Cremation insurance policy information

Home » Trend » Cremation insurance policy informationYour Cremation insurance policy images are ready. Cremation insurance policy are a topic that is being searched for and liked by netizens now. You can Find and Download the Cremation insurance policy files here. Find and Download all free images.

If you’re looking for cremation insurance policy images information related to the cremation insurance policy topic, you have pay a visit to the right site. Our website always gives you hints for downloading the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

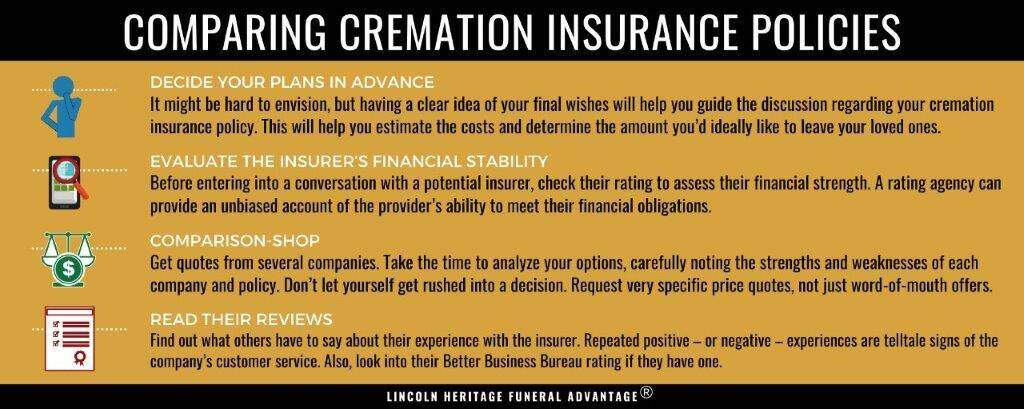

Cremation Insurance Policy. Finding the right cremation insurance policy can help reduce the financial burden on your loved ones. However, keep in mind that most cremation insurance policies have strict benefit limits. Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing. We always recommend double to cover the cost of your entire funeral.

Cremation Insurance Policy Close Up Of Approved Funeral From funkishusvedhavet.blogspot.com

Cremation Insurance Policy Close Up Of Approved Funeral From funkishusvedhavet.blogspot.com

Finding the right cremation insurance policy can help reduce the financial burden on your loved ones. For example, if you get a $20,000 policy and the funeral expenses are only $10,000, your family keeps the rest. Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing. Last updated on october 27, 2021. Cremation insurance plans provide a death benefit payout to your beneficiaries when you pass away. Studies show that more than 60% of adults in america no longer insist on religious funerals for themselves or family members.

Cremation insurance gives you the money faster than life insurance, and life insurance is all about covering your family’s expenses after you leave this world while a cremation insurance policy helps cover the cost of your last rites.

Cremation insurance is a form of life insurance designed to cover specific final expenses. The cost of cremation insurance can be reasonable if you buy it from an independent agent, although some policies may only pay in installments. Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing. Cremation insurance is a type of final expense whole life insurance. We always recommend double to cover the cost of your entire funeral. What’s nice about cremation insurance is that your loved ones don’t have to spend all of the money on cremation.

Source: funkishusvedhavet.blogspot.com

Source: funkishusvedhavet.blogspot.com

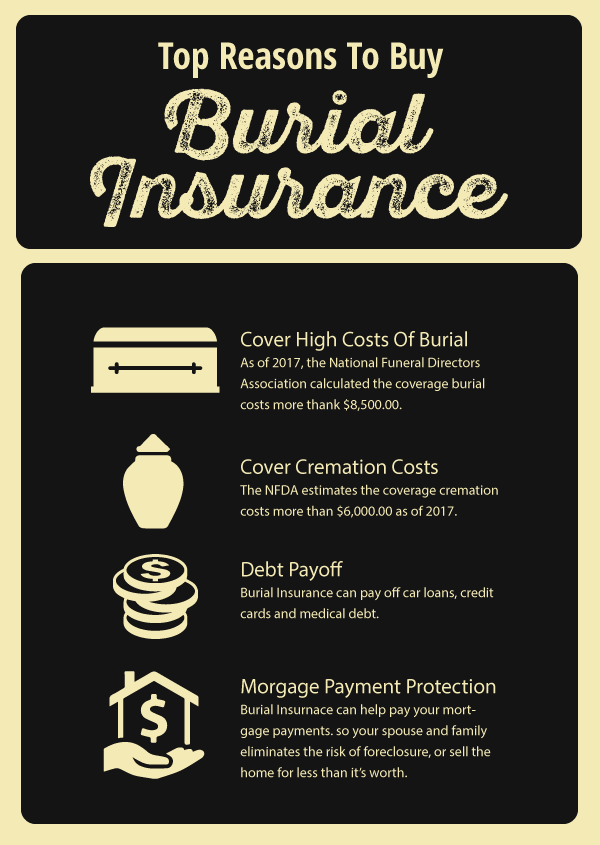

Studies show that more than 60% of adults in america no longer insist on religious funerals for themselves or family members. Depending on the company the death benefit could be higher. So what are the benefits of purchasing a burial or cremation policy? Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing. Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing.

Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

Final expense insurance policies may be signed with a funeral home or crematory or with an insurance company. Cremation insurance is a type of final expense whole life insurance. With the cost of traditional funerals on the rise, many families turn to cremation to save money and simplify funeral planning. Depending on the company the death benefit could be higher. What’s nice about cremation insurance is that your loved ones don’t have to spend all of the money on cremation.

Source: pinterest.com

Source: pinterest.com

This fact has made cremations almost as common as burials in america. One phone call and we will take care of your needs by offering the best cremation insurance policy. What is a cremation insurance policy. You should have the option to buy small amounts of protection, if you only need a little bit of coverage to pay for the cremation costs, or larger policies that will leave extra money for your beneficiaries to pay off your mortgage or medical bills. For those, a final expense policy (also called funeral insurance or burial insurance) could be the best option to get insurance protection.

Source: pinterest.com

Source: pinterest.com

So what are the benefits of purchasing a burial or cremation policy? For example, if you get a $20,000 policy and the funeral expenses are only $10,000, your family keeps the rest. You can pay the entire amount up front or set up a payment plan over a period of years. Cubeta of insurance for final expense, cremation insurance is meant to protect your family members from excessive financial burdens when you pass away and leave behind a wish to be cremated. This means your policy will come with three permanent benefits.

Source: eldiariodeunheroe.blogspot.com

Source: eldiariodeunheroe.blogspot.com

Given the rising cost of performing final rites in the us, cremation or burial insurance policies are no longer optional. Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing. What is a cremation insurance policy. The money provided is used for funeral home fees, cremation, cremation casket, the urn, and/or any lingering debt or financial obligations. Cremation insurance is a small life insurance policy where the proceeds are meant to pay for a cremation and other final expenses.

Source: pinterest.com.mx

Source: pinterest.com.mx

Given the rising cost of performing final rites in the us, cremation or burial insurance policies are no longer optional. Do i need this coverage? So what are the benefits of purchasing a burial or cremation policy? Burial insurance plans or a funeral expense policy was created to cover the cost of your funeral. Cremation insurance is a type of final expense whole life insurance.

Source: pinterest.com

Source: pinterest.com

Instead, they only need a smaller plan that will help their loved ones pay for the expenses related to a burial or cremation. With the cost of traditional funerals on the rise, many families turn to cremation to save money and simplify funeral planning. Studies show that more than 60% of adults in america no longer insist on religious funerals for themselves or family members. Our direct cremation insurance is safe, flawless, and takes away the hassle of making the last arrangements of your loved one. Do i need this coverage?

Source: senior-lifeservices.com

Source: senior-lifeservices.com

Finding the right cremation insurance policy can help reduce the financial burden on your loved ones. One phone call and we will take care of your needs by offering the best cremation insurance policy. Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing. So what are the benefits of purchasing a burial or cremation policy? This article will discuss how these plans work, the cost, tips for finding the best policy, and much more.

Source: howlifeworks.com

Source: howlifeworks.com

Cremation insurance is a form of life insurance designed to cover specific final expenses. For those, a final expense policy (also called funeral insurance or burial insurance) could be the best option to get insurance protection. A cremation insurance policy should allow you to choose how much coverage you would like. Cremation insurance gives you the money faster than life insurance, and life insurance is all about covering your family’s expenses after you leave this world while a cremation insurance policy helps cover the cost of your last rites. Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing.

Source: youtube.com

Source: youtube.com

Given the rising cost of performing final rites in the us, cremation or burial insurance policies are no longer optional. Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing. For those, a final expense policy (also called funeral insurance or burial insurance) could be the best option to get insurance protection. Burial insurance plans or a funeral expense policy was created to cover the cost of your funeral. Cremation insurance can become a supplement to your life insurance policy.

Source: waynedundee.com

Source: waynedundee.com

Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing. Given the rising cost of performing final rites in the us, cremation or burial insurance policies are no longer optional. Cremation insurance is a form of life insurance designed to cover specific final expenses. Do i need this coverage? Cremation insurance policies are very similar to burial insurance policies and follow the same structure.

Source: pinterest.com

Source: pinterest.com

Cremation insurance is a small value life insurance policy designed to cover the cost of cremation and any funeral or memorial services at the time of death. Cremation insurance gives you the money faster than life insurance, and life insurance is all about covering your family’s expenses after you leave this world while a cremation insurance policy helps cover the cost of your last rites. Burial insurance plans or a funeral expense policy was created to cover the cost of your funeral. Cremation insurance can become a supplement to your life insurance policy. This article will discuss how these plans work, the cost, tips for finding the best policy, and much more.

Source: quotecruncher.co.za

Source: quotecruncher.co.za

Cremation insurance is a form of life insurance designed to cover specific final expenses. If you already have term or whole life insurance, your loved ones can use your existing policy to pay final expenses. Cremation insurance is a form of life insurance designed to cover specific final expenses. Final expense insurance policies may be purchased through a funeral home or. For example, if you get a $20,000 policy and the funeral expenses are only $10,000, your family keeps the rest.

Source: pinterest.com

Source: pinterest.com

For those, a final expense policy (also called funeral insurance or burial insurance) could be the best option to get insurance protection. Last updated on october 27, 2021. Do i need this coverage? We offer final expense policies from a variety of top insurance carriers to ensure that you get a plan that suits your needs. We always recommend double to cover the cost of your entire funeral.

![What is Burial Insurance? Find Out Here [INFOGRAPHIC] What is Burial Insurance? Find Out Here [INFOGRAPHIC]](https://gx0ri2vwi9eyht1e3iyzyc17-wpengine.netdna-ssl.com/wp-content/uploads/2016/06/whatisb.jpg) Source: choicemutual.com

Source: choicemutual.com

Cremation insurance generally covers everything from the cremation itself to any services such as a memorial service or viewing. What’s nice about cremation insurance is that your loved ones don’t have to spend all of the money on cremation. Cremation insurance is a type of final expense whole life insurance. The base policy is for cremation services and animal cremation, but additional coverage is available as needed for members who offer embalming, funeral services and cemetery management. This means your policy will come with three permanent benefits.

Source: lhlic.com

Source: lhlic.com

You also need to plan on some additional administrative and maintenance fees. Do i need this coverage? Cremation insurance can become a supplement to your life insurance policy. A prepaid cremation is a form of agreement between two parties regarding the client’s cremation. We always recommend double to cover the cost of your entire funeral.

Source: senior-lifeservices.com

Source: senior-lifeservices.com

You also need to plan on some additional administrative and maintenance fees. A prepaid cremation is a form of agreement between two parties regarding the client’s cremation. Cremation insurance gives you the money faster than life insurance, and life insurance is all about covering your family’s expenses after you leave this world while a cremation insurance policy helps cover the cost of your last rites. What is a cremation insurance policy. The base policy is for cremation services and animal cremation, but additional coverage is available as needed for members who offer embalming, funeral services and cemetery management.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information