Cooling off period life insurance information

Home » Trending » Cooling off period life insurance informationYour Cooling off period life insurance images are available. Cooling off period life insurance are a topic that is being searched for and liked by netizens today. You can Download the Cooling off period life insurance files here. Find and Download all free images.

If you’re searching for cooling off period life insurance pictures information related to the cooling off period life insurance interest, you have visit the right blog. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

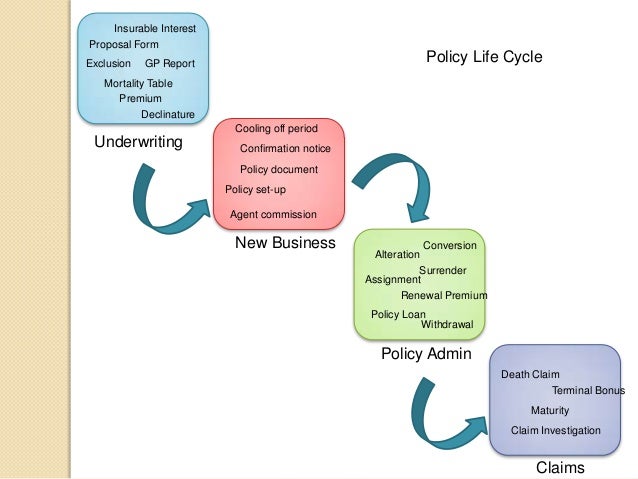

Cooling Off Period Life Insurance. Premiums for life cover won’t be refunded if you terminate after this period unless you pay your yearly premium in advance. Can i cancel my life insurance policy at any time? The annual notice will include: This ‘cool off’ period can range from a few days to a couple of months.

Jargon Buster CoolingOff vs Waiting Period MiWayLife From miwaylife.co.za

Jargon Buster CoolingOff vs Waiting Period MiWayLife From miwaylife.co.za

It can range from a few days to couple of months. This includes renewals for insurance where the agreement has been sent by post. Most of the time, it�s whichever of those two things is later. This period will be different, depending on the insurer. Within this period, you can cancel your plan and ask for full refund. Can i cancel my life insurance policy at any time?

This is called cooling off period.

This is called cooling off period. A consumer has a right to cancel, without penalty and without giving any reason, within: And g) provide you with an annual notice in writing each year prior to the anniversary of your life insurance policy. There is a cooling off period with your life insurance; How do cooling off periods operate? If the proposer withdraws from the contract, then the insurance company will have to return the premium paid minus some deductions, such as the cost of covering the risk for the short period during which cover was provided, medical examination expenses and stamp duty.

Source: miwaylife.co.za

Source: miwaylife.co.za

The insurer is under an obligation to inform the assured of the right of cancellation, and the time for cancellation runs. Or (2) 14 days for any other. This is the cooling off period. Your period of insurance is shown in your policy schedule. You have the right to cancel your life insurance policy within 15 days from the day you signed up for the plan.

Source: qobupez.dfaduke.com

You have 30 days from the date the policy schedule or any other important documents are issued to check that the insurance meets your needs. Contact details if you have any questions or need to make a claim You have the right to cancel your life insurance policy within 15 days from the day you signed up for the plan. How do cooling off periods operate? If the proposer withdraws from the contract, then the insurance company will have to return the premium paid minus some deductions, such as the cost of covering the risk for the short period during which cover was provided, medical examination expenses and stamp duty.

Source: mozo.com.au

Source: mozo.com.au

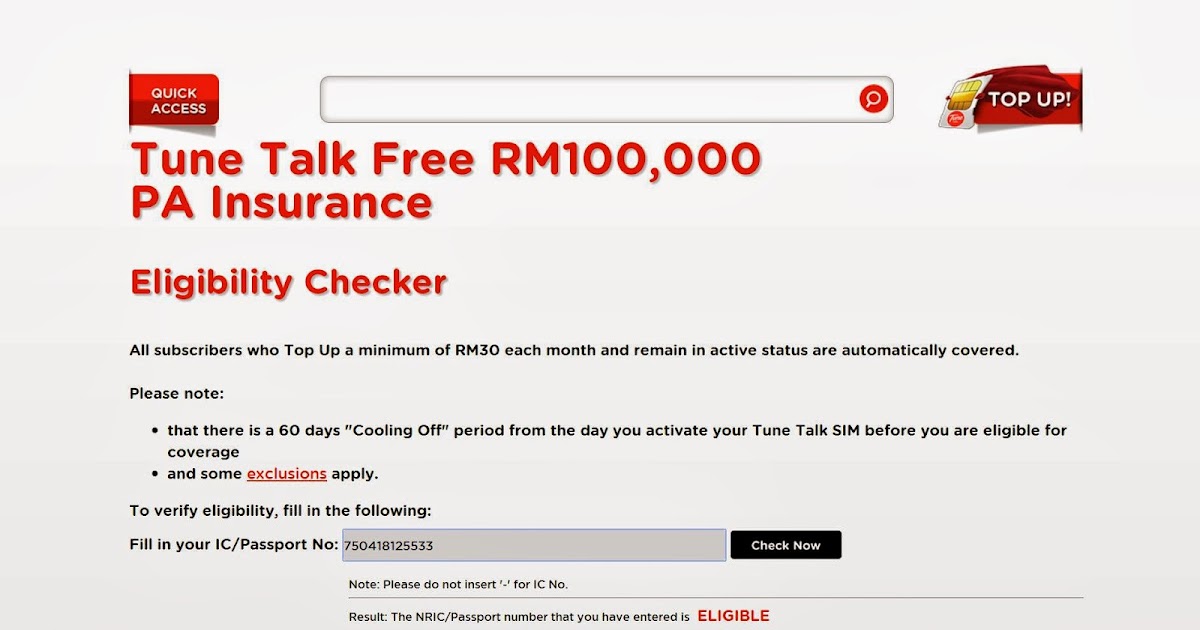

Financial products including banking, credit, insurance, personal pensions and investments, sold by distance means are subject to a 14 day cooling off period (this is 30 days in the case of life insurance and personal pensions). Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Your period of insurance is shown in your policy schedule. You have 30 days from the date the policy schedule or any other important documents are issued to check that the insurance meets your needs. If the proposer withdraws from the contract, then the insurance company will have to return the premium paid minus some deductions, such as the cost of covering the risk for the short period during which cover was provided, medical examination expenses and stamp duty.

Source: successfulways.com.au

Source: successfulways.com.au

The annual notice will include: How do cooling off periods operate? You have the right to cancel your life insurance policy within 15 days from the day you signed up for the plan. However, this is only applicable if you haven’t made any claims. You have 30 days from the date the policy schedule or any other important documents are issued to check that the insurance meets your needs.

Source: express.co.uk

Source: express.co.uk

Within this period, you can cancel your plan and ask for full refund. This period will be different, depending on the insurer. During this time if the insurance applicant is affected by a certain illness then he/she may not be able to buy medical insurance coverage. Financial products including banking, credit, insurance, personal pensions and investments, sold by distance means are subject to a 14 day cooling off period (this is 30 days in the case of life insurance and personal pensions). It can range from a few days to couple of months.

Source: slideshare.net

Source: slideshare.net

This period will be different, depending on the insurer. Financial products including banking, credit, insurance, personal pensions and investments, sold by distance means are subject to a 14 day cooling off period (this is 30 days in the case of life insurance and personal pensions). A cooling off period is designed to protection life insurance customers from aggressive sales tactics by enabling the consumer time to fully reflect on, and understand the impact of, their purchase. If the proposer withdraws from the contract, then the insurance company will have to return the premium paid minus some deductions, such as the cost of covering the risk for the short period during which cover was provided, medical examination expenses and stamp duty. It can range from a few days to couple of months.

Source: petinsuranceaustralia.com.au

Source: petinsuranceaustralia.com.au

Your period of insurance is shown in your policy schedule. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. This is the cooling off period. This is called cooling off period. The date your policy starts, or;

Source: escenicartics.blogspot.com

Source: escenicartics.blogspot.com

A consumer has a right to cancel, without penalty and without giving any reason, within: You have 30 days from the date the policy schedule or any other important documents are issued to check that the insurance meets your needs. How do cooling off periods operate? The annual notice will include: The date your policy starts, or;

.jpg “Calling it Quits The 30day “cooling off” period before”) Source: withersworldwide.com

Can i cancel my life insurance policy at any time? Hong kong life insurance plans will have a cooling off period which is no shorter than 21 days after the date of delivery of the policy, or. And g) provide you with an annual notice in writing each year prior to the anniversary of your life insurance policy. A consumer has a right to cancel, without penalty and without giving any reason, within: Premiums for life cover won’t be refunded if you terminate after this period unless you pay your yearly premium in advance.

Source: financialexpress.com

Source: financialexpress.com

Or (2) 14 days for any other. Can i cancel my life insurance policy at any time? If the proposer withdraws from the contract, then the insurance company will have to return the premium paid minus some deductions, such as the cost of covering the risk for the short period during which cover was provided, medical examination expenses and stamp duty. There is a cooling off period with your life insurance; This period will be different, depending on the insurer.

Source: en101song216.blogspot.com

Source: en101song216.blogspot.com

(1) 30 days for a contract of insurance which is, or has elements of, a pure protection contract or payment protection contract; Financial products including banking, credit, insurance, personal pensions and investments, sold by distance means are subject to a 14 day cooling off period (this is 30 days in the case of life insurance and personal pensions). The date your policy starts, or; The annual notice will include: This ‘cool off’ period can range.

Source: ineededsomepieceofmind.blogspot.com

Source: ineededsomepieceofmind.blogspot.com

This includes renewals for insurance where the agreement has been sent by post. Contact details if you have any questions or need to make a claim This ‘cool off’ period can range from a few days to a couple of months. Within this period, you can cancel your plan and ask for full refund. If you�re cancelling a life insurance policy with us, the answer depends on when you decide to cancel your legal & general life insurance.

Source: toneexcelwow4786.blogspot.com

Source: toneexcelwow4786.blogspot.com

If life insurance policy is cancelled within the ‘cooling off period’ the policyholder is entitled to a full refund. (1) 30 days for a contract of insurance which is, or has elements of, a pure protection contract or payment protection contract; Within this period, you can cancel your plan and ask for full refund. How do cooling off periods operate? Your period of insurance is shown in your policy schedule.

Source: insurancediaries.com

Source: insurancediaries.com

If you want to cancel within this time, we�ll refund any premiums you�ve paid. If the proposer withdraws from the contract, then the insurance company will have to return the premium paid minus some deductions, such as the cost of covering the risk for the short period during which cover was provided, medical examination expenses and stamp duty. During this time if the insurance applicant is affected by a certain illness then he/she may not be able to buy medical insurance coverage. And g) provide you with an annual notice in writing each year prior to the anniversary of your life insurance policy. This includes renewals for insurance where the agreement has been sent by post.

Source: ineededsomepieceofmind.blogspot.com

Source: ineededsomepieceofmind.blogspot.com

How do cooling off periods operate? Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. There is a cooling off period with your life insurance; It can range from a few days to couple of months. If life insurance policy is cancelled within the ‘cooling off period’ the policyholder is entitled to a full refund.

Source: en101song216.blogspot.com

Source: en101song216.blogspot.com

If life insurance policy is cancelled within the ‘cooling off period’ the policyholder is entitled to a full refund. And g) provide you with an annual notice in writing each year prior to the anniversary of your life insurance policy. Premiums for life cover won’t be refunded if you terminate after this period unless you pay your yearly premium in advance. This ‘cool off’ period can range. This is called cooling off period.

Source: ftadviser.com

Source: ftadviser.com

Financial products including banking, credit, insurance, personal pensions and investments, sold by distance means are subject to a 14 day cooling off period (this is 30 days in the case of life insurance and personal pensions). It can range from a few days to couple of months. This ‘cool off’ period can range. Or (2) 14 days for any other. If you cancel your policy within 30 days of receiving both the notice and the policy, we will refund any premiums paid.

Source: confused.com

Source: confused.com

It can range from a few days to couple of months. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. There have been documented cases of pulmonary, cardiovascular, and. If you want to cancel within this time, we�ll refund any premiums you�ve paid. Most of the time, it�s whichever of those two things is later.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cooling off period life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea