Credit balance insurance Idea

Home » Trending » Credit balance insurance IdeaYour Credit balance insurance images are available. Credit balance insurance are a topic that is being searched for and liked by netizens now. You can Get the Credit balance insurance files here. Download all royalty-free vectors.

If you’re looking for credit balance insurance images information connected with to the credit balance insurance topic, you have come to the right blog. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

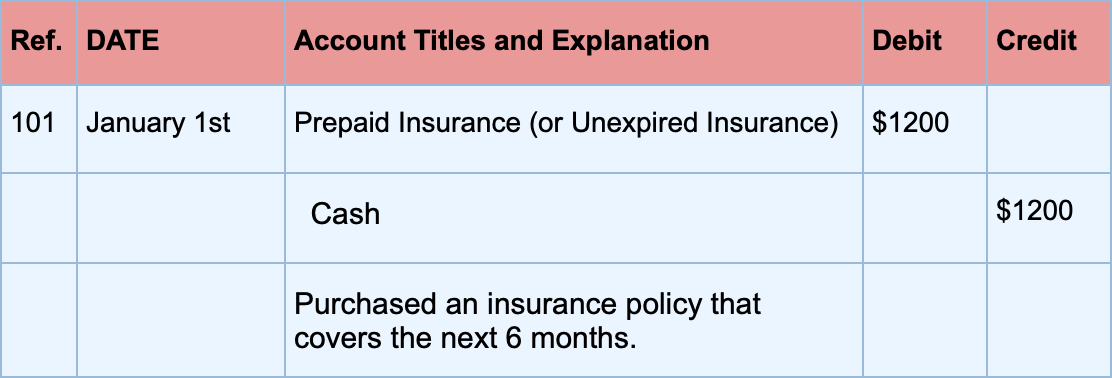

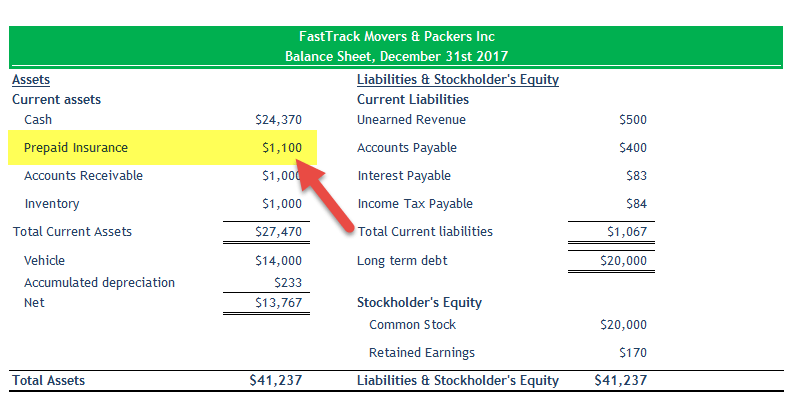

Credit Balance Insurance. Whatever the cause of the credit balance in the prepaid insurance account, the account needs to be switched to a liability or zeroed out by making payment before issuing a. Td credit card balance protection insurance — exclusively for td credit card cardholders — insured cardholder’s name & address: The cost of the insurance is $0.25 per $100 of the balance of your desjardins credit card. Pay your card balance up to a certain amount as defined by the credit card company if you die.

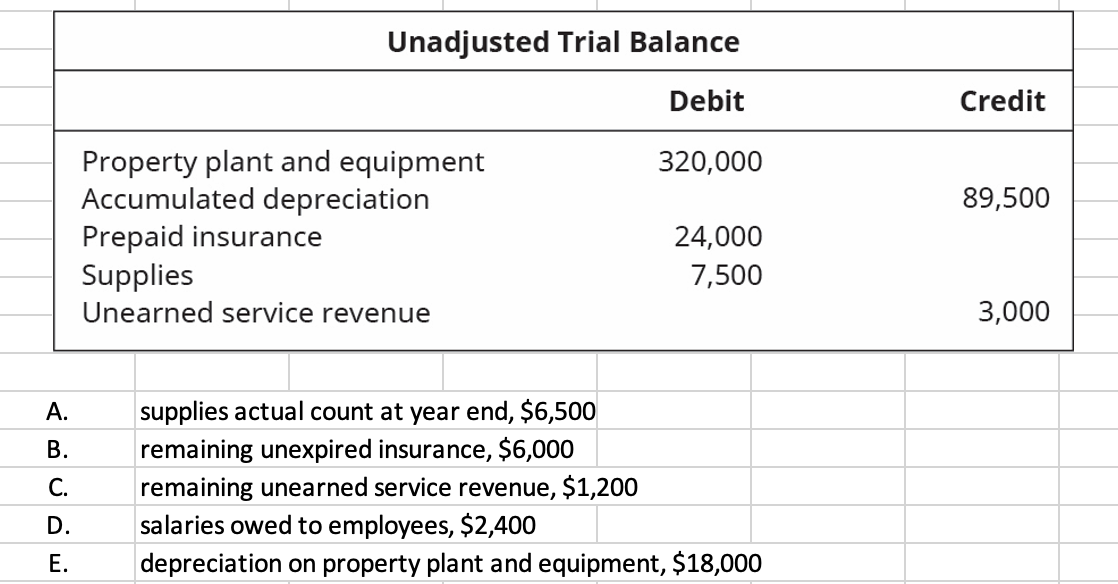

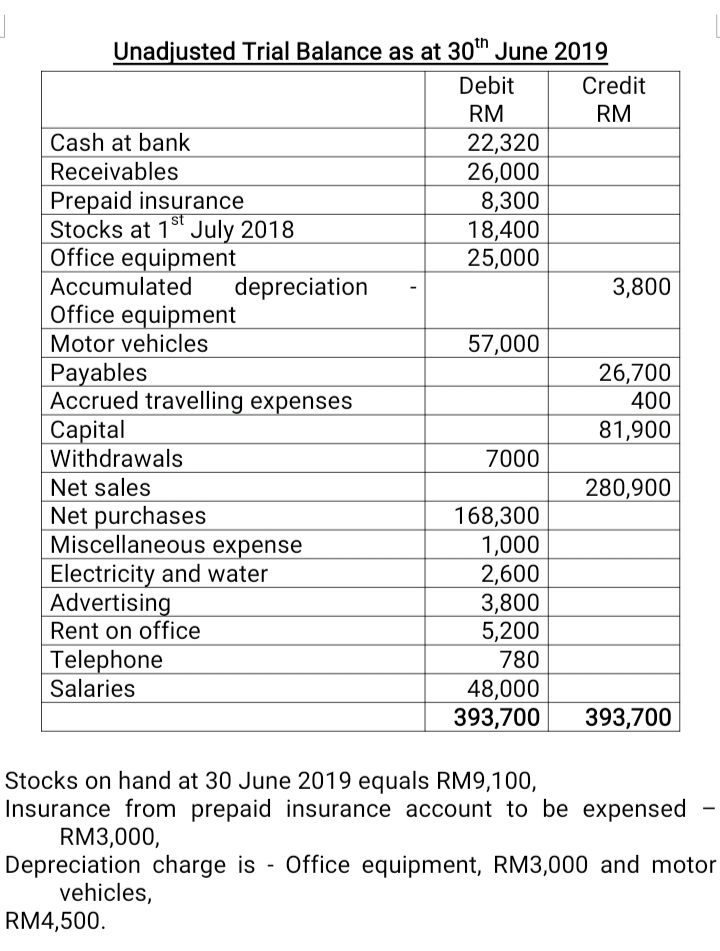

Answered Unadjusted Trial Balance Debit Credit… bartleby From bartleby.com

Answered Unadjusted Trial Balance Debit Credit… bartleby From bartleby.com

This can occur for many reasons; The cost of the insurance is $0.25 per $100 of the balance of your desjardins credit card. 1) review of the credit balance report. Balance insurance is offered by most credit card companies and many people think if they become ill or unemployed it will pay off their balances, but it will usually just make the minimum monthly. 4) verification that refund checks are both signed and mailed Prior to issuing the december 31 financial statements, the company must remove the $120 credit balance in prepaid insurance by debiting prepaid insurance and crediting insurance.

Balance insurance is offered by most credit card companies and many people think if they become ill or unemployed it will pay off their balances, but it will usually just make the minimum monthly.

Credit balances are not “extra cash” or a positive asset for a provider, as they technically belong to either the. Balance protection insurance, which can have other names like payment protection insurance and balance protector premium, is completely different from credit card loss insurance. 1) review of the credit balance report. Credit card insurance — also known as payment protection, credit shield or credit guard — is an optional feature that covers your credit card payments if something unexpected happens to you. Credit card balance insurance is an optional service that may cover the payments, or part of the payments due on your credit card under specific conditions, such as if you become sick, disabled or die. Errors in the insurance carriers processing of the claim, duplicate payments, or interest paid on.

