Couples life insurance Idea

Home » Trending » Couples life insurance IdeaYour Couples life insurance images are available in this site. Couples life insurance are a topic that is being searched for and liked by netizens now. You can Download the Couples life insurance files here. Get all free vectors.

If you’re searching for couples life insurance pictures information related to the couples life insurance interest, you have pay a visit to the ideal site. Our website frequently gives you hints for viewing the highest quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Couples Life Insurance. You can customize each respective policy to match the coverage amount and term length that each partner desires, saving 5%. Having the right life insurance in place now will help protect your loved ones financially should something happen to you in the future. Having couples life insurance would ensure that these expenses and obligations would still be met should a tragedy happen to your family. A few reasons to consider couples life insurance… increased expenses.

Life Insurance for 64 Year Olds Approval Tips & Sample From insuranceblogbychris.com

Life Insurance for 64 Year Olds Approval Tips & Sample From insuranceblogbychris.com

Otherwise, both policies work the same way. It could help with your share of the mortgage and any other debts, so your partner won’t be held back. (1) a joint life insurance policy, also known as a dual life insurance policy, covers both spouses and may be. Life insurance helps ensure the life you’ve built together continues. An important purchase most couples need to make as they plan for the future is life insurance. Life insurance is one way of looking out for your partner and minimising any financial burdens.

Having the right life insurance in place now will help protect your loved ones financially should something happen to you in the future.

Otherwise, both policies work the same way. Do more with plans that offer pure protection, retirement. It could help with your share of the mortgage and any other debts, so your partner won’t be held back. You choose how long the policy lasts, but it only pays out once during the term. A few reasons to consider couples life insurance… increased expenses. If you die, it can affect your partner financially.

Source: dreamstime.com

Source: dreamstime.com

Life insurance is one way of looking out for your partner and minimising any financial burdens. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Here’s more on what happens to your debts after you die. Life insurance is an important source of support because it can help couples face the future with more confidence. You can customize each respective policy to match the coverage amount and term length that each partner desires, saving 5%.

Source: onequote.ie

Source: onequote.ie

Life insurance helps ensure the life you’ve built together continues. An important purchase most couples need to make as they plan for the future is life insurance. Having the right life insurance in place now will help protect your loved ones financially should something happen to you in the future. It is a life insurance policy that covers two people rather than one. Two people are covered by one policy.

Source: pinterest.com

Source: pinterest.com

Life insurance is an important source of support because it can help couples face the future with more confidence. Reasons to consider couples life insurance. Life insurance is an important source of support because it can help couples face the future with more confidence. Couples often have shared financial commitments. A joint policy or two single policies.

Source: in.pinterest.com

Source: in.pinterest.com

Joint life insurance is different to single life insurance in one main way: Why should couples have life insurance? A few reasons to consider couples life insurance… increased expenses. A joint policy or two single policies. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: moneyworld.com

Source: moneyworld.com

Reduce taxable income by up to rs. Life insurance is an important source of support because it can help couples face the future with more confidence. A joint life insurance policy can either pay out when the first person dies, or the second, but not for both. Even though nothing can prepare you for the emotional loss of a spouse or partner, life insurance can help prepare you for the financial loss. Here’s more on what happens to your debts after you die.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

There are mainly three types of life insurance policies or contract choices for couples: Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. 1,50,000 deduction under section 80c**. What is joint life insurance? Here’s more on what happens to your debts after you die.

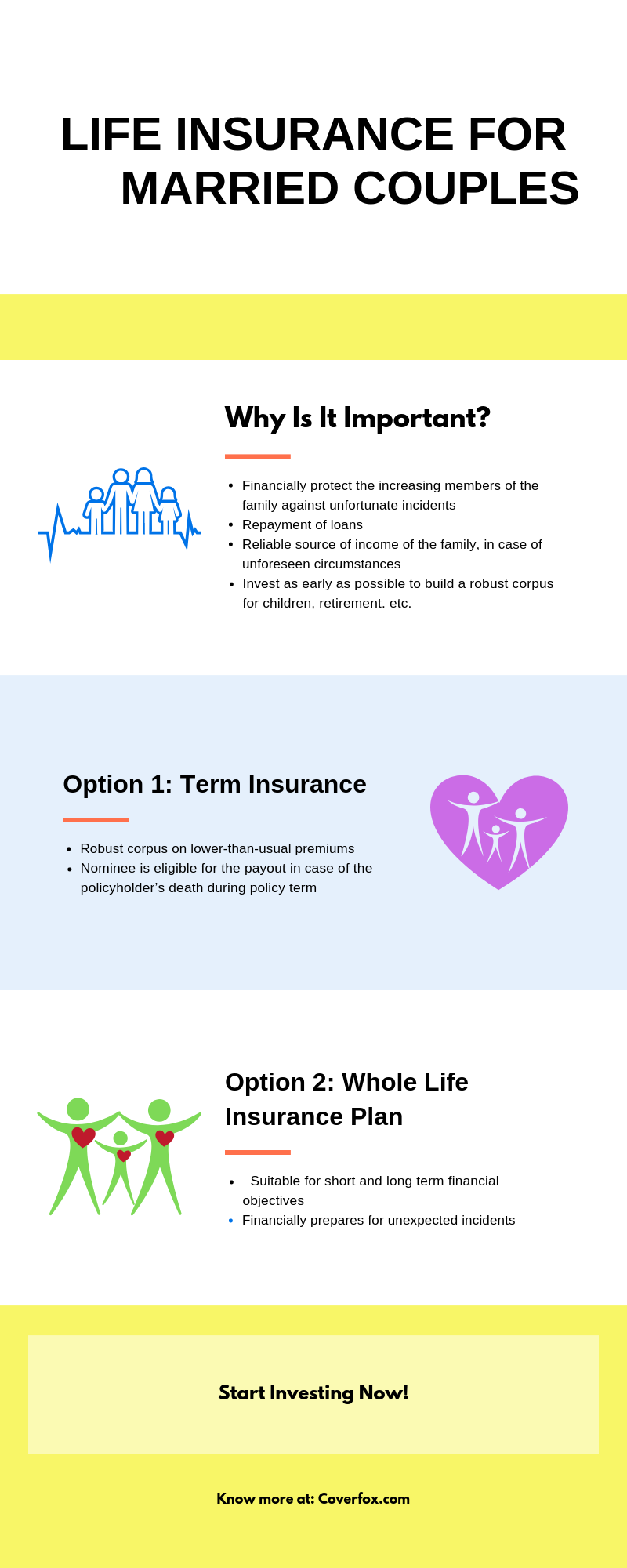

Source: coverfox.com

Source: coverfox.com

Couples can also consider joint life insurance, so both. Life insurance options for couples You are your partner likely share a lot together, whether it be a home or mortgage, children, pets, vehicles or salaries. Couples often have shared financial commitments. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: yerkesstephensins.com

Source: yerkesstephensins.com

What is joint life insurance? Even though nothing can prepare you for the emotional loss of a spouse or partner, life insurance can help prepare you for the financial loss. Couples often have shared financial commitments. Couples who want to take out life insurance generally have two options: Couples choose to have life insurance for many reasons including to pay off a mortgage, settle debts, handle final expenses, manage living expenses, or provide for heirs;

Source: shutterstock.com

Source: shutterstock.com

You can customize each respective policy to match the coverage amount and term length that each partner desires, saving 5%. If a couple decided to get life insurance for married couples, both can name each as the beneficiary so that if one dies, then the other will have financial support from the life insurance pay out. You choose how long the policy lasts, but it only pays out once during the term. Life insurance options for couples. In addition, in the unfortunate case that both die and they have children, then the children can be named as the beneficiaries, giving financial.

Source: trustlife.ca

Source: trustlife.ca

In addition, in the unfortunate case that both die and they have children, then the children can be named as the beneficiaries, giving financial. When couples look at purchasing life insurance policies together, they are usually married or in a de facto relationship (in other words, they are generally living together). Life insurance is an important source of support because it can help couples face the future with more confidence. There is also an option for a “combined life insurance policy.” similar to a joint life policy, this is one policy issued for both lives insured with a few differences. When you and your spouse are shopping for life insurance, you may want to consider a few things, such as the amount of coverage you need to protect your dependents, the number of years your policy should last and whether you want a joint life.

Source: br.pinterest.com

Source: br.pinterest.com

There is also an option for a “combined life insurance policy.” similar to a joint life policy, this is one policy issued for both lives insured with a few differences. Couples choose to have life insurance for many reasons including to pay off a mortgage, settle debts, handle final expenses, manage living expenses, or provide for heirs; Having the right life insurance in place now will help protect your loved ones financially should something happen to you in the future. You can customize each respective policy to match the coverage amount and term length that each partner desires, saving 5%. Consider getting plenty of life insurance to meet all your financial responsibilities now and in the future.

Source: einsurance.com

Source: einsurance.com

Having the right life insurance in place now will help protect your loved ones financially should something happen to you in the future. If you die, it can affect your partner financially. Consider getting plenty of life insurance to meet all your financial responsibilities now and in the future. Reduce taxable income by up to rs. Reasons to consider couples life insurance.

Source: pinterest.com

Source: pinterest.com

Why should couples have life insurance? It is a life insurance policy that covers two people rather than one. A joint life insurance policy can either pay out when the first person dies, or the second, but not for both. What is joint life insurance? Life insurance helps ensure the life you’ve built together continues.

Source: express.co.uk

Source: express.co.uk

Consider getting plenty of life insurance to meet all your financial responsibilities now and in the future. 1,50,000 deduction under section 80c**. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. When couples look at purchasing life insurance policies together, they are usually married or in a de facto relationship (in other words, they are generally living together). How does joint life insurance work?

Source: cbhs.com.au

Source: cbhs.com.au

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Couples can also consider joint life insurance, so both. Life insurance options for couples Life insurance is an important source of support because it can help couples face the future with more confidence. Why should couples have life insurance?

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Options range from an individual term life or permanent policy for each individual in a couple to riders that expand coverage; You can customize each respective policy to match the coverage amount and term length that each partner desires, saving 5%. Even though nothing can prepare you for the emotional loss of a spouse or partner, life insurance can help prepare you for the financial loss. If a couple decided to get life insurance for married couples, both can name each as the beneficiary so that if one dies, then the other will have financial support from the life insurance pay out. Consider getting plenty of life insurance to meet all your financial responsibilities now and in the future.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Here’s more on what happens to your debts after you die. Even though nothing can prepare you for the emotional loss of a spouse or partner, life insurance can help prepare you for the financial loss. If you die, it can affect your partner financially. Many couples consider life insurance options when taking the next step in their relationship, and with good reason. An important purchase most couples need to make as they plan for the future is life insurance.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Life insurance for married couples can help cover those debts if one partner were to die. Life insurance options for couples Reduce taxable income by up to rs. A few reasons to consider couples life insurance… increased expenses. It is a life insurance policy that covers two people rather than one.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title couples life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea