Cpi insurance meaning Idea

Home » Trending » Cpi insurance meaning IdeaYour Cpi insurance meaning images are ready. Cpi insurance meaning are a topic that is being searched for and liked by netizens today. You can Find and Download the Cpi insurance meaning files here. Get all free photos and vectors.

If you’re searching for cpi insurance meaning pictures information connected with to the cpi insurance meaning interest, you have visit the ideal blog. Our site frequently provides you with hints for viewing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

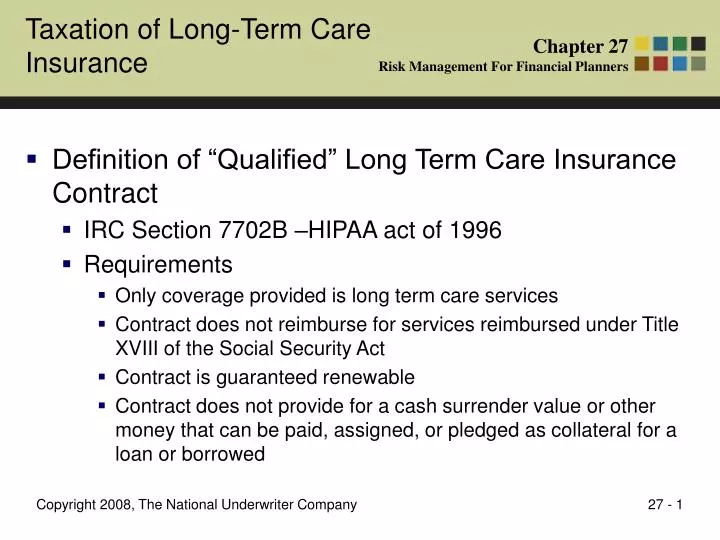

Cpi Insurance Meaning. Payment protection insurance (ppi), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt. Looking for online definition of cpi or what cpi stands for? Cpi stands for collateral protection insurance. The cpi provider receives information on all new loans and updates on existing loans in a lender’s portfolio and tracks the insurance status of each.

How is collateral protection insurance abbreviated? Today, our focus is on the first product, collateral protection insurance (cpi). This is because it covers the entire amount left on the loan, whereas normal insurance covers the actual cash value of the collateral, which means you’re covering the true value of your collateral. More how social security benefits work Jun 10, 2021 — collateral protection insurance (cpi) is car insurance that protects your car against physical damage. When borrowers take out an auto loan, their loan agreement usually requires that they maintain physical damage insurance to cover the loan collateral, naming your financial institution as an additional interest on the policy.

This is where the australian taxation office looks at the average prices that we all pay for goods and services across australia.

The consumer price index (cpi) measures the average change in prices over time that consumers pay for a basket of goods and services. Cpi is defined as collateral protection insurance frequently. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Period of insurance means the period during which cover is provided by this policy of insurance as specified in the schedules. Policy of insurance means the proposal, the definitions, the conditions, the exclusions, the schedules and the section(s) of this policy of insurance. Jun 10, 2021 — collateral protection insurance (cpi) is car insurance that protects your car against physical damage.

Source: blog.statenational.com

The cpi is a measure of consumer price inflation produced to international standards and in line with european regulations. It is chosen by your lender and added (9). The consumer price index (cpi) is a measure of the aggregate price level in an economy. Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Collateral protection insurance, or cpi, is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan.

First published in january 1996 as the harmonised index of consumer prices (hicp), the cpi is the inflation measure used in the government’s target for inflation. Today, our focus is on the first product, collateral protection insurance (cpi). Cpi is listed in the world�s largest and most authoritative dictionary database of abbreviations and acronyms the free dictionary More how social security benefits work Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance.

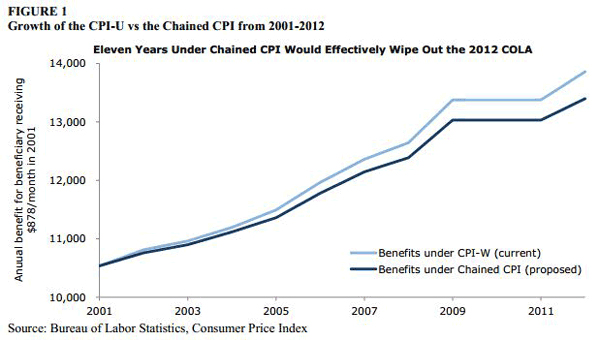

Source: horrydemocrats.org

Source: horrydemocrats.org

Period of insurance means the period during which cover is provided by this policy of insurance as specified in the schedules. It is chosen by your lender and added (9). Cpi is also much more expensive than typical insurance. Cpi is listed in the world�s largest and most authoritative dictionary database of abbreviations and acronyms the free dictionary It looks at the cost of 11 categories that make up the bulk of living expenses in major cities:

Source: e3e3chobots.blogspot.com

Source: e3e3chobots.blogspot.com

Collateral protection insurance, or cpi, is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan. Premium means the premium payable under this policy of insurance calculated in The consumer price index (cpi) measures the average change in prices over time that consumers pay for a basket of goods and services. It looks at the cost of 11 categories that make up the bulk of living expenses in major cities: The cpi measures the changes in the purchasing power of a country’s currency usd/cad currency cross the usd/cad currency pair represents the quoted rate for exchanging us to cad, or, how many canadian dollars one.

Source: mantlefp.com

Source: mantlefp.com

Period of insurance means the period during which cover is provided by this policy of insurance as specified in the schedules. Cpi is also much more expensive than typical insurance. Cpi is defined as collateral protection insurance frequently. What is the consumer price index (cpi)? The cpi is a measure of consumer price inflation produced to international standards and in line with european regulations.

Source: e3e3chobots.blogspot.com

Source: e3e3chobots.blogspot.com

Cpi is listed in the world�s largest and most authoritative dictionary database of abbreviations and acronyms the free dictionary What is the consumer price index (cpi)? More how social security benefits work The cpi measures the changes in the purchasing power of a country’s currency usd/cad currency cross the usd/cad currency pair represents the quoted rate for exchanging us to cad, or, how many canadian dollars one. This is because it covers the entire amount left on the loan, whereas normal insurance covers the actual cash value of the collateral, which means you’re covering the true value of your collateral.

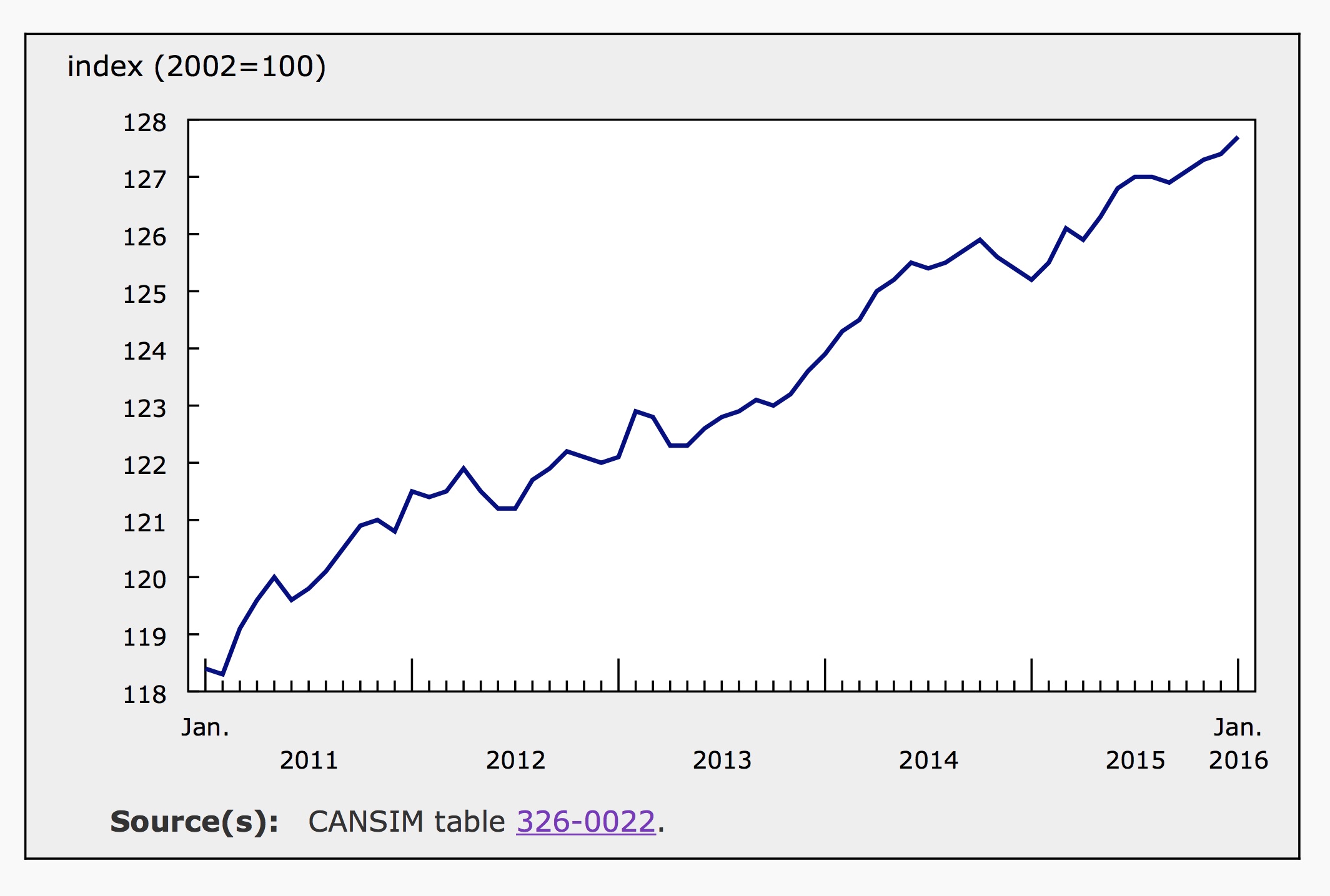

Source: inflationcalculator.ca

Source: inflationcalculator.ca

When borrowers take out an auto loan, their loan agreement usually requires that they maintain physical damage insurance to cover the loan collateral, naming your financial institution as an additional interest on the policy. The consumer price index (cpi) measures the average change in prices over time that consumers pay for a basket of goods and services. Policy of insurance means the proposal, the definitions, the conditions, the exclusions, the schedules and the section(s) of this policy of insurance. This is where the australian taxation office looks at the average prices that we all pay for goods and services across australia. Cpi is defined as collateral protection insurance frequently.

Source: opportunityinstitute.org

Source: opportunityinstitute.org

The cpi measures the changes in the purchasing power of a country’s currency usd/cad currency cross the usd/cad currency pair represents the quoted rate for exchanging us to cad, or, how many canadian dollars one. This is where the australian taxation office looks at the average prices that we all pay for goods and services across australia. The cpi measures the changes in the purchasing power of a country’s currency usd/cad currency cross the usd/cad currency pair represents the quoted rate for exchanging us to cad, or, how many canadian dollars one. First published in january 1996 as the harmonised index of consumer prices (hicp), the cpi is the inflation measure used in the government’s target for inflation. The consumer price index (cpi) measures the average change in prices over time that consumers pay for a basket of goods and services.

Source: thebalance.com

Source: thebalance.com

The consumer price index (cpi) is a measure of the aggregate price level in an economy. The provider confirms which borrowers have not provided adequate proof of. It looks at the cost of 11 categories that make up the bulk of living expenses in major cities: Cpi is defined as collateral protection insurance frequently. The cpi consists of a bundle of commonly purchased goods and services.

Source: investopedia.com

Source: investopedia.com

What is the consumer price index (cpi)? More how social security benefits work Cpi stands for collateral protection insurance. When borrowers take out an auto loan, their loan agreement usually requires that they maintain physical damage insurance to cover the loan collateral, naming your financial institution as an additional interest on the policy. Cpi is listed in the world�s largest and most authoritative dictionary database of abbreviations and acronyms the free dictionary

Source: acronymsandslang.com

Source: acronymsandslang.com

Period of insurance means the period during which cover is provided by this policy of insurance as specified in the schedules. This is where the australian taxation office looks at the average prices that we all pay for goods and services across australia. The consumer price index (cpi) measures the average change in prices over time that consumers pay for a basket of goods and services. The cpi provider receives information on all new loans and updates on existing loans in a lender’s portfolio and tracks the insurance status of each. Jun 10, 2021 — collateral protection insurance (cpi) is car insurance that protects your car against physical damage.

Source: investopedia.com

Source: investopedia.com

The consumer price index measures the average cost of living in australia. Cpi is insurance coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Collateral protection insurance, or cpi, is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan. It protects the lender’s loan balance in case of loss of collateral while uninsured. The provider confirms which borrowers have not provided adequate proof of.

Source: thehansindia.com

Source: thehansindia.com

Collateral protection insurance policies are dual interest policies, meaning that both the lender and the borrower will. Today, our focus is on the first product, collateral protection insurance (cpi). Collateral protection insurance (cpi) is coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. The cpi consists of a bundle of commonly purchased goods and services. The consumer price index (cpi) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation.

Source: statenational.com

Source: statenational.com

First published in january 1996 as the harmonised index of consumer prices (hicp), the cpi is the inflation measure used in the government’s target for inflation. Jun 10, 2021 — collateral protection insurance (cpi) is car insurance that protects your car against physical damage. First published in january 1996 as the harmonised index of consumer prices (hicp), the cpi is the inflation measure used in the government’s target for inflation. Premium means the premium payable under this policy of insurance calculated in Mortgage collateral protection insurance (cpi) ensure borrower compliance with hazard, wind and flood insurance regulatory requirements.

Source: vajiramias.com

Source: vajiramias.com

Payment protection insurance (ppi), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt. The cpi consists of a bundle of commonly purchased goods and services. Collateral protection insurance, or cpi, is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan. The cpi is a measure of consumer price inflation produced to international standards and in line with european regulations. How is collateral protection insurance abbreviated?

Source: kinglybrookesllp.co.uk

Source: kinglybrookesllp.co.uk

The consumer price index measures the average cost of living in australia. Cpi is insurance coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance. Collateral protection insurance, or cpi, is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan. The cpi measures the changes in the purchasing power of a country’s currency usd/cad currency cross the usd/cad currency pair represents the quoted rate for exchanging us to cad, or, how many canadian dollars one. Jun 10, 2021 — collateral protection insurance (cpi) is car insurance that protects your car against physical damage.

Source: youtube.com

Source: youtube.com

Looking for online definition of cpi or what cpi stands for? Collateral protection insurance policies are dual interest policies, meaning that both the lender and the borrower will. This is because it covers the entire amount left on the loan, whereas normal insurance covers the actual cash value of the collateral, which means you’re covering the true value of your collateral. How is collateral protection insurance abbreviated? Cpi is insurance coverage placed on a borrower’s vehicle, on behalf of a lender, when there is a lapse in insurance.

Source: e3e3chobots.blogspot.com

Source: e3e3chobots.blogspot.com

Cpi is listed in the world�s largest and most authoritative dictionary database of abbreviations and acronyms the free dictionary More how social security benefits work Cpi is also much more expensive than typical insurance. Period of insurance means the period during which cover is provided by this policy of insurance as specified in the schedules. Collateral protection insurance, or cpi, is purchased or imposed by lending institutions to protect themselves from losses in the event the borrower to whom a loan was issued fails to carry insurance on the collateral used to secure the loan.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cpi insurance meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea