Critical illness vs health insurance Idea

Home » Trending » Critical illness vs health insurance IdeaYour Critical illness vs health insurance images are ready in this website. Critical illness vs health insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Critical illness vs health insurance files here. Find and Download all free photos and vectors.

If you’re looking for critical illness vs health insurance images information connected with to the critical illness vs health insurance keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

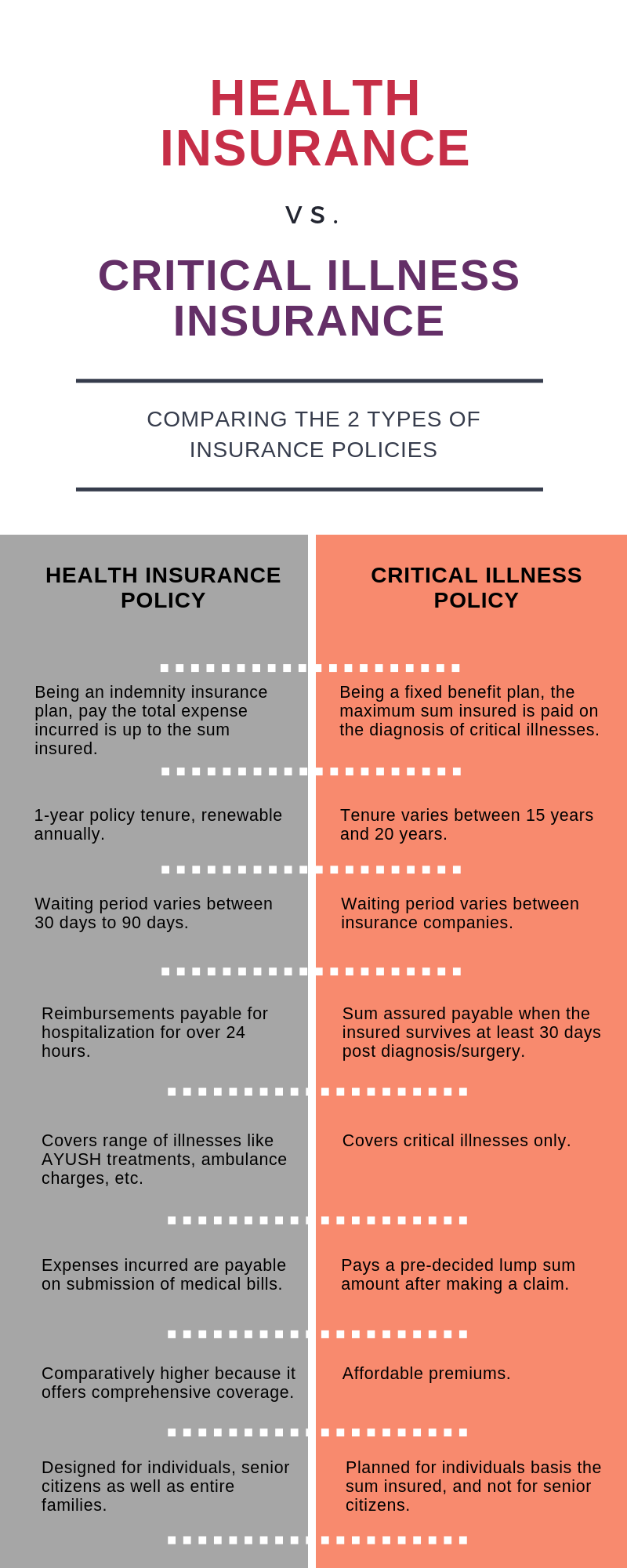

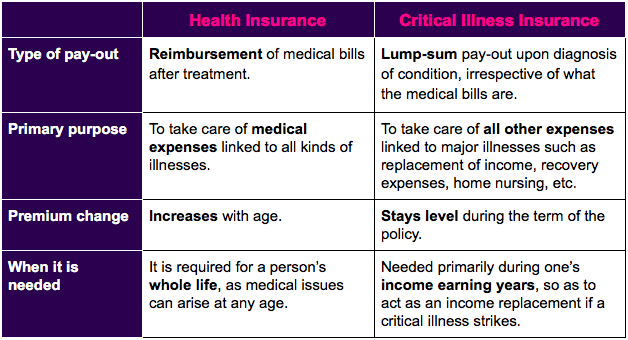

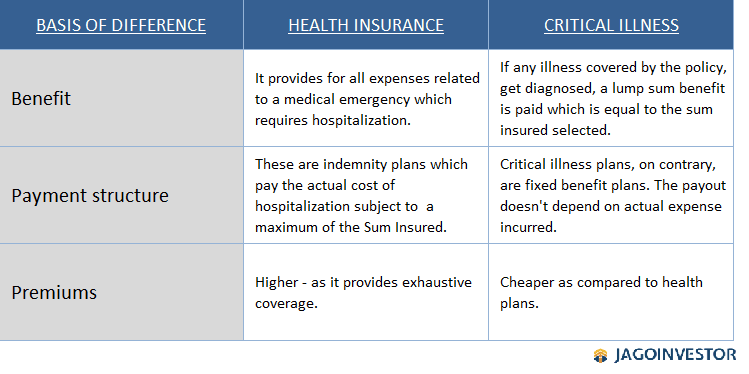

Critical Illness Vs Health Insurance. Unlike health cover, a critical illness plan does not pay for hospitalisation. Health insurance plans allow a higher coverage amount compared to critical illness plans. A critical illness insurance plan works differently than the standard health. The plan covers a list of critical illnesses and treatments, the common ones being cancer, stroke, multiple sclerosis, major organ transplant, open chest cabg, heart attack, etc.

Know The Difference Critical Illness vs Cancer Insurance From insurancefirst.sg

Know The Difference Critical Illness vs Cancer Insurance From insurancefirst.sg

The government does not require you to sign up. Normal medical insurance policies usually cost more since they cover a wide range of possible events, resulting in a higher premium amount as well. Regular health plans reimburse your medical expenses and cover hospitalization costs. There are a few major differences between health insurance and critical illness insurance policies. The plan covers a list of critical illnesses and treatments, the common ones being cancer, stroke, multiple sclerosis, major organ transplant, open chest cabg, heart attack, etc. Critical illness cover vs health insurance.

Get advice & quote call 0800 316 3166.

It can be a beneficial perk if you have the budget to pay for it on top of your health insurance premiums. It can be a beneficial perk if you have the budget to pay for it on top of your health insurance premiums. Everyone gets ill to some degree in their lives; Health insurance is a common form of coverage because of this penalty, as well as the high potential cost of medical bills. The government does not require you to sign up. Health insurance and critical illness insurance both have a waiting period.

Source: insurancefirst.sg

Source: insurancefirst.sg

On the other hand, critical illness insurance is a benefit plan that pays you a round sum if you are diagnosed with any of the critical illnesses that are covered. Heart attack cerebral haemorrhage multiple sclerosis organ transplant cancer coronary artery bypass surgery such illnesses can require prolonged treatment and care. Policy period both plans differ from each other in terms of their policy tenure. Unlike health cover, a critical illness plan does not pay for hospitalisation. Once the claim is successful, the insurer pays a lump sum to cover the cost of treatment.

![]() Source: arbetovinsurance.com

Source: arbetovinsurance.com

However, critical illness plans do not have such high coverage. Unlike health cover, a critical illness plan does not pay for hospitalisation. Health insurance is a common form of coverage because of this penalty, as well as the high potential cost of medical bills. It can be a beneficial perk if you have the budget to pay for it on top of your health insurance premiums. Health insurance v/s critical illness cover in general health insurance, the policyholders can avail cashless hospitalization services or get reimbursement for their medical expenses.

Source: imoney.my

Source: imoney.my

A critical illness insurance plan can be purchased as an additional rider to an existing health plan or as an individual policy. A life insurance plan and a critical illness plan are two important insurance plans which find relevance in our lives. Health plans are indemnity plans. It can be a beneficial perk if you have the budget to pay for it on top of your health insurance premiums. Whereas critical illness insurance can be purchased for only one person.

Source: youtube.com

Source: youtube.com

While health insurance offers basic coverages, a critical illness policy is more extensive in nature. Health insurance is a common form of coverage because of this penalty, as well as the high potential cost of medical bills. Once the claim is successful, the insurer pays a lump sum to cover the cost of treatment. You can avail a critical illness plan at a cheaper rate than a health insurance plan. Health insurance plans allow a higher coverage amount compared to critical illness plans.

Source: coverfox.com

Source: coverfox.com

Everyone gets ill to some degree in their lives; On the other hand, in critical illness, you get a lump sum in case you are diagnosed with a critical illness, which is covered by the policy. A life insurance plan and a critical illness plan are two important insurance plans which find relevance in our lives. For instance, in a health plan of rs.5 lakhs, if the medical bills amount to rs.2 lakhs, claim would be paid for rs.2 lakhs. A traditional health insurance plan primarily covers expenditures around hospitalization.

Source: hypokhagneries.blogspot.com

Source: hypokhagneries.blogspot.com

The premium costs of regular health insurance plans are a little on a higher side as they provide extensive coverage. But both medical covers have different sets of coverage benefits. For instance, in a health plan of rs.5 lakhs, if the medical bills amount to rs.2 lakhs, claim would be paid for rs.2 lakhs. Some of the diseases (critical illness) covered are: They pay the actual costs incurred up to a maximum of the sum insured.

Source: jagoinvestor.com

Source: jagoinvestor.com

Critical illness cover vs health insurance. However, critical illness plans do not have such high coverage. Critical illness cover vs health insurance. These policies do not cover all the diseases and might impose a waiting period for certain disorders. But both medical covers have different sets of coverage benefits.

![]() Source: paisabazaar.com

Source: paisabazaar.com

Health insurance and critical illness insurance both have a waiting period. It can be a beneficial perk if you have the budget to pay for it on top of your health insurance premiums. Below are the details of both the insurance plans: Critical and terminal health insurance can be confusing as both the plans cover serious illnesses and diseases. There are a few major differences between health insurance and critical illness insurance policies.

Source: angloifa.com

Source: angloifa.com

Some of the diseases (critical illness) covered are: While health insurance offers basic coverages, a critical illness policy is more extensive in nature. Once the claim is successful, the insurer pays a lump sum to cover the cost of treatment. The government does not require you to sign up. For instance, in a health plan of rs.5 lakhs, if the medical bills amount to rs.2 lakhs, claim would be paid for rs.2 lakhs.

Source: bursahaga.com

Source: bursahaga.com

Critical and terminal health insurance can be confusing as both the plans cover serious illnesses and diseases. But both medical covers have different sets of coverage benefits. These policies do not cover all the diseases and might impose a waiting period for certain disorders. Difference between critical illness plans and regular health insurance plans the critical illness plans offer lump sum benefits while regular plans are indemnity based policies, and the critical illness plans are purchased for a longer. Unlike health cover, a critical illness plan does not pay for hospitalisation.

Source: turtlemint.com

Source: turtlemint.com

Health insurance and critical illness insurance both have a waiting period. With a critical illness cover, you are able to. A critical illness insurance policy is an additional health insurance policy which caters in providing financial protection and security against specific listed life threatening diseases. Critical illness vs terminal illness insurance: Health insurance and critical illness insurance both have a waiting period.

Source: dallaslatest.blogspot.com

Source: dallaslatest.blogspot.com

Critical illness insurance only covers a handful of predetermined medical conditions. Critical illness cover vs health insurance. On the other hand, critical illness insurance is a benefit plan that pays you a round sum if you are diagnosed with any of the critical illnesses that are covered. Difference between critical illness plans and regular health insurance plans the critical illness plans offer lump sum benefits while regular plans are indemnity based policies, and the critical illness plans are purchased for a longer. Get advice & quote call 0800 316 3166.

Source: hypokhagneries.blogspot.com

Source: hypokhagneries.blogspot.com

Heart attack cerebral haemorrhage multiple sclerosis organ transplant cancer coronary artery bypass surgery such illnesses can require prolonged treatment and care. However, hospitalization accounts for only 35% of the expense. Some of the diseases (critical illness) covered are: The government does not require you to sign up. Health insurance and critical illness insurance both have a waiting period.

Source: youtube.com

Source: youtube.com

Critical illness cover vs health insurance. Regular health plans reimburse your medical expenses and cover hospitalization costs. Critical illness insurance only covers a handful of predetermined medical conditions. Get advice & quote call 0800 316 3166. The plan covers a list of critical illnesses and treatments, the common ones being cancer, stroke, multiple sclerosis, major organ transplant, open chest cabg, heart attack, etc.

Source: alltrendingtrades.com

Source: alltrendingtrades.com

It can be a beneficial perk if you have the budget to pay for it on top of your health insurance premiums. Both policies are meant to offer financial coverage as per the situation of the policyholder. Some of the diseases (critical illness) covered are: A critical illness insurance policy is an additional health insurance policy which caters in providing financial protection and security against specific listed life threatening diseases. Heart attack cerebral haemorrhage multiple sclerosis organ transplant cancer coronary artery bypass surgery such illnesses can require prolonged treatment and care.

Source: aia.com.my

Source: aia.com.my

Everyone gets ill to some degree in their lives; A critical illness insurance policy is an additional health insurance policy which caters in providing financial protection and security against specific listed life threatening diseases. Critical illness vs terminal illness insurance: But the more members there are in the health insurance plan, the higher the premium of it and, compared to that, critical illness insurance turns out to be relatively cheaper. Normal medical insurance policies usually cost more since they cover a wide range of possible events, resulting in a higher premium amount as well.

Source: comparepolicy.com

Source: comparepolicy.com

Since health insurance plans are extensive in nature and cover the insured extensively, the premiums are considerably higher than a critical illness plan. Everyone gets ill to some degree in their lives; The government does not require you to sign up. However, critical illness plans do not have such high coverage. You can avail a critical illness plan at a cheaper rate than a health insurance plan.

Source: dallaslatest.blogspot.com

Source: dallaslatest.blogspot.com

Get advice & quote call 0800 316 3166. If you are diagnosed with any one of the covered conditions, you will receive a lump sum benefit. While health insurance offers basic coverages, a critical illness policy is more extensive in nature. Health insurance plans allow a higher coverage amount compared to critical illness plans. They pay the actual costs incurred up to a maximum of the sum insured.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title critical illness vs health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea