Credit disability insurance information

Home » Trend » Credit disability insurance informationYour Credit disability insurance images are ready. Credit disability insurance are a topic that is being searched for and liked by netizens now. You can Get the Credit disability insurance files here. Get all free photos.

If you’re looking for credit disability insurance pictures information connected with to the credit disability insurance keyword, you have visit the ideal blog. Our website always gives you hints for seeing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Credit Disability Insurance. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. “that’ll never happen to me.”. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. The benefit period is the same as the loan.

This coverage pays your minimum payment to your credit card issuer if you become disabled. Credit disability insurance is insurance coverage that provides additional safety by helping make payments when one is incapacitated to work for a period of time. Credit disability insurance means insurance on a debtor to provide indemnity for payments coming due on a specific loan or other credit transaction while the debtor is disabled. However, with credit disability insurance, monthly loan payments may not be a problem. It makes payments to your lender if you become sick or disabled and are unable to work. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum.

Credit disability insurance, also known as accident and health insurance, makes payments on the loan for a limited amount of time if you become ill or injured and cannot work.

Credit disability insurance means insurance on a debtor to provide indemnity for payments coming due on a specific loan or other credit transaction while the debtor is disabled. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. When you apply for a loan ask to see how much this. Credit disability and credit life insurance may help reduce or pay off your covered loan, up to the policy maximum, in the event of a covered life event, injury, illness or death. This coverage pays your minimum payment to your credit card issuer if you become disabled. Members borrowing money from the credit union may be eligible for this coverage if they are actively employed 25 or more hours per week and under age 70.

Source: pacentralfcu.com

Source: pacentralfcu.com

Your purchase of member’s choice ® credit life and credit disability insurance, Credit disability insurance is an optional insurance policy that is often available when you take out a personal loan. This optional coverage is available for purchase by eligible customers at the time you complete the financing arrangements for your boat. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. Your purchase of member’s choice ® credit life and credit disability insurance,

Source: goldcu.org

Source: goldcu.org

Credit disability is a health insurance policy. Credit disability insurance takes over your loan payments (up to the contract limit) if you should become ill or disabled and will continue to make payments until you return to work. There is a 30 day waiting period. Credit disability insurance may save your finances! Credit disability normally is more expensive than credit life insurance.

Source: envistacu.com

Source: envistacu.com

You may have to be disabled for a certain amount of time before the insurance will kick in. When you apply for a loan ask to see how much this. Credit life insurance pays off a debt if you pass away. “that’ll never happen to me.”. February 09, 2022 a credit disability insurance agreement.

Source: kimndevin.blogspot.com

Source: kimndevin.blogspot.com

When you apply for a loan ask to see how much this. There may be a waiting period before the benefit pays out. “that’ll never happen to me.”. If you become disabled, it helps to cover your loan payments while you are out of work and have limited income. The premium may be included with your monthly loan payment.

Source: youtube.com

Source: youtube.com

You can’t add this insurance and make a claim on the same day. It makes payments to your lender if you become sick or disabled and are unable to work. Credit disability is a health insurance policy. Credit disability insurance is optional and is not required as a condition for granting a loan. Credit disability insurance may save your finances!

Credit life and disability insurance are optional products offered to pay off your auto loan in the case of death or disability. What is the benefit of a credit disability insurance plan quizlet? Credit disability insurance means insurance on a debtor to provide indemnity for payments coming due on a specific loan or other credit transaction while the debtor is disabled. Credit disability is a health insurance policy. The benefit period is the same as the loan.

Source: classaction.org

Source: classaction.org

Makes the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled and is unable to work. Makes the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled and is unable to work. Credit disability insurance, also known as accident and health insurance, makes payments on the loan for a limited amount of time if you become ill or injured and cannot work. There is a 30 day waiting period. Unlike credit life insurance, disability insurance may pay for all or part of the debt, depending on the type of.

Source: lakeviewfcu.com

Source: lakeviewfcu.com

The premium may be included with your monthly loan payment. If you become disabled, it helps to cover your loan payments while you are out of work and have limited income. Credit life and disability insurance are optional products offered to pay off your auto loan in the case of death or disability. It covers the risk of being disabled and unable to loan money. Credit disability is a health insurance policy.

Source: knowyourinsurance.net

Source: knowyourinsurance.net

Credit disability insurance is optional and is not required as a condition for granting a loan. You may have to be disabled for a certain amount of time before the insurance will kick in. The face value of a credit life insurance policy decreases proportionately with the outstanding loan amount as the loan is paid off over time, until both reach zero value. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. “that’ll never happen to me.”.

Source: topmarkfcu.com

It covers the risk of being disabled and unable to loan money. Coverage is designed to fit your lifestyle, it is totally voluntary. If you become disabled, it helps to cover your loan payments while you are out of work and have limited income. It covers the risk of being disabled and unable to loan money. If you choose to purchase credit disability insurance, there are several ways you can pay for it.

Source: envistacu.com

Source: envistacu.com

Credit disability insurance is insurance coverage that provides additional safety by helping make payments when one is incapacitated to work for a period of time. Perhaps not, but over the past year, we’ve seen a huge. “that’ll never happen to me.”. When you apply for a loan ask to see how much this. Unlike credit life insurance, disability insurance may pay for all or part of the debt, depending on the type of.

Source: somersetfcu.com

Source: somersetfcu.com

Im3207 cuna mutual group is the marketing name for cuna mutual. Im3207 cuna mutual group is the marketing name for cuna mutual. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. Credit disability and credit life insurance may help reduce or pay off your covered loan, up to the policy maximum, in the event of a covered life event, injury, illness or death. 1 in 6 canadians will be disabled for 3 months or longer before the age of 50.

Source: peoplesenergycu.org

Source: peoplesenergycu.org

“that’ll never happen to me.”. Who do you expect to pay your. Perhaps not, but over the past year, we’ve seen a huge. Credit disability insurance, also known as accident and health insurance, makes payments on the loan for a limited amount of time if you become ill or injured and cannot work. Credit disability insurance is optional and is not required as a condition for granting a loan.

Source: youtube.com

Source: youtube.com

Credit life pays the remainder of your loan in the event you die before the loan is fully repaid to the lender. Credit disability normally is more expensive than credit life insurance. Unlike credit life insurance, disability insurance may pay for all or part of the debt, depending on the type of. However, with credit disability insurance, monthly loan payments may not be a problem. “that’ll never happen to me.”.

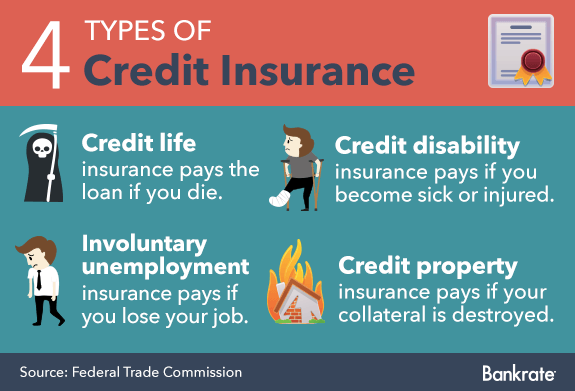

Source: bankrate.com

Source: bankrate.com

Credit disability normally is more expensive than credit life insurance. If you choose to purchase credit disability insurance, there are several ways you can pay for it. Credit disability insurance is an optional insurance policy that is often available when you take out a personal loan. Credit life insurance pays off a debt if you pass away. If you become disabled, it helps to cover your loan payments while you are out of work and have limited income.

Source: moneyunder30.com

Source: moneyunder30.com

Credit disability insurance is optional and is not required as a condition for granting a loan. There may be a limit on the number of payments or the total dollar amount the policy will pay. Credit disability insurance means insurance on a debtor to provide indemnity for payments coming due on a specific loan or other credit transaction while the debtor is disabled. Credit life pays the remainder of your loan in the event you die before the loan is fully repaid to the lender. A disability can stop you from the income you need to meet monthly loan obligations.

Source: myhhfcu.org

Source: myhhfcu.org

Holding company, a mutual insurance holding company, its subsidiaries and affiliates. Credit life insurance pays off a debt if you pass away. Coverage is designed to fit your lifestyle, it is totally voluntary. It covers the risk of being disabled and unable to loan money. Credit disability insurance takes over your loan payments (up to the contract limit) if you should become ill or disabled and will continue to make payments until you return to work.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Credit disability insurance may save your finances! A disability can stop you from the income you need to meet monthly loan obligations. Makes the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled and is unable to work. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title credit disability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information