asked to undergo a physical. You can convert the cover under the policy into a new policy, to allow it to run for a longer period of time. While a term life policy may be the right fit for you today, years later you may want to switch to permanent life insurance coverage. Convertible insurance is a type of life insurance that allows the policy owner to change a term policy into a whole or universal policy without going through the health qualification process again. Most life insurance policies have a number of riders that can be attached to alter the way a policy works.

Source: prosperitylife.com

Renewable and convertible life insurance 👪 feb 2022. This feature is also called a conversion privilege, guaranteed renewable, or guaranteed insurability. Life auto home health business renter disability commercial auto long term care annuity. (the term policy will state whether it’s convertible, along with any time limits on making the move. Convertible term life insurance is a policy that provides the insurer with the option of converting a term policy to a permanent one at the conclusion of the term without any penalties or having to undergo a medical exam.

Source: partners4prosperity.com

Source: partners4prosperity.com

It gives you the flexibility to keep your life cover in place if your needs change in the future. Term life insurance is a policy that provides the insured person coverage for a certain period of time. You can convert the cover under the policy into a new policy, to allow it to run for a longer period of time. So, what is convertible term life insurance? Convertible life insurance is term life insurance policy that can transform into a permanent policy later down the road when the timing is.

Source: trustlife.ca

Source: trustlife.ca

The conversion duration is shorter than the stretch of time the term life insurance covers the insured. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. A convertible life insurance policy allows you to make the most of low premiums now while knowing you’ll still qualify for permanent coverage later on — regardless of your health. At age 45, he decides to convert that policy to a permanent life insurance policy. Convertible life insurance allows you to transition your term life policy into a permanent life policy.

Source: onlineinsuranceadvices.blogspot.com

Source: onlineinsuranceadvices.blogspot.com

As a result, convertible term life insurance generally ensures that you can buy a permanent policy even if you develop a medical condition in the future. This article will tell you more about: It gives you the flexibility to keep your life cover in place if your needs change in the future. Term life insurance is a policy that provides the insured person coverage for a certain period of time. Typically the convertible part of the policy is a rider.

Source: coverfox.com

Source: coverfox.com

This article will tell you more about: The good news is, a convertible term life insurance policy can give you the best of both worlds: Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. (the term policy will state whether it’s convertible, along with any time limits on making the move. Convertible term is a form of life insurance that allows you to exchange it for permanent life insurance without going through the insurance company’s underwriting process.

Source: everquote.com

Source: everquote.com

Convertible term cover allows you to extend the term of your policy at any point without having to undergo a fresh medical examination or provide any evidence of good health. Most life insurance policies have a number of riders that can be attached to alter the way a policy works. At age 45, he decides to convert that policy to a permanent life insurance policy. Convertible life insurance typically refers to an arrangement that grants the person insured by a term insurance policy to alter their insurance plan from a term life insurance policy to a permanent or whole life insurance policy. So, what is convertible term life insurance?

Source: writingviews.com

Source: writingviews.com

Reasons to consider a convertible policy A convertible life insurance policy is simply a term life insurance policy that can convert to a permanent life insurance policy. Term life insurance lasts a specific period — such as 10, 20 or 30 years — and your beneficiary gets a payout from the insurer if you die within that timeframe. It gives you the flexibility to keep your life cover in place if your needs change in the future. Convertible term life insurance 👪 feb 2022.

Source: pinterest.com

Source: pinterest.com

Convertible life insurance typically refers to an arrangement that grants the person insured by a term insurance policy to alter their insurance plan from a term life insurance policy to a permanent or whole life insurance policy. Term life insurance lasts a specific period — such as 10, 20 or 30 years — and your beneficiary gets a payout from the insurer if you die within that timeframe. Convertible term is a form of life insurance that allows you to exchange it for permanent life insurance without going through the insurance company’s underwriting process. Convertible term cover allows you to extend the term of your policy at any point without having to undergo a fresh medical examination or provide any evidence of good health. As a result, convertible term life insurance generally ensures that you can buy a permanent policy even if you develop a medical condition in the future.

Source: flickr.com

Source: flickr.com

The affordable protection of a term policy now, plus the option to convert to a permanent life insurance policy later on. Convertible term life insurance 👪 feb 2022. A convertible life insurance policy is a term policy that can be converted into whole or permanent life insurance. Most life insurance policies have a number of riders that can be attached to alter the way a policy works. Term life insurance lasts a specific period — such as 10, 20 or 30 years — and your beneficiary gets a payout from the insurer if you die within that timeframe.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

Convertible life insurance is term life insurance policy that can transform into a permanent policy later down the road when the timing is. Convertible life insurance typically refers to an arrangement that grants the person insured by a term insurance policy to alter their insurance plan from a term life insurance policy to a permanent or whole life insurance policy. They can be exchanged for, or converted to, permanent policies issued by the same insurance company. Convertible life insurance, also called convertible insurance, is a type of term life insurance that allows the policy owner to convert the term coverage into permanent coverage without undergoing a new underwriting process. Most term life insurance policies are convertible:

Source: nilife.com

Source: nilife.com

A convertible life insurance policy is a term policy that can be converted into whole or permanent life insurance. Most term life insurance policies are convertible: This article will tell you more about: (the term policy will state whether it’s convertible, along with any time limits on making the move. So, what is convertible term life insurance?

Source: youtube.com

Source: youtube.com

The conversion duration is shorter than the stretch of time the term life insurance covers the insured. Learn more about convertible term life insurance, including how it works and whether it might be a good life insurance choice for you. The conversion duration is shorter than the stretch of time the term life insurance covers the insured. Convertible insurance is a type of life insurance that allows the policy owner to change a term policy into a whole or universal policy without going through the health qualification process again. This article will tell you more about:

Source: pinterest.com

Source: pinterest.com

This feature is also called a conversion privilege, guaranteed renewable, or guaranteed insurability. With convertible life insurance, the insurer guarantees that you can convert your policy, and the underwriting process is simplified. It gives you the flexibility to keep your life cover in place if your needs change in the future. How convertible life insurance works; It’s also known as a ‘conversion option’ as part of a term life insurance policy.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

A convertible insurance policy is a term related to life insurance. They can be exchanged for, or converted to, permanent policies issued by the same insurance company. Convertible life insurance allows you to transition your term life policy into a permanent life policy. Term life insurance is a policy that provides the insured person coverage for a certain period of time. Term life differs from permanent or whole life insurance as that coverage stays with you for your whole life.

Source: npa1.org

Source: npa1.org

Normally, you won�t be asked to undergo a physical. This article will tell you more about: Convertible insurance is a type of life insurance that allows the policy owner to change a term policy into a whole or universal policy without going through the health qualification process again. Most term life insurance policies are convertible: This feature is also called a conversion privilege, guaranteed renewable, or guaranteed insurability.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title convertible life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea