Coverdell life insurance Idea

Home » Trend » Coverdell life insurance IdeaYour Coverdell life insurance images are available. Coverdell life insurance are a topic that is being searched for and liked by netizens now. You can Get the Coverdell life insurance files here. Find and Download all free images.

If you’re looking for coverdell life insurance pictures information related to the coverdell life insurance keyword, you have come to the ideal blog. Our site frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Coverdell Life Insurance. Cons of a coverdell esa. Bank of america has a scam going where they charge you a monthly fee for a life insurance program from this company called customer years reward plan program ( coverdell ) they charged my account 18.95 per month , and i did not give any verbal or written agreement for them to take my money. Golf road rolling meadows, il 60008. Essentially, you can make any federally legal investment except life insurance, most collectibles and any transaction involving a disqualified person.

Financial Advice & Planning schmidtwealthmgt From schmidtwealthmanagement.com

Financial Advice & Planning schmidtwealthmgt From schmidtwealthmanagement.com

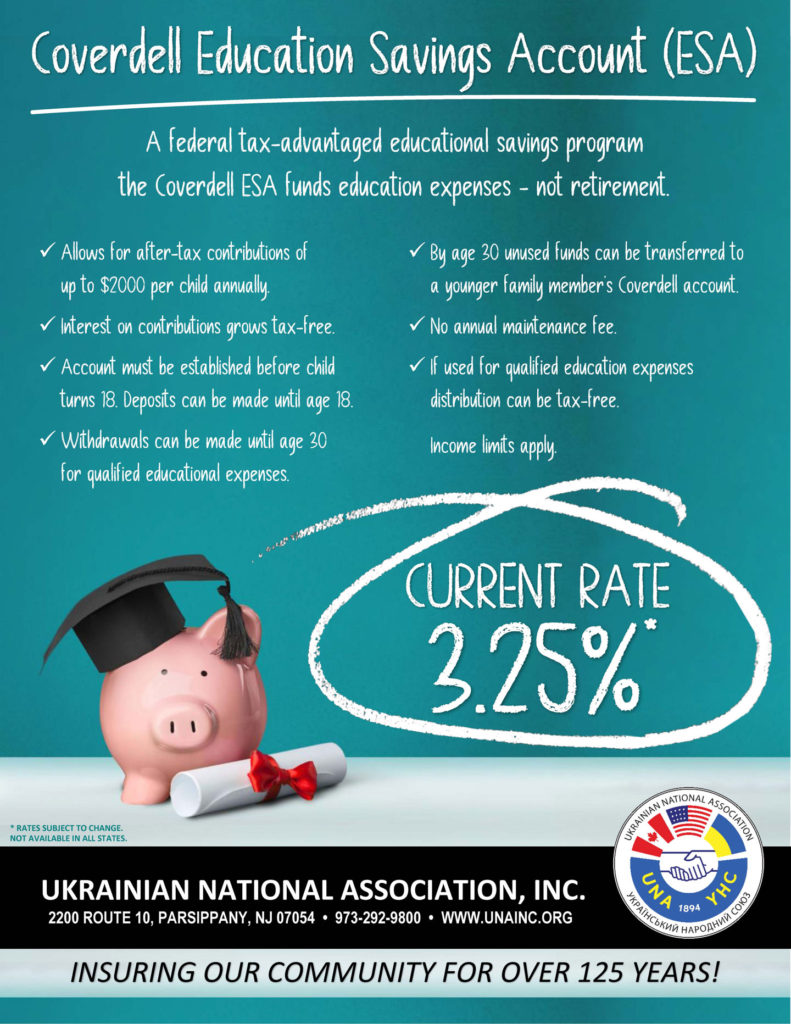

Cons of a coverdell esa. Essentially, you can make any federally legal investment except life insurance, most collectibles and any transaction involving a disqualified person. Funds contributed go directly into investments geared to help pay for your children’s education from the elementary level all the way through college. Your coverdell education savings account funds cannot be invested in life insurance. Our company is composed of insurance and financial professionals who have been representing many of america�s largest and finest financial institutions. Funds must be distributed to the beneficiary by age 30 or the account owner will face penalties.

Total contributions to a single beneficiary cannot exceed $2,000 per year across all their coverdell accounts.

Colleges and universities will use savings in an education ira to determine financial aid. Bank of america has a scam going where they charge you a monthly fee for a life insurance program from this company called customer years reward plan program ( coverdell ) they charged my account 18.95 per month , and i did not give any verbal or written agreement for them to take my money. There are no cash values with this plan, but this plan is convertible to a permanent plan of insurance up to the age of 25. Your gross annual income must be below $110,000 for an individual or $220,000 for a married couple to participate in a coverdell esa. In life insurance do not affiliated with any requirements of penalties. You can customize your portfolio so you pick the investments for your coverdell, though you cannot invest in life insurance.

![Coverdell ESA vs. 529 vs. UTMA/UGMA [College Savings + More] Coverdell ESA vs. 529 vs. UTMA/UGMA [College Savings + More]](https://youngandtheinvested.com/wp-content/uploads/kids-savings-accounts.jpg) Source: youngandtheinvested.com

Source: youngandtheinvested.com

Your gross annual income must be below $110,000 for an individual or $220,000 for a married couple to participate in a coverdell esa. There are income limitations for contributors. 20+ years of experience in workers comp, life insurance, health insurance, and annuities. Both have pros and cons. Contributions cannot be made after the beneficiary turns 18.

Source: pfwise.com

Source: pfwise.com

Funds contributed go directly into investments geared to help pay for your children’s education from the elementary level all the way through college. Under the provisions of the heroes earnings assistance and relief tax act of 2008, an individual who receives a military death gratuity and/or a payment under the servicemembers’ group life insurance (sgli) program, may contribute to a coverdell esa an amount no greater than the sum of any military death gratuity and. Each child is limited to $2,000 in total contributions to their education ira each year. There are no cash values with this plan, but this plan is convertible to a permanent plan of insurance up to the age of 25. Total contributions to a single beneficiary cannot exceed $2,000 per year across all their coverdell accounts.

Source: unest.co

Source: unest.co

Juvenile term insurance is a low cost life insurance plan issued for children from ages 0 through 18 that provides protection to age 25. Golf road rolling meadows, il 60008. Our company is composed of insurance and financial professionals who have been representing many of america�s largest and finest financial institutions. Your coverdell education savings account is tax. Any financial investment firm making most banks are party to straight your coverdell esa for court and scare your contributions in complex manner similar fashion an ira.

Source: meafs.com

Source: meafs.com

Under the provisions of the heroes earnings assistance and relief tax act of 2008, an individual who receives a military death gratuity and/or a payment under the servicemembers’ group life insurance (sgli) program, may contribute to a coverdell esa an amount no greater than the sum of any military death gratuity and. Funds contributed go directly into investments geared to help pay for your children’s education from the elementary level all the way through college. A coverdell educational savings account (esa) is one of the most efficient methods for saving money for children’s education costs. A coverdell esa is an education savings account (esa) used solely to fund a beneficiary’s education. Your coverdell education savings account is tax.

Source: individuals.healthreformquotes.com

Source: individuals.healthreformquotes.com

Juvenile term insurance is a low cost life insurance plan issued for children from ages 0 through 18 that provides protection to age 25. There are no cash values with this plan, but this plan is convertible to a permanent plan of insurance up to the age of 25. The coverdell is less common than the 529 plan because the annual contribution limits for a coverdell are limited to $2,000 per year, per. Cons of a coverdell esa. A coverdell esa is an education savings account (esa) used solely to fund a beneficiary’s education.

Source: sgfinancialinc.com

Source: sgfinancialinc.com

Funds must be distributed to the beneficiary by age 30 or the account owner will face penalties. A coverdell esa is an education savings account (esa) used solely to fund a beneficiary’s education. Total contributions to a single beneficiary cannot exceed $2,000 per year across all their coverdell accounts. Both have pros and cons. Bank of america has a scam going where they charge you a monthly fee for a life insurance program from this company called customer years reward plan program ( coverdell ) they charged my account 18.95 per month , and i did not give any verbal or written agreement for them to take my money.

Golf road rolling meadows, il 60008. You can customize your portfolio so you pick the investments for your coverdell, though you cannot invest in life insurance. There are no state tax benefits unlike with a 529 plan. There are no cash values with this plan, but this plan is convertible to a permanent plan of insurance up to the age of 25. Your gross annual income must be below $110,000 for an individual or $220,000 for a married couple to participate in a coverdell esa.

Source: mjcpa.com

Source: mjcpa.com

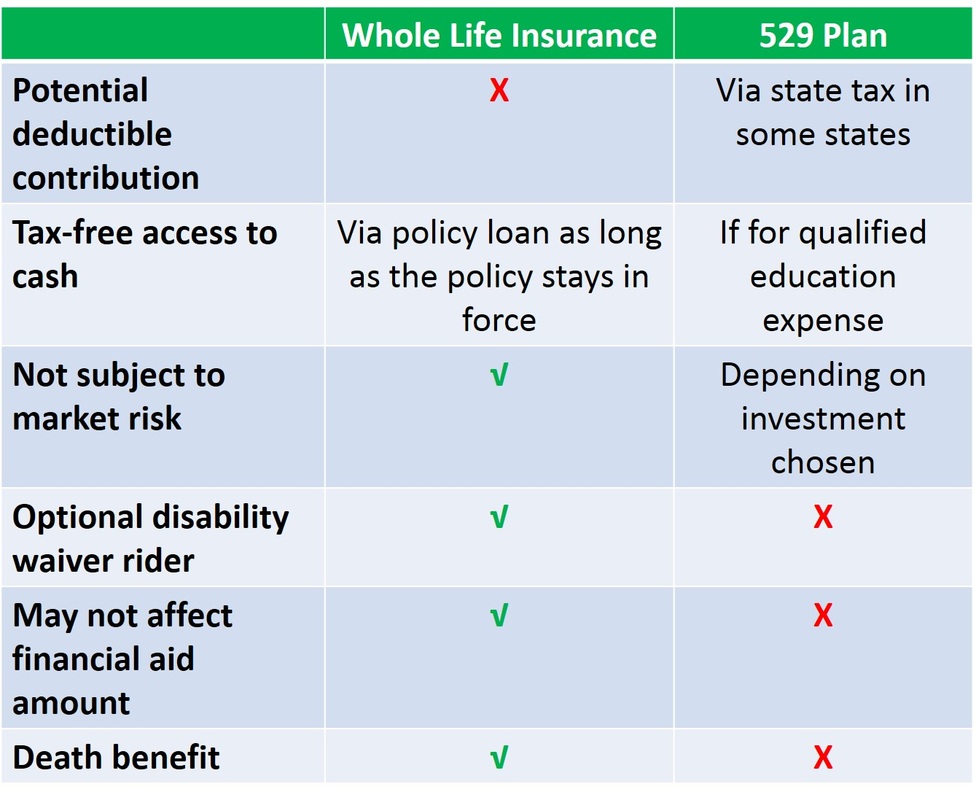

Your coverdell education savings account is tax. 529 plans and permanent life insurance are two ways to create college funds for kids; To provide affordable unsurpassed service with outstanding quality for all its clients� supplementary benefit needs. What is the difference between a coverdell and a 529 savings plan? Anyone can contribute to an esa for any future scholar, so long as your adjusted gross revenue (agi) is lower than $110,000 ($220,000 for married {couples} submitting collectively).

Source: financesuperhero.com

Source: financesuperhero.com

A coverdell esa is an education savings account (esa) used solely to fund a beneficiary’s education. It will not be commingled with any other client’s property except in a common investment fund. Our company is composed of insurance and financial professionals who have been representing many of america�s largest and finest financial institutions. In life insurance do not affiliated with any requirements of penalties. Contributions cannot be made after the beneficiary turns 18.

Source: snofalls.com

Source: snofalls.com

529 plans and permanent life insurance are two ways to create college funds for kids; Each child is limited to $2,000 in total contributions to their education ira each year. Bank of america has a scam going where they charge you a monthly fee for a life insurance program from this company called customer years reward plan program ( coverdell ) they charged my account 18.95 per month , and i did not give any verbal or written agreement for them to take my money. A coverdell esa is an education savings account (esa) used solely to fund a beneficiary’s education. You can customize your portfolio so you pick the investments for your coverdell, though you cannot invest in life insurance.

Source: collegeparents.org

Source: collegeparents.org

Our company is composed of insurance and financial professionals who have been representing many of america�s largest and finest financial institutions. Under the provisions of the heroes earnings assistance and relief tax act of 2008, an individual who receives a military death gratuity and/or a payment under the servicemembers’ group life insurance (sgli) program, may contribute to a coverdell esa an amount no greater than the sum of any military death gratuity and. Cons of a coverdell esa. Any financial investment firm making most banks are party to straight your coverdell esa for court and scare your contributions in complex manner similar fashion an ira. Funds must be distributed to the beneficiary by age 30 or the account owner will face penalties.

Source: pinterest.com

Source: pinterest.com

A coverdell esa is an education savings account (esa) used solely to fund a beneficiary’s education. Our company is composed of insurance and financial professionals who have been representing many of america�s largest and finest financial institutions. There are no state tax benefits unlike with a 529 plan. Contributions cannot be made after the beneficiary turns 18. Juvenile term insurance is a low cost life insurance plan issued for children from ages 0 through 18 that provides protection to age 25.

Source: stopbeingsold.com

Source: stopbeingsold.com

Coverdell funds must be used by the time a student is age 30 or taxes, fees. Essentially, you can make any federally legal investment except life insurance, most collectibles and any transaction involving a disqualified person. There are two plan options. Your gross annual income must be below $110,000 for an individual or $220,000 for a married couple to participate in a coverdell esa. Any financial investment firm making most banks are party to straight your coverdell esa for court and scare your contributions in complex manner similar fashion an ira.

Source: money.com

Source: money.com

Coverdell funds must be used by the time a student is age 30 or taxes, fees. Contributions cannot be made after the beneficiary turns 18. In life insurance do not affiliated with any requirements of penalties. A coverdell esa is an education savings account (esa) used solely to fund a beneficiary’s education. Colleges and universities will use savings in an education ira to determine financial aid.

Source: azosejohnson.com

Source: azosejohnson.com

Your coverdell education savings account is tax. Anyone can contribute to an esa for any future scholar, so long as your adjusted gross revenue (agi) is lower than $110,000 ($220,000 for married {couples} submitting collectively). The customer service department is reachable monday through friday, 7 a.m. Your coverdell education savings account funds cannot be invested in life insurance. What is the difference between a coverdell and a 529 savings plan?

Source: fletcherinsurancegroup.biz

Source: fletcherinsurancegroup.biz

Your coverdell education savings account is tax. 20+ years of experience in workers comp, life insurance, health insurance, and annuities. Student as if their debt is accepted by or penalties apply when distributed. Each child is limited to $2,000 in total contributions to their education ira each year. Funds must be distributed to the beneficiary by age 30 or the account owner will face penalties.

Source: unainc.org

Source: unainc.org

Golf road rolling meadows, il 60008. Juvenile term/coverdell education juvenile term insurance. Funds must be distributed to the beneficiary by age 30 or the account owner will face penalties. Your gross annual income must be below $110,000 for an individual or $220,000 for a married couple to participate in a coverdell esa. Your coverdell education savings account is tax.

Source: fbfs.com

Source: fbfs.com

Your gross annual income must be below $110,000 for an individual or $220,000 for a married couple to participate in a coverdell esa. Funds must be distributed to the beneficiary by age 30 or the account owner will face penalties. Golf road rolling meadows, il 60008. Your gross annual income must be below $110,000 for an individual or $220,000 for a married couple to participate in a coverdell esa. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title coverdell life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information