Credit life and disability insurance Idea

Home » Trend » Credit life and disability insurance IdeaYour Credit life and disability insurance images are ready in this website. Credit life and disability insurance are a topic that is being searched for and liked by netizens now. You can Download the Credit life and disability insurance files here. Download all royalty-free vectors.

If you’re looking for credit life and disability insurance images information connected with to the credit life and disability insurance keyword, you have pay a visit to the right site. Our website frequently gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

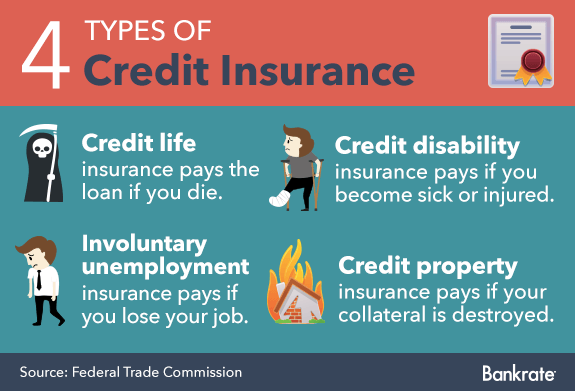

Credit Life And Disability Insurance. Credit life and disability insurance can help protect your family’s livelihood and your good credit from your loan debts in case of your disability or death. Credit disability insurance to make the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled and is unable to work. Some credit disability insurance is only available in a package of credit insurance options, such as credit life insurance, involuntary unemployment coverage and property coverage. Credit life and credit disability insurance is sold in conjunction with credit transactions to protect a variety of loans.

Credit Life And Disability Insurance Thismuchistrue Karen From thismuchistrue-karen.blogspot.com

Credit Life And Disability Insurance Thismuchistrue Karen From thismuchistrue-karen.blogspot.com

Credit life is similar to a special type of life insurance called “decreasing term” insurance. Credit disability insurance pays your eligible loan payments should you become totally disabled due to a covered illness or injury. Use the life & disability worksheet to. Credit life and credit disability insurance is sold in conjunction with credit transactions to protect a variety of loans. Designed to make your loan payments if you become totally disabled due to a covered injury or illness.* could help ease the financial burden of your loan obligation. You decide which payments you want to protect and the monthly premium may be added to your loan.

Credit insurance and credit disability insurance are services provided by several insurance companies.

No one may like to think about it, but we never know when death or disability will strike. Credit life and disability insurance can help protect your family’s livelihood and your good credit from your loan debts in case of your disability or death. Credit disability insurance to make the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled and is unable to work. Credit life pays the remainder of your loan in the event you die before the loan is fully repaid to the lender. The borrower only pays for what he or she needs. Credit disability insurance pays your eligible loan payments should you become totally disabled due to a covered illness or injury.

Source: kimndevin.blogspot.com

Source: kimndevin.blogspot.com

When a borrower has chosen to purchase this insurance, the benefits are designed to pay off or reduce the loan in the event of a covered death or disability. They also may go by different names. Credit life insurance = decreasing term insurance. Credit life and disability rates must be approved by this office before they can be used. Credit life and disability insurance are optional products offered by car dealerships and lending institutions to pay off your auto loan in the case of death or disability.

Source: youtube.com

Source: youtube.com

Credit disability and credit life insurance may help reduce or pay off your covered loan or make your monthly loan payment, up to the policy maximum, in the event of a covered life event, injury, illness or death. No one may like to think about it, but we never know when death or disability will strike. Credit disability insurance to make the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled and is unable to work. Credit life and disability insurance is a voluntary coverage that may reimburse you for all or part of your monthly loan payment up to the policy maximum if you or your covered joint borrower dies or if you should become totally. It is recommended that rate filings for credit life and disability be submitted at least 60 days before the requested effective date.

Source: bankrate.com

Source: bankrate.com

Credit disability insurance to make the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled and is unable to work. Credit disability is often called credit accident and health insurance. Credit life and disability insurance are optional products offered to pay off your auto loan in the case of death or disability. It is recommended that rate filings for credit life and disability be submitted at least 60 days before the requested effective date. Credit life insurance is designed to help reduce or pay off your eligible loan balance, up to the policy maximum, should an unexpected life event occur.

Source: lakeviewfcu.com

Source: lakeviewfcu.com

Credit life insurance reduces or pays off your loan balance if you pass away. It is recommended that rate filings for credit life and disability be submitted at least 60 days before the requested effective date. Credit life is similar to a special type of life insurance called “decreasing term” insurance. Credit life and credit disability insurance is sold in conjunction with credit transactions to protect a variety of loans. Pays off or reduces the insured balance on a loan if the borrower dies.

Source: goldcu.org

Source: goldcu.org

Credit life and credit disability insurance is sold in conjunction with credit transactions to protect a variety of loans. Makes the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled. No one may like to think about it, but we never know when death or disability will strike. Credit disability and credit life insurance may help reduce or pay off your covered loan or make your monthly loan payment, up to the policy maximum, in the event of a covered life event, injury, illness or death. Use the life & disability worksheet to.

Source: envistacu.com

Source: envistacu.com

Credit life and disability insurance are optional products offered by car dealerships and lending institutions to pay off your auto loan in the case of death or disability. Credit disability insurance, on the other hand, covers loan payment in case you suffer a disability that makes you unable to work. Credit insurance and credit disability insurance are services provided by several insurance companies. Moreover, the company has a corporate office in irving,. It is recommended that rate filings for credit life and disability be submitted at least 60 days before the requested effective date.

Source: hvcu.org

Source: hvcu.org

If you suffer disability and you are not able to work, credit disability. Credit life insurance is designed to help reduce or pay off your eligible loan balance, up to the policy maximum, should an unexpected life event occur. They also may go by different names. Credit life pays the remainder of your loan in the event you die before the loan is fully repaid to the lender. No one may like to think about it, but we never know when death or disability will strike.

Source: somersetfcu.com

Source: somersetfcu.com

Designed to make your loan payments if you become totally disabled due to a covered injury or illness.* could help ease the financial burden of your loan obligation. Bdc makes it easy to integrate this protection plan with other coverage options, providing. Some credit disability insurance is only available in a package of credit insurance options, such as credit life insurance, involuntary unemployment coverage and property coverage. You decide which payments you want to protect and the monthly premium may be added to your loan. For example, a credit life insurance policy might be called credit card payment protection insurance, mortgage protection insurance or auto loan protection insurance.

Source: envistacu.com

Source: envistacu.com

Makes the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled. Credit disability and credit life insurance may help reduce or pay off your covered loan or make your monthly loan payment, up to the policy maximum, in the event of a covered life event, injury, illness or death. Credit disability insurance to make the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled and is unable to work. Credit life and disability insurance are optional products offered by car dealerships and lending institutions to pay off your auto loan in the case of death or disability. Credit life and disability rates must be approved by this office before they can be used.

Source: envistacu.com

Source: envistacu.com

The benefits are paid to the financial institutions holding the loan. Bdc makes it easy to integrate this protection plan with other coverage options, providing. Member�s choice® credit life and credit disability insurance, underwritten by cuna mutual insurance society, can be purchased to cover your loan to help reduce or pay off your loan or loan payment, in the event of death or total disability respectively. Use the life & disability worksheet to. When a borrower has chosen to purchase this insurance, the benefits are designed to pay off or reduce the loan in the event of a covered death or disability.

Source: myhhfcu.org

Source: myhhfcu.org

Credit life pays the remainder of your loan in the event you die before the loan is fully repaid to the lender. Credit life and disability insurance is a voluntary coverage that may reimburse you for all or part of your monthly loan payment up to the policy maximum if you or your covered joint borrower dies or if you should become totally. If the loan is paid off early, any unused Credit life insurance reduces or pays off your loan balance if you pass away. Credit life and disability credit life credit life insurance is simply term life insurance purchased in conjunction with a consumer credit transaction which provides a death benefit to pay off or reduce the credit obligation in the event of an insured’s death during the term of.

Source: fayetteschoolcu.org

Source: fayetteschoolcu.org

Credit life and disability credit life credit life insurance is simply term life insurance purchased in conjunction with a consumer credit transaction which provides a death benefit to pay off or reduce the credit obligation in the event of an insured’s death during the term of. Credit life and credit disability insurance is sold in conjunction with credit transactions to protect a variety of loans. Credit life and disability insurance are optional products offered by car dealerships and lending institutions to pay off your auto loan in the case of death or disability. Credit insurance benefits (credit life & disability) benefits to the borrower the borrower has a sense of security knowing that his or her loan is covered in the event of a sudden accident or illness, or unexpected death. Credit life is similar to a special type of life insurance called “decreasing term” insurance.

Source: dealerassociates.com

Source: dealerassociates.com

The credit insurance clients underwriting is done through several investments programs. Credit disability insurance pays your eligible loan payments should you become totally disabled due to a covered illness or injury. Credit life insurance = decreasing term insurance. Credit disability insurance, on the other hand, covers loan payment in case you suffer a disability that makes you unable to work. Credit life and disability credit life credit life insurance is simply term life insurance purchased in conjunction with a consumer credit transaction which provides a death benefit to pay off or reduce the credit obligation in the event of an insured’s death during the term of.

Source: palmettohealthcu.org

Source: palmettohealthcu.org

These types of additional insurance products are optional to the consumer and are not required for. For instance, union security life insurance company which is a member of assurant group (lamb, 360). Credit life and disability insurance are optional products offered by car dealerships and lending institutions to pay off your auto loan in the case of death or disability. Use the naic rate transmittal form to submit both initial rate filings and subsequent rate change filings. Makes the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled.

Credit disability insurance, on the other hand, covers loan payment in case you suffer a disability that makes you unable to work. Credit disability insurance for loans: Credit disability and credit life insurance may help reduce or pay off your covered loan or make your monthly loan payment, up to the policy maximum, in the event of a covered life event, injury, illness or death. Credit life pays the remainder of your loan in the event you die before the loan is fully repaid to the lender. For example, a credit life insurance policy might be called credit card payment protection insurance, mortgage protection insurance or auto loan protection insurance.

Source: keikaiookami.blogspot.com

Source: keikaiookami.blogspot.com

Credit disability insurance may help make your loan payments, up to the policy maximum, in the event you become totally disabled due to a covered illness or injury. Bdc makes it easy to integrate this protection plan with other coverage options, providing. Credit life insurance and credit disability insurance are the most commonly offered forms of coverage. Credit life and credit disability insurance is sold in conjunction with credit transactions to protect a variety of loans. Credit life and disability insurance is a voluntary coverage that may reimburse you for all or part of your monthly loan payment up to the policy maximum if you or your covered joint borrower dies or if you should become totally.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

You decide which payments you want to protect and the monthly premium may be added to your loan. Credit disability insurance to make the monthly loan payment (up to the contract limit) on a loan if the borrower becomes ill or disabled and is unable to work. Designed to make your loan payments if you become totally disabled due to a covered injury or illness.* could help ease the financial burden of your loan obligation. The benefits are paid to the financial institutions holding the loan. It is recommended that rate filings for credit life and disability be submitted at least 60 days before the requested effective date.

Source: geoffleemortgage.com

Source: geoffleemortgage.com

Requires no complicated enrollment forms or physical exam. Use the life & disability worksheet to. If you suffer disability and you are not able to work, credit disability. They also may go by different names. Credit life is similar to a special type of life insurance called “decreasing term” insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title credit life and disability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information