Cpi insurance information

Home » Trend » Cpi insurance informationYour Cpi insurance images are ready in this website. Cpi insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Cpi insurance files here. Find and Download all free photos.

If you’re looking for cpi insurance pictures information related to the cpi insurance keyword, you have pay a visit to the ideal blog. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Cpi Insurance. Collateral protection insurance, or cpi, is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan. The partners and staff of cpi companies are uniquely committed to the success of the products we sell. Lexham insurance offer low cost insurance premiums on all new and used cpi scooters and motorcycles. Lenders buy to protect their assets in the event of a physical damage loss to what would otherwise be an uninsured vehicle.

Your auto loan portfolio can be your biggest liability. When a customer fails to provide adequate physical insurance on the car, the lender has the right to place the asset on cpi. With 40 years and over 18 million loans tracked, we discovered that while 8% of borrowers don’t verify their insurance on collateral, only 1 to 3% that will. Between 1913 and 1977, the bls focused on measuring this type of cpi. Cpi is a commercial insurance product between a lender and collateral protection insurance company. We are the best back office in the life insurance business.

Over the last decade, more than 500,000 people chose cph for liability insurance.

Speciality insurance companies built a coverage model to offer this as a protection product. Lenders buy to protect their assets in the event of a physical damage loss to what would otherwise be an uninsured vehicle. Cpi is a commercial insurance product between a lender and collateral protection insurance company. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. That’s where collateral protection insurance (cpi) can.

Source: vendingmarketwatch.com

Source: vendingmarketwatch.com

Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. With 40 years and over 18 million loans tracked, we discovered that while 8% of borrowers don’t verify their insurance on collateral, only 1 to 3% that will. Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. That’s where collateral protection insurance (cpi) can. Cpi is a commercial insurance product between a lender and collateral protection insurance company.

Source: verifacto.com

Source: verifacto.com

That’s where collateral protection insurance (cpi) can. The cpi for health insurance was 100.000 in the year 2005 and 173.188 in 2021: Between 1913 and 1977, the bls focused on. When a customer secures a loan for a vehicle, they must sign a point of sale letter that commits them as the borrower to purchase and maintain comprehensive and collision coverage on the vehicle as long as. Because our business is specialized, we are able to focus on your liability needs in a way that bigger companies are not.

Source: cepagram.com

Source: cepagram.com

Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. That’s where collateral protection insurance (cpi) can. Speciality insurance companies built a coverage model to offer this as a protection product. Because our business is specialized, we are able to focus on your liability needs in a way that bigger companies are not. We strive to offer you quality insurance coverage with a high level of professional, personalized.

Source: goldexapp.com

Source: goldexapp.com

Bureau of labor statistics, $20 in 2005 has the same purchasing power as $34.64 in 2021 (in the cpi category of health insurance ). The cpi for health insurance was 100.000 in the year 2005 and 173.188 in 2021: The insuring party and 2. Because our business is specialized, we are able to focus on your liability needs in a way that bigger companies are not. But along with a car come costs like loan payments, fuel, parking, and car insurance.

Source: acronymsandslang.com

Source: acronymsandslang.com

Collateral protection insurance (cpi) pertains to a situation that occurs when your vehicle insurance changes or lapses during the life of a vehicle loan (27). Collateral protection insurance (cpi) pertains to a situation that occurs when your vehicle insurance changes or lapses during the life of a vehicle loan (27). Between 1913 and 1977, the bls focused on. Cpi is a commercial insurance product between a lender and collateral protection insurance company. Managed by lexham insurance consultants ltd.

Source: youtube.com

Source: youtube.com

With 40 years and over 18 million loans tracked, we discovered that while 8% of borrowers don’t verify their insurance on collateral, only 1 to 3% that will. Banks finance companies auto dealers utilities with the right technology, you can cancel out the noise of insurance tracking. Vehicle collateral protection insurance (cpi) credit unions; With a loan portfolio of any size, verifying and tracking insurance can be burdensome. Because our business is specialized, we are able to focus on your liability needs in a way that bigger companies are not.

Source: verifacto.com

Source: verifacto.com

That’s where collateral protection insurance (cpi) can. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Guardian financial & insurance company is a local friendly commercial and personal insurance agency in the kanawha region. Collateral protection insurance, or cpi, is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan. We strive to offer you quality insurance coverage with a high level of professional, personalized.

Source: thebuzzernews.blogspot.com

It includes theft, animal impacts. That’s where collateral protection insurance (cpi) can. Speciality insurance companies built a coverage model to offer this as a protection product. When a customer secures a loan for a vehicle, they must sign a point of sale letter that commits them as the borrower to purchase and maintain comprehensive and collision coverage on the vehicle as long as. We strive to offer you quality insurance coverage with a high level of professional, personalized.

Source: goldeneagle-insurance.com

Source: goldeneagle-insurance.com

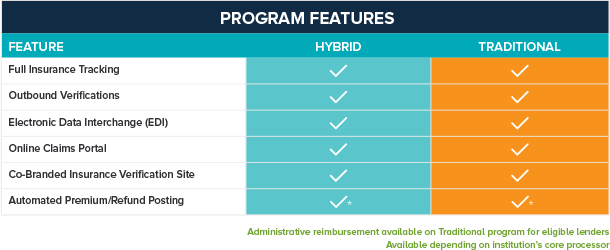

Because our business is specialized, we are able to focus on your liability needs in a way that bigger companies are not. But along with a car come costs like loan payments, fuel, parking, and car insurance. We can get you better rates, better coverage, and give you more personal attention and care than anyone else in the industry. Cpi is a commercial insurance product between a lender and collateral protection insurance company. Collateral protection insurance (cpi) programs.

Source: unitas360.com

Institutions added this to their portfolio, and ensured loan agreements allowed them to add policies if needed. Cpi is a commercial insurance product between a lender and collateral protection insurance company. Over the last decade, more than 500,000 people chose cph for liability insurance. Cpi is a commercial insurance product between a lender and collateral protection insurance company. When a customer fails to provide adequate physical insurance on the car, the lender has the right to place the asset on cpi.

Source: cpifinancial.com

Source: cpifinancial.com

In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle. When a customer fails to provide adequate physical insurance on the car, the lender has the right to place the asset on cpi. Cpi is a commercial insurance product between a lender and collateral protection insurance company. Our team of associates represent over 50 years of collective experience in this field, and we are able to serve Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage.

Source: cpiinsure.com

Source: cpiinsure.com

When a customer fails to provide adequate physical insurance on the car, the lender has the right to place the asset on cpi. Over the last decade, more than 500,000 people chose cph for liability insurance. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle. Lexham insurance offer low cost insurance premiums on all new and used cpi scooters and motorcycles. 173.188 / 100.000 * $20 = $34.64.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

Over the last decade, more than 500,000 people chose cph for liability insurance. Our team of associates represent over 50 years of collective experience in this field, and we are able to serve Between 1913 and 1977, the bls focused on measuring this type of cpi. The insuring party and 2. Lenders buy to protect their assets in the event of a physical damage loss to what would otherwise be an uninsured vehicle.

But along with a car come costs like loan payments, fuel, parking, and car insurance. Lenders buy to protect their assets in the event of a physical damage loss to what would otherwise be an uninsured vehicle. Between 1913 and 1977, the bls focused on measuring this type of cpi. The partners and staff of cpi companies are uniquely committed to the success of the products we sell. 173.188 / 100.000 * $20 = $34.64.

Source: statenational.com

Source: statenational.com

Over the last decade, more than 500,000 people chose cph for liability insurance. Cpi has the following options: 173.188 / 100.000 * $20 = $34.64. When borrowers take out an auto loan, their loan agreement usually requires that they maintain physical damage insurance to cover the loan collateral, naming your financial institution as an additional. The insurer the insuring party has submitted to the insurer a proposal requesting insurance cover to be provided under one or more sections of this policy of insurance and the proposal has been accepted by the insurer.

Source: ons.gov.uk

The insuring party and 2. That’s where collateral protection insurance (cpi) can. We are the best back office in the life insurance business. When a customer secures a loan for a vehicle, they must sign a point of sale letter that commits them as the borrower to purchase and maintain comprehensive and collision coverage on the vehicle as long as. Collateral protection insurance (cpi) pertains to a situation that occurs when your vehicle insurance changes or lapses during the life of a vehicle loan (27).

![]() Source: goldeneagle-insurance.com

Source: goldeneagle-insurance.com

Collateral protection insurance, or cpi, is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan. Between 1913 and 1977, the bls focused on measuring this type of cpi. We are the best back office in the life insurance business. Collateral protection insurance — or cpi — is a type of car insurance purchased by your lender to protect your vehicle if you don�t have the required amount of insurance coverage. That’s where collateral protection insurance (cpi) can.

Source: mantlefp.com

Source: mantlefp.com

When a customer fails to provide adequate physical insurance on the car, the lender has the right to place the asset on cpi. When borrowers take out an auto loan, their loan agreement usually requires that they maintain physical damage insurance to cover the loan collateral, naming your financial institution as an additional. With a loan portfolio of any size, verifying and tracking insurance can be burdensome. What is a cpi letter? We are the best back office in the life insurance business.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cpi insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information