Credit default swap vs insurance Idea

Home » Trending » Credit default swap vs insurance IdeaYour Credit default swap vs insurance images are available. Credit default swap vs insurance are a topic that is being searched for and liked by netizens now. You can Get the Credit default swap vs insurance files here. Download all free photos and vectors.

If you’re searching for credit default swap vs insurance pictures information linked to the credit default swap vs insurance keyword, you have come to the right site. Our website frequently gives you suggestions for seeking the highest quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

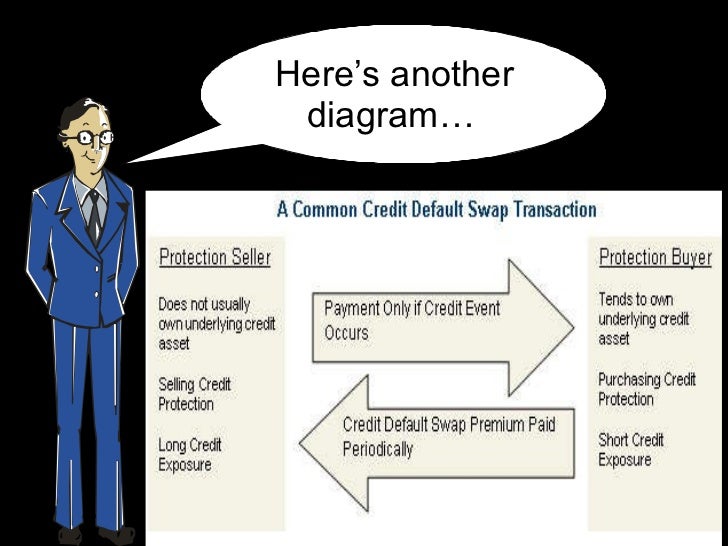

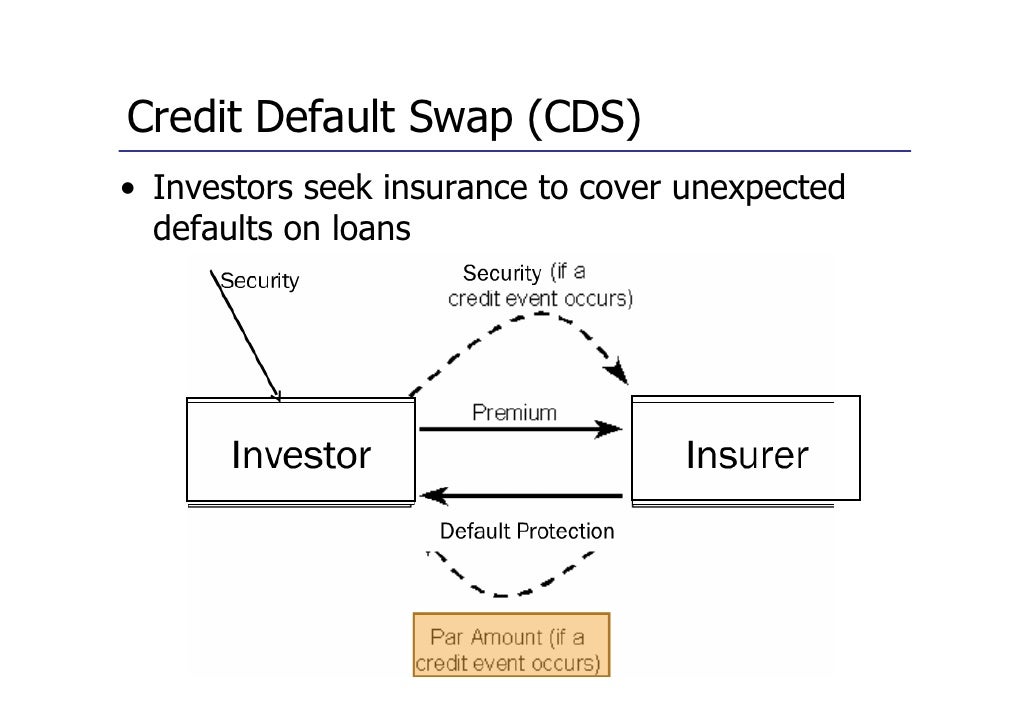

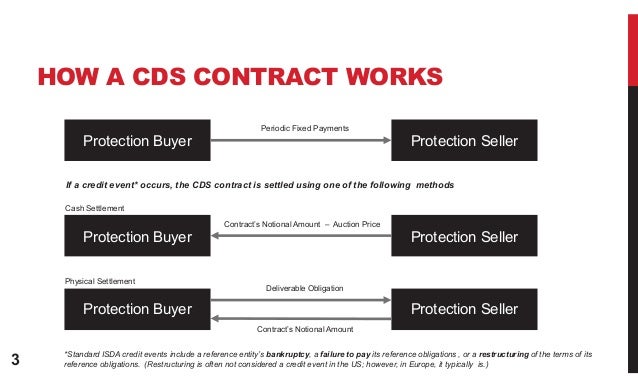

Credit Default Swap Vs Insurance. However, the parallel between insurance contracts and credit default swaps does not hold in two important ways. We will first look at what a cds is. A credit default swap (cds) is a financial derivative that guarantees against bond risk. Although credit default swaps are often compared to insurance contracts, one important difference is that with an insurance policy, the policyholder must also own the property being insured.

How do credit default swaps work? Quora From quora.com

The investor makes no payment unless a. With a cds, your counterparty can go bankrupt just like with any otc trade. A credit default swap is a type of insurance that protects a party against payment defaults. There are stringent requirements for an insurance company to actually be able to pay out in case of an event happening. The credit default swap market is far less regulated than the insurance market. Banks in particular need to ensure that cds and guarantees are not treated as insurance

Thus the nancial institution bearing the credit risk is often not the institution that carried out the original credit check|this disjunction is not a good thing as became apparent in the credit crisis of 2007.

With a cds, your counterparty can go bankrupt just like with any otc trade. Credit default insurance allows for. We will first look at what a cds is. Credit default swaps do not qualify as insurance in the classical sense because: 1) they protect against speculative losses; Insurance providers are required to keep enough money in the bank to cover claims, but swap sellers are not required to do the same.

Source: youtube.com

Source: youtube.com

The distinct difference between the health insurance scenario on the last page and credit default swaps is that the health insurance industry is heavily regulated. A credit default swap is a type of insurance that protects a party against payment defaults. The credits referenced in a cds are known as “reference entities.”. Cds was bought for leveraging portfolios, hedging, arbitration, and speculation. In case of a default, the seller has to pay the entire agreed amount, including the interest.

Source: thevisiblefoot.blogspot.com

Source: thevisiblefoot.blogspot.com

A cds is a financial instrument or arrangement that protects buyers of the cds from risk of default by its lenders. The credit default swap market is generally divided into three sectors: Summary credit default swaps (cds), guarantees and insurance policies are used regularly by financial institutions seeking to protect themselves from counterparty failures or, in the case of cds, also to engage in speculative trading or arbitrage activity. A credit default swap (cds) is a financial derivative that guarantees against bond risk. We will first look at what a cds is.

Source: youtube.com

Source: youtube.com

Credit default insurance is a financial agreement that is used to mitigate the risk of loss from default by a borrower or bond issuer. That makes credit default swaps much riskier than insurance for buyers. The distinct difference between the health insurance scenario on the last page and credit default swaps is that the health insurance industry is heavily regulated. However, the parallel between insurance contracts and credit default swaps does not hold in two important ways. In case of a default, the seller has to pay the entire agreed amount, including the interest.

Source: assetmacro.com

Source: assetmacro.com

That makes credit default swaps much riskier than insurance for buyers. A credit default swap is a type of insurance that protects a party against payment defaults. Like an insurance policy, the buyer makes periodic payments to the seller. In case of a default, the seller has to pay the entire agreed amount, including the interest. And 2) no insurable interest is required for their purchase.

Source: dinero14.webcindario.com

Source: dinero14.webcindario.com

Between the banks and other counterparties such as insurance companies. In case of a default, the seller has to pay the entire agreed amount, including the interest. Through a cds, the buyer can avoid the consequences of a borrower�s default by shifting some or. A credit default swap (cds) is a financial derivative that guarantees against bond risk. A credit default swap is a type of insurance that protects a party against payment defaults.

Source: slideshare.net

Source: slideshare.net

Credit default insurance allows for. Insurance providers are required to keep enough money in the bank to cover claims, but swap sellers are not required to do the same. That is, the seller of the cds insures the buyer against some reference asset defaulting. Although cds and bonds measure equivalent credit risk, there are many The credit default swap market is far less regulated than the insurance market.

A credit default swap (cds) is a financial swap agreement that the seller of the cds will compensate the buyer in the event of a debt default (by the debtor) or other credit event. A credit default swap (cds) is analogous to an insurance contract, with the buyer of credit protection paying a periodic fee in return for receiving compensation should the specified reference entity experience a credit event during the contract’s life. A credit default swap is a type of insurance that protects a party against payment defaults. Credit default swaps (�cdss�), guarantees and insurance policies are commonly used in the financial markets to provide protection from the failures of obligors. Insurance providers are required to keep enough money in the bank to cover claims, but swap sellers are not required to do the same.

Source: pt.coursera.org

Source: pt.coursera.org

A credit default swap (cds) is a financial derivative that guarantees against bond risk. It allows one lender to swap its risk with another. Summary credit default swaps (cds), guarantees and insurance policies are used regularly by financial institutions seeking to protect themselves from counterparty failures or, in the case of cds, also to engage in speculative trading or arbitrage activity. The distinct difference between the health insurance scenario on the last page and credit default swaps is that the health insurance industry is heavily regulated. The credit default swap market is far less regulated than the insurance market.

Source: slideshare.net

Source: slideshare.net

Most of the people think that credit default swaps (cds) and insurance is the same. Banks in particular need to ensure that cds and guarantees are not treated as insurance De nition of credit default swaps Thus the nancial institution bearing the credit risk is often not the institution that carried out the original credit check|this disjunction is not a good thing as became apparent in the credit crisis of 2007. And 2) no insurable interest is required for their purchase.

Source: prepnuggets.com

Source: prepnuggets.com

It allows one lender to swap its risk with another. There are stringent requirements for an insurance company to actually be able to pay out in case of an event happening. Credit default swaps (�cdss�), guarantees and insurance policies are commonly used in the financial markets to provide protection from the failures of obligors. They allow purchasers to buy protection against an unlikely but devastating event. Insurance providers are required to keep enough money in the bank to cover claims, but swap sellers are not required to do the same.

Source: quora.com

Between the banks and other counterparties such as insurance companies. A cds is a financial instrument or arrangement that protects buyers of the cds from risk of default by its lenders. There are stringent requirements for an insurance company to actually be able to pay out in case of an event happening. First, you do not have to hold the bonds to buy a credit default swap on that bond, whereas with an insurance contract, you typically have a direct economic exposure to obtain insurance. With a cds, your counterparty can go bankrupt just like with any otc trade.

Source: slideshare.net

Source: slideshare.net

Banks in particular need to ensure that cds and guarantees are not treated as insurance However, the parallel between insurance contracts and credit default swaps does not hold in two important ways. The investor receives a fee from the seller of the default risk. Banks in particular need to ensure that cds and guarantees are not treated as insurance In return, the buyer has to pay interest over the agreed period of time.

Source: icebergfinanza.finanza.com

Source: icebergfinanza.finanza.com

Most of the people think that credit default swaps (cds) and insurance is the same. Credit default swaps (cdss) are essentially insurance policies issued by banks (sellers) and taken out by investors (buyers) to protect against failure among their investments. A credit default swap (cds) is a financial derivative that guarantees against bond risk. 1) they protect against speculative losses; First, you do not have to hold the bonds to buy a credit default swap on that bond, whereas with an insurance contract, you typically have a direct economic exposure to obtain insurance.

Source: researchgate.net

Source: researchgate.net

There are stringent requirements for an insurance company to actually be able to pay out in case of an event happening. The credit default swap market is far less regulated than the insurance market. A credit default swap or option is simply an exchange of a fee in exchange for a payment if a credit default event occurs. However, the parallel between insurance contracts and credit default swaps does not hold in two important ways. And 2) no insurable interest is required for their purchase.

Source: commons.wikimedia.org

Source: commons.wikimedia.org

In contrast, the buyer of a credit default swap need not be the owner of the financial instrument for which the swap is providing a financial guarantee. Although cds and bonds measure equivalent credit risk, there are many The credit default swap market is far less regulated than the insurance market. The credits referenced in a cds are known as “reference entities.”. Credit default swaps (cdss) are essentially insurance policies issued by banks (sellers) and taken out by investors (buyers) to protect against failure among their investments.

Source: docireport.org

Source: docireport.org

The investor makes no payment unless a. In return, the buyer has to pay interest over the agreed period of time. They allow purchasers to buy protection against an unlikely but devastating event. With a cds, your counterparty can go bankrupt just like with any otc trade. Credit default insurance allows for.

Source: differencebetween.com

Source: differencebetween.com

First, you do not have to hold the bonds to buy a credit default swap on that bond, whereas with an insurance contract, you typically have a direct economic exposure to obtain insurance. Although credit default swaps are often compared to insurance contracts, one important difference is that with an insurance policy, the policyholder must also own the property being insured. A credit default swap is a type of insurance that protects a party against payment defaults. First, you do not have to hold the bonds to buy a credit default swap on that bond, whereas with an insurance contract, you typically have a direct economic exposure to obtain insurance. De nition of credit default swaps

Source: slideshare.net

Source: slideshare.net

Credit default swaps (�cdss�), guarantees and insurance policies are commonly used in the financial markets to provide protection from the failures of obligors. And 2) no insurable interest is required for their purchase. De nition of credit default swaps It allows one lender to swap its risk with another. A credit default swap (cds) is analogous to an insurance contract, with the buyer of credit protection paying a periodic fee in return for receiving compensation should the specified reference entity experience a credit event during the contract’s life.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title credit default swap vs insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea