Creditor insurance scotiabank information

Home » Trending » Creditor insurance scotiabank informationYour Creditor insurance scotiabank images are ready. Creditor insurance scotiabank are a topic that is being searched for and liked by netizens today. You can Get the Creditor insurance scotiabank files here. Download all free images.

If you’re looking for creditor insurance scotiabank pictures information linked to the creditor insurance scotiabank keyword, you have pay a visit to the ideal site. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

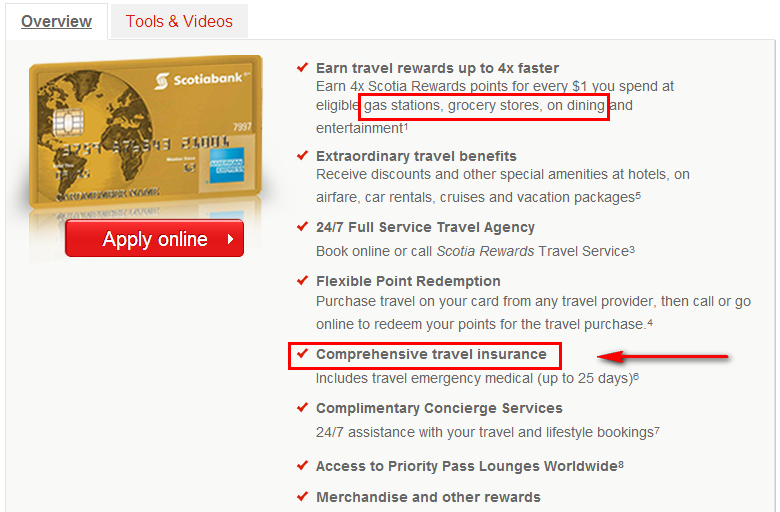

Creditor Insurance Scotiabank. Resolving complaints we are dedicated to ensuring that every effort is made to resolve your concerns about our creditor insurance products. If you are not sure how to use this tool, please speak to one of our advisors for assistance. Scotia line of credit protection; Scotia mortgage protection is underwritten by the canada life assurance company under a group policy issued to the bank of nova scotia.

Customers need to have a mortgage with scotiabank in order to add protection. You are sufficiently protected to pay off all your outstanding scotiabank debt obligations. 301 kb) line of credit protection Death, critical illness, and hospitalization coverage are available in the basic. Creditor insurance protection planner by answering a few questions, we can help you understand how to best protect your scotiabank credit and loan obligations based on your individual needs. Creditor insurance for scotiabank mortgages is optional and offers you coverage on your scotiabank mortgage for:

All coverage is subject to the terms and conditions outlined in the certificate of insurance which you will receive within 30 days once your scotia credit card protection application has been approved.

Life insurance for the cardholder and secondary cardholder (joint coverage) on the same scotiabank mastercard account costs $0.52 for every $100 of outstanding balance. These products are not available in scotiabank branches. 301 kb) line of credit protection Insure up to $1 million on a term 1 plan, or up to $250,000 in term 10, 20, or 100 plans. Term products are renewable up to age 75. Identifying those issues that require escalation and follow the appropriate escalation process and/or assign to the appropriate contact as per policy.

Source: pinterest.com

Source: pinterest.com

Scotia plan loan life & disability protection insurance; This page has been viewed by: Identifying those issues that require escalation and follow the appropriate escalation process and/or assign to the appropriate contact as per policy. Acquiring and maintaining knowledge and understanding of scotialife financial creditor insurance products and scotiabank lending products. All coverage is subject to the terms and conditions outlined in the certificate of insurance which you will receive within 30 days once your scotia credit card protection application has been approved.

Source: creditwalk.ca

Source: creditwalk.ca

Insure up to $1 million on a term 1 plan, or up to $250,000 in term 10, 20, or 100 plans. Provide a professional and courteous customer experience and take accountability for resolving customer concerns in a timely manner through: 100% of your scotiabank debt. Scotia credit card protection insurance; 269 kb) job loss claim form (pdf:

Resolving complaints we are dedicated to ensuring that every effort is made to resolve your concerns about our creditor insurance products. 466 kb) disability claim form (pdf: Death, critical illness, and hospitalization coverage are available in the basic. Scotialife critical illness insurance and scotialife health & dental insurance are underwritten by sun life assurance company of canada; Scotia line of credit protection is underwritten by the canada life assurance company under a group policy issued to the bank of nova scotia.

Source: newsday.co.tt

Source: newsday.co.tt

Customers need to have a mortgage with scotiabank in order to add protection. Ensuring that all team members have a thorough understanding of scotialife financial creditor insurance product offerings and they are able to recognize and act upon quality retention,. You are sufficiently protected to pay off all your outstanding scotiabank debt obligations. If you had a disability. Scotia credit card protection is underwritten by chubb life insurance company of canada under a group policy issued to the bank of nova scotia.

Source: rategenie.ca

Source: rategenie.ca

Learn more about our comprehensive range of affordable creditor protection coverage that matches your scotiabank credit account. All coverage is subject to the terms and conditions outlined in the certificate of insurance which you will receive within 30 days once your scotia credit card protection application has been approved. Acquiring and maintaining knowledge and understanding of scotialife financial creditor insurance products and scotiabank lending products. 466 kb) disability claim form (pdf: Scotia plan loan life & disability protection;

Source: scotiabank.com

Source: scotiabank.com

Acquiring and maintaining knowledge and understanding of. 301 kb) line of credit protection Consumers (0 reviews) 0 out of 5 stars: What you need to know about this insurance coverage: 466 kb) disability claim form (pdf:

Source: creditwalk.ca

Source: creditwalk.ca

Scotia line of credit protection insurance; If you enrol for life and critical illness insurance, the cost for the cardholder (single coverage) is $0.53 a month for every $100 of outstanding balance on the previous month. All insurance coverage is subject to the terms and conditions outlined in the applicable certificate of insurance provided. Life, critical illness, disability, and job loss coverage.scotia credit card protection: 100% of your scotiabank debt.

Source: insurdinary.ca

Source: insurdinary.ca

Scotia line of credit protection insurance; All insurance coverage is subject to the terms and conditions outlined in the applicable certificate of insurance provided. What you need to know about this insurance coverage: If you had a disability. Creditor insurance for scotiabank mortgages is optional and offers you coverage on your scotiabank mortgage for:

Source: scotiabank.com

Source: scotiabank.com

These products are not available in scotiabank branches. Scotia credit card protection insurance; Customers need to have a mortgage with scotiabank in order to add protection. Claim forms scotia credit card protection life claim form (pdf: Acquiring and maintaining knowledge and understanding of.

Source: ratehub.ca

Source: ratehub.ca

All coverage is subject to the terms and conditions outlined in the certificate of insurance which you will receive upon enrolment. If you enrol for life and critical illness insurance, the cost for the cardholder (single coverage) is $0.53 a month for every $100 of outstanding balance on the previous month. Provide a professional and courteous customer experience and take accountability for resolving customer concerns in a timely manner through: 269 kb) job loss claim form (pdf: › life insurance › critical illness insurance › disability insurance you can choose any or all of these coverages.

Source: creditwalk.ca

Source: creditwalk.ca

Scotia plan loan life & disability protection insurance; 301 kb) line of credit protection 347kb) critical illness claim form (pdf: Death, critical illness, and hospitalization coverage are available in the basic. Addressing issues promptly and accurately.

Source: gy.scotiabank.com

Source: gy.scotiabank.com

349 kb) hospitalization claim form (pdf: If you are not sure how to use this tool, please speak to one of our advisors for assistance. Scotia mortgage protection is underwritten by the canada life assurance company under a group policy issued to the bank of nova scotia. Addressing issues promptly and accurately. Life, critical illness, and disability coverage.scotia line of credit protection:

Source: gtb.scotiabank.com

Source: gtb.scotiabank.com

Learn more about our comprehensive range of affordable creditor protection coverage that matches your scotiabank credit account. Scotia line of credit protection; Scotia plan loan life & disability protection insurance; Addressing issues promptly and accurately. Scotia plan loan life & disability protection;

Source: scotiabank.com

Source: scotiabank.com

Claim forms scotia credit card protection life claim form (pdf: Acquiring and maintaining knowledge and understanding of scotialife financial creditor insurance products and scotiabank lending products. Claim forms scotia credit card protection life claim form (pdf: Life, critical illness, disability, and job loss coverage.scotia credit card protection: As an insurance provider, scotiabank offers creditor and travel insurance products through its scotialife financial product line, providing mortgage and property protection to canadian homeowners.

Source: insurdinary.ca

Source: insurdinary.ca

466 kb) disability claim form (pdf: Scotia business loan protection insurance; Scotialife critical illness insurance and scotialife health & dental insurance are underwritten by sun life assurance company of canada; Learn more about our comprehensive range of affordable creditor protection coverage that matches your scotiabank credit account. Provide a professional and courteous customer experience and take accountability for resolving customer concerns in a timely manner through:

Acquiring and maintaining knowledge and understanding of. If you enrol for life and critical illness insurance, the cost for the cardholder (single coverage) is $0.53 a month for every $100 of outstanding balance on the previous month. Life, critical illness, disability, and job loss coverage.scotia credit card protection: Insure up to $1 million on a term 1 plan, or up to $250,000 in term 10, 20, or 100 plans. Creditor insurance protection planner by answering a few questions, we can help you understand how to best protect your scotiabank credit and loan obligations based on your individual needs.

301 kb) line of credit protection 0:00 / 0:00 / 0:00 100% of your scotiabank debt. Our claims service is available mon to fri 8:00am to 6:00pm est. Acquiring and maintaining knowledge and understanding of scotialife financial creditor insurance products and scotiabank lending products.

Source: lowestrates.ca

Term products are renewable up to age 75. This page has been viewed by: Scotia business loan protection insurance; Learn more about our comprehensive range of affordable creditor protection coverage that matches your scotiabank credit account. Scotia line of credit protection insurance;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title creditor insurance scotiabank by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea