Cremation insurance Idea

Home » Trend » Cremation insurance IdeaYour Cremation insurance images are available. Cremation insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Cremation insurance files here. Download all free images.

If you’re looking for cremation insurance images information connected with to the cremation insurance keyword, you have pay a visit to the right blog. Our site always provides you with hints for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

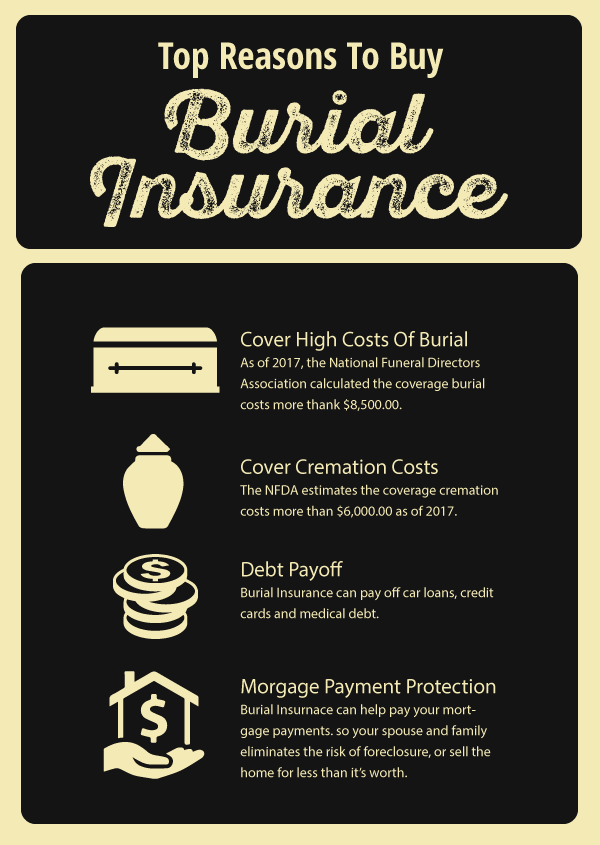

Cremation Insurance. The policy face amount, determined by the policy owner, is usually chosen to equal the cost of cremation and associated services. So, in the end, it all comes down to your choice, and how you want to proceed. All in all, this type of insurance is really helpful. Cremation insurance covers the expenses of cremation and with this insurance, you will also get an urn.

AARP Burial Insurance Review From nextgen-life-insurance.com

AARP Burial Insurance Review From nextgen-life-insurance.com

Term life insurance is the most affordable way to do this. For a low monthly payment, seniors can remove any financial burden family members may otherwise take on. Cremation insurance covers the expenses of cremation and with this insurance, you will also get an urn. The average funeral will cost $10,000, this big price tag includes several factors: If you already have term or whole life insurance, your loved ones can use your existing policy to pay final expenses. A direct cremation with no memorial service is the most affordable option.

Topics covered in this article.

For a low monthly payment, seniors can remove any financial burden family members may otherwise take on. However, the funeral home and the burial ceremony can be arranged only if a family member requests it. This is a drastic difference from the average cost of a cremation: This article will discuss how these plans work, the cost, tips for finding the best policy, and much more. The policy face amount, determined by the policy owner, is usually chosen to equal the cost of cremation and associated services. The average funeral will cost $10,000, this big price tag includes several factors:

Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

In the past, cremation has cost less than traditional burial, but with more people choosing to be cremated every year, funeral homes have started adjusting their prices. The ins and outs of cremation insurance. The policy face amount, determined by the policy owner, is usually chosen to equal the cost of cremation and associated services. If you already have term or whole life insurance, your loved ones can use your existing policy to pay final expenses. This will make sure all expenses are covered with no.

Source: burialinsurancepro.org

Source: burialinsurancepro.org

Topics covered in this article. There are many elderly people that live alone in spain, often through no fault of their own. Cremation insurance covers the expenses of cremation and with this insurance, you will also get an urn. Determine which type of cremation is right for you and calculate how much coverage will be needed. For a low monthly payment, seniors can remove any financial burden family members may otherwise take on.

Source: blogpapi.com

Source: blogpapi.com

The average funeral will cost $10,000, this big price tag includes several factors: In the past, cremation has cost less than traditional burial, but with more people choosing to be cremated every year, funeral homes have started adjusting their prices. The policy face amount, determined by the policy owner, is usually chosen to equal the cost of cremation and associated services. Life insurance coverage is the best way to cover your final expenses, cremation costs, and protect your loved ones from financial duress A direct cremation with no memorial service is the most affordable option.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Final expense insurance is also known as cremation insurance. Cremation services cost about $3,000 and if you add the cost of the funeral or memorial service and an urn, columbarium. Cremation insurance is a small life insurance policy where the proceeds are meant to pay for a cremation and other final expenses. This will make sure all expenses are covered with no. Cremation insurance is a simple and affordable way to prepare for funeral costs.

![Best Burial Insurance Companies [Top Plans for 2017] Best Burial Insurance Companies [Top Plans for 2017]](https://gx0ri2vwi9eyht1e3iyzyc17-wpengine.netdna-ssl.com/wp-content/uploads/2016/08/best-Burial-Insurance-Companies-e1486710162471.png) Source: choicemutual.com

Source: choicemutual.com

Finding the right cremation insurance policy can help reduce the financial burden on your loved ones. In the past, cremation has cost less than traditional burial, but with more people choosing to be cremated every year, funeral homes have started adjusting their prices. Aptly named, cremation insurance pays for the costs associated with cremating the insured individual, who is often (but not always) the policy owner. All in all, this type of insurance is really helpful. Final expense insurance policies may be signed with a funeral home or crematory or with an insurance company.

Source: senior-lifeservices.com

Source: senior-lifeservices.com

Cremation insurance plans even though cremation usually costs less than traditional burials, it can still be an expensive service. $3,000, but can be as low as $1,000. Headstones, caskets, burial and filling. Cremation services cost about $3,000 and if you add the cost of the funeral or memorial service and an urn, columbarium. Unlike whole life insurance, when you purchase cremation insurance, you’re setting aside money for the cost of your cremation, memorial service and any other costs that may be associated with your final wishes.

Source: funeralfunds.com

Source: funeralfunds.com

This is a drastic difference from the average cost of a cremation: However, if you want to get cremation insurance specifically, that is also an option. What is final expense insurance? The ins and outs of cremation insurance. Cremation insurance is a small value life insurance policy designed to cover the cost of cremation and any funeral or memorial services at the time of death.

Source: burialinsurancepro.org

Source: burialinsurancepro.org

The average funeral will cost $10,000, this big price tag includes several factors: Cremation insurance is a small value life insurance policy designed to cover the cost of cremation and any funeral or memorial services at the time of death. Aptly named, cremation insurance pays for the costs associated with cremating the insured individual, who is often (but not always) the policy owner. Cremation insurance is a type of final expense life insurance specifically earmarked to cover the costs of cremation and other final wishes. Cremation insurance is a form of life insurance designed to cover specific final expenses.

Source: buyburialinsuranceonline.com

Source: buyburialinsuranceonline.com

Cremation insurance is a small life insurance policy where the proceeds are meant to pay for a cremation and other final expenses. Cremation insurance covers the expenses of cremation and with this insurance, you will also get an urn. Cremation insurance is similar to life insurance, except for the fact that it is the money that you are saving for your funeral or memorial service. A cremation insurance policy is really another name for a popular form of life insurance coverage known as final expense insurance. When your kids have grown up and doing their own thing, perhaps in spain or more often than not in another country, couples grow old together and enjoy the.

Source: funkishusvedhavet.blogspot.com

Source: funkishusvedhavet.blogspot.com

However, some buyers will increase the face amount to pay for. When your kids have grown up and doing their own thing, perhaps in spain or more often than not in another country, couples grow old together and enjoy the. Our cremation insurance coverage to make your loved one’s last moments memorable. One of the biggest reasons that cremation is becoming more popular is the rising cost of a traditional burial. Cremation insurance is a small value life insurance policy designed to cover the cost of cremation and any funeral or memorial services at the time of death.

Source: burialinsurance.org

Source: burialinsurance.org

Even though cremation usually costs less than traditional burials, it can still be an expensive service. Final expense insurance is also known as cremation insurance. There are many elderly people that live alone in spain, often through no fault of their own. So, in the end, it all comes down to your choice, and how you want to proceed. With the cost of traditional funerals on the rise, many families turn to cremation to save money and simplify funeral planning.

Source: youtube.com

Source: youtube.com

However, the funeral home and the burial ceremony can be arranged only if a family member requests it. Cremation insurance is a small life insurance policy where the proceeds are meant to pay for a cremation and other final expenses. Cremation insurance is a type of final expense life insurance specifically earmarked to cover the costs of cremation and other final wishes. With our cremation insurance policy, we adopt a unique, simple approach to ensure the burial of your loved one. Cremation services cost about $3,000 and if you add the cost of the funeral or memorial service and an urn, columbarium.

Source: nomedicallifeinsurance.ca

Source: nomedicallifeinsurance.ca

Cremation insurance is a type of final expense life insurance specifically earmarked to cover the costs of cremation and other final wishes. Aptly named, cremation insurance pays for the costs associated with cremating the insured individual, who is often (but not always) the policy owner. What is final expense insurance? Cremation insurance is a type of final expense life insurance specifically earmarked to cover the costs of cremation and other final wishes. These riders offer additional funds that are designated for paying for a variety of items, including a funeral, burial, or cremation.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

This article will discuss how these plans work, the cost, tips for finding the best policy, and much more. With the cost of traditional funerals on the rise, many families turn to cremation to save money and simplify funeral planning. Determine which type of cremation is right for you and calculate how much coverage will be needed. Topics covered in this article. Even though cremation usually costs less than traditional burials, it can still be an expensive service.

Source: waynedundee.com

Source: waynedundee.com

This article will discuss how these plans work, the cost, tips for finding the best policy, and much more. Life insurance coverage is the best way to cover your final expenses, cremation costs, and protect your loved ones from financial duress However, if you want to get cremation insurance specifically, that is also an option. However, some buyers will increase the face amount to pay for. The ins and outs of cremation insurance.

Source: kayla-lifeisgreat.blogspot.com

Source: kayla-lifeisgreat.blogspot.com

Cremation insurance plans even though cremation usually costs less than traditional burials, it can still be an expensive service. The average funeral will cost $10,000, this big price tag includes several factors: For a low monthly payment, seniors can remove any financial burden family members may otherwise take on. Cremation insurance is a small life insurance policy where the proceeds are meant to pay for a cremation and other final expenses. All in all, this type of insurance is really helpful.

Source: youtube.com

Source: youtube.com

This is a drastic difference from the average cost of a cremation: There are many elderly people that live alone in spain, often through no fault of their own. Cremation services cost about $3,000 and if you add the cost of the funeral or memorial service and an urn, columbarium. Topics covered in this article. Life insurance coverage is the best way to cover your final expenses, cremation costs, and protect your loved ones from financial duress

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cremation insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information