Corporate owned life insurance taxation Idea

Home » Trending » Corporate owned life insurance taxation IdeaYour Corporate owned life insurance taxation images are ready. Corporate owned life insurance taxation are a topic that is being searched for and liked by netizens now. You can Download the Corporate owned life insurance taxation files here. Find and Download all royalty-free images.

If you’re searching for corporate owned life insurance taxation images information connected with to the corporate owned life insurance taxation interest, you have visit the right blog. Our website frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Corporate Owned Life Insurance Taxation. Revisions to the internal revenue code in 2006 provide, however, that life insurance proceeds are included as taxable income of the corporate owner of a life insurance policy unless certain irs requirements are met. Corporate owned life insurance (coli) is an important informal funding option due to its significant tax advantages. After august 17th 2006 laws were changed to allow for income taxation of death benefits on these policies issued. However, since 2018, the small business limit is reduced by $5 for every $1 of passive investment over $50,000 in any given year.

Corporateowned Life Insurance, 9786137270752 From knigozal.com

Corporateowned Life Insurance, 9786137270752 From knigozal.com

Most corporate clients assume that proceeds of a life insurance policy insuring the life of an employee are tax free. The company pays the premium, owns the cash value of the policy, and becomes the beneficiary of the insurance. Corporate owned life insurance taxation. To fund these programs, a company purchases and holds life insurance policies for plan participants. Other names for the practice include janitor�s insurance and dead peasants insurance. 101 (j) (1) was added with the enactment of the pension protection act of 2006, p.l.

The company pays the premium, owns the cash value of the policy, and becomes the beneficiary of the insurance.

Corporate owned life insurance (coli) is life insurance a corporate employer buys covering one or more. Corporate owned life insurance (coli) is life insurance a corporate employer buys covering one or more. Any companies recognize that the skills and abilities of their employees are invaluable to the conduct of their businesses. A corporate owned asset transfer plan would be best suited to someone who is a shareholder of a canadian controlled private corporation (ccpc) that has a life insurance need, as well as significant assets in taxable investments and is looking for a way to reduce the tax on passive income earned on surplus cash in the corporation. When an insured retired employee dies, the policy death benefit allows the company to recover part or all of the. Other names for the practice include janitor�s insurance and dead peasants insurance.

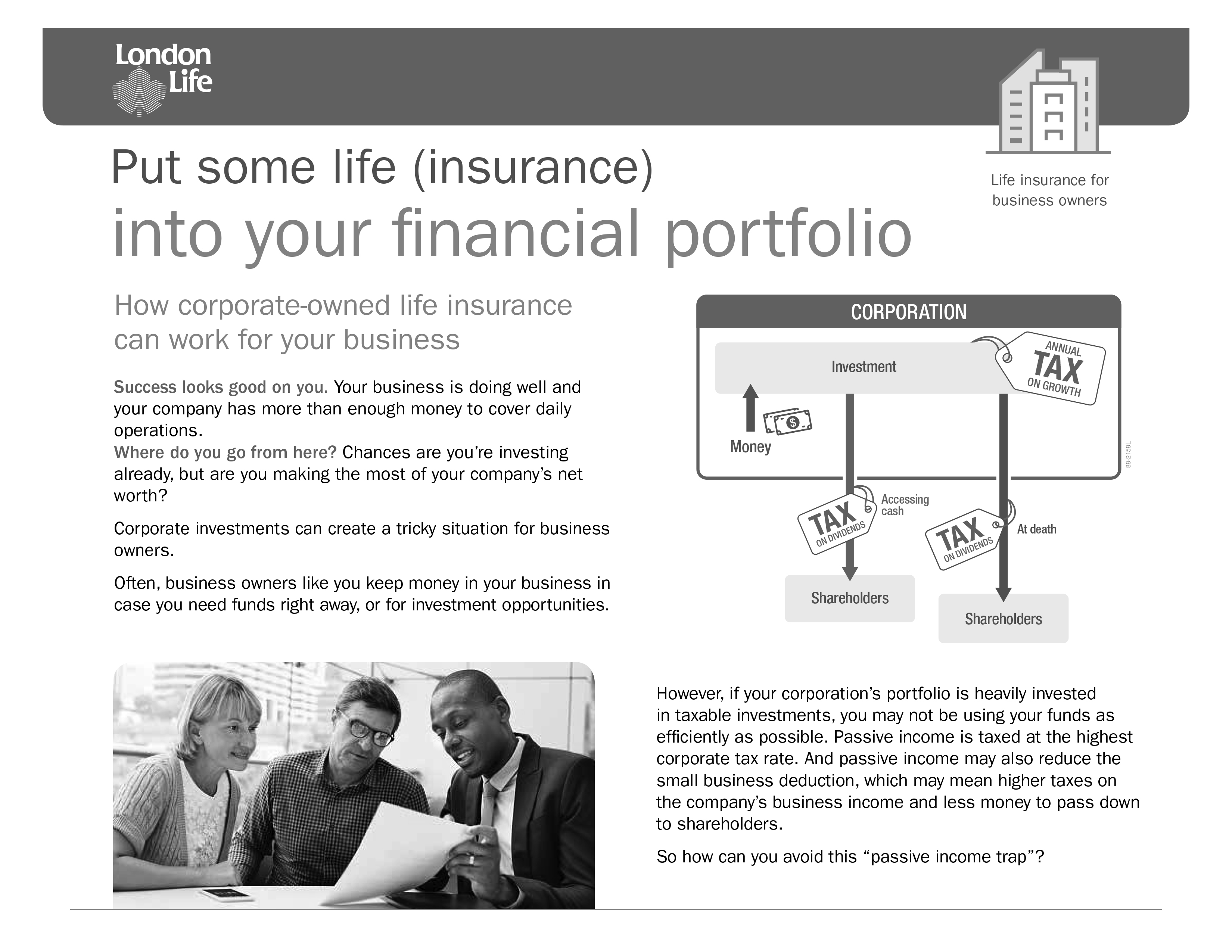

Source: corporatelifeinsurance.ca

Source: corporatelifeinsurance.ca

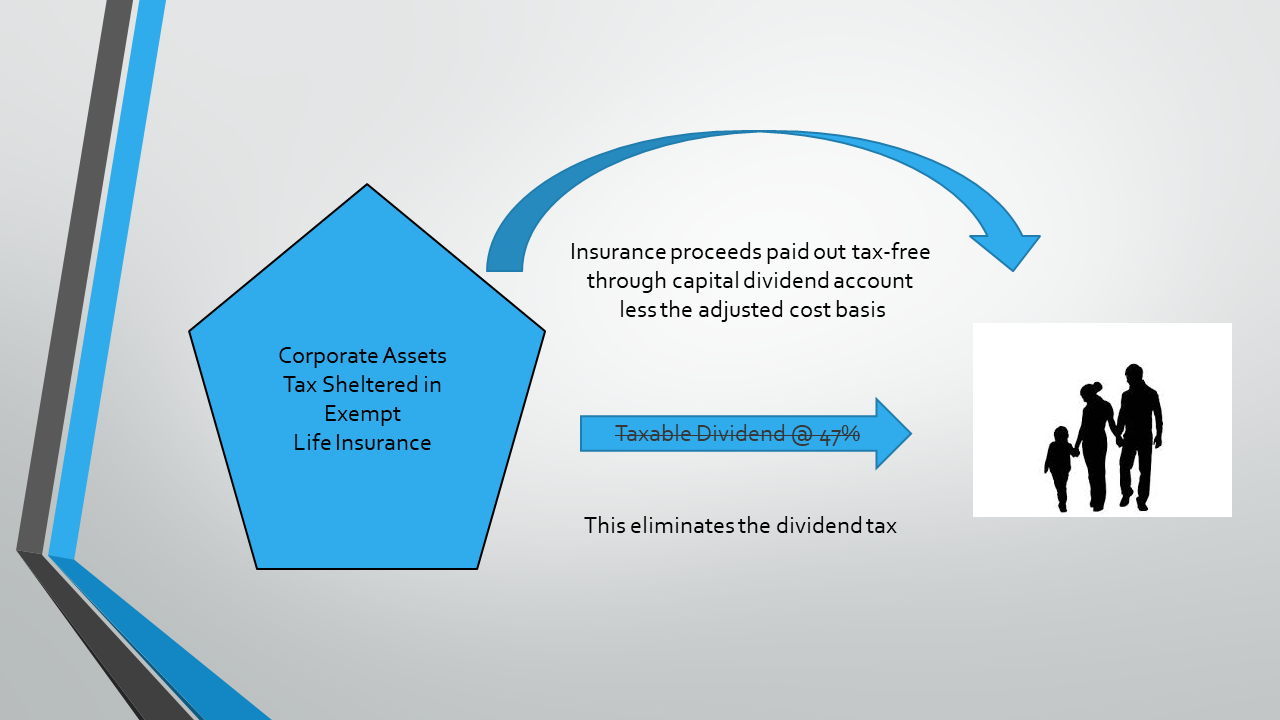

Previously, many corporations would retain earnings and invest them to avoid or delay personal taxes. By paying the proceeds to an estate via capital dividend, corporate owned life insurance can fund tax liabilities and equalize the value among beneficiaries,. Much of the law on life insurance is codified in the insurance acts of each province and territory. The company pays the premium, owns the cash value of the policy, and becomes the beneficiary of the insurance. As owner of the policy, you’re responsible for paying the premiums.

Source: smartwealthfinancial.ca

Source: smartwealthfinancial.ca

With coli, the corporation purchases and owns a life insurance policy on a key employee or employees. To fund these programs, a company purchases and holds life insurance policies for plan participants. To fund these programs, a company purchases and holds life insurance policies for plan participants. Much of the law on life insurance is codified in the insurance acts of each province and territory. Recent changes to the tax rules have increased the popularity of corporate owned life insurance.

Source: torontocaribbean.com

Source: torontocaribbean.com

Why corporate owned life insurance is essential in an esop from glistrategies.com. Kate’s personal marginal tax rate is 48% and her corporate tax rate is 12%. The company pays the premium, owns the cash value of the policy, and becomes the beneficiary of the insurance. Corporate owned life insurance taxation. Life insurance is a distinct body of law in the same sense that the laws of tort, trusts, and contract are distinct bodies of law.

Source: glistrategies.com

Source: glistrategies.com

Other names for the practice include janitor�s insurance and dead peasants insurance. It is also the primary beneficiary. In general, proceeds from life insurance policies are tax free under the general exception rules in sec. To fund the policy premiums personally, kate will need to earn $962 each month in order to have $500 after tax to pay the premiums. After august 17th 2006 laws were changed to allow for income taxation of death benefits on these policies issued.

Source: ggfl.ca

Source: ggfl.ca

To fund the policy premiums personally, kate will need to earn $962 each month in order to have $500 after tax to pay the premiums. For example, kate owns a ccpc and is considering buying life insurance with a monthly premium of $500. Current tax law for colithe tax rules pertaining to coli are fairly complex and also vary somewhat from one state to another in some caseslife insurance is one of the most tax advantaged. As owner of the policy, you’re responsible for paying the premiums. Recent changes to the tax rules have increased the popularity of corporate owned life insurance.

![]() Source: bdo.ca

Source: bdo.ca

This general rule changed when sec. Corporate owned life insurance taxation. However, since 2018, the small business limit is reduced by $5 for every $1 of passive investment over $50,000 in any given year. Any companies recognize that the skills and abilities of their employees are invaluable to the conduct of their businesses. The company purchases and owns a life insurance policy on a key employee and is the primary beneficiary.

Source: rockharbour.ca

Source: rockharbour.ca

Life insurance is a distinct body of law in the same sense that the laws of tort, trusts, and contract are distinct bodies of law. This general rule changed when sec. However, since 2018, the small business limit is reduced by $5 for every $1 of passive investment over $50,000 in any given year. Kate’s personal marginal tax rate is 48% and her corporate tax rate is 12%. The company pays the premium, owns the cash value of the policy, and becomes the beneficiary of the insurance.

Source: proinsure.ca

Source: proinsure.ca

Corporate owned life insurance taxation. Any companies recognize that the skills and abilities of their employees are invaluable to the conduct of their businesses. Kate’s personal marginal tax rate is 48% and her corporate tax rate is 12%. Corporate owned life insurance taxation. Because companies used coli policies to.

Source: mosespc.com

Source: mosespc.com

Often in small businesses, lenders will require that loans be personally guaranteed by the owner. Why corporate owned life insurance is essential in an esop from glistrategies.com. The taxation of life insurance is codified in s.148 of the income tax act (“act”) along with numerous regulations. However, since 2018, the small business limit is reduced by $5 for every $1 of passive investment over $50,000 in any given year. Because companies used coli policies to.

Source: knigozal.com

Source: knigozal.com

Current tax law for colithe tax rules pertaining to coli are fairly complex and also vary somewhat from one state to another in some caseslife insurance is one of the most tax advantaged. By paying the proceeds to an estate via capital dividend, corporate owned life insurance can fund tax liabilities and equalize the value among beneficiaries,. Most corporate clients assume that proceeds of a life insurance policy insuring the life of an employee are tax free. It is also the primary beneficiary. After august 17th 2006 laws were changed to allow for income taxation of death benefits on these policies issued.

Source: brokencurve.com

Source: brokencurve.com

The company pays the premium, owns the cash value of the policy, and becomes the beneficiary of the insurance. With coli, the corporation purchases and owns a life insurance policy on a key employee or employees. Revisions to the internal revenue code in 2006 provide, however, that life insurance proceeds are included as taxable income of the corporate owner of a life insurance policy unless certain irs requirements are met. Corporate owned life insurance taxation. The company pays the premium, owns the cash value of the policy, and becomes the beneficiary of the insurance.

Source: bankownedlifeinsurance.org

Source: bankownedlifeinsurance.org

This general rule changed when sec. As beneficiary of the policy, you retain all rights to the benefits under the policy. Because companies used coli policies to. This general rule changed when sec. For example, kate owns a ccpc and is considering buying life insurance with a monthly premium of $500.

Source: accomplishinsurance.com

Source: accomplishinsurance.com

However, since 2018, the small business limit is reduced by $5 for every $1 of passive investment over $50,000 in any given year. The taxation of life insurance is codified in s.148 of the income tax act (“act”) along with numerous regulations. To fund these programs, a company purchases and holds life insurance policies for plan participants. The company pays the premium, owns the cash value of the policy, and becomes the beneficiary of the insurance. Recent changes to the tax rules have increased the popularity of corporate owned life insurance.

Source: barriefinancialplanner.com

Source: barriefinancialplanner.com

By paying the proceeds to an estate via capital dividend, corporate owned life insurance can fund tax liabilities and equalize the value among beneficiaries,. Often in small businesses, lenders will require that loans be personally guaranteed by the owner. To fund the policy premiums personally, kate will need to earn $962 each month in order to have $500 after tax to pay the premiums. The company purchases and owns a life insurance policy on a key employee and is the primary beneficiary. As owner of the policy, you’re responsible for paying the premiums.

Source: capcorp.ca

Source: capcorp.ca

Because companies used coli policies to. Current tax law for colithe tax rules pertaining to coli are fairly complex and also vary somewhat from one state to another in some caseslife insurance is one of the most tax advantaged. The company pays the premium, owns the cash value of the policy, and becomes the beneficiary of the insurance. As beneficiary of the policy, you retain all rights to the benefits under the policy. Other names for the practice include janitor�s insurance and dead peasants insurance.

Source: paystubs.net

Source: paystubs.net

The company purchases and owns a life insurance policy on a key employee and is the primary beneficiary. Kate’s personal marginal tax rate is 48% and her corporate tax rate is 12%. Because companies used coli policies to. Previously, many corporations would retain earnings and invest them to avoid or delay personal taxes. Other names for the practice include janitor�s insurance and dead peasants insurance.

Source: booking.sglpwm.com

Source: booking.sglpwm.com

This general rule changed when sec. When an insured retired employee dies, the policy death benefit allows the company to recover part or all of the. Current tax law for colithe tax rules pertaining to coli are fairly complex and also vary somewhat from one state to another in some caseslife insurance is one of the most tax advantaged. As beneficiary of the policy, you retain all rights to the benefits under the policy. Any companies recognize that the skills and abilities of their employees are invaluable to the conduct of their businesses.

Source: david-burns.com

Source: david-burns.com

For example, kate owns a ccpc and is considering buying life insurance with a monthly premium of $500. Much of the law on life insurance is codified in the insurance acts of each province and territory. Previously, many corporations would retain earnings and invest them to avoid or delay personal taxes. As beneficiary of the policy, you retain all rights to the benefits under the policy. In general, proceeds from life insurance policies are tax free under the general exception rules in sec.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title corporate owned life insurance taxation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea