Credit disability insurance policy Idea

Home » Trending » Credit disability insurance policy IdeaYour Credit disability insurance policy images are available. Credit disability insurance policy are a topic that is being searched for and liked by netizens today. You can Get the Credit disability insurance policy files here. Download all royalty-free photos.

If you’re looking for credit disability insurance policy pictures information linked to the credit disability insurance policy topic, you have visit the right blog. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

Credit Disability Insurance Policy. If you are unable to work because of a disability, this coverage makes your monthly minimum loan payments for a limited time period. Credit disability insurance this coverage pays your minimum payment to your credit card issuer if you become disabled. The opinion in the case was issued by the houston court of appeals, first district, in december of 2011. Credit insurance is an insurance policy that covers to pay existing debts of the policyholder in case of death, disability, insolvency or loss of employment of the insured or due to any other reasons covered in an insurance policy.

Umbrella Insurance and the Advantages of Packaging Your From baldersoninsurance.com

Umbrella Insurance and the Advantages of Packaging Your From baldersoninsurance.com

The style of the case is, bernice hudspeth v. Individual credit disability insurance can pay a monthly installment loan payment directly to your financing institution if you become disabled. Credit disability insurance (also called credit accident and health insurance): Read the credit disability insurance brochure and watch this video to learn more! A credit disability insurance policy is an agreement between three parties: The policy�s benefit, or face value, will typically be tied to your outstanding balance, so it decreases over time as you pay off the loan.

Credit disability and credit life insurance may help reduce or pay off your covered loan or make your monthly loan payment, up to the policy maximum, in the event of a covered life event, injury, illness or death.

“that’ll never happen to me.”. A credit disability insurance policy will pay off a specific loan if you were to become disabled. Credit disability insurance pays regardless of any other coverage that you already have in place. Credit insurance is an insurance policy that covers to pay existing debts of the policyholder in case of death, disability, insolvency or loss of employment of the insured or due to any other reasons covered in an insurance policy. “that’ll never happen to me.”. May help to make the monthly loan payments for the insured, up to the policy maximum terms and limits.

Source: infographicportal.com

Source: infographicportal.com

A borrower, an insurance company, and a lender. You decide which payments you want to protect and the monthly premium may be added to your loan. If you are totally disabled due to a covered sickness or accident, credit disability insurance is designed to make your loan payment, up to the policy maximum. You have the flexibility to use your benefit payments to pay any credit bills you owe you maintain the policy for your entire working career These policies are regulated by the lender, not by individual state.

Source: investopedia.com

Source: investopedia.com

It aids in paying some or all of existing debts if the insured is involuntarily unemployed What is credit protection insurance? It aids in paying some or all of existing debts if the insured is involuntarily unemployed Build a triangle of protection ® help safeguard the people and possessions that matter most by building a triangle of protection around your home and family with three different products — life, disability income, and homeowners insurance. Maximum monthly disability benefit/ monthly loan payment up to maximum of $850;

Source: bankrate.com

Source: bankrate.com

A credit disability insurance policy is an agreement between three parties: The policy�s benefit, or face value, will typically be tied to your outstanding balance, so it decreases over time as you pay off the loan. A borrower, an insurance company, and a lender. When can a credit disability policy be issued? Credit disability insurance pays regardless of any other coverage that you already have in place.

Source: pinterest.com

Source: pinterest.com

With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. The opinion in the case was issued by the houston court of appeals, first district, in december of 2011. Credit insurance are your members� loans protected in the event of an unexpected life event, such as disability or death? Credit insurance is an insurance policy that covers to pay existing debts of the policyholder in case of death, disability, insolvency or loss of employment of the insured or due to any other reasons covered in an insurance policy. A credit disability insurance policy is an agreement between three parties:

Source: moneyunder30.com

Source: moneyunder30.com

Credit insurance is an insurance policy that covers to pay existing debts of the policyholder in case of death, disability, insolvency or loss of employment of the insured or due to any other reasons covered in an insurance policy. The policy�s benefit, or face value, will typically be tied to your outstanding balance, so it decreases over time as you pay off the loan. Credit and disability life insurance premiums can be structured in one of two ways: Debt cancellation policies involve only a borrower and a lender. Maximum total benefit per disability:

Source: financialresidency.com

Source: financialresidency.com

A credit disability insurance policy is an agreement between three parties: Debt cancellation policies involve only a borrower and a lender. Build a triangle of protection ® help safeguard the people and possessions that matter most by building a triangle of protection around your home and family with three different products — life, disability income, and homeowners insurance. Individual credit disability insurance can pay a monthly installment loan payment directly to your financing institution if you become disabled. Nearly 40% of consumers don�t have $400 in cash to cover an emergency expense.

Source: canajunfinances.com

Source: canajunfinances.com

The policy may require that you be working a certain number of hours a week before the disability. Credit disability insurance protection included in your individual policy gives you some important benefits: If you are totally disabled due to a covered sickness or accident, credit disability insurance is designed to make your loan payment, up to the policy maximum. Build a triangle of protection ® help safeguard the people and possessions that matter most by building a triangle of protection around your home and family with three different products — life, disability income, and homeowners insurance. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum.

Source: badcredit.org

Source: badcredit.org

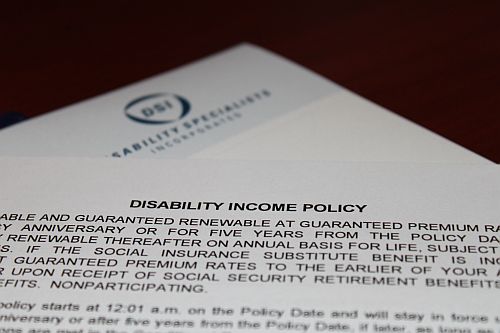

It shows how complicated some of the “credit disability insurance” policies can be. “that’ll never happen to me.”. The policy may require that you be working a certain number of hours a week before the disability. If you are unable to work because of a disability, this coverage makes your monthly minimum loan payments for a limited time period. Credit disability and credit life insurance may help reduce or pay off your covered loan or make your monthly loan payment, up to the policy maximum, in the event of a covered life event, injury, illness or death.

Source: baldersoninsurance.com

Source: baldersoninsurance.com

The policy may require that you be working a certain number of hours a week before the disability. These policies are regulated by the lender, not by individual state. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. When can a credit disability policy be issued? The benefits are paid to the financial institution holding the loan.

Source: iffa-yana.blogspot.com

Source: iffa-yana.blogspot.com

What is credit protection insurance? The opinion in the case was issued by the houston court of appeals, first district, in december of 2011. Read the credit disability insurance brochure and watch this video to learn more! If you are unable to work because of a disability, this coverage makes your monthly minimum loan payments for a limited time period. Build a triangle of protection ® help safeguard the people and possessions that matter most by building a triangle of protection around your home and family with three different products — life, disability income, and homeowners insurance.

Source: instantdisability.com

Source: instantdisability.com

The benefits are paid to the financial institution holding the loan. If you are totally disabled due to a covered sickness or accident, credit disability insurance is designed to make your loan payment, up to the policy maximum. The style of the case is, bernice hudspeth v. May help to make the monthly loan payments for the insured, up to the policy maximum terms and limits. Credit disability insurance pays your loan payments when you can’t work after a disability.

Source: tpcu.on.ca

A credit disability insurance policy is an agreement between three parties: The opinion in the case was issued by the houston court of appeals, first district, in december of 2011. Money from your other disability coverage will not have to be used to make the payment on your loan, freeing up more funds to use for household necessities like the mortgage, food, car payments, doctor visits, prescriptions, etc. Credit disability insurance pays regardless of any other coverage that you already have in place. If you are unable to work because of a disability, this coverage makes your monthly minimum loan payments for a limited time period.

Source: huffingtonpost.com

Source: huffingtonpost.com

With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. A credit disability insurance policy will pay off a specific loan if you were to become disabled. Credit disability insurance pays regardless of any other coverage that you already have in place. Credit insurance is an insurance policy that covers to pay existing debts of the policyholder in case of death, disability, insolvency or loss of employment of the insured or due to any other reasons covered in an insurance policy. Credit insurance are your members� loans protected in the event of an unexpected life event, such as disability or death?

Source: goodfinancialcents.com

Source: goodfinancialcents.com

May help to make the monthly loan payments for the insured, up to the policy maximum terms and limits. Credit disability insurance is insurance designed specifically to cover all or part of a debt if the borrower becomes disabled to the point where his or her ability to work is totally diminished. Group credit life insurance policies are generally sold to lenders, such as banks and credit unions, who offer you coverage when you obtain a loan. You decide which payments you want to protect and the monthly premium may be added to your loan. Credit disability insurance protection included in your individual policy gives you some important benefits:

Source: instantdisability.com

Source: instantdisability.com

Maximum total benefit per disability: It aids in paying some or all of existing debts if the insured is involuntarily unemployed It shows how complicated some of the “credit disability insurance” policies can be. The benefits are paid to the financial institution holding the loan. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum.

Source: wiseradvisor.com

Source: wiseradvisor.com

Credit insurance is an insurance policy that covers to pay existing debts of the policyholder in case of death, disability, insolvency or loss of employment of the insured or due to any other reasons covered in an insurance policy. Credit disability insurance pays regardless of any other coverage that you already have in place. Unlike credit life insurance, disability insurance may pay for all or part of the debt, depending on the type of disability. With credit disability insurance, if you’re disabled from work due to injury or illness, your monthly loan payments will be made, up to the monthly benefit maximum, until you’re no longer disabled, your loan is paid, or reach the policy maximum. Member’s finances don’t need to be disrupted due to accident or illness.

Source: firstcommercecu.com

Source: firstcommercecu.com

The opinion in the case was issued by the houston court of appeals, first district, in december of 2011. You decide which payments you want to protect and the monthly premium may be added to your loan. These policies are regulated by the lender, not by individual state. Build a triangle of protection ® help safeguard the people and possessions that matter most by building a triangle of protection around your home and family with three different products — life, disability income, and homeowners insurance. Credit disability insurance pays regardless of any other coverage that you already have in place.

Source: singsaver.com.sg

Source: singsaver.com.sg

You may have to be disabled for a certain amount of time before the insurance will kick in. What is a credit protection policy? Credit insurance are your members� loans protected in the event of an unexpected life event, such as disability or death? The benefits are paid to the financial institution holding the loan. Build a triangle of protection ® help safeguard the people and possessions that matter most by building a triangle of protection around your home and family with three different products — life, disability income, and homeowners insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title credit disability insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea