Credit insurance policy definition information

Home » Trend » Credit insurance policy definition informationYour Credit insurance policy definition images are available in this site. Credit insurance policy definition are a topic that is being searched for and liked by netizens now. You can Download the Credit insurance policy definition files here. Get all free vectors.

If you’re looking for credit insurance policy definition images information related to the credit insurance policy definition keyword, you have come to the ideal blog. Our website always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

Credit Insurance Policy Definition. Credit insurance meets your needs and is tailored to all your transactions with an overall term (execution and payment) of more than 2 years: Credit protection insurance, also known as creditor’s insurance, creditor’s group insurance, or credit insurance, is used to pay out a mortgage or loan balance (up to the maximum specified in the certificate of insurance) or to make/postpone debt payments on the customer’s behalf in the event of death, disability, job loss or critical illness. The insurer should be willing to provide coverage against customer nonpayment if a proposed customer clears its internal review process. Credit insurance guarantees a lender will be repaid if a borrower is unable to pay his or her debt due to, for example, death or disability.

What Is The Benefit Of A Credit Disability Insurance Plan From louisvillelatest.blogspot.com

Capital is protected cash flows are maintained loan servicing and repayments are enhanced Trade credit insurance provides cover for businesses if customers who owe money for products or services do not pay their debts, or pay them later than the payment terms dictate. It gives businesses the confidence to extend credit to new customers and improves access to funding, often at more competitive rates. Credit life insurance pays a policyholder’s debts when the policyholder dies. Export credit insurance is available from private insurance underwriters, such as the german company atradius, the french coface as well as from government agencies, such as us eximbank. Although credit insurance is solely for the benefit of the lender, it is purchased and paid for by the borrower.

The classic example is that of one commercial enterprise extending credit to another enterprise or individual.

Whereas the insured has made a written proposal and declaration (`the The classic example is that of one commercial enterprise extending credit to another enterprise or individual. It makes sure invoices will be paid and allows companies to reliably manage the commercial and political risks of trade that are beyond their control. Definition credit risk — the possibility that either one of the parties to a contract will not be able to satisfy its financial obligation under that contract. Trade credit insurance provides cover for businesses if customers who owe money for products or services do not pay their debts, or pay them later than the payment terms dictate. Credit insurance is often an extra service that�s offered by your credit card lender, either at the time you apply or later in the life of the loan.

Source: creditinsurance.com

Source: creditinsurance.com

Business owners may be required to purchase credit insurance as a condition of. Credit life insurance is a type of life insurance policy designed to pay off a borrower�s outstanding debts if the. Operative clause this policy is issued by sbi general insurance company limited (hereinafter referred to as the company’) to the proposer (hereinafter referred to as the insured’) named in the schedule attached herewith. Credit insurance is a type of insurance policy purchased by a borrower that pays off one or more existing debts in the event of a death, disability, or in rare cases, unemployment. Credit insurance is often an extra service that�s offered by your credit card lender, either at the time you apply or later in the life of the loan.

Source: mortalcocktail.blogspot.com

Source: mortalcocktail.blogspot.com

Special insurance coverage for exporters to protect against non payment by the importer (coverage may extend to certain other risks, depending on the policy). It makes sure invoices will be paid and allows companies to reliably manage the commercial and political risks of trade that are beyond their control. Credit insurance meets your needs and is tailored to all your transactions with an overall term (execution and payment) of more than 2 years: Unlike term or universal life insurance, it doesn’t pay out to the policyholder’s chosen beneficiaries. Credit life insurance is a type of life insurance policy designed to pay off a borrower�s outstanding debts if the.

Operative clause this policy is issued by sbi general insurance company limited (hereinafter referred to as the company’) to the proposer (hereinafter referred to as the insured’) named in the schedule attached herewith. It�s not sold by agents. Trade credit insurance provides cover for businesses if customers who owe money for products or services do not pay their debts, or pay them later than the payment terms dictate. Set the payment terms for parties to whom credit is extended. Credit insurance is an insurance policy that pays a seller if a buyer does not pay an invoice.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Credit protection insurance, also known as creditor’s insurance, creditor’s group insurance, or credit insurance, is used to pay out a mortgage or loan balance (up to the maximum specified in the certificate of insurance) or to make/postpone debt payments on the customer’s behalf in the event of death, disability, job loss or critical illness. A credit insurance is a type of business insurance designed to protect businesses from commercial and political risks that may impact the finances of the business. It gives businesses the confidence to extend credit to new customers and improves access to funding, often at more competitive rates. Trade credit insurance, purchased by businesses to insure payment of credit extended by the business payment protection insurance, purchased by consumers to. Credit insurance meets your needs and is tailored to all your transactions with an overall term (execution and payment) of more than 2 years:

Source: memesita.com

Source: memesita.com

Credit insurance is often an extra service that�s offered by your credit card lender, either at the time you apply or later in the life of the loan. The premiums will vary based on the amount of the benefit. Whereas the insured has made a written proposal and declaration (`the Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted default, insolvency or bankruptcy. Credit insurance is also called “payment protection insurance,” or “credit protection.” a “voluntary debt cancellation addendum” works similarly;

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Credit insurance benefits are first paid to the. A credit insurance is a type of business insurance designed to protect businesses from commercial and political risks that may impact the finances of the business. Such risks can be beyond the control of businesses or individuals. Transferring risk away from the business and over to an insurer, credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts. Credit insurance guarantees a lender will be repaid if a borrower is unable to pay his or her debt due to, for example, death or disability.

Source: mortalcocktail.blogspot.com

Source: mortalcocktail.blogspot.com

Credit insurance is most commonly offered as a group policy through a bank, credit union or vendor such as an auto dealer or furniture store, although you may be able to buy a policy individually. Export credit insurance is available from private insurance underwriters, such as the german company atradius, the french coface as well as from government agencies, such as us eximbank. Business owners may be required to purchase credit insurance as a condition of. Instead, the policyholder’s creditors receive the value of a credit life insurance policy. Credit insurance is also called “payment protection insurance,” or “credit protection.” a “voluntary debt cancellation addendum” works similarly;

Source: youtube.com

Source: youtube.com

It gives businesses the confidence to extend credit to new customers and improves access to funding, often at more competitive rates. Whereas the insured has made a written proposal and declaration (`the Although credit insurance is solely for the benefit of the lender, it is purchased and paid for by the borrower. Credit insurance benefits are first paid to the. Capital is protected cash flows are maintained loan servicing and repayments are enhanced

Source: investopedia.com

Source: investopedia.com

Determine which customers are extended credit and billed. Credit insurance benefits are first paid to the. Credit insurance is a type of insurance policy purchased by a borrower that pays off one or more existing debts in the event of a death, disability, or in rare cases, unemployment. Credit insurance refers to several kinds of insurance relating to financial credit : Such risks can be beyond the control of businesses or individuals.

Source: otterstedt.com

Source: otterstedt.com

Credit insurance is a type of insurance policy purchased by a borrower that pays off one or more existing debts in the event of a death, disability, or in rare cases, unemployment. Although credit insurance is solely for the benefit of the lender, it is purchased and paid for by the borrower. Credit insurance refers to several kinds of insurance relating to financial credit : Credit insurance is most commonly offered as a group policy through a bank, credit union or vendor such as an auto dealer or furniture store, although you may be able to buy a policy individually. Presentation insurance for banks insurance for french exporters documents.

Source: slideshare.net

Source: slideshare.net

Determine which customers are extended credit and billed. Trade credit insurance, purchased by businesses to insure payment of credit extended by the business payment protection insurance, purchased by consumers to. Credit insurance benefits are first paid to the. If you’re wondering how this works, you’ve come to the right place. Operative clause this policy is issued by sbi general insurance company limited (hereinafter referred to as the company’) to the proposer (hereinafter referred to as the insured’) named in the schedule attached herewith.

Source: credit-insurance.ae

Source: credit-insurance.ae

Credit insurance benefits are first paid to the. Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted default, insolvency or bankruptcy. Simply put, a credit policy is a set of guidelines that sets credit and payment terms for customers and establishes a clear course of action for late payments. Such risks can be beyond the control of businesses or individuals. Credit life insurance is a type of life insurance policy designed to pay off a borrower�s outstanding debts if the.

Source: investopedia.com

Source: investopedia.com

Although credit insurance is solely for the benefit of the lender, it is purchased and paid for by the borrower. Operative clause this policy is issued by sbi general insurance company limited (hereinafter referred to as the company’) to the proposer (hereinafter referred to as the insured’) named in the schedule attached herewith. Transferring risk away from the business and over to an insurer, credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts. It�s not sold by agents. If you’re wondering how this works, you’ve come to the right place.

Source: cekasuransi.blogspot.com

Source: cekasuransi.blogspot.com

Capital is protected cash flows are maintained loan servicing and repayments are enhanced A credit insurance is a type of business insurance designed to protect businesses from commercial and political risks that may impact the finances of the business. Determine which customers are extended credit and billed. However, safeguarding against risks like loss or damage to the business is important to expand the business. Credit life insurance pays a policyholder’s debts when the policyholder dies.

Source: louisvillelatest.blogspot.com

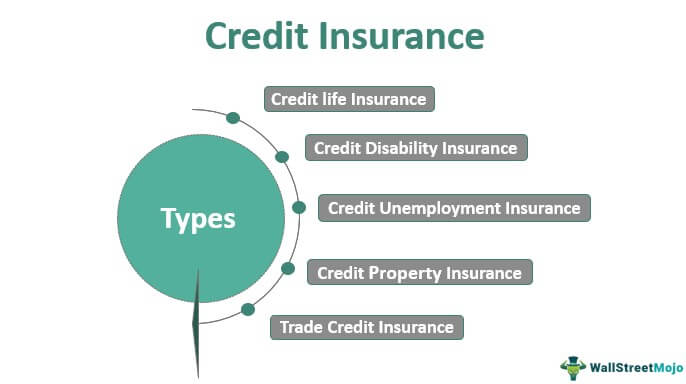

Credit insurance refers to several kinds of insurance relating to financial credit : A good policy will generally do four things: The insurer should be willing to provide coverage against customer nonpayment if a proposed customer clears its internal review process. Credit life insurance is a type of life insurance policy designed to pay off a borrower�s outstanding debts if the. Credit disability insurance is designed to pay the scheduled monthly payment, or a portion of it, if a borrower becomes totally disabled due to a covered sickness or injury as defined by the certificate or policy of insurance provisions.

Source: goldonomic.com

Source: goldonomic.com

Presentation insurance for banks insurance for french exporters documents. The premiums will vary based on the amount of the benefit. Simply put, a credit policy is a set of guidelines that sets credit and payment terms for customers and establishes a clear course of action for late payments. It gives businesses the confidence to extend credit to new customers and improves access to funding, often at more competitive rates. The benefits are paid to the financial institution holding the loan.

Source: thaifrx.com

Source: thaifrx.com

Credit life insurance is a type of life insurance policy designed to pay off a borrower�s outstanding debts if the. Operative clause this policy is issued by sbi general insurance company limited (hereinafter referred to as the company’) to the proposer (hereinafter referred to as the insured’) named in the schedule attached herewith. Credit insurance refers to several kinds of insurance relating to financial credit : Transferring risk away from the business and over to an insurer, credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts. Credit insurance is most commonly offered as a group policy through a bank, credit union or vendor such as an auto dealer or furniture store, although you may be able to buy a policy individually.

Source: remerasbaires.blogspot.com

Source: remerasbaires.blogspot.com

It�s not sold by agents. Credit insurance is often an extra service that�s offered by your credit card lender, either at the time you apply or later in the life of the loan. Credit life insurance pays a policyholder’s debts when the policyholder dies. Simply put, a credit policy is a set of guidelines that sets credit and payment terms for customers and establishes a clear course of action for late payments. It�s not sold by agents.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title credit insurance policy definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information