Credit insurance explained information

Home » Trending » Credit insurance explained informationYour Credit insurance explained images are ready. Credit insurance explained are a topic that is being searched for and liked by netizens today. You can Find and Download the Credit insurance explained files here. Find and Download all free photos.

If you’re searching for credit insurance explained images information linked to the credit insurance explained keyword, you have pay a visit to the right blog. Our website frequently provides you with hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

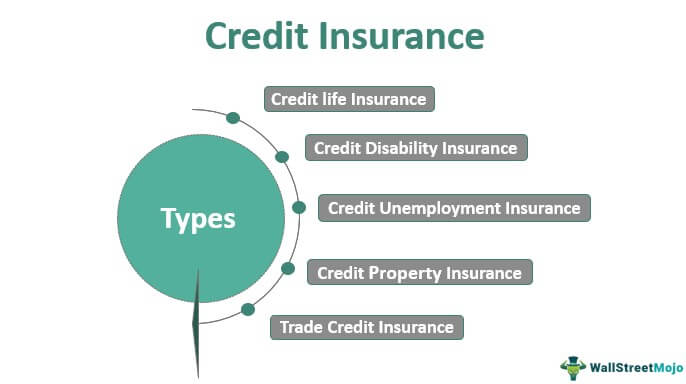

Credit Insurance Explained. If you receive a note from an insolvency practitioner saying that one of your customers has. Australian businesses owe around $950 billion to other businesses. The option is often elected by a head of household to cover the possibility they would leave a family with a huge debt bill if an. Credit life insurance is a specialized type of policy intended to pay off specific outstanding debts in case the borrower dies before the debt is fully repaid.

12+ Auto Insurance Explained Most Searched North Coast From northcoastautoi4g.blogspot.com

If you’ve ever applied for a loan, there’s a good chance you’ve been asked about adding credit life or credit disability insurance to your loan. As a brief summary, coface credit insurance protects your business from customer insolvency and payment default in the following key ways. November 28, 2019 well covered (steadfast) trade credit insurance is an important tool in a small business’ arsenal to protect against the risk of debts not being paid. In fact, foreign companies buy an average of 40 percent more when they are offered open terms, according to the world trade organization. A guide on how credit insurance works with an example. Credit disability insurance is insurance coverage that provides additional safety by helping make payments when one is incapacitated to work for a period of time.

Credit insurance is a type of insurance policy purchased by a borrower that pays off one or more existing debts in the event of a death, disability, or in.

Get the complete guide to credit insurance learn about all things credit insurance all in one place. Credit life insurance is a type of life insurance policy. If you’ve ever applied for a loan, there’s a good chance you’ve been asked about adding credit life or credit disability insurance to your loan. As a brief summary, coface credit insurance protects your business from customer insolvency and payment default in the following key ways. The lower the outstanding loan amount. Credit insurance is designed to protect businesses from unexpected losses due to the insolvency of a customer or the failure to pay an undisputed invoice.

Source: newsroom.ekfinancialgroup.com.au

Source: newsroom.ekfinancialgroup.com.au

A guide on how credit insurance works with an example. Get the complete guide to credit insurance learn about all things credit insurance all in one place. Credit disability insurance is insurance coverage that provides additional safety by helping make payments when one is incapacitated to work for a period of time. November 28, 2019 well covered (steadfast) trade credit insurance is an important tool in a small business’ arsenal to protect against the risk of debts not being paid. It exists for the sole purpose of covering the outstanding debts of a deceased borrower (s) after his death.

Source: tci.mercantileib.com.au

Source: tci.mercantileib.com.au

Credit insurance and surety are closely tied to economic development. Using credit insurance, you can offer competitive extended payment terms and often operate higher credit exposures on your customers, allowing you to broaden your sales scope giving access to profits which were previously unattainable. View our credit insurance guide video for a more detailed overview of how the coface credit insurance process works. November 28, 2019 well covered (steadfast) trade credit insurance is an important tool in a small business’ arsenal to protect against the risk of debts not being paid. As a brief summary, coface credit insurance protects your business from customer insolvency and payment default in the following key ways.

Source: gocarcredit.co.uk

Source: gocarcredit.co.uk

Thus, the lower the original value of a credit life insurance policy; Credit insurance goes beyond indemnification and does not replace a company’s credit practices, but rather supplements and enhances the job of a credit professional. Get the complete guide to credit insurance learn about all things credit insurance all in one place. Which means it’s essential to have protections in place so that in the. Credit insurance allows you to capitalise on sales beyond your normal risk appetite.

Source: holidaylounge.co.uk

Source: holidaylounge.co.uk

August 7, 2021 those who have ever applied for a personal loan, auto loan, or mortgage may have been offered credit life insurance at some point. It exists for the sole purpose of covering the outstanding debts of a deceased borrower (s) after his death. “no thanks.” in some cases, you don’t need it. View our credit insurance guide video for a more detailed overview of how the coface credit insurance process works. Using credit insurance, you can offer competitive extended payment terms and often operate higher credit exposures on your customers, allowing you to broaden your sales scope giving access to profits which were previously unattainable.

Source: creditsesame.com

Source: creditsesame.com

As a brief summary, coface credit insurance protects your business from customer insolvency and payment default in the following key ways. Australian businesses owe around $950 billion to other businesses. This coverage can be purchased for either a specific client, referred to as named buyer, or for all business receivables, referred to as portfolio coverage. With a typical term life insurance policy your family gets a payout if you pass away during the specified coverage period or term. The lower the outstanding loan amount.

Source: rd.com

Source: rd.com

Credit insurance and surety are closely tied to economic development. Credit insurance is a type of insurance policy purchased by a borrower that pays off one or more existing debts in the event of a death, disability, or in. If a customer doesn’t pay, you can simply claim against your insurance policy. Upon his demise, they activate the policy. Export credit insurance, funatsu, h.

Source: topfinancialresources.com

Source: topfinancialresources.com

Australian businesses owe around $950 billion to other businesses. Thus, the lower the original value of a credit life insurance policy; This video from atradius concisely explains what credit insurance is and shows the relationship between the buyer, the supplier, and the credit insurer.disco. In fact, foreign companies buy an average of 40 percent more when they are offered open terms, according to the world trade organization. Australian businesses owe around $950 billion to other businesses.

Source: getinsurance.ng

Source: getinsurance.ng

“insolvency, where a business cannot pay its debts, is a common scenario. This coverage can be purchased for either a specific client, referred to as named buyer, or for all business receivables, referred to as portfolio coverage. Trade credit insurance is a subset of this, and can help protect and mitigate risk for exporters from credit loss. Academic research on export credit insurance. Credit life insurance is a type of life insurance policy.

Source: theinsurancedictionary.com

Source: theinsurancedictionary.com

With a typical term life insurance policy your family gets a payout if you pass away during the specified coverage period or term. The option is often elected by a head of household to cover the possibility they would leave a family with a huge debt bill if an. Credit disability insurance is insurance coverage that provides additional safety by helping make payments when one is incapacitated to work for a period of time. The lower the outstanding loan amount. However, with credit disability insurance, monthly loan payments may not be a problem.

Source: policyadvice.net

Source: policyadvice.net

Credit insurance is a risk management tool the compensate policyholder when their clients fail to pay for goods and services credit insurance enables sellers to extend credit more liberally surely compensates the beneficiary if contractual legal or regular obligation is not me. A guide on how credit insurance works with an example. Which means it’s essential to have protections in place so that in the. With a typical term life insurance policy your family gets a payout if you pass away during the specified coverage period or term. If a customer doesn’t pay, you can simply claim against your insurance policy.

Source: northcoastautoi4g.blogspot.com

View our credit insurance guide video for a more detailed overview of how the coface credit insurance process works. This video from atradius concisely explains what credit insurance is and shows the relationship between the buyer, the supplier, and the credit insurer.disco. The option is often elected by a head of household to cover the possibility they would leave a family with a huge debt bill if an. “no thanks.” in some cases, you don’t need it. November 28, 2019 well covered (steadfast) trade credit insurance is an important tool in a small business’ arsenal to protect against the risk of debts not being paid.

Source: funciogamma.blogspot.com

Source: funciogamma.blogspot.com

Which means it’s essential to have protections in place so that in the event a creditor does not meet its obligations, the business can still recoup its money. The lower the outstanding loan amount. November 28, 2019 well covered (steadfast) trade credit insurance is an important tool in a small business’ arsenal to protect against the risk of debts not being paid. Get the complete guide to credit insurance learn about all things credit insurance all in one place. Australian businesses owe around $950 billion to other businesses.

Source: youtube.com

Source: youtube.com

Upon his demise, they activate the policy. If you’ve ever applied for a loan, there’s a good chance you’ve been asked about adding credit life or credit disability insurance to your loan. Which means it’s essential to have protections in place so that in the event a creditor does not meet its obligations, the business can still recoup its money. Academic research on export credit insurance. Trade credit insurance is an important tool in a small business’ arsenal to protect against the risk of debts not being paid.

Source: visual.ly

Source: visual.ly

This is the perfect starting point if you want to understand how a credit. This is the perfect starting point if you want to understand how a credit. Australian businesses owe around $950 billion to other businesses. A disability can stop you from the income you need to meet monthly loan obligations. Academic research on export credit insurance.

Source: cofaceitfirst.com

Source: cofaceitfirst.com

Academic research on export credit insurance. This coverage can be purchased for either a specific client, referred to as named buyer, or for all business receivables, referred to as portfolio coverage. Australian businesses owe around $950 billion to other businesses. If you receive a note from an insolvency practitioner saying that one of your customers has. While trade credit insurance is most often used to protect foreign or export accounts receivable, it can also be used for.

Source: blog.tabiib.com

Source: blog.tabiib.com

Thus, the lower the original value of a credit life insurance policy; Australian businesses owe around $950 billion to other businesses. This video from atradius concisely explains what credit insurance is and shows the relationship between the buyer, the supplier, and the credit insurer.disco. November 28, 2019 well covered (steadfast) trade credit insurance is an important tool in a small business’ arsenal to protect against the risk of debts not being paid. View our credit insurance guide video for a more detailed overview of how the coface credit insurance process works.

Source: moneyshop.co.za

Source: moneyshop.co.za

Credit insurance and surety are closely tied to economic development. November 28, 2019 well covered (steadfast) trade credit insurance is an important tool in a small business’ arsenal to protect against the risk of debts not being paid. Academic research on export credit insurance. Credit insurance is a risk management tool the compensate policyholder when their clients fail to pay for goods and services credit insurance enables sellers to extend credit more liberally surely compensates the beneficiary if contractual legal or regular obligation is not me. Credit insurance and surety are closely tied to economic development.

Source: getinsurance.ng

Source: getinsurance.ng

Credit disability insurance is insurance coverage that provides additional safety by helping make payments when one is incapacitated to work for a period of time. While trade credit insurance is most often used to protect foreign or export accounts receivable, it can also be used for. This is the perfect starting point if you want to understand how a credit. Academic research on export credit insurance. Trade credit insurance is an important tool in a small business’ arsenal to protect against the risk of debts not being paid.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title credit insurance explained by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea