Corporate legal liability insurance definition Idea

Home » Trend » Corporate legal liability insurance definition IdeaYour Corporate legal liability insurance definition images are available. Corporate legal liability insurance definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Corporate legal liability insurance definition files here. Find and Download all free vectors.

If you’re searching for corporate legal liability insurance definition images information linked to the corporate legal liability insurance definition interest, you have pay a visit to the right site. Our site frequently gives you hints for refferencing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

Corporate Legal Liability Insurance Definition. Corporate legal liability (cll) insurance is similar to d&o insurance but defends claims made against the company as opposed to individuals. Since corporations and other business entities are a major part of the economic landscape,. Liability insurance also covers the cost of a company�s legal defense, while paying for any settlement offerings or awards a company is mandated to pay as per legal judgments leveled against them. The term liability insurance refers to an insurance product that provides an insured party with protection against claims resulting from injuries and damage to other people or property.

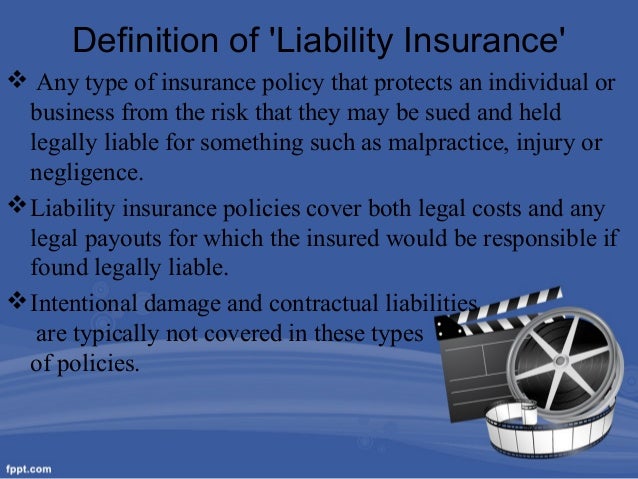

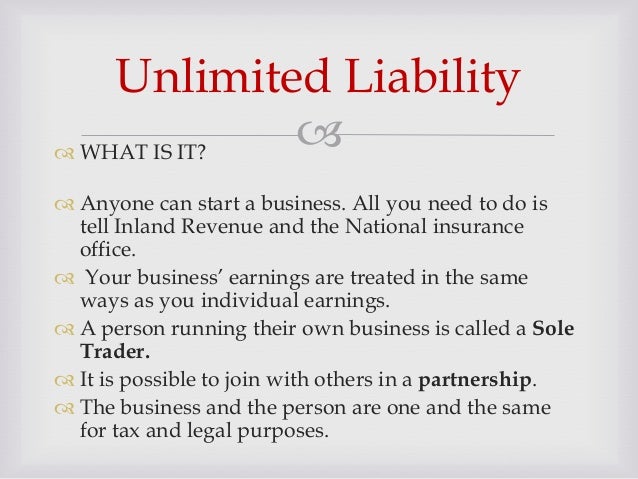

Film Liability insurance From slideshare.net

Film Liability insurance From slideshare.net

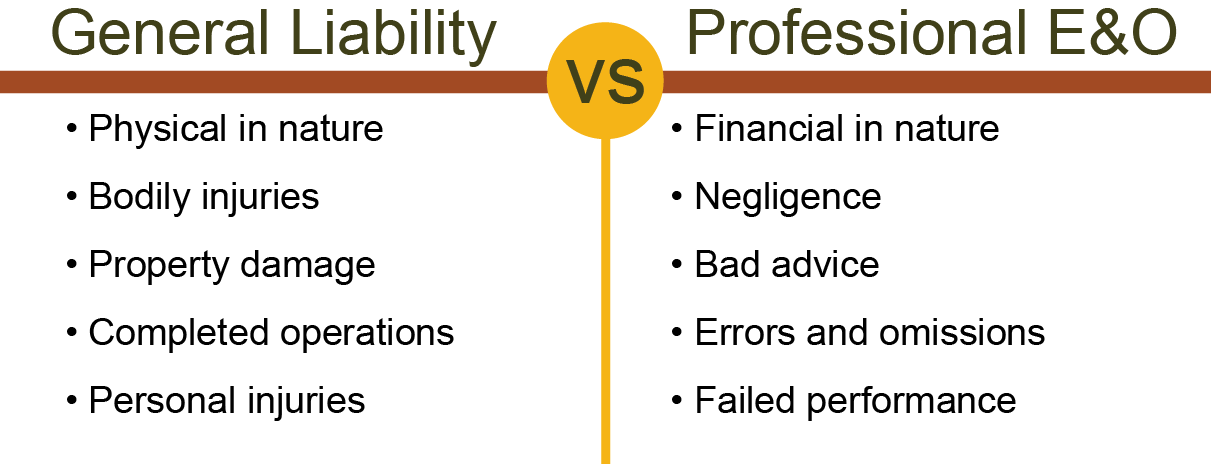

Corporate legal liability (cll) insurance is similar to d&o insurance but defends claims made against the company as opposed to individuals. Liability insurance policies cover the insured against any claims due to causing bodily injuries and damages to the property of unknown people. This means that claims are only covered if they are made while the policy is in effect or within a contractually agreed extended reporting period, irrespective of when the event giving rise to the claim occurred. Professional liability insurance (pl), also known as errors and omissions insurance (e&o), helps cover claims that your business made errors in the services you provided. General liability insurance protects corporations against claims of negligence against company representatives, products and services. Get quote & buy online!

Professional liability insurance is a safety net for your business mistakes, such as failure to deliver the work product your clients expected and for which they paid.

Understanding this coverage is an important first step in managing cgl risks. Professional liability insurance covers your legal expenses in cases where a customer alleges your work was: Since corporations and other business entities are a major part of the economic landscape,. Corporate legal liability (cll) insurance is similar to d&o insurance but defends claims made against the company as opposed to individuals. Liability insurance policies cover the insured against any claims due to causing bodily injuries and damages to the property of unknown people. , as of a determination date, means the full corporate liability as of the determination date, as set out in the actuarial report for the valuation year that contains the determination date, multiplied by the funding ratio for the actuarial report.

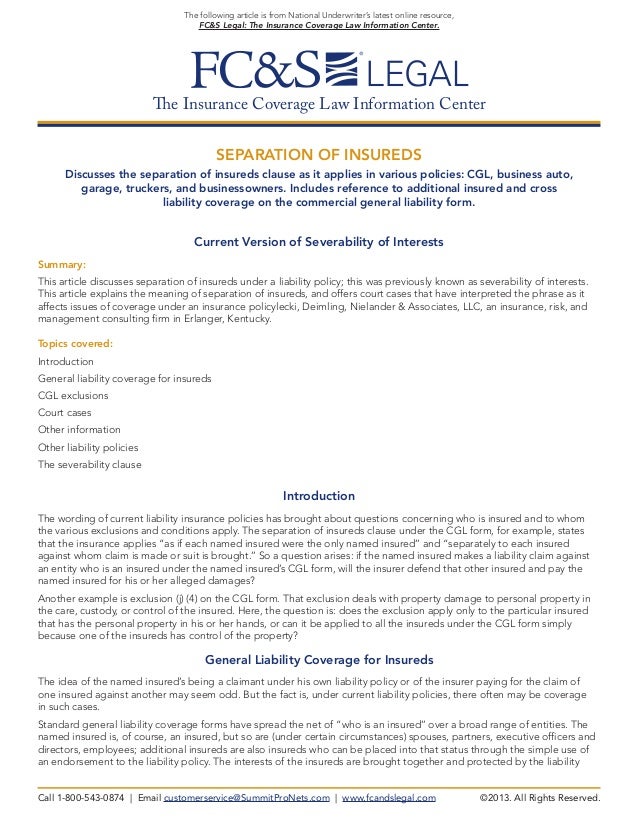

Source: slideshare.net

Source: slideshare.net

Liability insurance policies cover the insured against any claims due to causing bodily injuries and damages to the property of unknown people. Corporate liability, also referred to as liability of legal persons, determines the extent to which a company as a legal person can be held liable for the acts and omissions of the natural persons it employs and, in some legal systems, for those of other associates and business partners. Get quote & buy online! Professional liability insurance (pl), also known as errors and omissions insurance (e&o), helps cover claims that your business made errors in the services you provided. Corporate legal liability (cll) insurance is similar to d&o insurance but defends claims made against the company as opposed to individuals.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

There are two ways in. Get quote & buy online! Legal liability describes a situation in which a small business is held legally responsible for injuring or financially harming another party, this judgment can result in fines, penalties, or other payments. If a person or entity (such as a company) does not uphold this responsibility, they may be sued. Liability insurance also covers the cost of a company�s legal defense, while paying for any settlement offerings or awards a company is mandated to pay as per legal judgments leveled against them.

Source: quickanddirtytips.com

Source: quickanddirtytips.com

Corporate legal liability insurance in detail corporate legal liability is essentially the liability a company may face for actions taken by the company itself, or its employees, that could be deemed unlawful. Legal liability describes a situation in which a small business is held legally responsible for injuring or financially harming another party, this judgment can result in fines, penalties, or other payments. Professional liability insurance is a safety net for your business mistakes, such as failure to deliver the work product your clients expected and for which they paid. Corporate liability, also referred to as liability of legal persons, determines the extent to which a company as a legal person can be held liable for the acts and omissions of the natural persons it employs and, in some legal systems, for those of other associates and business partners. General liability typically covers legal claims due to an accident or an injury.

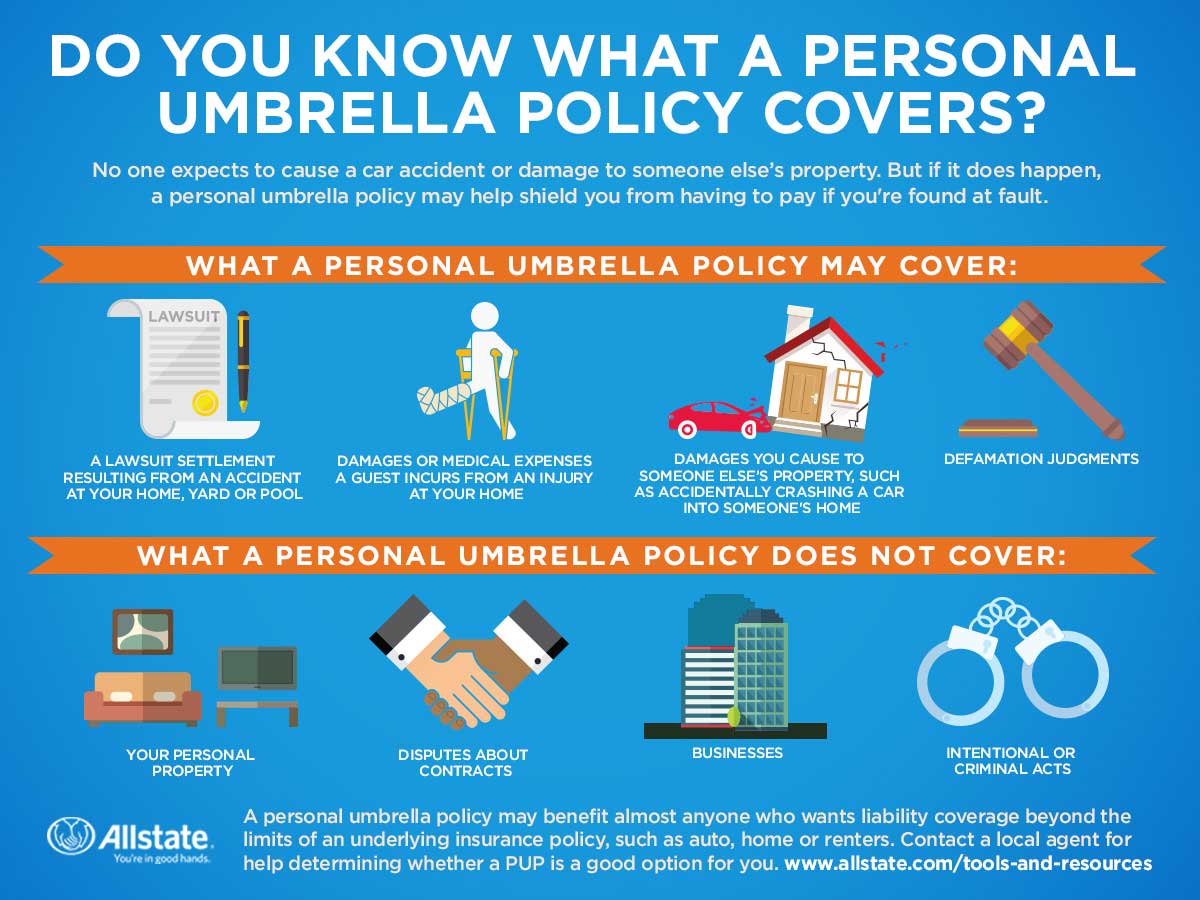

Source: allstate.com

Source: allstate.com

Liability insurance exposures can arise from many sources, from third party actions, products or emerging risks to environmental disasters. This means that claims are only covered if they are made while the policy is in effect or within a contractually agreed extended reporting period, irrespective of when the event giving rise to the claim occurred. The insurance policy pays for any costs incurred from bodily injury, medical expenses, property damage, libel or slander. The term liability insurance refers to an insurance product that provides an insured party with protection against claims resulting from injuries and damage to other people or property. Liability insurance policies cover the insured against any claims due to causing bodily injuries and damages to the property of unknown people.

Source: slideshare.net

Source: slideshare.net

These claims range from maladministration of a company pension, an employee benefit claim, breach of data protection or corporate identity crime. Get quote & buy online! General liability insurance protects corporations against claims of negligence against company representatives, products and services. Corporate liability simply means the extent to which a corporation is responsible for the actions of its employees. The term liability insurance refers to an insurance product that provides an insured party with protection against claims resulting from injuries and damage to other people or property.

Source: investopedia.com

Source: investopedia.com

If a person or entity (such as a company) does not uphold this responsibility, they may be sued. Corporate liability simply means the extent to which a corporation is responsible for the actions of its employees. Corporate legal liability (cll) insurance is similar to d&o insurance but defends claims made against the company as opposed to individuals. General liability typically covers legal claims due to an accident or an injury. Understanding this coverage is an important first step in managing cgl risks.

Source: trustedchoice.com

Source: trustedchoice.com

General liability typically covers legal claims due to an accident or an injury. The insurance policy pays for any costs incurred from bodily injury, medical expenses, property damage, libel or slander. Understanding this coverage is an important first step in managing cgl risks. General liability typically covers legal claims due to an accident or an injury. Professional liability insurance covers your legal expenses in cases where a customer alleges your work was:

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Corporate legal liability (cll) insurance is similar to d&o insurance but defends claims made against the company as opposed to individuals. Ad general liability insurance that�s affordable & tailored for you. Liability insurance exposures can arise from many sources, from third party actions, products or emerging risks to environmental disasters. What is corporate legal liability insurance? General liability typically covers legal claims due to an accident or an injury.

Source: billgreen.law

Source: billgreen.law

For instance, if your client claims you gave them inaccurate financial advice and sues you because they lost money, e&o insurance can help cover your legal defense costs. It is designed to cover not only directors and officers, but also managers and employees, when they incur liability. Get quote & buy online! Corporate liability simply means the extent to which a corporation is responsible for the actions of its employees. Liability insurance exposures can arise from many sources, from third party actions, products or emerging risks to environmental disasters.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Get quote & buy online! The insurance policy pays for any costs incurred from bodily injury, medical expenses, property damage, libel or slander. Ad general liability insurance that�s affordable & tailored for you. Professional liability insurance is a safety net for your business mistakes, such as failure to deliver the work product your clients expected and for which they paid. Corporate legal liability (cll) insurance is similar to d&o insurance but defends claims made against the company as opposed to individuals.

Source: slideshare.net

Source: slideshare.net

It is designed to cover not only directors and officers, but also managers and employees, when they incur liability. There are two ways in. Liability insurance policies cover the insured against any claims due to causing bodily injuries and damages to the property of unknown people. The court proceedings may find the person or entity liable for paying the complainant for bodily injury, property damage, lost wages, etc. Since corporations and other business entities are a major part of the economic landscape,.

Source: insurancenoon.com

Source: insurancenoon.com

Professional liability insurance covers your legal expenses in cases where a customer alleges your work was: Corporate liability, also referred to as liability of legal persons, determines the extent to which a company as a legal person can be held liable for the acts and omissions of the natural persons it employs and, in some legal systems, for those of other associates and business partners. This means that claims are only covered if they are made while the policy is in effect or within a contractually agreed extended reporting period, irrespective of when the event giving rise to the claim occurred. Legal liability is a person or entity’s legal responsibility under the law. These claims range from maladministration of a company pension, an employee benefit claim, breach of data protection or corporate identity crime.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

Corporate legal liability insurance covers you and any subsidiary of yours domiciled in the united kingdom of great britain and northern ireland, the channel islands, the isle of man or gibraltar for investigations and claims made against you during the Liability insurance policies cover the insured against any claims due to causing bodily injuries and damages to the property of unknown people. Legal liability is a person or entity’s legal responsibility under the law. Since corporations and other business entities are a major part of the economic landscape,. Besides covering the legal costs involved, liability insurance provides coverage for payouts which the insured is legally liable to pay.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Corporate legal liability insurance covers you and any subsidiary of yours domiciled in the united kingdom of great britain and northern ireland, the channel islands, the isle of man or gibraltar for investigations and claims made against you during the General liability typically covers legal claims due to an accident or an injury. Liability insurance policies cover the insured against any claims due to causing bodily injuries and damages to the property of unknown people. Lawsuits can cost substantial amounts of money,. Professional liability insurance is a safety net for your business mistakes, such as failure to deliver the work product your clients expected and for which they paid.

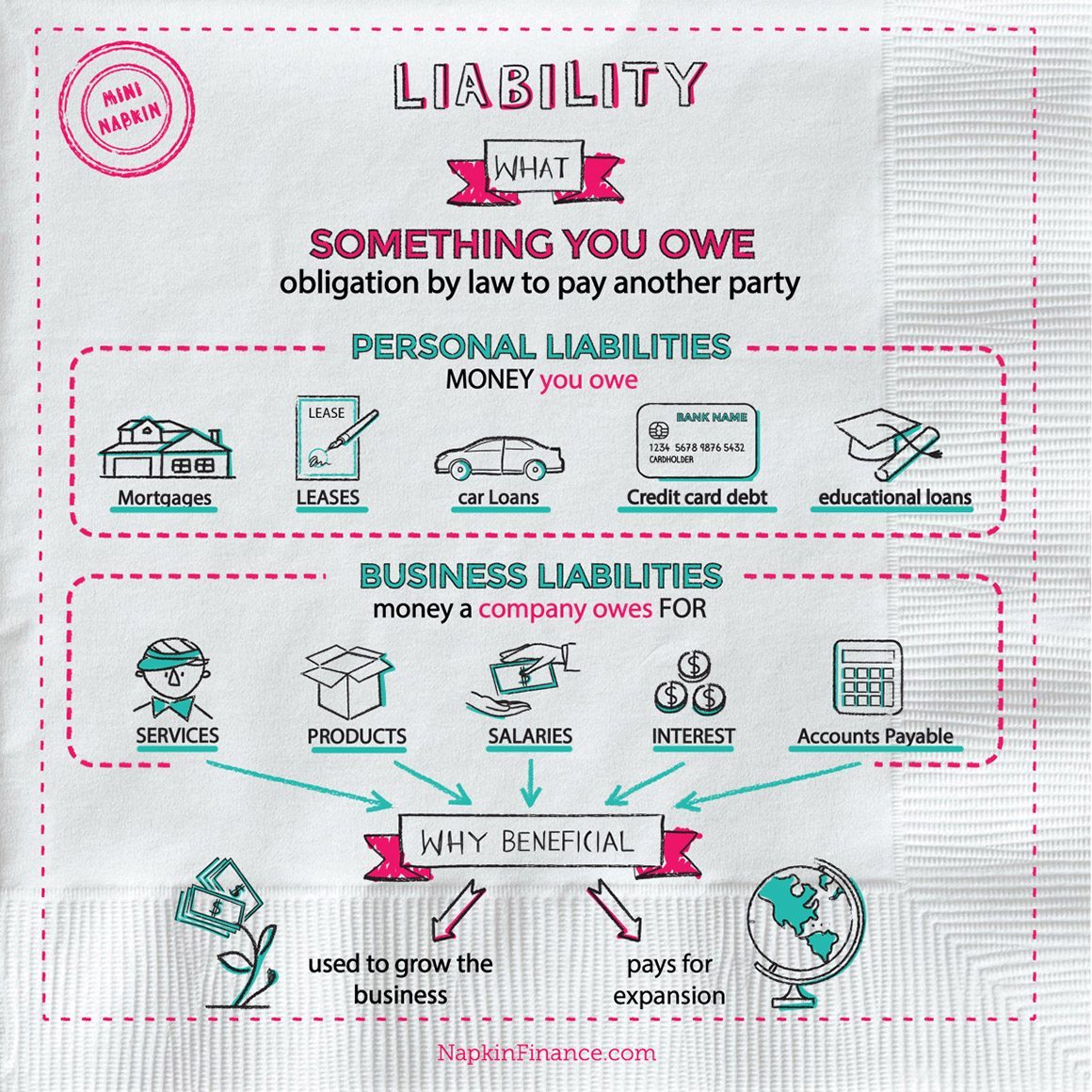

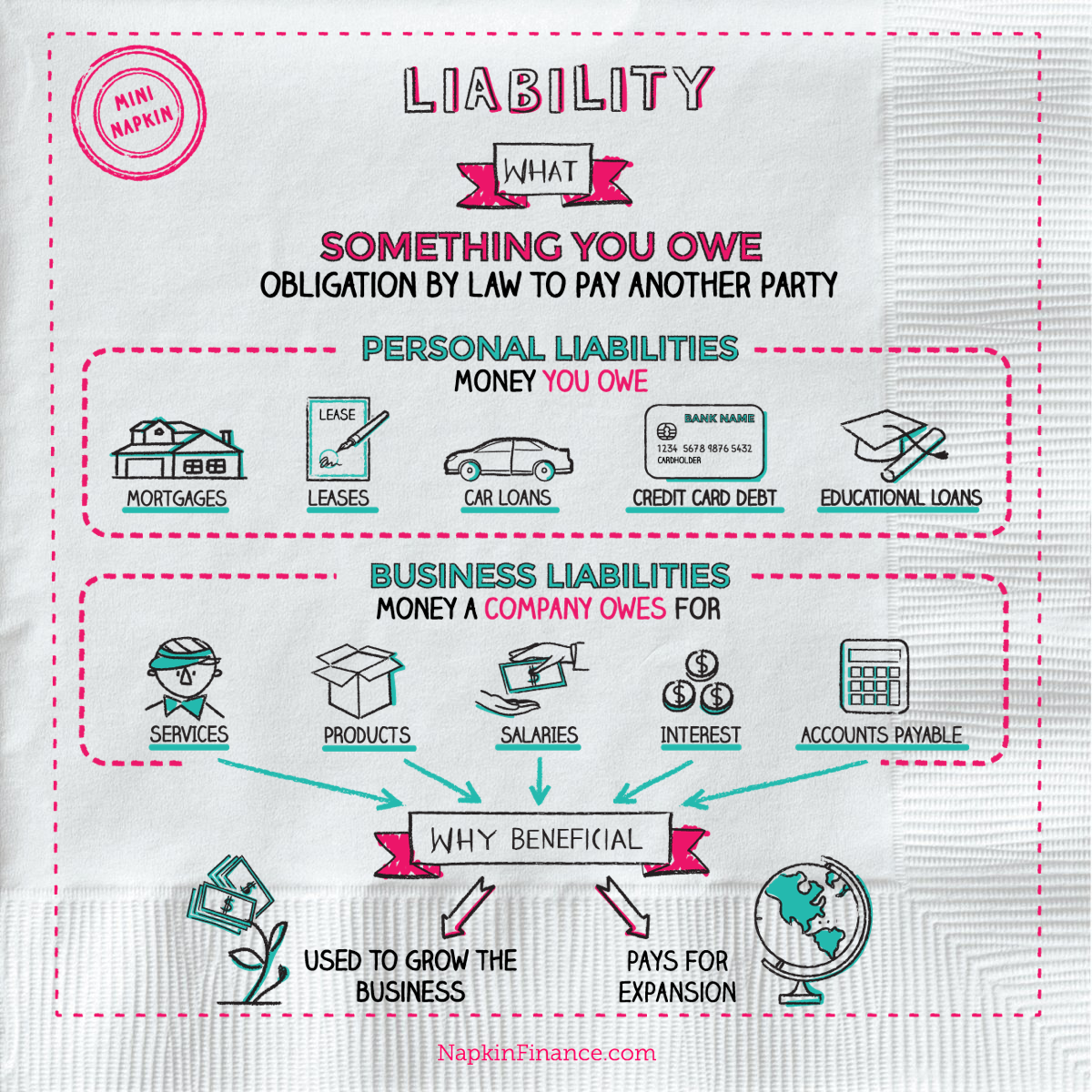

Source: napkinfinance.com

Source: napkinfinance.com

Ad general liability insurance that�s affordable & tailored for you. There are two ways in. The court proceedings may find the person or entity liable for paying the complainant for bodily injury, property damage, lost wages, etc. For instance, if your client claims you gave them inaccurate financial advice and sues you because they lost money, e&o insurance can help cover your legal defense costs. Ad general liability insurance that�s affordable & tailored for you.

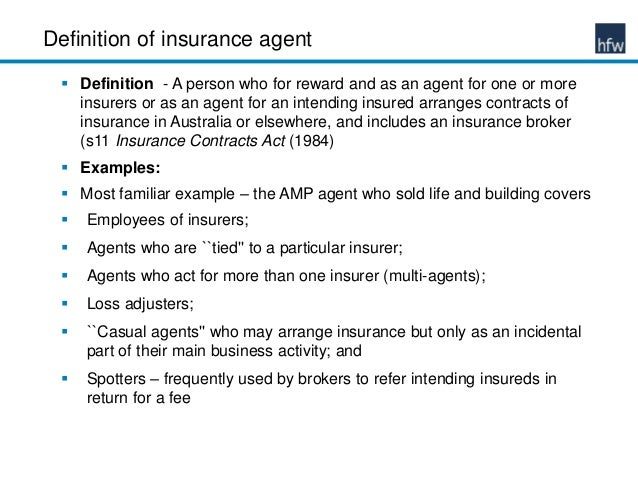

Source: slideshare.net

Source: slideshare.net

It is designed to cover not only directors and officers, but also managers and employees, when they incur liability. For instance, if your client claims you gave them inaccurate financial advice and sues you because they lost money, e&o insurance can help cover your legal defense costs. Corporate liability simply means the extent to which a corporation is responsible for the actions of its employees. Since corporations and other business entities are a major part of the economic landscape,. A commercial general liability (cgl) policy protects your business from financial loss should you be liable for property damage or personal and advertising injury caused by your services, business operations or your employees.

Source: everquote.com

Source: everquote.com

Corporate legal liability (cll) insurance is similar to d&o insurance but defends claims made against the company as opposed to individuals. Ad general liability insurance that�s affordable & tailored for you. Lawsuits can cost substantial amounts of money,. Professional liability insurance is a safety net for your business mistakes, such as failure to deliver the work product your clients expected and for which they paid. There are two ways in.

Source: napkinfinance.com

Source: napkinfinance.com

Corporate legal liability (cll) insurance is similar to d&o insurance but defends claims made against the company as opposed to individuals. For instance, if your client claims you gave them inaccurate financial advice and sues you because they lost money, e&o insurance can help cover your legal defense costs. General liability insurance protects corporations against claims of negligence against company representatives, products and services. What is corporate legal liability insurance? Liability insurance policies cover the insured against any claims due to causing bodily injuries and damages to the property of unknown people.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title corporate legal liability insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information