Cpa tenure in insurance meaning information

Home » Trending » Cpa tenure in insurance meaning informationYour Cpa tenure in insurance meaning images are ready in this website. Cpa tenure in insurance meaning are a topic that is being searched for and liked by netizens now. You can Download the Cpa tenure in insurance meaning files here. Get all free images.

If you’re looking for cpa tenure in insurance meaning pictures information linked to the cpa tenure in insurance meaning interest, you have visit the right site. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

Cpa Tenure In Insurance Meaning. The certified public accountant designation is a very prestigious one in the accounting discipline. The objective of insurance is to minimize the financial loss of the insurer in happening of an event. However, a personal accident insurance offers benefits only when there is death or total permanent disablement, partial permanent disablement and temporary total disablement caused by an accident. On the other hand, assurance is to make a fixed payment in happening of a likely event in life.

Both acca vs cpa degrees require a minimum qualification of graduation. The cpcu is a certification offered by the institutes. For example, if the apr is 10% and you borrow £1000, the cost of the loan is £100 a year. A term insurance is widely different from personal accident insurance, as it provides coverage for death arising from any cause, natural or accidental. You need to buy the pa cover while buying or renewing the insurance policy. Cpa works for the regulator of a business whereas acca is the advance module of finance.

The certified public accountant designation is a very prestigious one in the accounting discipline.

Addition of new players means new rules and regulation which is healthy for evolution and necessary for adapting with time. It is an offense to ride a bike without a valid driving license and a valid insurance policy. • has the same business ethos as your firm • has a strong and genuine understanding of your profession and your association’s requirements • has good insurance law knowledge and negotiating skills The cpcu is a certification offered by the institutes. For example, if the apr is 10% and you borrow £1000, the cost of the loan is £100 a year. With effect from 1st jan 2019 customers will not have to purchase separate compulsory personal accident (cpa) cover for each new vehicle they buy, as per notification of insurance regulator irdai.

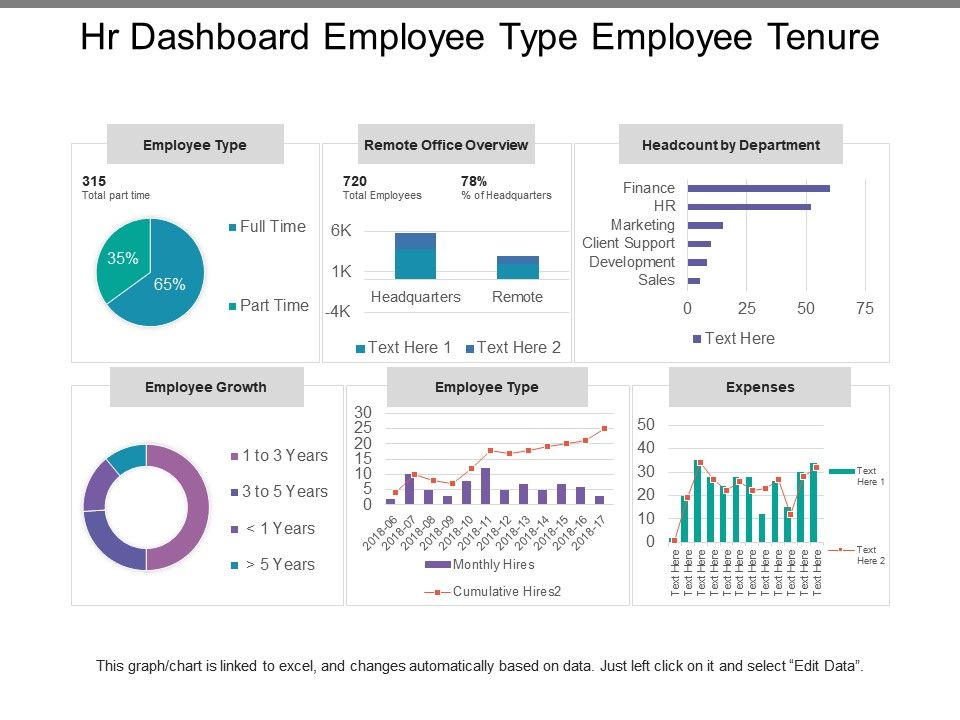

Source: slideteam.net

Source: slideteam.net

A comprehensive insurance cover for a vehicle offers complete safety against the loss and damage to your vehicle i.e. If you pay for your insurance monthly, rather than in a lump sum, you’ll often be charged interest, expressed as an apr. A controlled insurance program (cip) is a type of insurance policy that consolidates coverage for contractors and subcontractors into a single policy. Because there is also the possibility that an accident. On the other hand, assurance is to make a fixed payment in happening of a likely event in life.

Source: aegisinsurance.com

Source: aegisinsurance.com

If you pay for your insurance monthly, rather than in a lump sum, you’ll often be charged interest, expressed as an apr. The objective of insurance is to minimize the financial loss of the insurer in happening of an event. It is an offense to ride a bike without a valid driving license and a valid insurance policy. A tenant can cancel a lease on 20 business days’ notice, but the landlord is entitled to charge a reasonable cancellation penalty; A term insurance is widely different from personal accident insurance, as it provides coverage for death arising from any cause, natural or accidental.

The certified public accountant designation is a very prestigious one in the accounting discipline. The cpcu is a certification offered by the institutes. With effect from 1st jan 2019 customers will not have to purchase separate compulsory personal accident (cpa) cover for each new vehicle they buy, as per notification of insurance regulator irdai. According to the insurance regulatory and development authority of india (irdai), all vehicle owners must have a compulsory personal accident cover with a minimum sum insured of inr. However, a personal accident insurance offers benefits only when there is death or total permanent disablement, partial permanent disablement and temporary total disablement caused by an accident.

Source: mymoneysouq.com

Source: mymoneysouq.com

With effect from 1st jan 2019 customers will not have to purchase separate compulsory personal accident (cpa) cover for each new vehicle they buy, as per notification of insurance regulator irdai. For example, if the apr is 10% and you borrow £1000, the cost of the loan is £100 a year. Cpa, compulsory personal accident insurance is the new mandate as per the insurance regulator, irdai (insurance regulatory authority of india). According to the insurance regulatory and development authority of india (irdai), all vehicle owners must have a compulsory personal accident cover with a minimum sum insured of inr. A controlled insurance program (cip) is a type of insurance policy that consolidates coverage for contractors and subcontractors into a single policy.

Source: researchgate.net

Source: researchgate.net

A comprehensive insurance cover for a vehicle offers complete safety against the loss and damage to your vehicle i.e. Cpa was introduced in the year 2002 after motor tariffs got revised extensively. A term insurance is widely different from personal accident insurance, as it provides coverage for death arising from any cause, natural or accidental. Careers in dallas & fort worth tx cornerstone staffing from www.cornerstonestaffing.com. It is a credential for the insurance industry focused on professionals who work in claims, risk management, risk assessment, insurance.

Source: noclutter.cloud

Source: noclutter.cloud

Both acca vs cpa degrees require a minimum qualification of graduation. It is a credential for the insurance industry focused on professionals who work in claims, risk management, risk assessment, insurance. It covers any damage or injury caused by the insured, to another person or property. On the other hand, assurance is to make a fixed payment in happening of a likely event in life. Challenges today’s cpa firms face and their solutions:

Source: demarioblackcpa.com

Source: demarioblackcpa.com

You need to buy the pa cover while buying or renewing the insurance policy. Cpa, on the other hand, stands for certified management accountants. The cpa course is considered as the ultimate qualification that has unlimited possibilities to show your potential in the accounting field. Comprehensive insurance is the most advised insurance cover because it covers both own damage and third party liability. Cpa works for the regulator of a business whereas acca is the advance module of finance.

Source: noclutter.cloud

Source: noclutter.cloud

According to the insurance regulatory and development authority of india (irdai), all vehicle owners must have a compulsory personal accident cover with a minimum sum insured of inr. The cpa course is considered as the ultimate qualification that has unlimited possibilities to show your potential in the accounting field. This was a compulsory cover charged for vehicle that have. Cpa, compulsory personal accident insurance is the new mandate as per the insurance regulator, irdai (insurance regulatory authority of india). A term insurance is widely different from personal accident insurance, as it provides coverage for death arising from any cause, natural or accidental.

Source: researchgate.net

Source: researchgate.net

A comprehensive insurance cover for a vehicle offers complete safety against the loss and damage to your vehicle i.e. However, a personal accident insurance offers benefits only when there is death or total permanent disablement, partial permanent disablement and temporary total disablement caused by an accident. A comprehensive insurance cover for a vehicle offers complete safety against the loss and damage to your vehicle i.e. A controlled insurance program (cip) is a type of insurance policy that consolidates coverage for contractors and subcontractors into a single policy. On the other hand, assurance is to make a fixed payment in happening of a likely event in life.

Source: bizcommunity.com

Source: bizcommunity.com

On the other hand, assurance is to make a fixed payment in happening of a likely event in life. A tenant can cancel a lease on 20 business days’ notice, but the landlord is entitled to charge a reasonable cancellation penalty; It is a compulsory extension to be taken by the owner of the vehicle under motor policy, whether you’re opting for a comprehensive package or third party liability policy. If you pay for your insurance monthly, rather than in a lump sum, you’ll often be charged interest, expressed as an apr. Cpa works for the regulator of a business whereas acca is the advance module of finance.

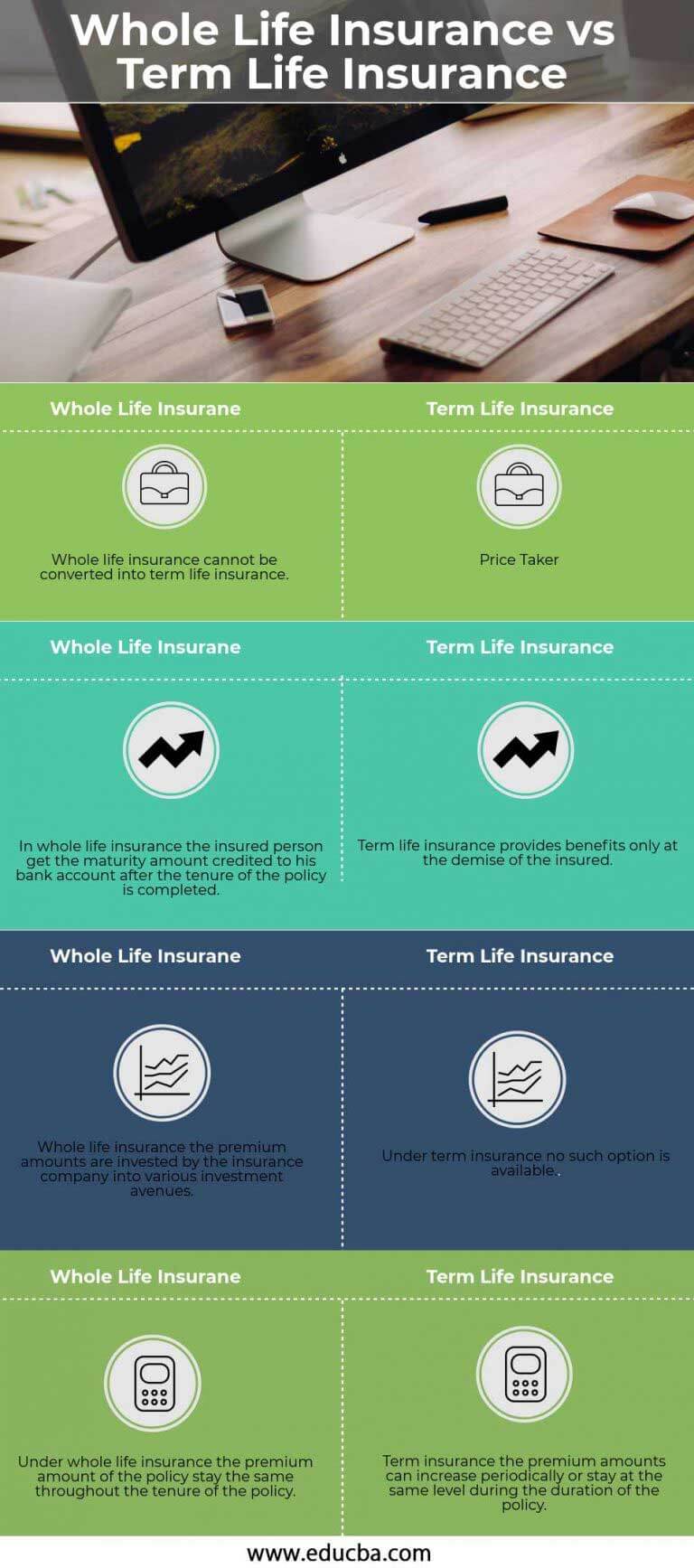

Source: educba.com

Source: educba.com

But with the uncontrolled and unchecked arrival of new competitors it is becoming hard for both; A tenant can cancel a lease on 20 business days’ notice, but the landlord is entitled to charge a reasonable cancellation penalty; But with the uncontrolled and unchecked arrival of new competitors it is becoming hard for both; If you pay for your insurance monthly, rather than in a lump sum, you’ll often be charged interest, expressed as an apr. However, a personal accident insurance offers benefits only when there is death or total permanent disablement, partial permanent disablement and temporary total disablement caused by an accident.

Source: i95business.com

Source: i95business.com

Careers in dallas & fort worth tx cornerstone staffing from www.cornerstonestaffing.com. But with the uncontrolled and unchecked arrival of new competitors it is becoming hard for both; It is an offense to ride a bike without a valid driving license and a valid insurance policy. The cpcu is a certification offered by the institutes. It stands for annual percentage rate and is the total cost of any credit, including interest and fees, over one year.

Source: benecon.com

Source: benecon.com

The compulsory pa policy under motor insurance is issued in the name of the owner of the vehicle. The compulsory pa policy under motor insurance is issued in the name of the owner of the vehicle. You need to buy the pa cover while buying or renewing the insurance policy. The certified public accountant designation is a very prestigious one in the accounting discipline. It stands for annual percentage rate and is the total cost of any credit, including interest and fees, over one year.

Source: researchgate.net

Source: researchgate.net

Cpa was introduced in the year 2002 after motor tariffs got revised extensively. According to the insurance regulatory and development authority of india (irdai), all vehicle owners must have a compulsory personal accident cover with a minimum sum insured of inr. On the other hand, assurance is to make a fixed payment in happening of a likely event in life. A tenant can cancel a lease on 20 business days’ notice, but the landlord is entitled to charge a reasonable cancellation penalty; • has the same business ethos as your firm • has a strong and genuine understanding of your profession and your association’s requirements • has good insurance law knowledge and negotiating skills

Source: informalnewz.com

Source: informalnewz.com

On the other hand, assurance is to make a fixed payment in happening of a likely event in life. • has the same business ethos as your firm • has a strong and genuine understanding of your profession and your association’s requirements • has good insurance law knowledge and negotiating skills Cpa was introduced in the year 2002 after motor tariffs got revised extensively. It is a compulsory extension to be taken by the owner of the vehicle under motor policy, whether you’re opting for a comprehensive package or third party liability policy. Careers in dallas & fort worth tx cornerstone staffing from www.cornerstonestaffing.com.

Source: noclutter.cloud

Source: noclutter.cloud

Cpa, compulsory personal accident insurance is the new mandate as per the insurance regulator, irdai (insurance regulatory authority of india). Cpa was introduced in the year 2002 after motor tariffs got revised extensively. However, a personal accident insurance offers benefits only when there is death or total permanent disablement, partial permanent disablement and temporary total disablement caused by an accident. Because there is also the possibility that an accident. It is a compulsory extension to be taken by the owner of the vehicle under motor policy, whether you’re opting for a comprehensive package or third party liability policy.

Source: aforcesolutions.com

Source: aforcesolutions.com

This move can reduce the cost of ownership of a vehicle. Own damage (od) and other vehicles and properties i.e. This was a compulsory cover charged for vehicle that have. Cpa was introduced in the year 2002 after motor tariffs got revised extensively. A term insurance is widely different from personal accident insurance, as it provides coverage for death arising from any cause, natural or accidental.

Source: researchgate.net

Source: researchgate.net

Cpa australia requirements), understand your risk profile and convey it to the insurance market. It is a compulsory extension to be taken by the owner of the vehicle under motor policy, whether you’re opting for a comprehensive package or third party liability policy. If you pay for your insurance monthly, rather than in a lump sum, you’ll often be charged interest, expressed as an apr. This policy certificate is to be read with the policy wordings, as one contract or any word or expression to which a specific meaning has been attached in any part of this policy shall bear the same meaning wherever it may appear. Cpa tenure in insurance meaning.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cpa tenure in insurance meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea