Critical care insurance canada information

Home » Trending » Critical care insurance canada informationYour Critical care insurance canada images are available. Critical care insurance canada are a topic that is being searched for and liked by netizens today. You can Find and Download the Critical care insurance canada files here. Get all royalty-free photos.

If you’re searching for critical care insurance canada images information linked to the critical care insurance canada topic, you have pay a visit to the ideal blog. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

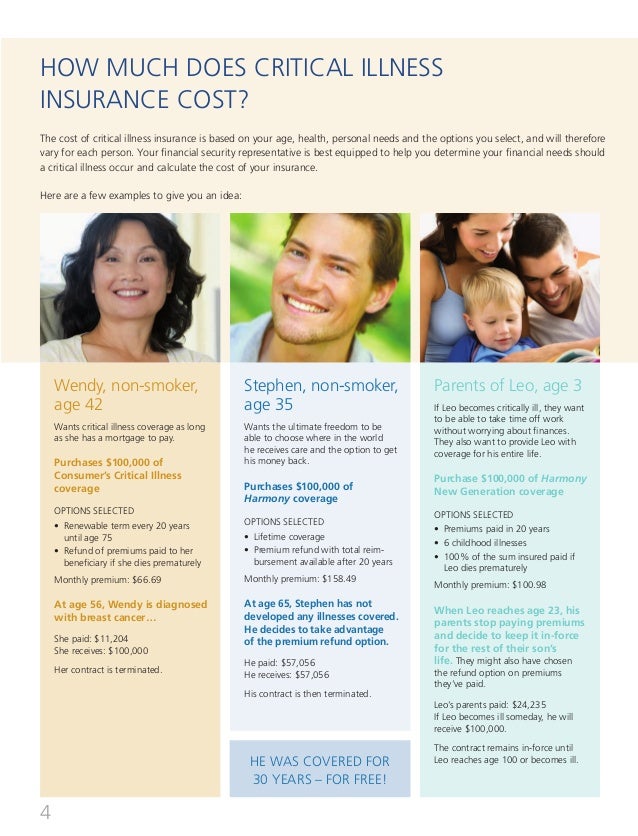

Critical Care Insurance Canada. Adult plans are available in amounts of $25,000 to $3,000,000. They are free to make their own spending choices and use the payments for any purpose, including living expenses, alternative therapies, child care, college. What is critical illness insurance? Critical illness insurance has a cost too, but it is less than the cost of getting sick with a prolonged illness.

Canadian Life and Health Insurance Critical Illness From canadianlifeandhealthinsurance.blogspot.com

Canadian Life and Health Insurance Critical Illness From canadianlifeandhealthinsurance.blogspot.com

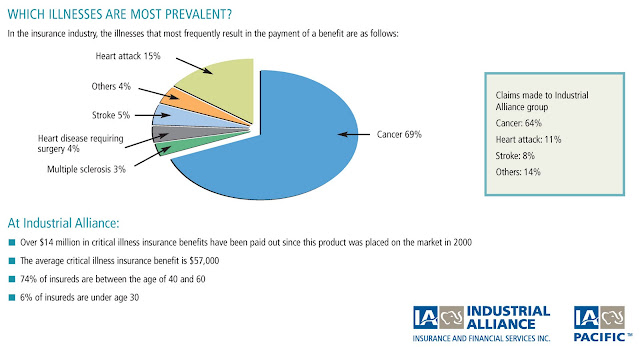

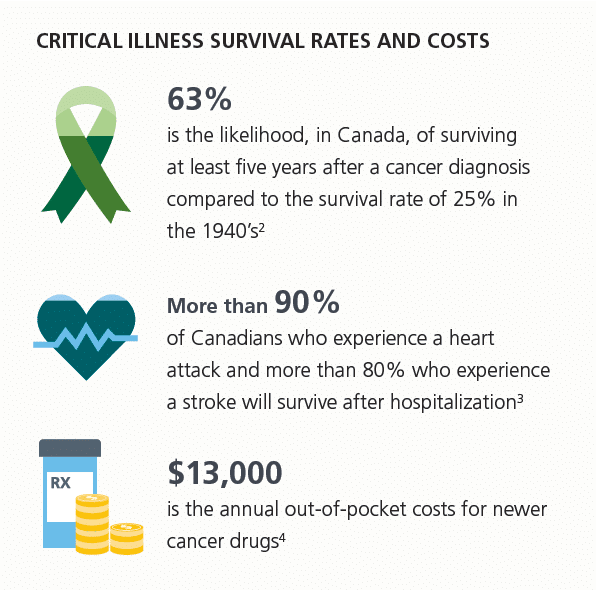

Critical illness insurance covers an individual against illnesses such as heart attack, stroke and cancer and is sold in terms of 10 years, 20. This benefit can replace your income while you recover, provide for travel or care expenses, and prevent financial hardship when dealing with a health crisis. Critical illness insurance has a cost too, but it is less than the cost of getting sick with a prolonged illness. When reviewing your claim, we will. What are your chances of getting seriously ill? Critical illness insurance can serve as a financial safety net for you and your family in the event that you are diagnosed with a critical illness, such as cancer or cardiac disease.

If you move from canada, your coverage is portable, provided you were a resident of canada at the time we issued your policy.

They are free to make their own spending choices and use the payments for any purpose, including living expenses, alternative therapies, child care, college. It can pay for expenses such as assistive modifications to your home (e.g. This benefit can replace your income while you recover, provide for travel or care expenses, and prevent financial hardship when dealing with a health crisis. Child plans are available in amounts of $25,000 to $1,000,000. Critical illness insurance can help you pay for all these expenses—or any other financial needs—until you are well enough to return to work. Most insurance companies in canada attach additional features to the basic.

Source: insurance-resource.ca

Source: insurance-resource.ca

Gives you the advantage of comprehensive critical illness coverage that includes a broad range of covered illnesses. Some critical illness insurance policies come with a return of premium rider. Critical illness insurance covers an individual against illnesses such as heart attack, stroke and cancer and is sold in terms of 10 years, 20. This benefit can replace your income while you recover, provide for travel or care expenses, and prevent financial hardship when dealing with a health crisis. Critical illness insurance helps you pay for costs beyond and outside of your disability, health, or life insurance plans.

Source: canada-insurancequotes.ca

Source: canada-insurancequotes.ca

Canadians may not know about critical illness insurance. Critical illness insurance can serve as a financial safety net for you and your family in the event that you are diagnosed with a critical illness, such as cancer or cardiac disease. When reviewing your claim, we will. Some critical illness insurance policies come with a return of premium rider. Critical illness insurance has a cost too, but it is less than the cost of getting sick with a prolonged illness.

Source: pinterest.com

Source: pinterest.com

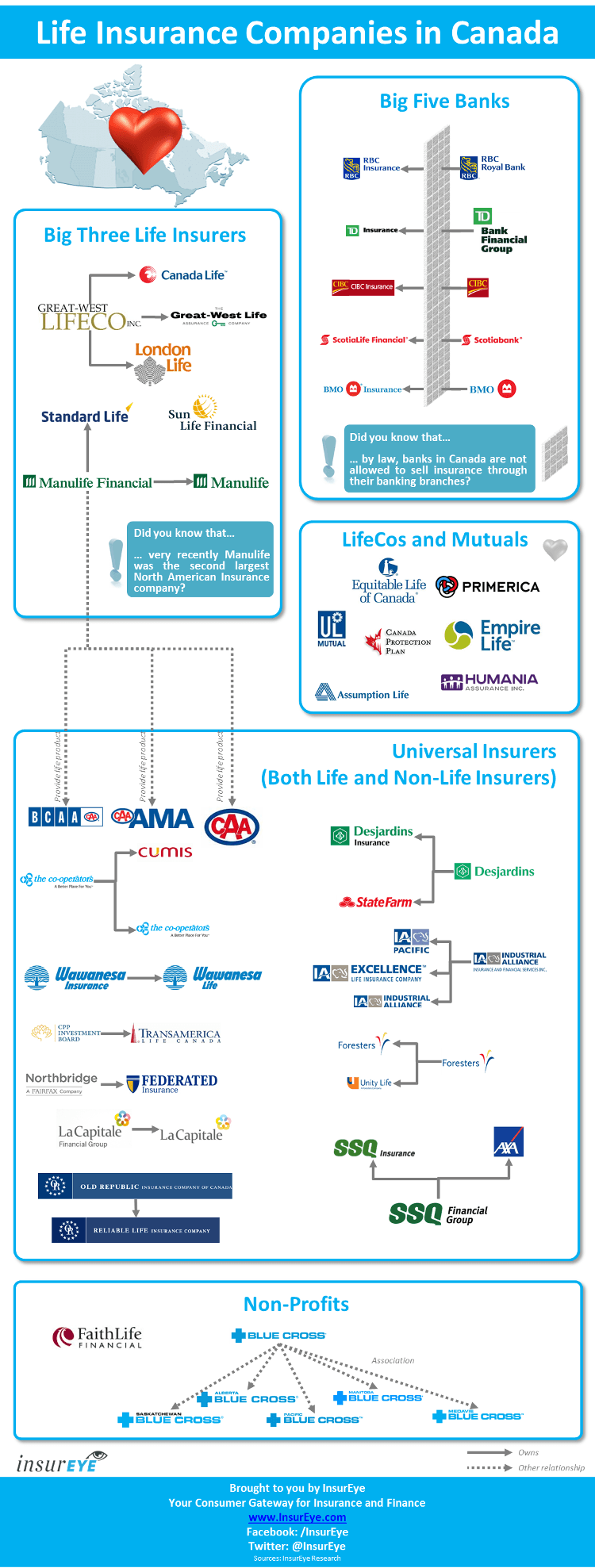

Helping protect your family means safeguarding the life you lead and the people you love, should something happen to you. Aig critical care insurance provides coverage for a plethora of conditions ranging from invasive cancer to coma, heart attack, stroke, renal failure, and severe burns. Critical illness insurance helps you pay for costs beyond and outside of your disability, health, or life insurance plans. Most canadian insurers will follow the definition provided by the canadian life and health and life insurance association (clhia) for various covered conditions including cancer. Critical illness insurance can serve as a financial safety net for you and your family in the event that you are diagnosed with a critical illness, such as cancer or cardiac disease.

Source: slideshare.net

Source: slideshare.net

If you can’t work because of injury, illness or premature. Financial consumer agency of canada. That’s lesser than a latte a week. Critical illness insurance can help you pay for all these expenses—or any other financial needs—until you are well enough to return to work. Most families find the premiums very manageable.

Source: torontocaribbean.com

Source: torontocaribbean.com

If you move from canada, your coverage is portable, provided you were a resident of canada at the time we issued your policy. If you can’t work because of injury, illness or premature. Most families find the premiums very manageable. Critical illness insurance can serve as a financial safety net for you and your family in the event that you are diagnosed with a critical illness, such as cancer or cardiac disease. Aig critical care insurance provides coverage for a plethora of conditions ranging from invasive cancer to coma, heart attack, stroke, renal failure, and severe burns.

Source: lsminsurance.ca

Source: lsminsurance.ca

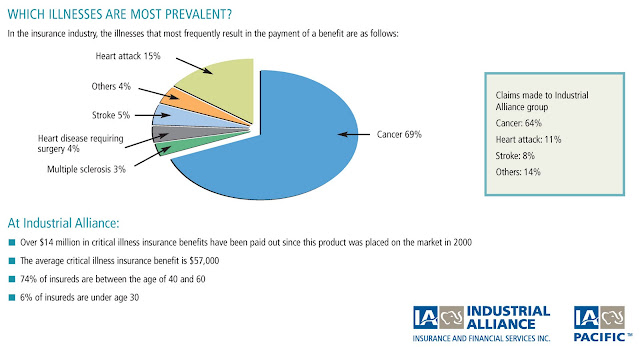

Here’s everything you need to know about critical illness insurance in canada. Child plans are available in amounts of $25,000 to $1,000,000. The canadian cancer society reported that 617 canadians were diagnosed with cancer every day, and; Critical illness insurance helps you pay for costs beyond and outside of your disability, health, or life insurance plans. If you move from canada, your coverage is portable, provided you were a resident of canada at the time we issued your policy.

Source: insureye.com

Source: insureye.com

The canadian cancer society reported that 617 canadians were diagnosed with cancer every day, and; Financial consumer agency of canada. Some critical illness insurance policies come with a return of premium rider. Aig critical care insurance provides coverage for a plethora of conditions ranging from invasive cancer to coma, heart attack, stroke, renal failure, and severe burns. Since these medical emergencies typically incur larger than average expenses, critical illness insurance can provide additional financial support to help you focus on your recovery.

Source: pinterest.com

Source: pinterest.com

Critical illness insurance helps you pay for costs beyond and outside of your disability, health, or life insurance plans. The chances of being diagnosed with a serious illness could be high. Some critical illness insurance policies come with a return of premium rider. Financial consumer agency of canada. Helping protect your family means safeguarding the life you lead and the people you love, should something happen to you.

Source: youtube.com

Source: youtube.com

Adult plans are available in amounts of $25,000 to $3,000,000. They are free to make their own spending choices and use the payments for any purpose, including living expenses, alternative therapies, child care, college. The 14 best critical illness insurance companies in 2021 are: The chances of being diagnosed with a serious illness could be high. Since these medical emergencies typically incur larger than average expenses, critical illness insurance can provide additional financial support to help you focus on your recovery.

Source: pharmatax.ca

Source: pharmatax.ca

They are free to make their own spending choices and use the payments for any purpose, including living expenses, alternative therapies, child care, college. Your contract will define which conditions you’re covered for, but some examples include cancer, heart attack or stroke. The younger you buy it, the better the rates. The chances of being diagnosed with a serious illness could be high. They are free to make their own spending choices and use the payments for any purpose, including living expenses, alternative therapies, child care, college.

Source: newstoryaboutleonettaslove.blogspot.com

Source: newstoryaboutleonettaslove.blogspot.com

If you can’t work because of injury, illness or premature. Critical illness insurance and taxable benefits. The heart and stroke foundation said 35,000 cardiac arrests and 62,00 strokes happen each year. That means if you pass away or a significant period of time lapses before you use the policy, your premiums are returned to you. The younger you buy it, the better the rates.

Source: slideshare.net

Source: slideshare.net

When reviewing your claim, we will. The 14 best critical illness insurance companies in 2021 are: Those who do may think they’re covered through a work group benefits plan or their province’s healthcare plan. Critical illness insurance can help. Critical illness insurance can serve as a financial safety net for you and your family in the event that you are diagnosed with a critical illness, such as cancer or cardiac disease.

Source: newstoryaboutleonettaslove.blogspot.com

Source: newstoryaboutleonettaslove.blogspot.com

Child plans are available in amounts of $25,000 to $1,000,000. It can pay for expenses such as assistive modifications to your home (e.g. Critical illness insurance covers an individual against illnesses such as heart attack, stroke and cancer and is sold in terms of 10 years, 20. Critical illness insurance is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list. Canadians may not know about critical illness insurance.

Source: insurance-resource.ca

Source: insurance-resource.ca

Critical illness insurance can help you pay for all these expenses—or any other financial needs—until you are well enough to return to work. They are free to make their own spending choices and use the payments for any purpose, including living expenses, alternative therapies, child care, college. Gives you the advantage of comprehensive critical illness coverage that includes a broad range of covered illnesses. Most families find the premiums very manageable. The chances of being diagnosed with a serious illness could be high.

Source: newstoryaboutleonettaslove.blogspot.com

Source: newstoryaboutleonettaslove.blogspot.com

Critical illness insurance and taxable benefits. Canadians may not know about critical illness insurance. This benefit can replace your income while you recover, provide for travel or care expenses, and prevent financial hardship when dealing with a health crisis. Your contract will define which conditions you’re covered for, but some examples include cancer, heart attack or stroke. Critical illness insurance covers an individual against illnesses such as heart attack, stroke and cancer and is sold in terms of 10 years, 20.

Source: canadawestassurance.com

Source: canadawestassurance.com

They are free to make their own spending choices and use the payments for any purpose, including living expenses, alternative therapies, child care, college. It can pay for expenses such as assistive modifications to your home (e.g. Critical illness insurance can serve as a financial safety net for you and your family in the event that you are diagnosed with a critical illness, such as cancer or cardiac disease. Most insurance companies in canada attach additional features to the basic. If you can’t work because of injury, illness or premature.

Source: insurance-resource.ca

Source: insurance-resource.ca

Critical illness insurance covers an individual against illnesses such as heart attack, stroke and cancer and is sold in terms of 10 years, 20. Gives you the advantage of comprehensive critical illness coverage that includes a broad range of covered illnesses. Critical illness insurance is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list. Child plans are available in amounts of $25,000 to $1,000,000. The 14 best critical illness insurance companies in 2021 are:

Source: canadianlifeandhealthinsurance.blogspot.com

Source: canadianlifeandhealthinsurance.blogspot.com

Most canadian insurers will follow the definition provided by the canadian life and health and life insurance association (clhia) for various covered conditions including cancer. That means if you pass away or a significant period of time lapses before you use the policy, your premiums are returned to you. The chances of being diagnosed with a serious illness could be high. That’s lesser than a latte a week. What is critical illness insurance?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title critical care insurance canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea