Cost of flood insurance in nc information

Home » Trending » Cost of flood insurance in nc informationYour Cost of flood insurance in nc images are available in this site. Cost of flood insurance in nc are a topic that is being searched for and liked by netizens now. You can Download the Cost of flood insurance in nc files here. Download all royalty-free images.

If you’re searching for cost of flood insurance in nc pictures information connected with to the cost of flood insurance in nc interest, you have pay a visit to the ideal site. Our website always provides you with suggestions for seeking the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

Cost Of Flood Insurance In Nc. Avoid buying a house that floods. The facts are that the average premium for federally backed flood insurance through the nfip is only $550 a year. Is $985 per year or $82 per month, your own rates may vary. How much structural coverage you are purchasing

Federal Flood Insurance Premiums for Homeowners Rise The From nytimes.com

Federal Flood Insurance Premiums for Homeowners Rise The From nytimes.com

Under the crs, the flood insurance premiums of a community’s residents and businesses are discounted to reflect that community’s work to reduce flood damage to existing buildings, manage development in areas not mapped by the nfip, protect new buildings beyond the minimum nfip protection level, preserve and/or restore natural functions of floodplains, help. The same year, homeowners paid an average flood insurance premium of around. I am very involved on a federal level with flood insurance reform. Filing a claim will not cause your rates to increase, and you cannot be turned down for coverage. You invest your time, money, blood, sweat and tears that you put into it. The average premium you�ll pay for flood insurance depends on factors such as your state, how much coverage you need and your proximity to water.

I hold many insurance designations and i am very involved within the industry, sitting on our state�s insurance association board.

As for the cost of north carolina private flood insurance, causey believes it will be a better deal than the federal version. Rates for flood insurance coverage are standard across the united states. The average premium you�ll pay for flood insurance depends on factors such as your state, how much coverage you need and your proximity to water. The same year, homeowners paid an average flood insurance premium of around. Protect your home and belongings from devastating water damage with flood insurance. In our research, we found the average.

Source: fivebrothersinsurance.com

Source: fivebrothersinsurance.com

openfema. accessed october 21, 2021. Whether your property is in a designated flood zone; You definitely want to feel confident your home and belongings are covered during hurricane season. The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. Florida is closely followed by maryland and texas, two other states that.

Source: wnep.com

Source: wnep.com

“i’ve not seen the premiums yet, but it’s my hope that the premiums per $100,000 would actually be lower than what’s offered in. How much structural coverage you are purchasing You can only purchase flood insurance through the nfip. The facts are that the average premium for federally backed flood insurance through the nfip is only $550 a year. Is $985 per year or $82 per month, your own rates may vary.

The average cost of flood insurance is $700, but the amount may change according to your home’s location and the materials used to build it. The average premium you�ll pay for flood insurance depends on factors such as your state, how much coverage you need and your proximity to water. The same year, homeowners paid an average flood insurance premium of around. Property owners currently qualify for a 10% reduction in flood insurance premiums because the county is a class 8 in the community rating system program. Florida is closely followed by maryland and texas, two other states that.

Most homeowners and commercial insurance policies exclude coverage for flooding. According to fema, in 2019, nfip flood claims averaged $52,000 nationwide. You can only purchase flood insurance through the nfip. Property owners currently qualify for a 10% reduction in flood insurance premiums because the county is a class 8 in the community rating system program. Contact ncdoi employee directory careers at ncdoi calendar

Source: cnbc.com

Source: cnbc.com

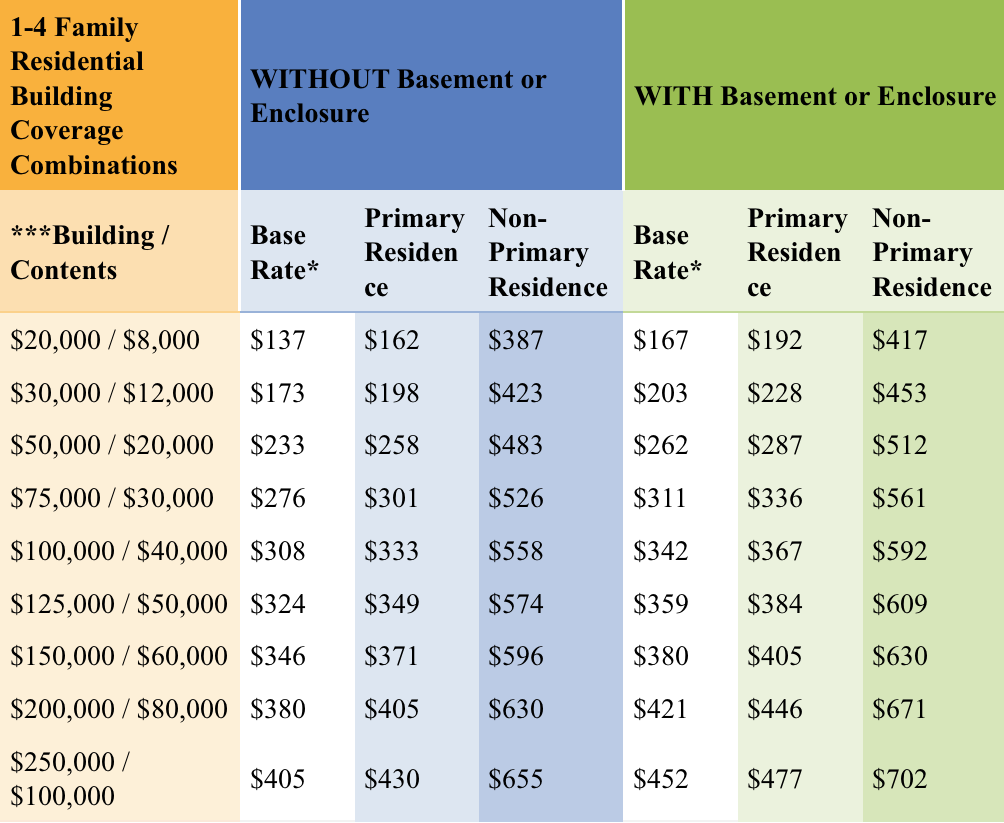

Cost of flood insurance in north carolina. openfema. accessed october 21, 2021. Average cost of flood insurance by state states with the highest flood insurance costs “i’ve not seen the premiums yet, but it’s my hope that the premiums per $100,000 would actually be lower than what’s offered in. The cost of a preferred risk policy starts as low as $129 a year.

Source: topclassactions.com

Source: topclassactions.com

Contact ncdoi employee directory careers at ncdoi calendar I hold many insurance designations and i am very involved within the industry, sitting on our state�s insurance association board. North carolina commercial flood insurance. Is $985 per year or $82 per month, your own rates may vary. This article will detail how flood insurance rates are determined, and help you find ways to save on flood insurance cost.

Source: app.com

Source: app.com

The average cost for $100,000 of coverage in north carolina is $370 per year. Whether your property is in a designated flood zone; Answered on feb 18, 2022. 8 rows how much does north carolina flood insurance cost? North carolina commercial flood insurance.

Source: farahfatihah90.blogspot.com

Source: farahfatihah90.blogspot.com

North carolina department of insurance. Outer banks flood maps click on the house at the top of the screen and then enter the address of the property. North carolina commercial flood insurance. The average cost for $100,000 of coverage in north carolina is $370 per year. “i’ve not seen the premiums yet, but it’s my hope that the premiums per $100,000 would actually be lower than what’s offered in.

Source: ncseagrant.ncsu.edu

Source: ncseagrant.ncsu.edu

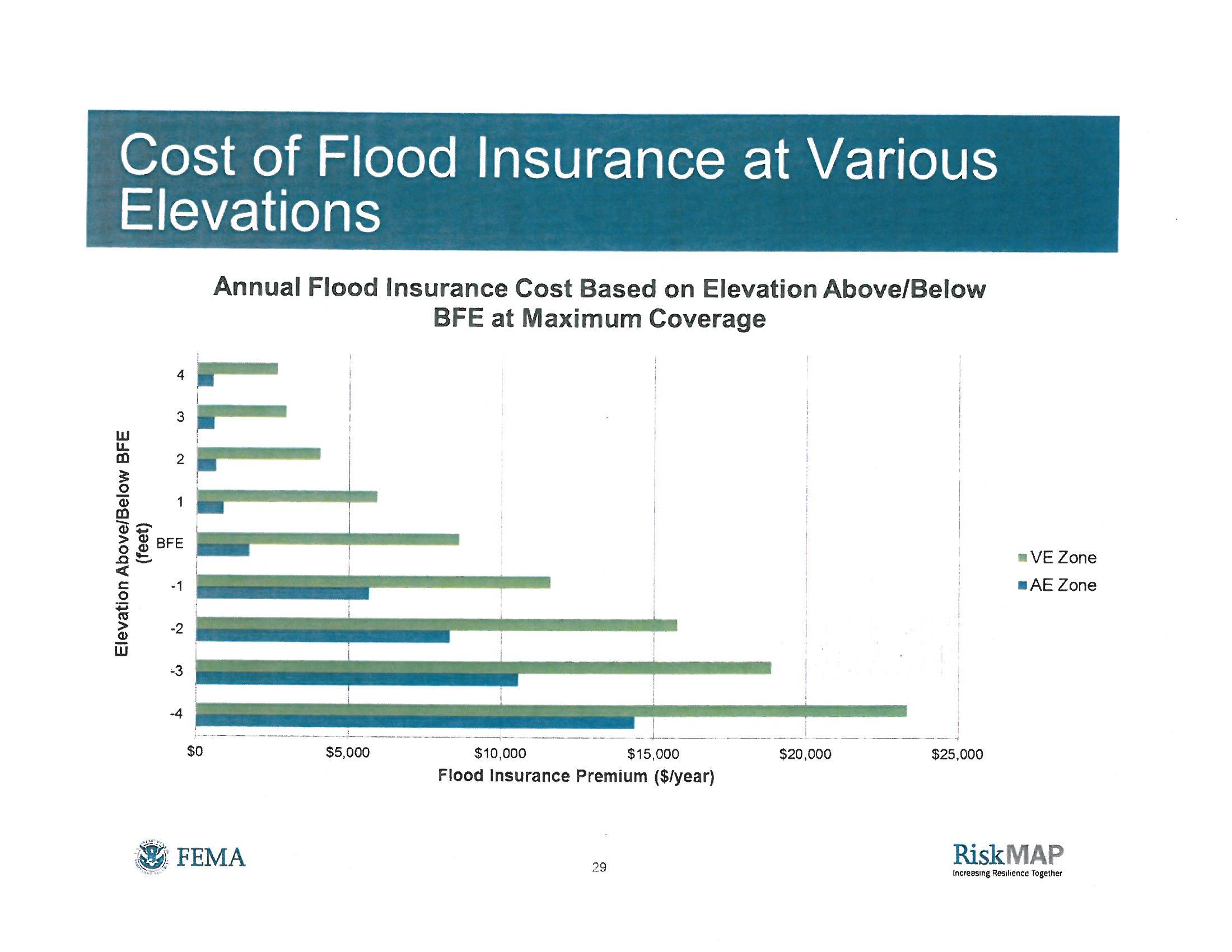

How much does flood insurance cost in fayetteville, nc? Under the crs, the flood insurance premiums of a community’s residents and businesses are discounted to reflect that community’s work to reduce flood damage to existing buildings, manage development in areas not mapped by the nfip, protect new buildings beyond the minimum nfip protection level, preserve and/or restore natural functions of floodplains, help. Answered on feb 18, 2022. 8 rows how much does north carolina flood insurance cost? The federal emergency management agency.

Source: moneyinmind.net

Rates for flood insurance coverage are standard across the united states. The average premium you�ll pay for flood insurance depends on factors such as your state, how much coverage you need and your proximity to water. Property owners currently qualify for a 10% reduction in flood insurance premiums because the county is a class 8 in the community rating system program. North carolina commercial flood insurance. This article will detail how flood insurance rates are determined, and help you find ways to save on flood insurance cost.

Source: farahfatihah90.blogspot.com

Source: farahfatihah90.blogspot.com

How much does flood insurance cost in fayetteville, nc? Filing a claim will not cause your rates to increase, and you cannot be turned down for coverage. Properties in the overlapped zones can not get federally backed f and will require private flood insurance. How much does flood insurance cost? [1] why you can trust our sources.

Source: vanbeurden.com

Source: vanbeurden.com

There are 76 communities in north carolina that qualify for discounts because they use a community rating system. Flood insurance policies are available through insurance agents for homes or businesses in communities that have joined the national flood insurance program (nfip). The same year, homeowners paid an average flood insurance premium of around. North carolina department of insurance. I hold many insurance designations and i am very involved within the industry, sitting on our state�s insurance association board.

Source: ocnj.us

Source: ocnj.us

Florida is closely followed by maryland and texas, two other states that. The average premium you�ll pay for flood insurance depends on factors such as your state, how much coverage you need and your proximity to water. The average cost of flood insurance through the national flood insurance program is $738 per year, but the cost of your own policy will depend on your home’s location and individual flood risk. The average cost for $100,000 of coverage in north carolina is $370 per year. “i’ve not seen the premiums yet, but it’s my hope that the premiums per $100,000 would actually be lower than what’s offered in.

I hold many insurance designations and i am very involved within the industry, sitting on our state�s insurance association board. Rates for coverage are standard across the united states and are based on: Contact ncdoi employee directory careers at ncdoi calendar How much does flood insurance cost in fayetteville, nc? North carolina commercial flood insurance.

Source: nytimes.com

Source: nytimes.com

[1] why you can trust our sources. Protect your home and belongings from devastating water damage with flood insurance. You can only purchase flood insurance through the nfip. [1] why you can trust our sources. Therefore, federal flood insurance is available to everyone in craven county.

Source: farahfatihah90.blogspot.com

Source: farahfatihah90.blogspot.com

North carolina department of insurance. Flood insurance policies are available through insurance agents for homes or businesses in communities that have joined the national flood insurance program (nfip). This article will detail how flood insurance rates are determined, and help you find ways to save on flood insurance cost. The town of beaufort is one such communities that participates in the nfip. Typically, the cost of flood insurance in north carolina can range from $700 to $800 per year.

Source: farahfatihah90.blogspot.com

Source: farahfatihah90.blogspot.com

Properties in the overlapped zones can not get federally backed f and will require private flood insurance. While the average cost of flood insurance in the u.s. openfema. accessed october 21, 2021. How much structural coverage you are purchasing Rates for flood insurance coverage are standard across the united states.

Source: themostimportantnews.com

Source: themostimportantnews.com

The average cost of flood insurance is $700, but the amount may change according to your home’s location and the materials used to build it. You invest your time, money, blood, sweat and tears that you put into it. openfema. accessed october 21, 2021. Answered on feb 18, 2022. Contact ncdoi employee directory careers at ncdoi calendar

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cost of flood insurance in nc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea