Cope information insurance Idea

Home » Trending » Cope information insurance IdeaYour Cope information insurance images are available in this site. Cope information insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Cope information insurance files here. Get all free vectors.

If you’re searching for cope information insurance images information connected with to the cope information insurance keyword, you have pay a visit to the ideal site. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Cope Information Insurance. Insurance forms will be filed at cope. You will be responsible for any amount not covered by insurance. Struction, occupancy, protection, and exposure. Whether it be a lack of secondary cope data or failure to record square footage, missing information on an sov will raise red flags with an underwriter or insurance provider.

Understanding Term Life Insurance YouTube From youtube.com

Understanding Term Life Insurance YouTube From youtube.com

Insured property legal name of building owner location address geolocation longitude latitude 2. Cope nyc is pleased to announce the fourth year of its artist in residence program at our 630 flushing avenue, brooklyn, ny location. Construction (e.g., frame, masonry, masonry veneer, superior construction, mixed—masonry/frame); However, iso estimates that approximately 50 percent of commercial properties are incorrectly. Cope stands for construction, occupancy, protection, exposure. Your medical information will be released to your insurance company in order for your claim to be processed.

The cyber cope insurance certification℠ (ccic) provides chubb brokers and agents with an understanding of industry best practices in cyber security risk management, governance and operations.

Information about the makeup of properties, what types of businesses occupy them, and what exterior hazards impact each, are necessary to accurately rate the risks. However, iso estimates that approximately 50 percent of commercial properties are incorrectly. Secondary cope characteristics relate to the building’s susceptibility to damage from windstorms or seismic activity. Cope stands for construction, occupancy, protection, exposure. The cyber cope insurance certification℠ (ccic) provides chubb brokers and agents with an understanding of industry best practices in cyber security risk management, governance and operations. Struction, occupancy, protection, and exposure.

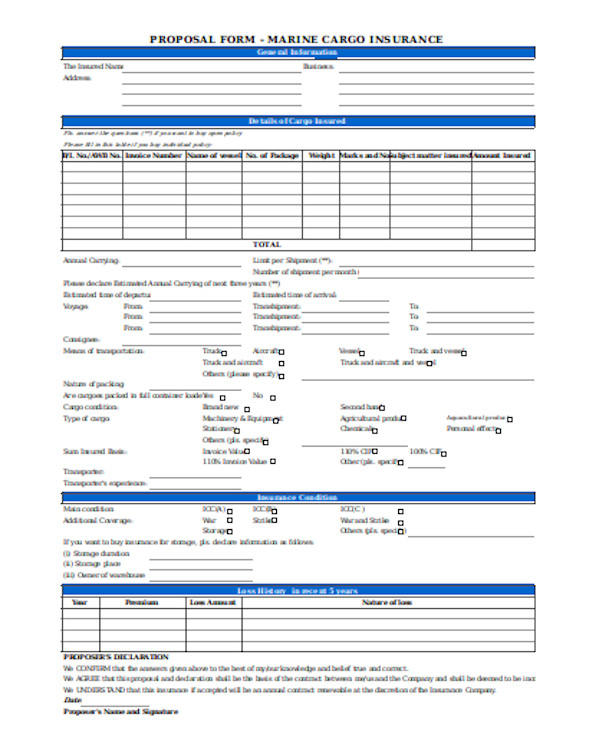

Source: sampleforms.com

Source: sampleforms.com

Based on a risk evaluation model universally used by property underwriters for hundreds of years, chubb’s cyber cope ® combines underwriting, data analytics, and various security disciplines into a structured framework, providing risk managers with a tool to better communicate with the organization’s security experts and to. Construction (e.g., frame, masonry, masonry veneer, superior construction, mixed—masonry/frame); Building floors total area (m2. Cope is an acronym that stands for the construction, occupancy, protection and exposure characteristics of a property. The cyber cope insurance certification℠ (ccic) provides chubb brokers and agents with an understanding of industry best practices in cyber security risk management, governance and operations.

Source: proactiveis.com

Source: proactiveis.com

Assessing my application for insurance and underwriting my policies, renewals, changes of coverage, evaluating claims, detecting and preventing fraud, and analyzing business results. Information about the makeup of properties, what types of businesses occupy them, and what exterior hazards impact each, are necessary to accurately rate the risks. Occupancy how the building is being used for commercial property and whether it is owner. Construction (e.g., frame, masonry, masonry veneer, superior construction, mixed—masonry/frame); When an insurance carrier decides to calculate a specific rating, they assess the construction, occupancy, protection, and exposure of your building, otherwise known as the property’s “cope.”.

Source: assetworks.com

Source: assetworks.com

Much of the necessary property underwriting information that goes into preparing a policy is known as cope data. Information on risk obtained by: Before submitting your sov, verify the data is as complete as. This information will be kept strictly confidential. Occupancy how the building is being used for commercial property and whether it is owner.

Source: assetworks.com

Source: assetworks.com

When an insurance carrier decides to calculate a specific rating, they assess the construction, occupancy, protection, and exposure of your building, otherwise known as the property’s “cope.”. Cope application (please answer all questions). Benefits will be paid to cope. Insurance forms will be filed at cope. For easy reference, the guide has been divided into multiple sections as listed below.

Source: pinterest.com

Source: pinterest.com

Cope stands for construction, occupancy, protection, exposure (property insurance) this definition appears somewhat frequently and is found in the following acronym finder categories: Based on a risk evaluation model universally used by property underwriters for hundreds of years, chubb’s cyber cope ® combines underwriting, data analytics, and various security disciplines into a structured framework, providing risk managers with a tool to better communicate with the organization’s security experts and to. Insured property legal name of building owner location address geolocation longitude latitude 2. This information will be kept strictly confidential. Occupancy how the building is being used for commercial property and whether it is owner.

Cope underwriting the modern property policy can be traced back to just after the great fire of london in 1666 property underwriters still use the same information to evaluate a risk: These are the main areas that an insurance underwriter must evaluate when writing an. Without cope data, underwriters may need to assume the worst, which could lead to higher insurance premiums for organizations. However, iso estimates that approximately 50 percent of commercial properties are incorrectly. Cope underwriting the modern property policy can be traced back to just after the great fire of london in 1666 property underwriters still use the same information to evaluate a risk:

Source: leadervest.com

Source: leadervest.com

An acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for property insurance: In the absence of this data, some insurers and. Before submitting your sov, verify the data is as complete as. In this quick guide, we will explore the fundamentals of cope data and catastrophe modeling. _____ _____ _____ _____ _____ your information

Source: abbeyautoline.co.uk

Source: abbeyautoline.co.uk

However, iso estimates that approximately 50 percent of commercial properties are incorrectly. In the absence of this data, some insurers and. These are the main areas that an insurance underwriter must evaluate when writing an. I confirm that all individuals whose personal Cope nyc is pleased to announce the fourth year of its artist in residence program at our 630 flushing avenue, brooklyn, ny location.

Source: verisk.com

Source: verisk.com

Secondary cope characteristics relate to the building’s susceptibility to damage from windstorms or seismic activity. Known to us mortals as “cope.” when the correct cope information is provided, the insurance mechanism performs as intended. Cope nyc is pleased to announce the fourth year of its artist in residence program at our 630 flushing avenue, brooklyn, ny location. Your medical information will be released to your insurance company in order for your claim to be processed. Cope data are the building blocks of underwriting and managing portfolio risk for the insurance industry.

Source: mugshotsbylyndajane.blogspot.com

Source: mugshotsbylyndajane.blogspot.com

Other:visit to risk by broker. Cope questionnaire cope insurance information required may we please have your assistance in supplying the information requested below. Construction, occupancy, protection and exposure. Benefits will be paid to cope. An acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for property insurance:

Source: fr.slideshare.net

Source: fr.slideshare.net

Buildings that have better cope scores are less likely to suffer serious damage in the event of a fire or natural disaster. Other:visit to risk by broker. Whether it be a lack of secondary cope data or failure to record square footage, missing information on an sov will raise red flags with an underwriter or insurance provider. I confirm that all individuals whose personal When you complete a commercial real estate insurance application, you will typically be required to submit most of this information.

Source: youtube.com

Source: youtube.com

Insured property legal name of building owner location address geolocation longitude latitude 2. In the absence of this data, some insurers and. Public entities want a good insurance rating, and that’s less likely when data is omitted from an sov. Cope stands for construction, occupancy, protection, exposure. Cope application (please answer all questions).

Source: pinterest.com

Source: pinterest.com

Cope stands for construction, occupancy, protection, exposure (property insurance) this definition appears somewhat frequently and is found in the following acronym finder categories: Insurance forms will be filed at cope. Without cope data, underwriters may need to assume the worst, which could lead to higher insurance premiums for organizations. Whether it be a lack of secondary cope data or failure to record square footage, missing information on an sov will raise red flags with an underwriter or insurance provider. Cope application (please answer all questions).

Source: healthplanspain.com

Source: healthplanspain.com

Public entities want a good insurance rating, and that’s less likely when data is omitted from an sov. Benefits will be paid to cope. Information on risk obtained by: Whether it be a lack of secondary cope data or failure to record square footage, missing information on an sov will raise red flags with an underwriter or insurance provider. Based on a risk evaluation model universally used by property underwriters for hundreds of years, chubb’s cyber cope ® combines underwriting, data analytics, and various security disciplines into a structured framework, providing risk managers with a tool to better communicate with the organization’s security experts and to.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

I confirm that all individuals whose personal Before submitting your sov, verify the data is as complete as. Assessing my application for insurance and underwriting my policies, renewals, changes of coverage, evaluating claims, detecting and preventing fraud, and analyzing business results. Cope stands for construction, occupancy, protection, exposure (property insurance) this definition appears somewhat frequently and is found in the following acronym finder categories: Cope questionnaire cope insurance information required may we please have your assistance in supplying the information requested below.

Source: www1.wsrb.com

Source: www1.wsrb.com

Information about the makeup of properties, what types of businesses occupy them, and what exterior hazards impact each, are necessary to accurately rate the risks. Your medical information will be released to your insurance company in order for your claim to be processed. This information will be kept strictly confidential. Both cope and secondary cope data help present the likelihood that an organization will experience losses due to a catastrophic event and quantify the potential property losses. _____ _____ _____ _____ _____ your information

Source: www1.wsrb.com

Source: www1.wsrb.com

Struction, occupancy, protection, and exposure. Based on a risk evaluation model universally used by property underwriters for hundreds of years, chubb’s cyber cope ® combines underwriting, data analytics, and various security disciplines into a structured framework, providing risk managers with a tool to better communicate with the organization’s security experts and to. This information will be kept strictly confidential. An acronym that stands for the four property risk characteristics an underwriter reviews when evaluating a submission for property insurance: Cope application (please answer all questions).

Source: socialbarrel.com

Source: socialbarrel.com

Occupancy how the building is being used for commercial property and whether it is owner. I confirm that all individuals whose personal Buildings that have better cope scores are less likely to suffer serious damage in the event of a fire or natural disaster. It’s a shorthand used in property insurance that refers to information that’s needed, and therefore gathered, by a person applying for some type of property insurance and their broker about the property they wish to insure. For easy reference, the guide has been divided into multiple sections as listed below.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cope information insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea