Cost of e o insurance for insurance agents Idea

Home » Trending » Cost of e o insurance for insurance agents IdeaYour Cost of e o insurance for insurance agents images are ready. Cost of e o insurance for insurance agents are a topic that is being searched for and liked by netizens now. You can Download the Cost of e o insurance for insurance agents files here. Get all free photos.

If you’re looking for cost of e o insurance for insurance agents pictures information connected with to the cost of e o insurance for insurance agents keyword, you have pay a visit to the right blog. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

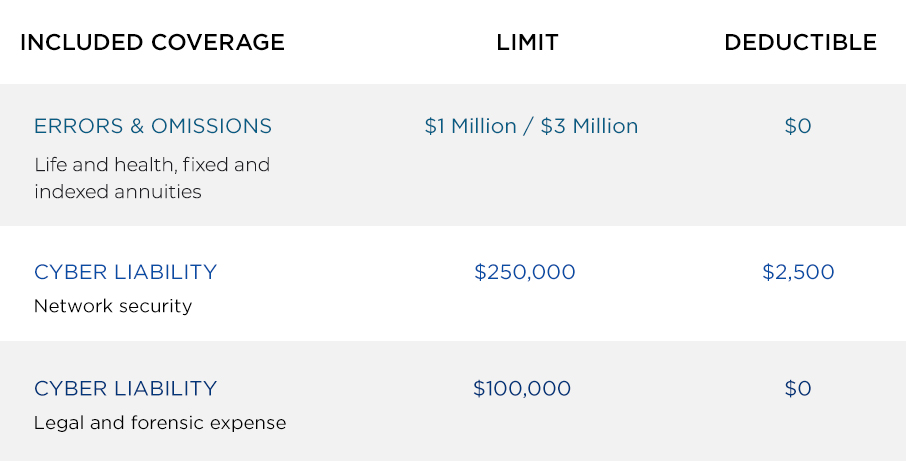

Cost Of E O Insurance For Insurance Agents. How to save money on errors and omissions (e&o) insurance according to insureon the median cost of professional liability insurance is about $710 a year, or $60 a month. E&o insurance for life & health insurance agents from $27.07/mo or $364.80/yr. E&o liability insurance is a necessity for every insurance agency. Travelers life and health insurance agents errors and omissions liability coverage is managed in conjunction with the national association of health underwriters (nahu) and mercer consumer to ensure coverages are tailored to specific errors and omissions exposures.

PPT How to Avoid the Need of E&O Insurance for Insurance From slideserve.com

PPT How to Avoid the Need of E&O Insurance for Insurance From slideserve.com

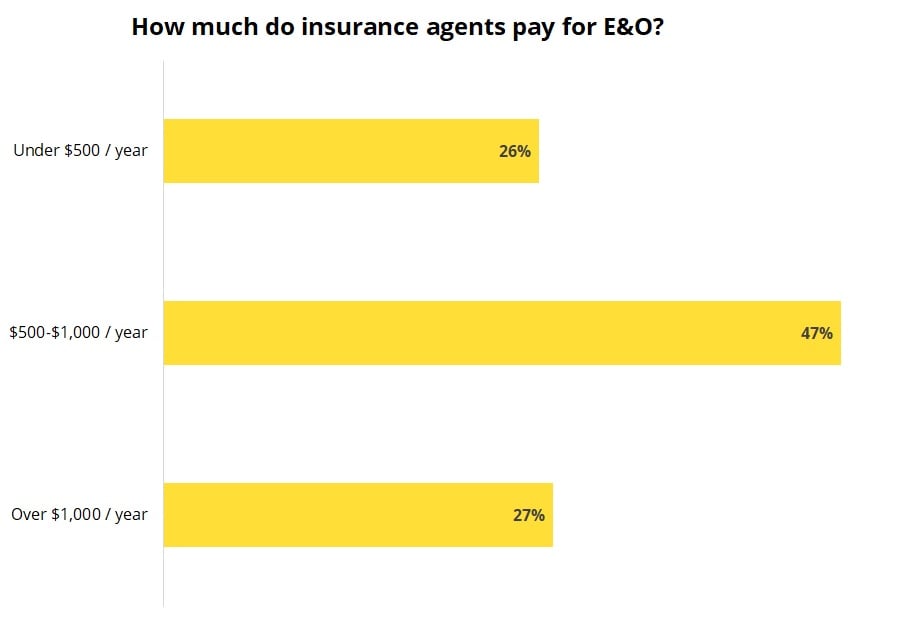

Now, let’s take a look at some sample e&o insurance policy prices: In the 5 top companies offering this insurance for insurance agents that we are able to get quotes, the costs range from $40 to $80 a month. New clients, for example, can take out an e&o insurance policy and pay premiums as low as $650. Cita insurance services offers an exclusive e&o program for insurance agents and agencies. Rated 4.8 out of 5 with 2112 reviews on prefer to talk? Basically, the second number is a way for the e&o carrier to limit their risk if an agent decides to commit negligence on a massive scale.

Some of our e&o program advantages include:

If you were licensed within past the 2 years, you may be able to take advantage of discounted errors and omissions insurance for new agents and brokers. Life & health agents can be insured for as little as $454 a year. The types of insurance you sell; That may seem like a lot, but in our increasingly litigious society, it’s a bargain compared to how much you’ll pay if a client sues you. How much does e&o insurance cost insurance agents? Cita insurance services offers an exclusive e&o program for insurance agents and agencies.

Source: pinterest.com

Source: pinterest.com

The insurance policy will cover $45,000, after. For help, support or just a quick question, feel free to call me. Instant proof of e and o insurance Examples of how much errors and omissions insurance costs average costs for e&o coverage are usually $500 to $1,000 per employee, per year. Coverage for insurance carrier insolvency.

Source: insureon.com

Source: insureon.com

Cita insurance services offers an exclusive e&o program for insurance agents and agencies. Eoforless is pleased to partner with 360 coverage pros to provide an errors & omissions insurance program with competitive rates and comprehensive coverage. Travelers life and health insurance agents errors and omissions liability coverage is managed in conjunction with the national association of health underwriters (nahu) and mercer consumer to ensure coverages are tailored to specific errors and omissions exposures. Rated 4.8 out of 5 with 2112 reviews on prefer to talk? Coverage for insurance carrier insolvency.

Source: techinsurance.com

Source: techinsurance.com

Life & health agents can be insured for as little as $454 a year. New clients, for example, can take out an e&o insurance policy and pay premiums as low as $650. Down payment includes one month�s premium, administration fees, and a $5.00 monthly processing fee. E&o insurance for life & health insurance agents from $27.07/mo or $364.80/yr. E&o liability insurance is a necessity for every insurance agency.

Source: insureon.com

Source: insureon.com

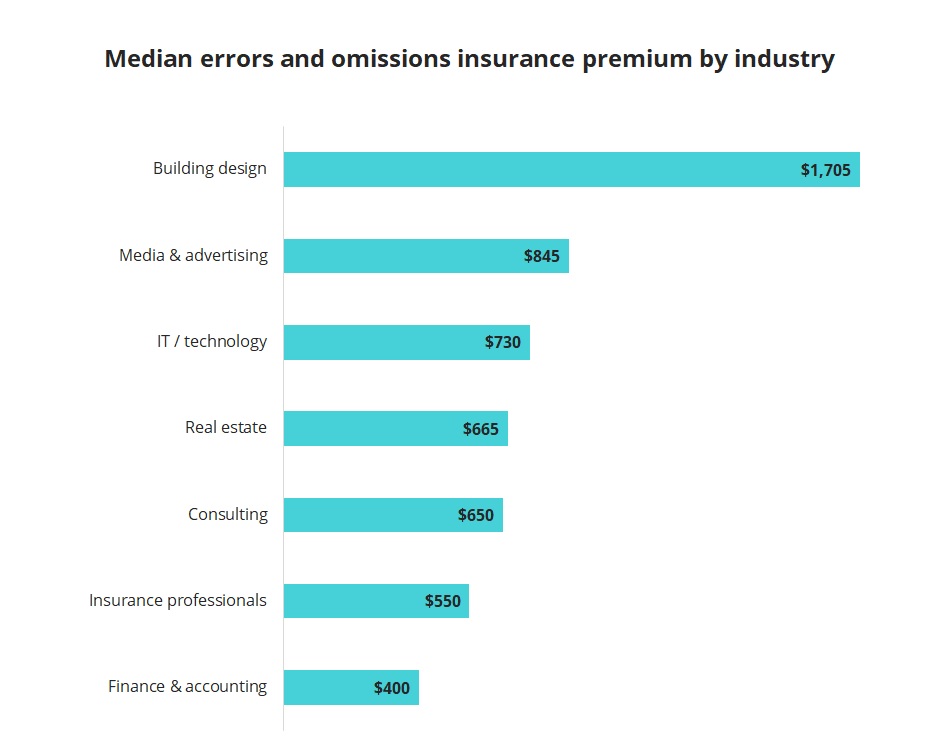

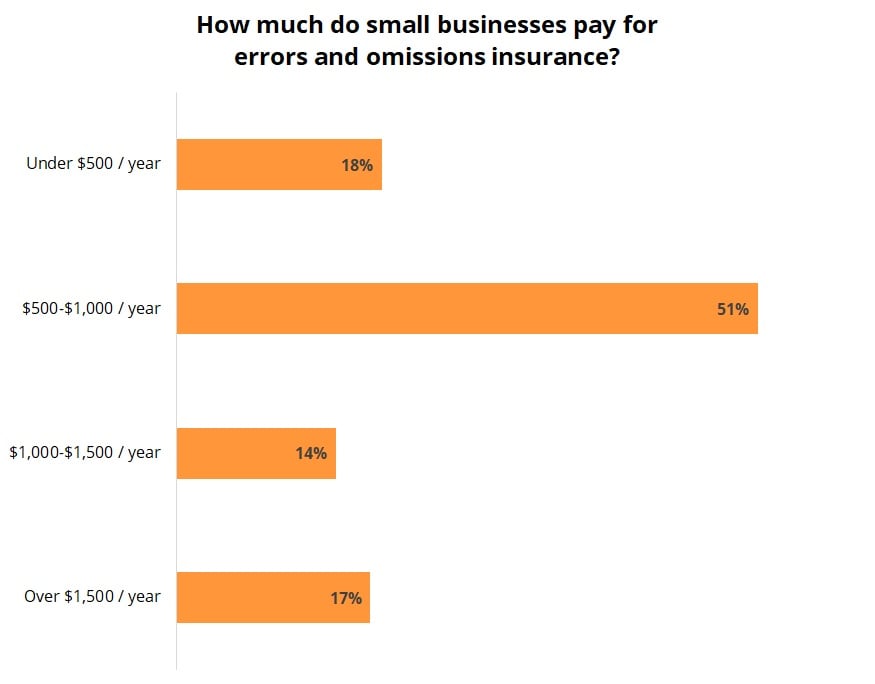

The median cost of e&o insurance is about $45 per month, or $550 annually, for insurance professionals. The types of insurance you sell; The cost of an e&o policy varies, but most small businesses pay an annual premium between $500 and $1,000. Travelers life and health insurance agents errors and omissions liability coverage is managed in conjunction with the national association of health underwriters (nahu) and mercer consumer to ensure coverages are tailored to specific errors and omissions exposures. Now, let’s take a look at some sample e&o insurance policy prices:

Source: student-health.org

Source: student-health.org

The cost of e&o insurance, however, depends, on the number of agents working in your office. Napa agent e&o insurance, also called errors and omissions insurance, starts at $26.25 per month. That may seem like a lot, but in our increasingly litigious society, it’s a bargain compared to how much you’ll pay if a client sues you. Instant proof of e and o insurance In the 5 top companies offering this insurance for insurance agents that we are able to get quotes, the costs range from $40 to $80 a month.

Source: everquote.com

Source: everquote.com

This is only an estimate. Life, accident and health insurance agents errors & omissions (e&o) liability. In the 5 top companies offering this insurance for insurance agents that we are able to get quotes, the costs range from $40 to $80 a month. Travelers life and health insurance agents errors and omissions liability coverage is managed in conjunction with the national association of health underwriters (nahu) and mercer consumer to ensure coverages are tailored to specific errors and omissions exposures. Insurance agent quotes vary based on the risks that your business faces, such as:

Source: leadheroes.com

Source: leadheroes.com

This is a group policy. How much does errors & omissions insurance cost? Cita insurance services offers an exclusive e&o program for insurance agents and agencies. Monthly payments will begin the third day of the month after the enrollment effective date. Travelers life and health insurance agents errors and omissions liability coverage is managed in conjunction with the national association of health underwriters (nahu) and mercer consumer to ensure coverages are tailored to specific errors and omissions exposures.

Source: techinsurance.com

Source: techinsurance.com

Low cost e&o for new agents now offered. New clients, for example, can take out an e&o insurance policy and pay premiums as low as $650. Insurance agents errors and omissions insurance coverage (e&o insurance) protects you from oversights and mistakes that insurance agents and adjusters make. If you have any employees the type of vehicle you use for work; So, if your business has 50 employees, you can estimate your errors and omissions premium to be between $25,000 and $50,000 per year.

Source: pinterest.com

Source: pinterest.com

Some of our e&o program advantages include: The cost of e&o insurance, however, depends, on the number of agents working in your office. The insurance policy will cover $45,000, after. Eoforless is pleased to partner with 360 coverage pros to provide an errors & omissions insurance program with competitive rates and comprehensive coverage. Coverage for insurance carrier insolvency.

Source: coverwallet.com

Source: coverwallet.com

How to save money on errors and omissions (e&o) insurance according to insureon the median cost of professional liability insurance is about $710 a year, or $60 a month. Low cost e&o for new agents now offered. If you have any employees the type of vehicle you use for work; Examples of how much errors and omissions insurance costs average costs for e&o coverage are usually $500 to $1,000 per employee, per year. The median cost of e&o insurance is about $45 per month, or $550 annually, for insurance professionals.

Source: agentsalliance.com

Source: agentsalliance.com

Cita insurance services offers an exclusive e&o program for insurance agents and agencies. Life & health agents can be insured for as little as $454 a year. Napa agent e&o insurance, also called errors and omissions insurance, starts at $26.25 per month. Say an e&o lawsuit costs a total of $50,000 and your deductible is $5,000. That may seem like a lot, but in our increasingly litigious society, it’s a bargain compared to how much you’ll pay if a client sues you.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

Now, let’s take a look at some sample e&o insurance policy prices: Eoforless is pleased to partner with 360 coverage pros to provide an errors & omissions insurance program with competitive rates and comprehensive coverage. A deductible is the amount of money you must pay toward a claim before your insurance benefits kick in. Cita insurance services offers an exclusive e&o program for insurance agents and agencies. How much does errors & omissions insurance cost?

Source: insurance-forums.com

Source: insurance-forums.com

New clients, for example, can take out an e&o insurance policy and pay premiums as low as $650. Insurance agent quotes vary based on the risks that your business faces, such as: The american agents alliance offers competitive prices for individual and corporate clients. So, if your business has 50 employees, you can estimate your errors and omissions premium to be between $25,000 and $50,000 per year. Monthly payments include one month�s premium and $5.00 processing fee.

Source: christinewphotography.blogspot.com

Source: christinewphotography.blogspot.com

Say an e&o lawsuit costs a total of $50,000 and your deductible is $5,000. That may seem like a lot, but in our increasingly litigious society, it’s a bargain compared to how much you’ll pay if a client sues you. Low cost e&o for new agents now offered. Rates for established ltc agents start at $430 annually. Eoforless is pleased to partner with 360 coverage pros to provide an errors & omissions insurance program with competitive rates and comprehensive coverage.

Source: agent.colburnfinancial.com

Source: agent.colburnfinancial.com

Instant proof of e and o insurance Insurance agents errors and omissions insurance coverage (e&o insurance) protects you from oversights and mistakes that insurance agents and adjusters make. E&o liability insurance is a necessity for every insurance agency. The cost of an e&o policy varies, but most small businesses pay an annual premium between $500 and $1,000. Highlights of the e&o insurance for agents (includes medadvantage) as a benefit to insurance agents — especially those who market medicare supplement insurance policies, the american association for medicare supplement insurance ( aamsi) makes available access to errors and omissions (e&o) liability insurance.

Source: bravopolicy.com

Since 1990, 360 coverage pros has assisted thousands of agents with their e&o needs. Rated 4.8 out of 5 with 2112 reviews on prefer to talk? Eoforless is pleased to partner with 360 coverage pros to provide an errors & omissions insurance program with competitive rates and comprehensive coverage. You can take steps to reduce your cost of e&o insurance, such as increasing your deductibles and shopping for discounts. The cost of an e&o policy varies, but most small businesses pay an annual premium between $500 and $1,000.

Source: bravopolicy.com

E&o program highlights* exclusive program Instant proof of e and o insurance This policy, also known as professional liability insurance, can protect your business from work mistakes that negatively impact clients. E&o insurance for life & health insurance agents from $27.07/mo or $364.80/yr. Cita insurance services offers an exclusive e&o program for insurance agents and agencies.

Source: slideserve.com

Source: slideserve.com

Some of our e&o program advantages include: If you prefer to pay monthly the cost is $34.05 per month with an additional down payment of $113.50. Errors and omissions insurance costs for insurance professionals. Down payment includes one month�s premium, administration fees, and a $5.00 monthly processing fee. In the 5 top companies offering this insurance for insurance agents that we are able to get quotes, the costs range from $40 to $80 a month.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cost of e o insurance for insurance agents by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea