Converting a group plan to permanent life insurance Idea

Home » Trend » Converting a group plan to permanent life insurance IdeaYour Converting a group plan to permanent life insurance images are available. Converting a group plan to permanent life insurance are a topic that is being searched for and liked by netizens now. You can Get the Converting a group plan to permanent life insurance files here. Find and Download all royalty-free photos.

If you’re looking for converting a group plan to permanent life insurance pictures information linked to the converting a group plan to permanent life insurance topic, you have pay a visit to the ideal blog. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Converting A Group Plan To Permanent Life Insurance. Though most term life plans are convertible, many policyholders don�t take advantage of it. Group benefits life conversion option. And now you have to decide whether to go with group sponsored life insurance policy. These are standard rates per $1,000 of insurance and apply to most individuals who are converting.

Life Insurance Conversion Period Annuity Conversion From myplatinumresign.blogspot.com

Life Insurance Conversion Period Annuity Conversion From myplatinumresign.blogspot.com

And now you have to decide whether to go with group sponsored life insurance policy. Some insurance companies do offer the option to continue coverage by converting to an individual permanent life insurance policy. However, many term life policies let you convert them to permanent insurance, such as whole life or universal life, without having to undergo a. Your group life insurance ends. Converting a group plan to permanent life insurance. Before you try to convert your permanent life insurance to term life insurance, you need to understand the differences between the two.

And now you have to decide whether to go with group sponsored life insurance policy.

Converting a term life insurance policy to a permanent policy allows you to extend your coverage without going through the underwriting process. Before you try to convert your permanent life insurance to term life insurance, you need to understand the differences between the two. Collect your current policy information. Most term policies offer you that option for. You will want to, with the help of an independent agent, understand the specific life insurance products available to convert to, like universal or whole life. Most group plans offer some type of conversion provision built into the policy.

Source: financialsamurai.com

Source: financialsamurai.com

You buy a separate permanent policy to go along with the current term policy. Individual plan upon employment termination. And now you have to decide whether to go with group sponsored life insurance policy. Group life insurance vs individual life insurance coverage you just started a new career or been with a company for a while and open enrollment is around the corner. The most common conversion option of a life insurance policy is from term to permanent.

Source: nisbenefits.com

Source: nisbenefits.com

Individual plan upon employment termination. Individual policy in the spouse�s name. Collect your current policy information. Term life insurance policies are temporary, but you can convert to a permanent life policy if you have a convertible term life policy. Term life insurance provides affordable coverage at a guaranteed premium for a certain amount of time, such as 10, 15, 20 or 30 years.

Source: themilitarywallet.com

Source: themilitarywallet.com

However, many term life policies let you convert them to permanent insurance, such as whole life or universal life, without having to undergo a. The life insurance company will extend coverage based on the fact that they were already approved as part of the group life insurance plan. Converting a group plan to permanent life insurance. Though most term life plans are convertible, many policyholders don�t take advantage of it. You can’t afford the higher premiums of a perm policy.

Source: nrilifeinsurance.com

Source: nrilifeinsurance.com

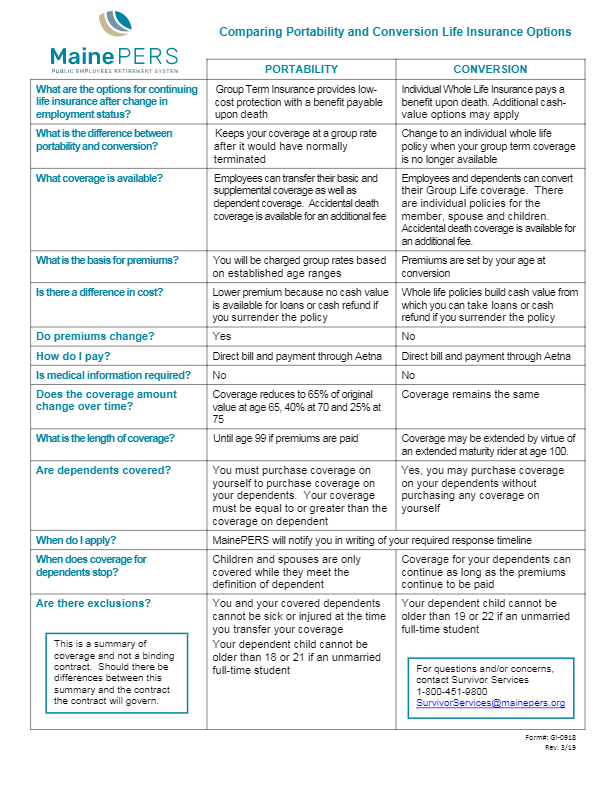

Term life insurance is the most affordable type of life insurance , and it only lasts for a specific period of time, usually 10 to 20 years, but it can be longer or shorter. These are standard rates per $1,000 of insurance and apply to most individuals who are converting. Here’s how portability and conversion work. Before you try to convert your permanent life insurance to term life insurance, you need to understand the differences between the two. Collect your current policy information.

Source: revisi.net

Source: revisi.net

However, many term life policies let you convert them to permanent insurance, such as whole life or universal life, without having to undergo a. Premium rates for the prudential guaranteed life insurance policy, issued by the prudential insurance company of america, are included in this brochure. Individual plan upon employment termination. In other words, as your income increases and your protection needs change, your life insurance strategy can change with you by potentially converting to a whole life policy later. Be sure to have on hand:

Source: nrilifeinsurance.com

Source: nrilifeinsurance.com

After the term ends, the premium spikes dramatically and continues to go up each year. Though most term life plans are convertible, many policyholders don�t take advantage of it. Your spouse’s group life insurance ends due to divorce, legal separation, or reaching the age limit in the group policy. Keep the term policy and ignore conversion to permanent life if: Term life insurance policies are temporary, but you can convert to a permanent life policy if you have a convertible term life policy.

Source: kennedyinvestmentgroup.com

Source: kennedyinvestmentgroup.com

Group benefits life conversion option. Most group plans offer some type of conversion provision built into the policy. Check the group life insurance plan set up by your employer to determine the type of policy you have. You need life insurance only for a limited time. In other words, as your income increases and your protection needs change, your life insurance strategy can change with you by potentially converting to a whole life policy later.

Source: blogarama.com

Source: blogarama.com

Check the group life insurance plan set up by your employer to determine the type of policy you have. You can’t afford the higher premiums of a perm policy. Some group plans offers a type of portable group insurance in which individuals carry the policy with them when they leave their employer. A conversion clause is a section of most life insurance contracts that allow policyholders to convert their term life insurance policy to a permanent form of life insurance. Annually renewable term a group life insurance plan must insure all eligible employees if the.

Source: myplatinumresign.blogspot.com

Source: myplatinumresign.blogspot.com

Some insurance companies do offer the option to continue coverage by converting to an individual permanent life insurance policy. Term life insurance policies typically offer the option to convert them into a permanent life insurance policy. Though most term life plans are convertible, many policyholders don�t take advantage of it. However, many term life policies let you convert them to permanent insurance, such as whole life or universal life, without having to undergo a. Be sure to have on hand:

Source: singh-insurancegroup.com

Source: singh-insurancegroup.com

Term life insurance is the most affordable type of life insurance , and it only lasts for a specific period of time, usually 10 to 20 years, but it can be longer or shorter. Some insurance companies do offer the option to continue coverage by converting to an individual permanent life insurance policy. You buy a separate permanent policy to go along with the current term policy. Converting a term life insurance policy to a permanent policy allows you to extend your coverage without going through the underwriting process. Collect your current policy information.

Source: fieldinsurance.com

Source: fieldinsurance.com

Whether to convert to permanent life insurance depends on your situation. Some group plans offers a type of portable group insurance in which individuals carry the policy with them when they leave their employer. The right to convert to a prudential guaranteed life insurance policy is guaranteed, provided. Whether to convert to permanent life insurance depends on your situation. Instead, they let the term life policy lapse and then buy a new term life policy or go without coverage.

Source: bankrate.com

Source: bankrate.com

The right to convert to a prudential guaranteed life insurance policy is guaranteed, provided. The life insurance company will extend coverage based on the fact that they were already approved as part of the group life insurance plan. Individual plan upon employment termination. You will want to, with the help of an independent agent, understand the specific life insurance products available to convert to, like universal or whole life. The conversion being applied within one month of termination the type of insurance most frequently used in group life plans is.

Source: fbsbenefits.com

Source: fbsbenefits.com

Individual plan upon employment termination. Check the group life insurance plan set up by your employer to determine the type of policy you have. Depending on the plan, this conversion will have to take place in the first month after separating. Group benefits life conversion option. Converting a group plan to permanent life insurance involves.

Source: pinterest.com

Source: pinterest.com

Here’s how portability and conversion work. Group term life insurance will sometimes have a conversion option that allows you to convert your term policy to a whole life policy. Collect your current policy information. Whenever you buy term insurance, make sure the policy has the option to convert to a permanent policy. Converting a group plan to permanent life insurance requires?

Source: blog.nisbenefits.com

Source: blog.nisbenefits.com

Term life insurance policies are temporary, but you can convert to a permanent life policy if you have a convertible term life policy. Term life insurance policies typically offer the option to convert them into a permanent life insurance policy. Keep the term policy and ignore conversion to permanent life if: Here’s how portability and conversion work. The life insurance company will extend coverage based on the fact that they were already approved as part of the group life insurance plan.

Source: nrilifeinsurance.com

Source: nrilifeinsurance.com

Individual plan upon employment termination. In other words, as your income increases and your protection needs change, your life insurance strategy can change with you by potentially converting to a whole life policy later. A conversion clause is a section of most life insurance contracts that allow policyholders to convert their term life insurance policy to a permanent form of life insurance. Group benefits life conversion option. Term life insurance policies typically offer the option to convert them into a permanent life insurance policy.

Source: insurance-resource.ca

Source: insurance-resource.ca

Group term life insurance will sometimes have a conversion option that allows you to convert your term policy to a whole life policy. Some group plans offers a type of portable group insurance in which individuals carry the policy with them when they leave their employer. Group term life insurance will sometimes have a conversion option that allows you to convert your term policy to a whole life policy. You will want to, with the help of an independent agent, understand the specific life insurance products available to convert to, like universal or whole life. Converting a group plan to permanent life insurance involves.

Source: mainepers.org

Source: mainepers.org

Most term policies offer you that option for. Individual plan with another insurer that has better rates. After the term ends, the premium spikes dramatically and continues to go up each year. Collect your current policy information. Check the group life insurance plan set up by your employer to determine the type of policy you have.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title converting a group plan to permanent life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information