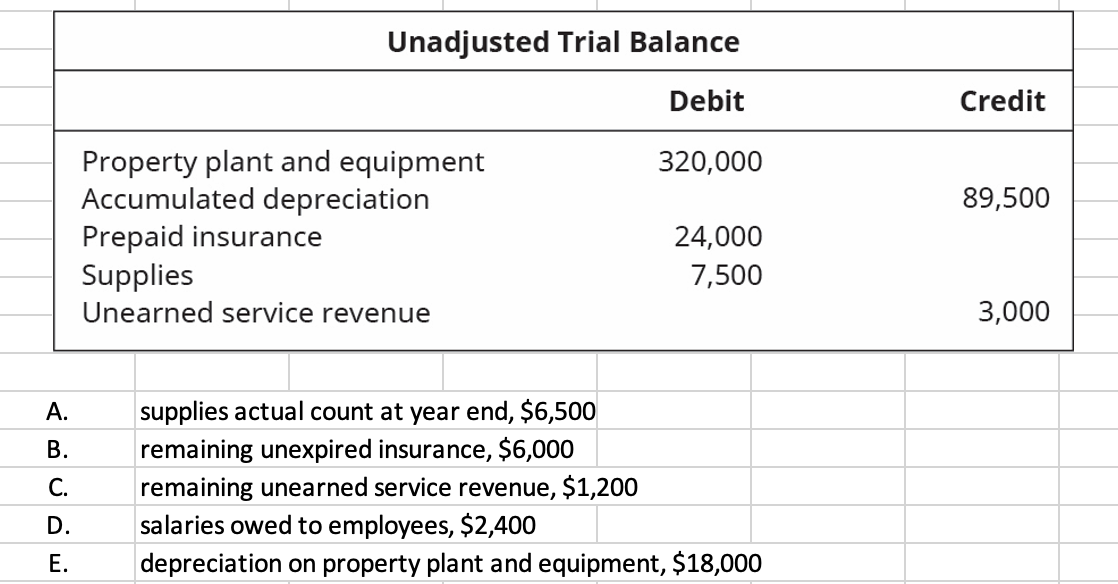

Source: chegg.com

Source: chegg.com

The cost of the insurance is $0.25 per $100 of the balance of your desjardins credit card. Balance protection insurance is insurance coverage used to help pay your outstanding credit card balance if one of several specified unforeseen circumstances happens to you. Balance protection insurance, which can have other names like payment protection insurance and balance protector premium, is completely different from credit card loss insurance. Errors in the insurance carriers processing of the claim, duplicate payments, or interest paid on. Losing your job without it being your fault.

Source: theinsurer.com

Source: theinsurer.com

- initiation of the refund process and delivery of supporting documentation. Learn more about credit card balance insurance. Covers the balance of current transactions on your credit card, including desjardins accord d financing and visa installment plans, in the event of death, dismemberment, disability, involuntary loss of employment or critical illness. This variable premium is added to your credit card account every month. Credit card balance protection insurance isn’t credit card loss insurance.

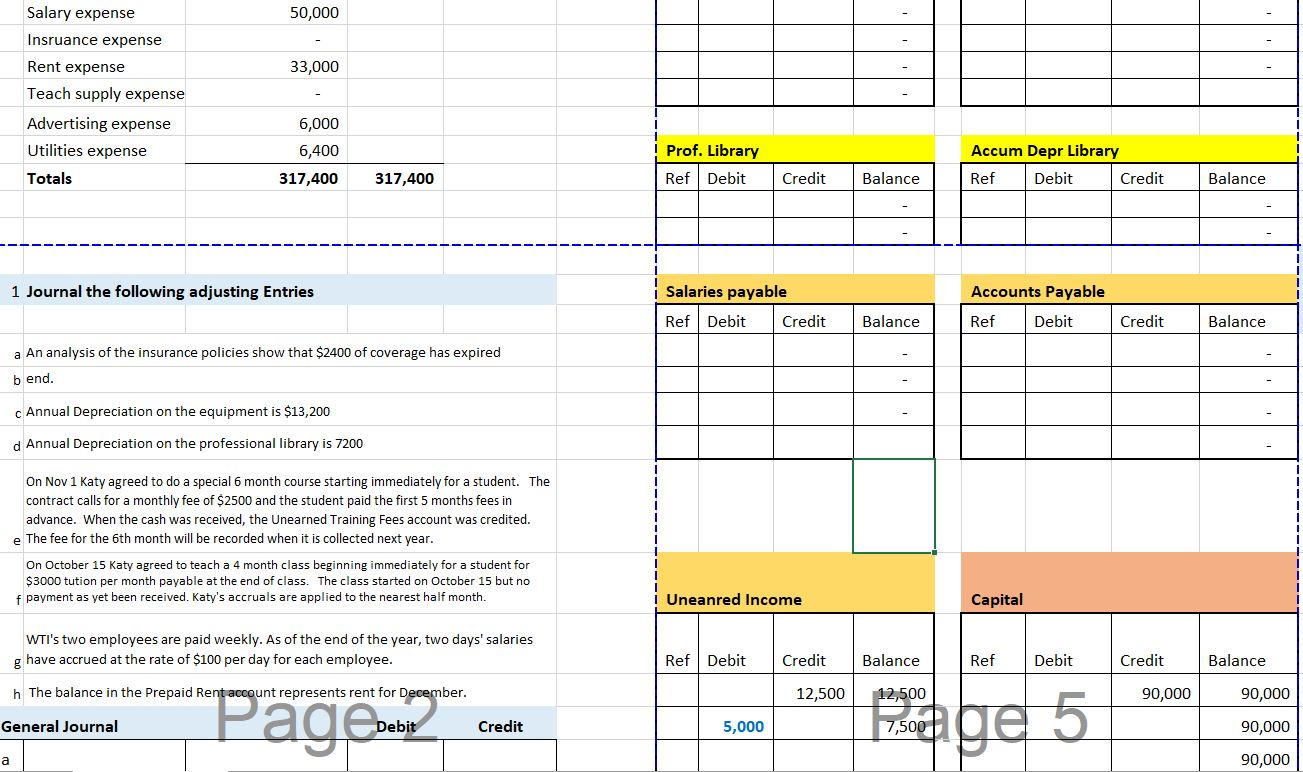

Source: bartleby.com

Source: bartleby.com

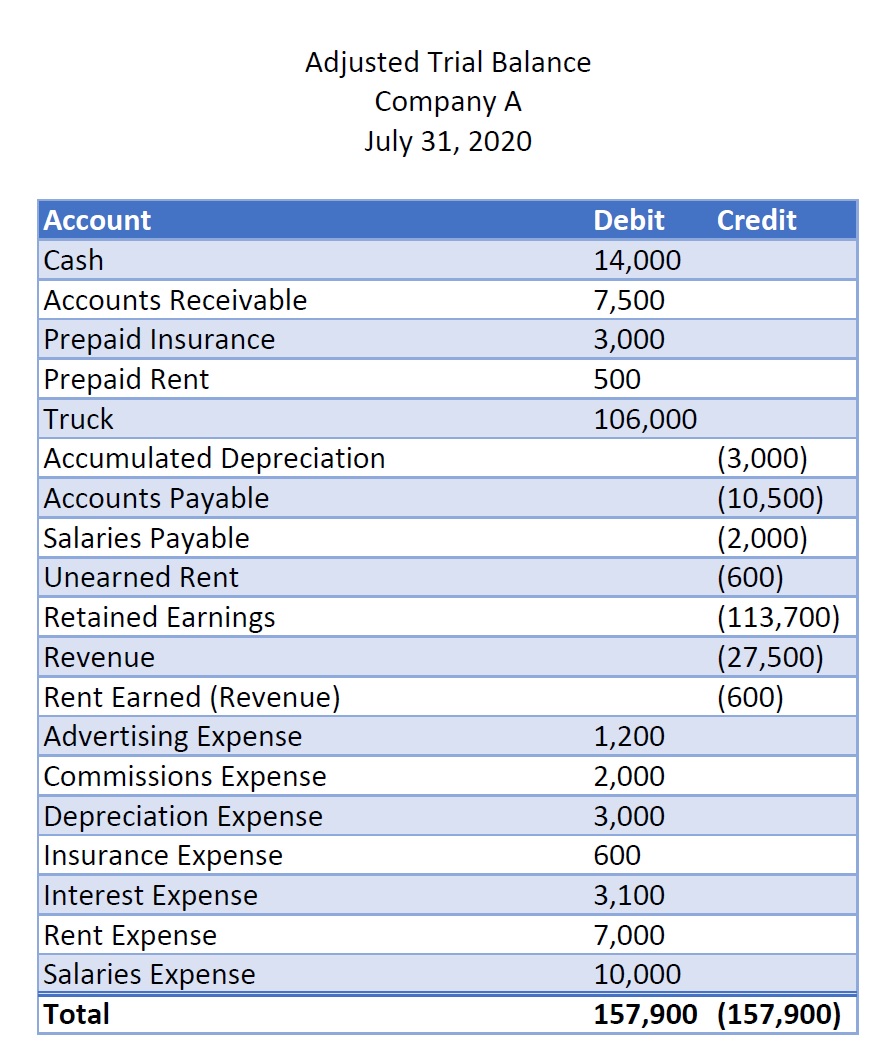

Several situations could cause a credit balance in the asset account prepaid insurance. The margin requirement of 150% means that the investor has to deposit 50% x $36,000 = $18,000 as initial margin into the margin account for a total credit balance of $18,000 + $36,000 = $54,000. The cost of the insurance is $0.25 per $100 of the balance of your desjardins credit card. Learn more about credit card balance insurance. No premium is charged if your balance is $0.

Source: opentextbc.ca

Source: opentextbc.ca

Credit card balance protection insurance isn’t credit card loss insurance. No premium is charged if your balance is $0. 4) verification that refund checks are both signed and mailed This can occur for many reasons; If an insurance premium is owing to the insurance company then there would be a liability account with a credit balance for the amount owed as of the balance sheet date.

Source: belecandcompany.com

Source: belecandcompany.com

There are important exclusions on the coverage that credit card balance insurance provides. The premium is added to the balance every month. Often they are the result of increasingly complicated healthcare billing and payment processes. There are important exclusions on the coverage that credit card balance insurance provides. 3) initiation of the refund process and delivery of supporting documentation.

Source: pinterest.com

Source: pinterest.com

Whatever the cause of the credit balance in the prepaid insurance account, the account needs to be switched to a liability or zeroed out by making payment before issuing a. Whatever the cause of the credit balance in the prepaid insurance account, the account needs to be switched to a liability or zeroed out by making payment before issuing a. Credit balances occur when improper payments and adjustments are made to the practice and exceed the related posted charges. 4) verification that refund checks are both signed and mailed The premium varies based on your credit balance.

Source: solveaccounting.blogspot.com

Source: solveaccounting.blogspot.com

Credit balance procedures need to be straightforward and should include: Credit card balance insurance, also known as ‘credit balance’ insurance or ‘credit card protection’ insurance, is designed to cover your monthly minimum credit card payments in case of loss of income due to job loss or extreme illness, or pay your balance in the event of death. Credit card balance protection insurance isn’t credit card loss insurance. This can occur for many reasons; There are important exclusions on the coverage that credit card balance insurance provides.

Source: homeworklib.com

Source: homeworklib.com

Learn more about credit card balance insurance. Balance protection insurance, which can have other names like payment protection insurance and balance protector premium, is completely different from credit card loss insurance. The cost of the insurance is $0.25 per $100 of the balance of your desjardins credit card. Errors in the insurance carriers processing of the claim, duplicate payments, or interest paid on. Prior to issuing the december 31 financial statements, the company must remove the $120 credit balance in prepaid insurance by debiting prepaid insurance and crediting insurance.

Source: chegg.com

Source: chegg.com

The importance of credit card balance protection creditor’s group insurance the credit card balance protection creditor’s group insurance underwritten by cumis is an optional insurance product which offers security during times of financial hardship caused by certain life events. 3) initiation of the refund process and delivery of supporting documentation. What is a credit balance? This variable premium is added to your credit card account every month. Credit card balance insurance benefits apply to the amount you owed on your credit card at the date of loss.

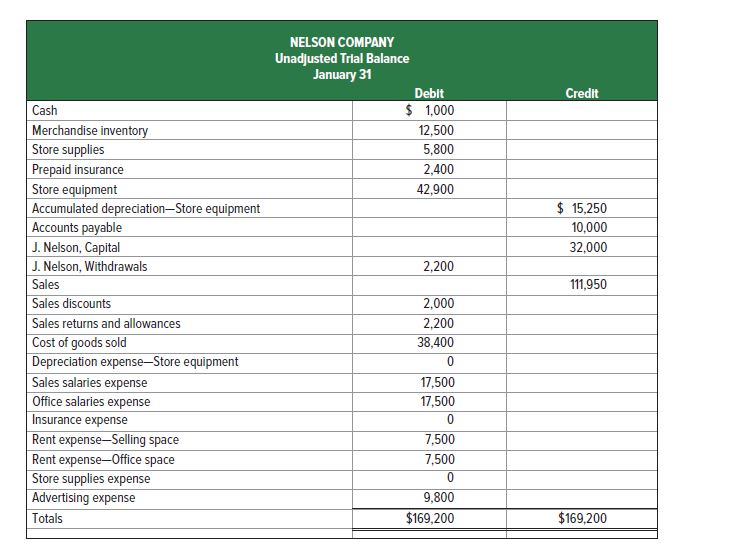

Source: bartleby.com

Source: bartleby.com

Td credit card balance protection insurance — exclusively for td credit card cardholders — insured cardholder’s name & address: This means the date of death, unemployment, total disability, and usually means the date your critical illness is diagnosed. The importance of credit card balance protection creditor’s group insurance the credit card balance protection creditor’s group insurance underwritten by cumis is an optional insurance product which offers security during times of financial hardship caused by certain life events. Pay or suspend your credit card repayments in the case you involuntarily lose your job, or are unfit for work due to health issues or disabilities. The cost of the insurance is $0.75 per $100 of the balance of your desjardins credit card, including visa installment and accord d financing plans.

Source: help.billing.webpt.com

Pay your card balance up to a certain amount as defined by the credit card company if you die. The premium varies based on your credit balance. Ce certificat est aussi disponible en français. Td credit card balance protection insurance — exclusively for td credit card cardholders — insured cardholder’s name & address: Credit card balance protection insurance isn’t credit card loss insurance.

Source: youtube.com

Source: youtube.com

Monthly premium rate per $100. Credit balance procedures need to be straightforward and should include: Pay your card balance up to a certain amount as defined by the credit card company if you die. Monthly premium rate per $100. The margin requirement of 150% means that the investor has to deposit 50% x $36,000 = $18,000 as initial margin into the margin account for a total credit balance of $18,000 + $36,000 = $54,000.

Source: thestar.com

Source: thestar.com

Pay your card balance up to a certain amount as defined by the credit card company if you die. Patient accounts with payments in excess of what was due by the insurance carrier or patient create credit balances. Monthly premium rate per $100. Learn more about credit card balance insurance. If you�re receiving disability benefits, you�re entitled to a refund of a portion of your monthly premium.

Source: bartleby.com

Source: bartleby.com

Whatever the cause of the credit balance in the prepaid insurance account, the account needs to be switched to a liability or zeroed out by making payment before issuing a. The premium is added to the balance every month. There are important exclusions on the coverage that credit card balance insurance provides. Several situations could cause a credit balance in the asset account prepaid insurance. The premium varies based on your credit balance.

Source: homeworklib.com

Source: homeworklib.com

The premium is added to the balance every month. Monthly premium rate per $100. Whatever the cause of the credit balance in the prepaid insurance account, the account needs to be switched to a liability or zeroed out by making payment before issuing a. The premium is added to the balance every month. Patient accounts with payments in excess of what was due by the insurance carrier or patient create credit balances.

Source: glitterdaspattysrosa.blogspot.com

Source: glitterdaspattysrosa.blogspot.com

- identification of both patient and insurance refunds. Balance protection insurance, which can have other names like payment protection insurance and balance protector premium, is completely different from credit card loss insurance. If one of the $600 payments is debited to insurance expense (or another account) instead of prepaid insurance , the monthly adjusting entries will cause the balance in the prepaid insurance account to become a credit balance. Often they are the result of increasingly complicated healthcare billing and payment processes. Prior to issuing the december 31 financial statements, the company must remove the $120 credit balance in prepaid insurance by debiting prepaid insurance and crediting insurance.

Source: bartleby.com

Source: bartleby.com

Credit card balance protection insurance can you help you: Credit card balance protection insurance can you help you: Monthly premium rate per $100. What is a credit balance? Credit card insurance, sometimes known as balance protection insurance, pays out your outstanding balance (subject to any limits in the policy) or makes monthly payments on your behalf to your credit card issuer if your income is interrupted by unforeseen events.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Credit card balance insurance is an optional service that may cover the payments, or part of the payments due on your credit card under specific conditions, such as if you become sick, disabled or die. The premium is added to the balance every month. Balance protection insurance, which can have other names like payment protection insurance and balance protector premium, is completely different from credit card loss insurance. The cost of the insurance is $0.25 per $100 of the balance of your desjardins credit card. Covers the balance of current transactions on your credit card, including desjardins accord d financing and visa installment plans, in the event of death, dismemberment, disability, involuntary loss of employment or critical illness.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title credit balance insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea